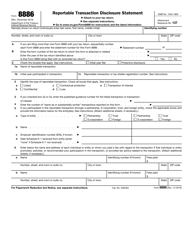

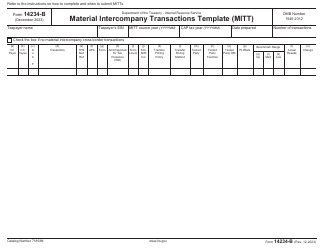

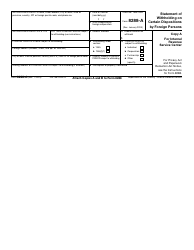

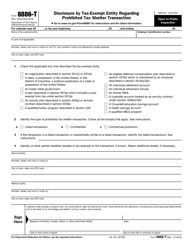

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule L

for the current year.

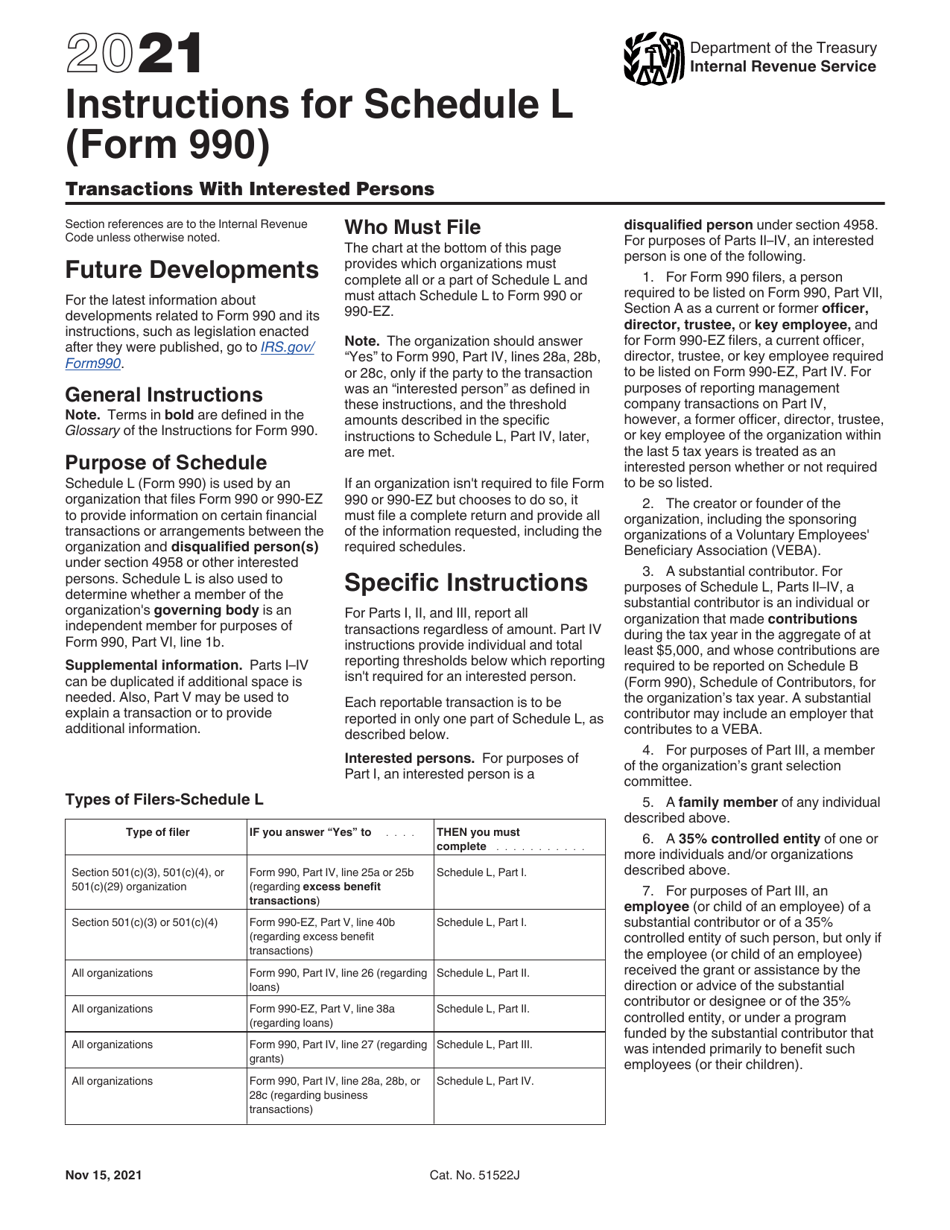

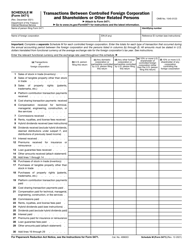

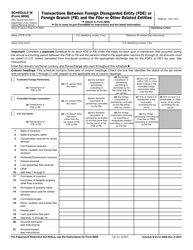

Instructions for IRS Form 990 Schedule L Transactions With Interested Persons

This document contains official instructions for IRS Form 990 Schedule L, Transactions With Interested Persons - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule L is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule L?

A: IRS Form 990 Schedule L is a form used by tax-exempt organizations to report certain transactions with interested persons.

Q: Who are considered interested persons?

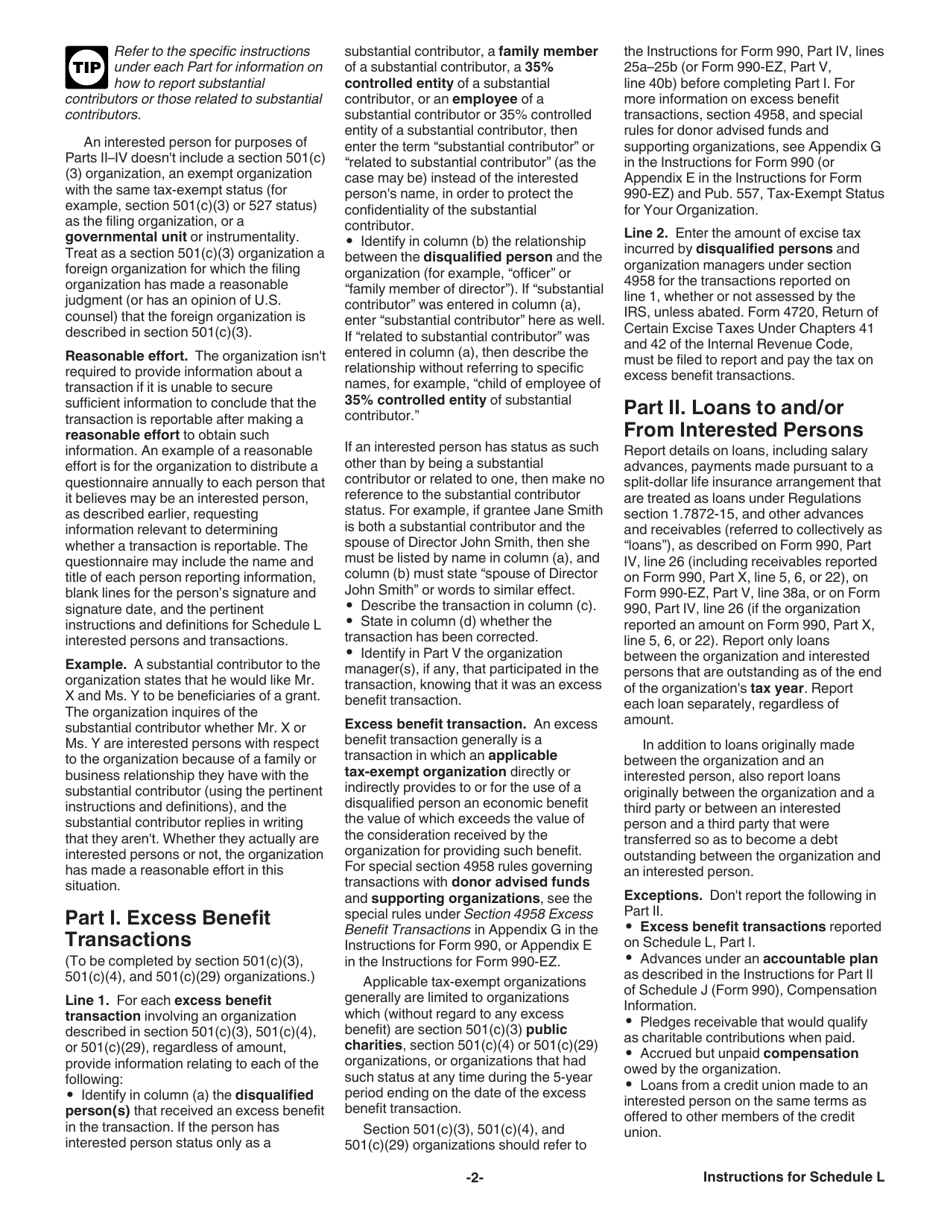

A: Interested persons include board members, officers, substantial contributors, and certain family members of these individuals.

Q: What kind of transactions are reported on Schedule L?

A: Schedule L reports transactions such as loans, grants, contracts, leases, and other financial arrangements between the organization and interested persons.

Q: Why do tax-exempt organizations need to report these transactions?

A: Reporting these transactions helps ensure transparency and prevents conflicts of interest within tax-exempt organizations.

Q: Are there any exceptions to reporting on Schedule L?

A: Some organizations may be exempt from reporting certain transactions if they meet specific criteria. However, it's best to consult with a tax professional or the IRS for specific guidance.

Q: How do organizations file Schedule L?

A: Organizations must attach Schedule L to their annual Form 990 when filing their tax return with the IRS.

Q: Is there a deadline for filing Schedule L?

A: Schedule L must be filed along with Form 990 by the organization's annual tax returndue date, which is typically on or around the 15th day of the 5th month after the end of the organization's fiscal year.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.