This version of the form is not currently in use and is provided for reference only. Download this version of

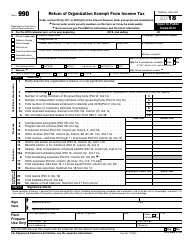

Instructions for IRS Form 990-EZ

for the current year.

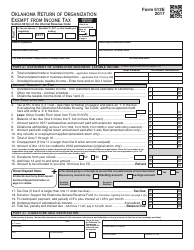

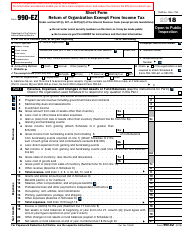

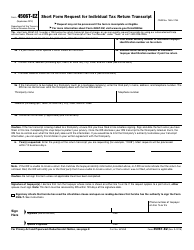

Instructions for IRS Form 990-EZ Short Form Return of Organization Exempt From Income Tax

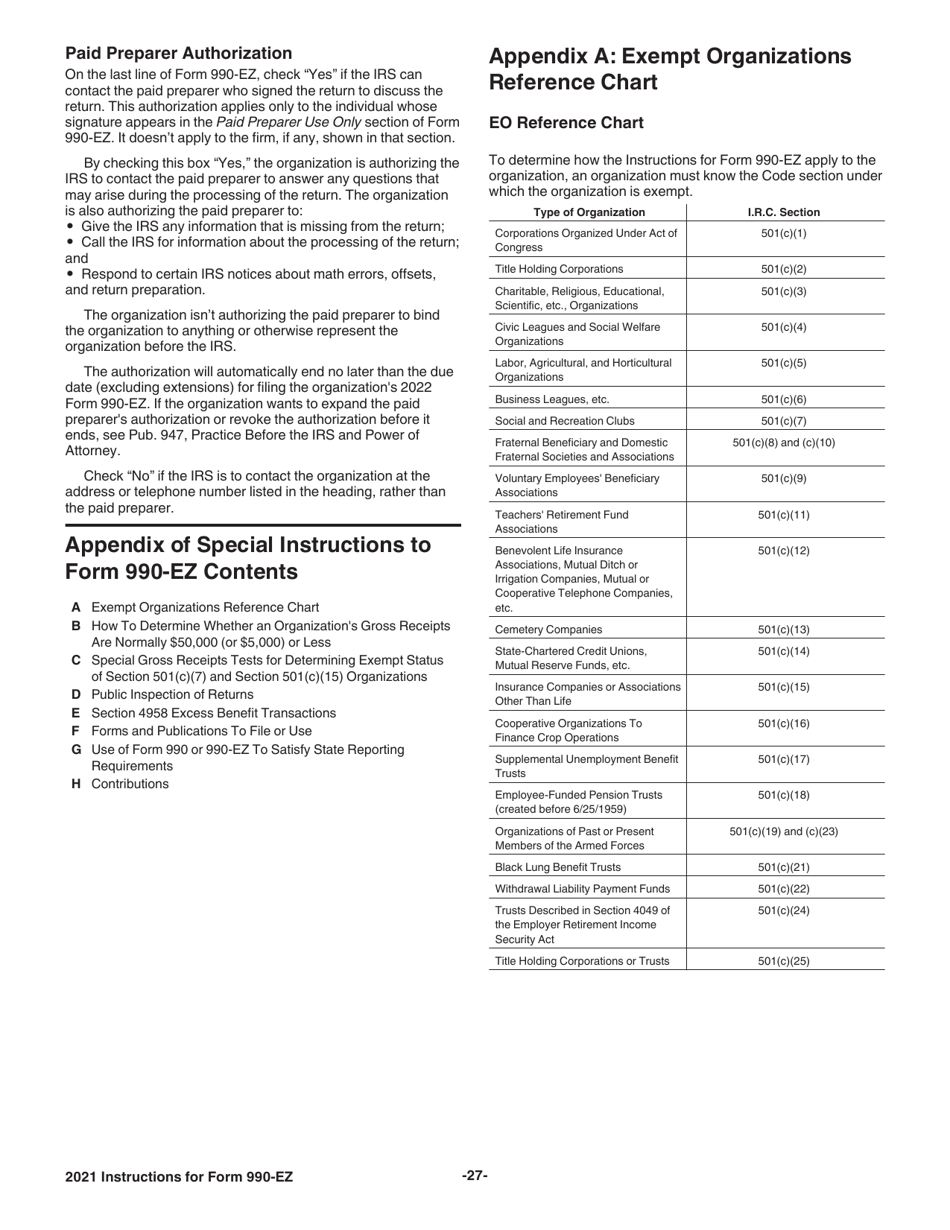

This document contains official instructions for IRS Form 990-EZ , Short Form Return of Organization Exempt From Income Tax - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is the IRS Form 990-EZ?

A: The IRS Form 990-EZ is a short form return for tax-exempt organizations to report their financial information.

Q: Who needs to file IRS Form 990-EZ?

A: Nonprofit organizations with gross receipts less than $200,000 and total assets less than $500,000 are eligible to file IRS Form 990-EZ.

Q: What information do I need to fill out IRS Form 990-EZ?

A: You will need to provide details about your organization's income, expenses, assets, and activities.

Q: When is the deadline to file IRS Form 990-EZ?

A: The deadline to file IRS Form 990-EZ is the 15th day of the 5th month after the end of your organization's fiscal year.

Q: Do I need to include any attachments with IRS Form 990-EZ?

A: Depending on your organization's activities, you may need to include additional schedules and attachments with IRS Form 990-EZ.

Q: Can I file IRS Form 990-EZ electronically?

A: Yes, you can file IRS Form 990-EZ electronically using the IRS e-file system.

Q: Is there a fee to file IRS Form 990-EZ?

A: No, there is no fee to file IRS Form 990-EZ.

Q: What happens if I don't file IRS Form 990-EZ?

A: Failure to file IRS Form 990-EZ can result in penalties and the loss of tax-exempt status for your organization.

Q: Can I amend my IRS Form 990-EZ?

A: Yes, you can file an amended IRS Form 990-EZ if you need to make changes to your original filing.

Instruction Details:

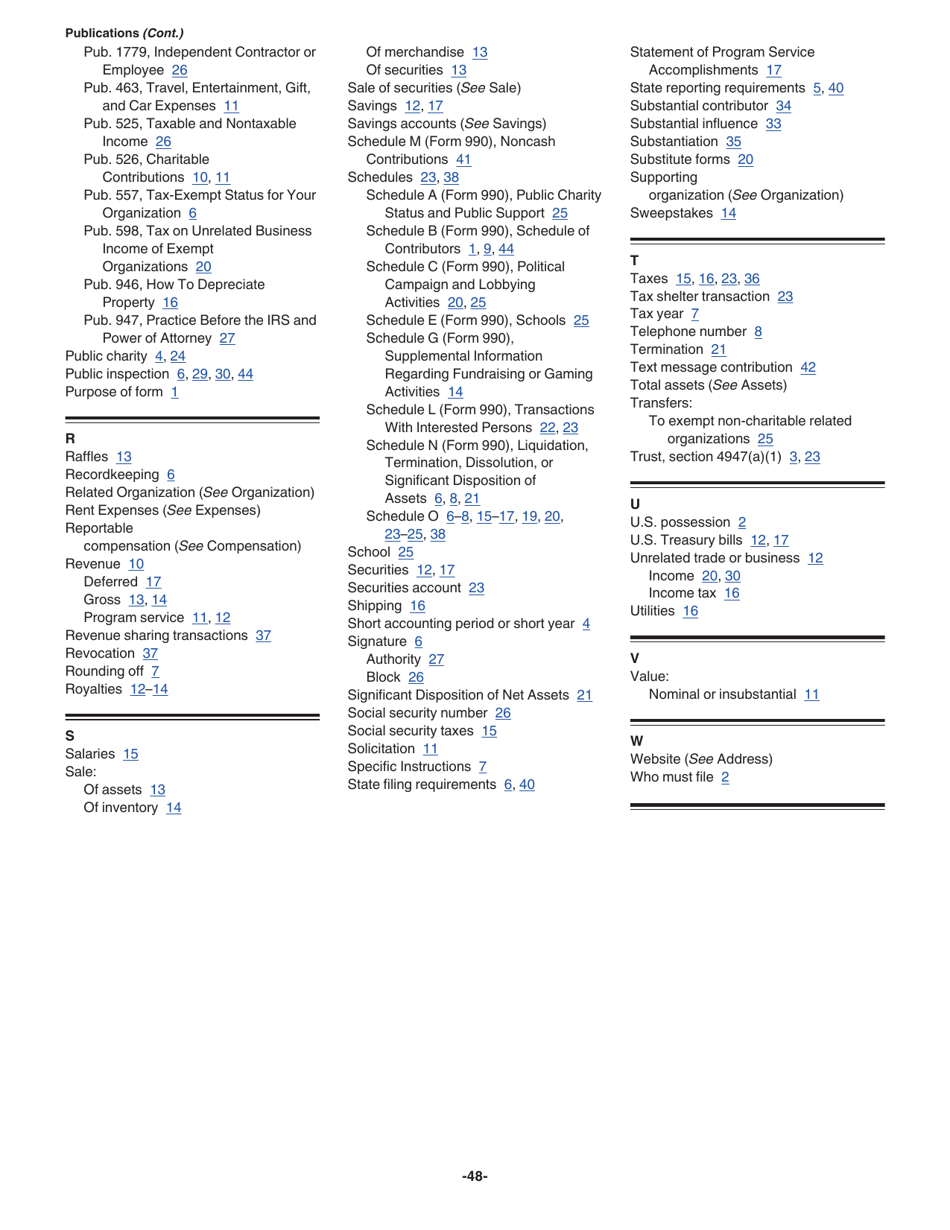

- This 48-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.