This version of the form is not currently in use and is provided for reference only. Download this version of

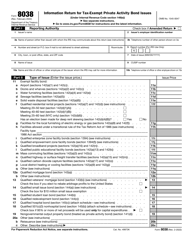

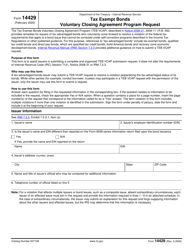

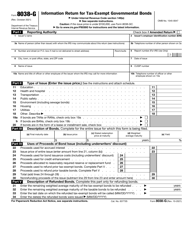

IRS Form 990 Schedule K

for the current year.

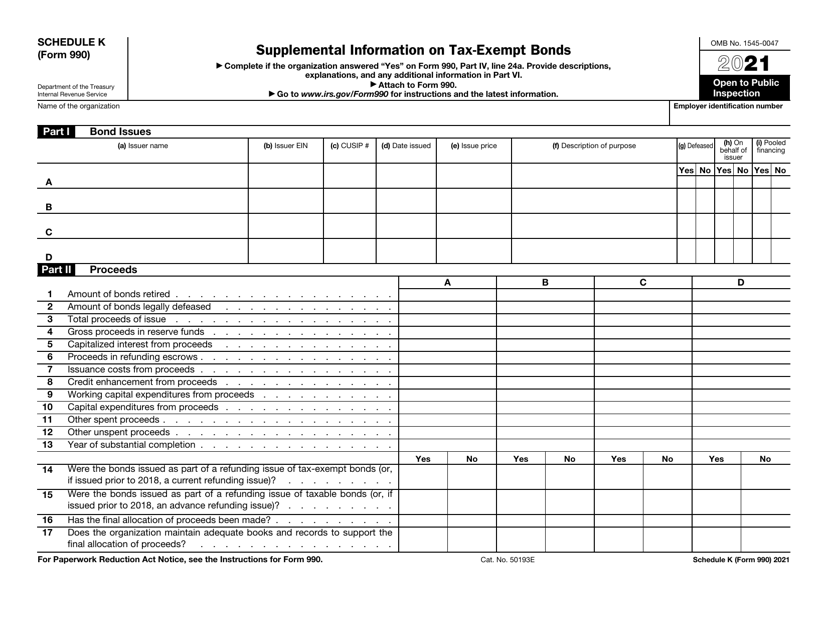

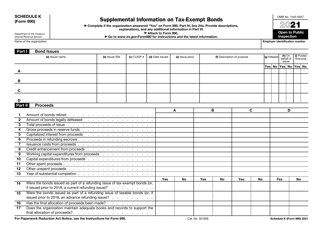

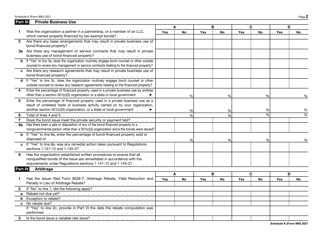

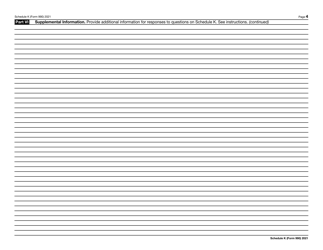

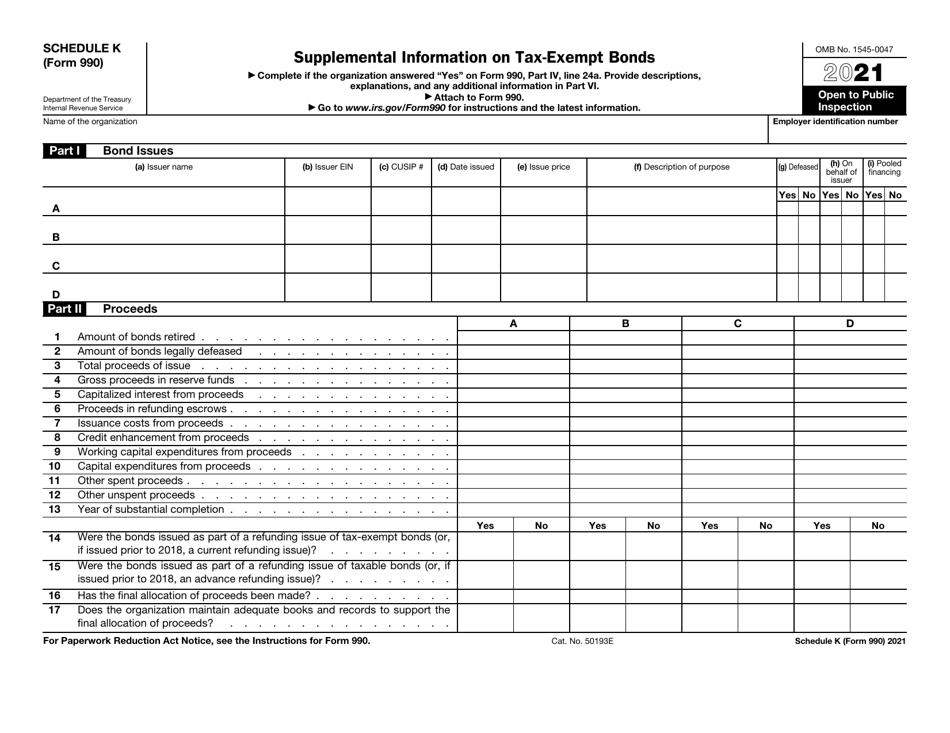

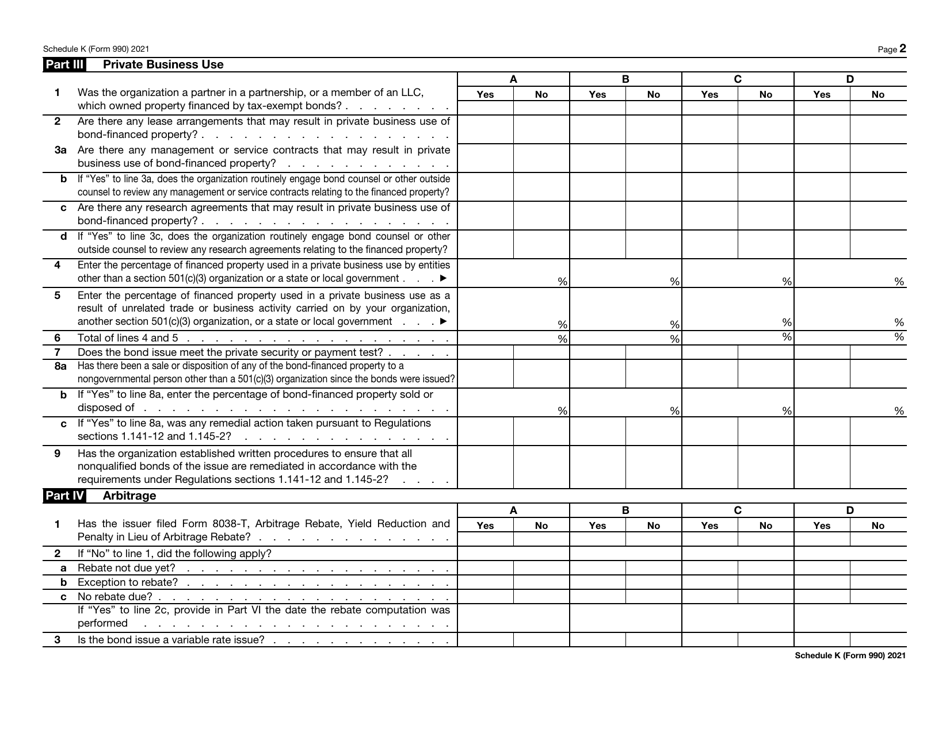

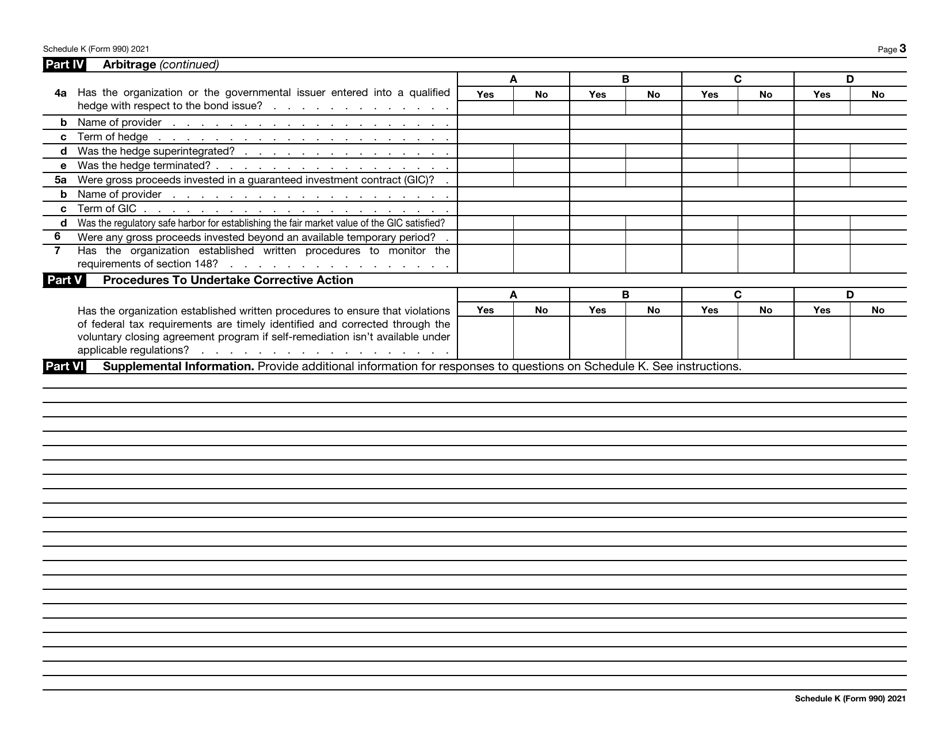

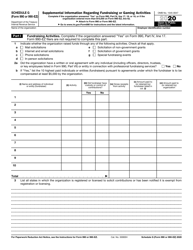

IRS Form 990 Schedule K Supplemental Information on Tax-Exempt Bonds

What Is IRS Form 990 Schedule K?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

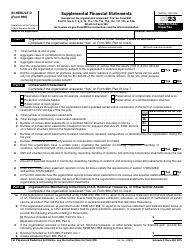

Q: What is IRS Form 990 Schedule K?

A: IRS Form 990 Schedule K is a supplemental form used for providing information on tax-exempt bonds.

Q: Who needs to file IRS Form 990 Schedule K?

A: Nonprofit organizations that have issued tax-exempt bonds need to file IRS Form 990 Schedule K.

Q: What information is required in IRS Form 990 Schedule K?

A: IRS Form 990 Schedule K requires information about the tax-exempt bonds issued by the nonprofit organization.

Q: What is the purpose of filing IRS Form 990 Schedule K?

A: The purpose of filing IRS Form 990 Schedule K is to report information on tax-exempt bonds and ensure compliance with tax regulations.

Q: When is the deadline for filing IRS Form 990 Schedule K?

A: IRS Form 990 Schedule K is typically filed along with the nonprofit organization's annual Form 990, which has a deadline of the 15th day of the 5th month after the end of the fiscal year.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule K through the link below or browse more documents in our library of IRS Forms.