This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule K

for the current year.

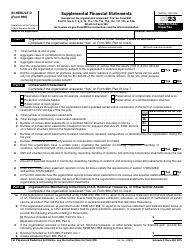

Instructions for IRS Form 990 Schedule K Supplemental Information on Tax-Exempt Bonds

This document contains official instructions for IRS Form 990 Schedule K, Supplemental Information on Tax-Exempt Bonds - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule K is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule K?

A: IRS Form 990 Schedule K is a form used to report supplemental information on tax-exempt bonds.

Q: What is the purpose of Schedule K?

A: The purpose of Schedule K is to provide additional details and information related to tax-exempt bonds.

Q: Who needs to fill out Schedule K?

A: If your organization has issued or holds tax-exempt bonds, you may need to fill out Schedule K as part of your IRS Form 990.

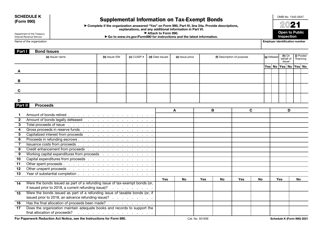

Q: What information is required on Schedule K?

A: Schedule K requires information such as details of any private business use of bond-financed property, arbitrage information, and any noncompliance with bond requirements.

Q: Can Schedule K be filed electronically?

A: As of now, Schedule K cannot be filed electronically and must be filed in paper format along with IRS Form 990.

Q: Do I need to attach any supporting documents with Schedule K?

A: You may need to attach certain supporting documents, such as bond transcripts or other relevant documents, depending on the information provided in Schedule K.

Q: What happens if I fail to file Schedule K?

A: Failure to file Schedule K or providing inaccurate information on the form may result in penalties or the revocation of tax-exempt status for your organization.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.