This version of the form is not currently in use and is provided for reference only. Download this version of

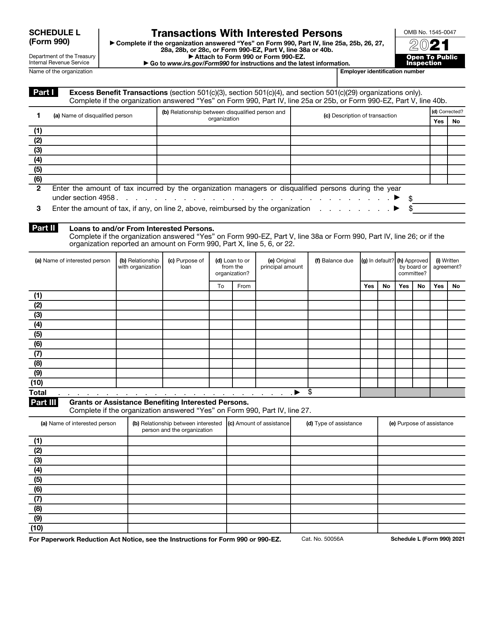

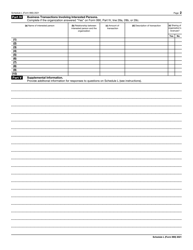

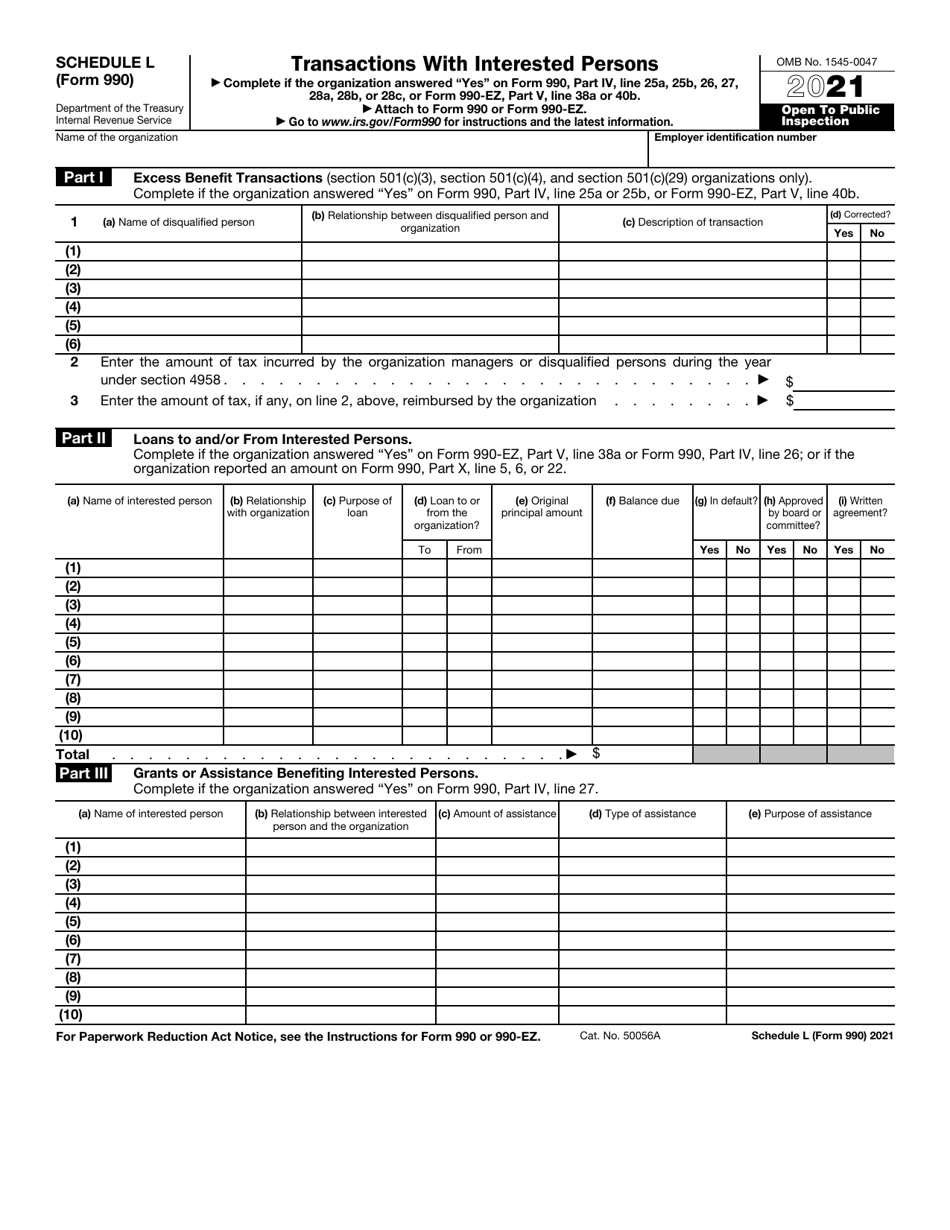

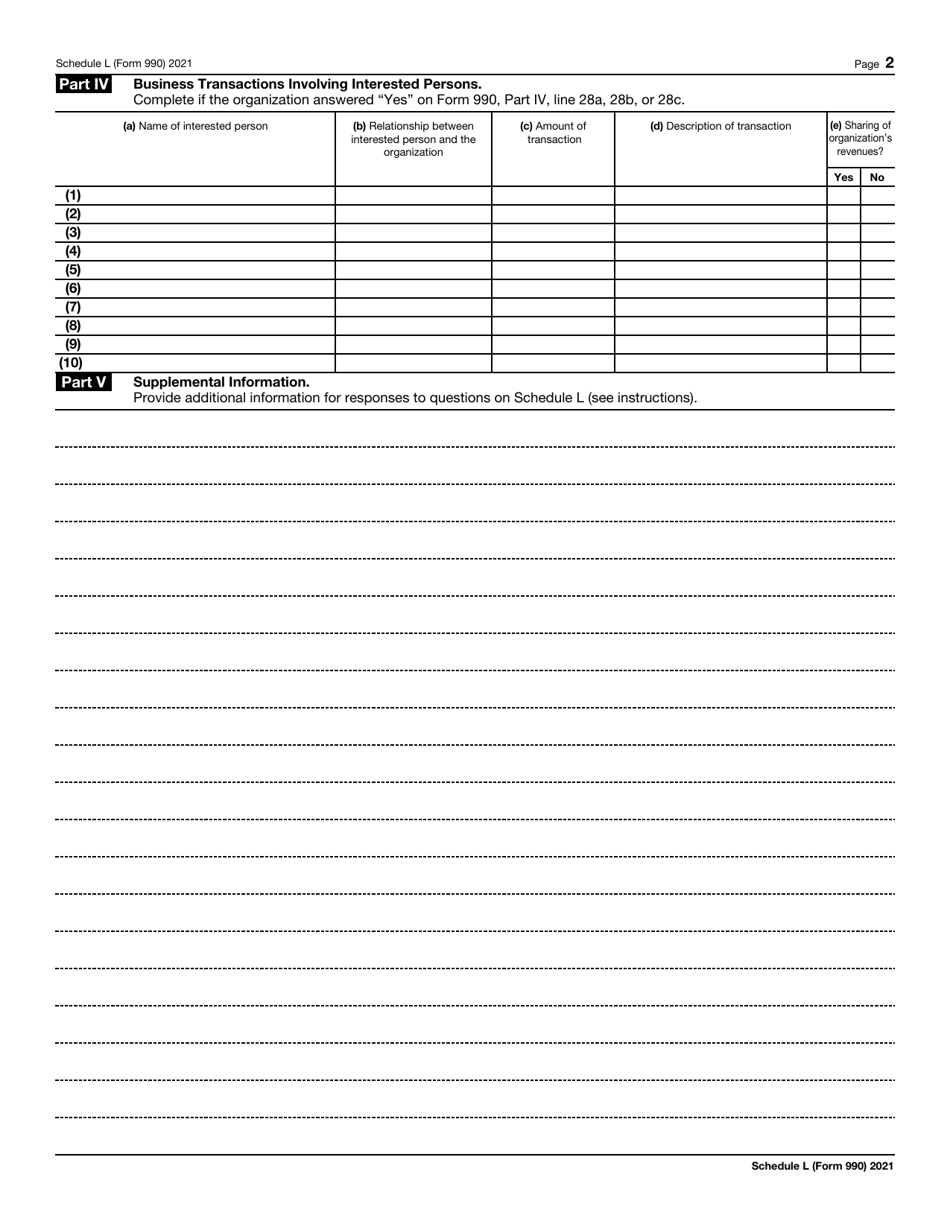

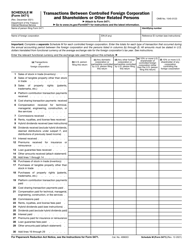

IRS Form 990 Schedule L

for the current year.

IRS Form 990 Schedule L Transactions With Interested Persons

What Is IRS Form 990 Schedule L?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule L?

A: IRS Form 990 Schedule L is a supplementary schedule attached to Form 990, which is used by tax-exempt organizations to provide information about transactions with interested persons.

Q: What are transactions with interested persons?

A: Transactions with interested persons refer to any financial arrangements, business dealings, or relationships between a tax-exempt organization and individuals or entities that have a close relationship or connection to the organization.

Q: Who are considered interested persons?

A: Interested persons include board members, officers, substantial contributors, and their family members, as well as any businesses or organizations they control.

Q: Why is Schedule L important?

A: Schedule L helps the IRS ensure that tax-exempt organizations are not engaging in transactions that could result in private benefit or conflicts of interest.

Q: What information is required on Schedule L?

A: Schedule L requires the organization to provide detailed information about each transaction, including the identities of the interested persons, the nature of the transaction, and the amount involved.

Q: When is Schedule L filed?

A: Schedule L is filed along with Form 990, which is typically due on the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are all tax-exempt organizations required to file Schedule L?

A: No, not all tax-exempt organizations are required to file Schedule L. It is only required for organizations that have engaged in transactions with interested persons during the tax year that meet certain thresholds.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule L through the link below or browse more documents in our library of IRS Forms.