This version of the form is not currently in use and is provided for reference only. Download this version of

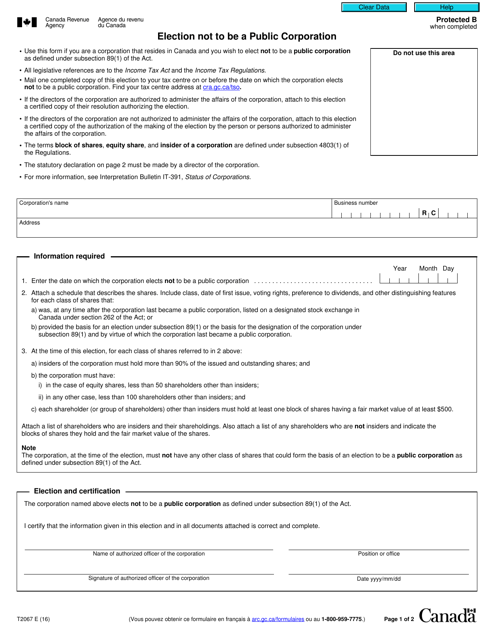

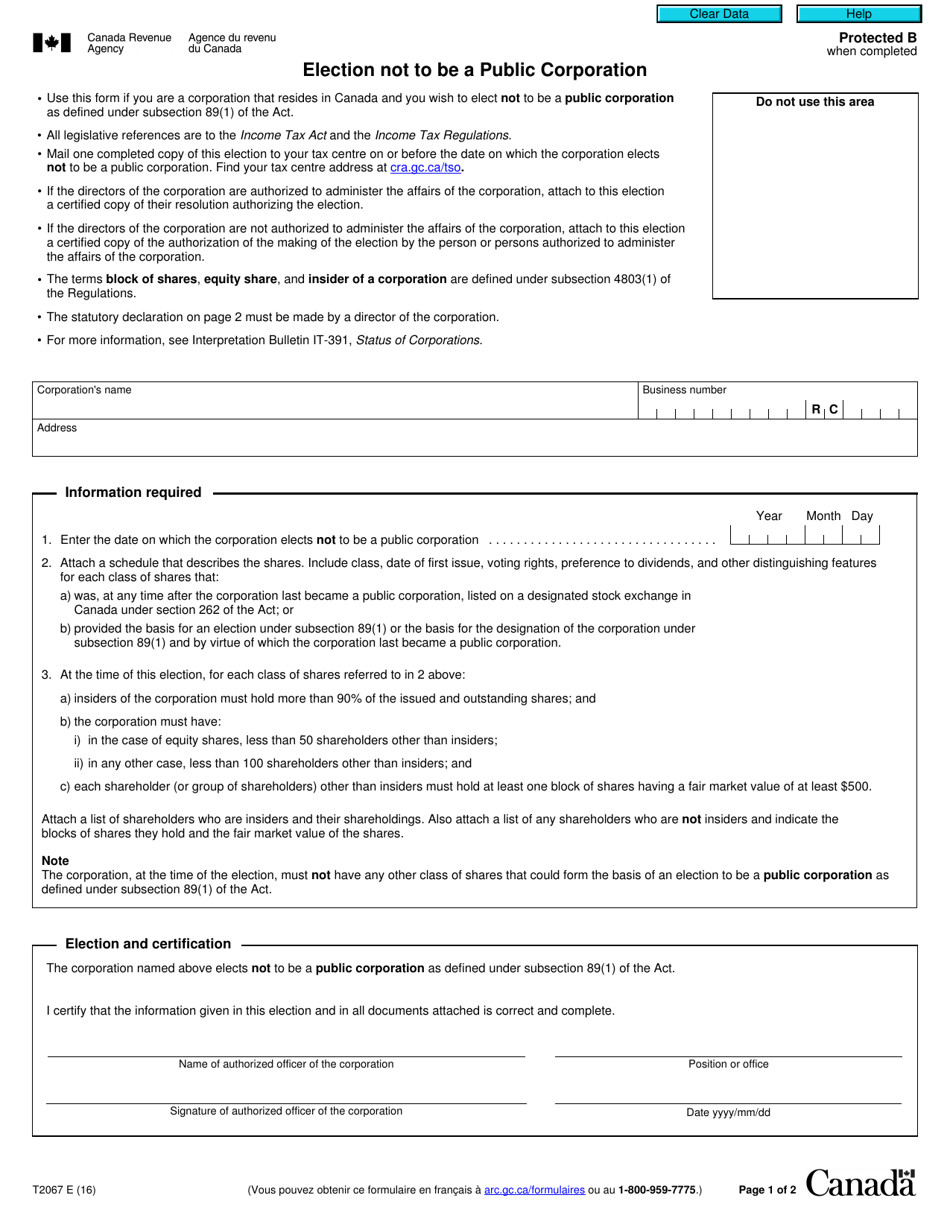

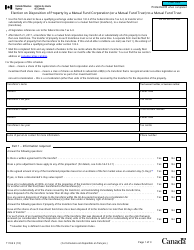

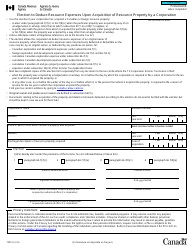

Form T2067

for the current year.

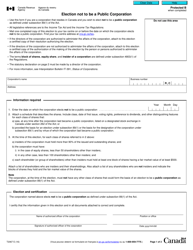

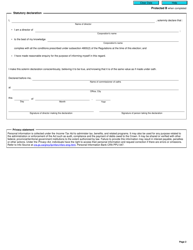

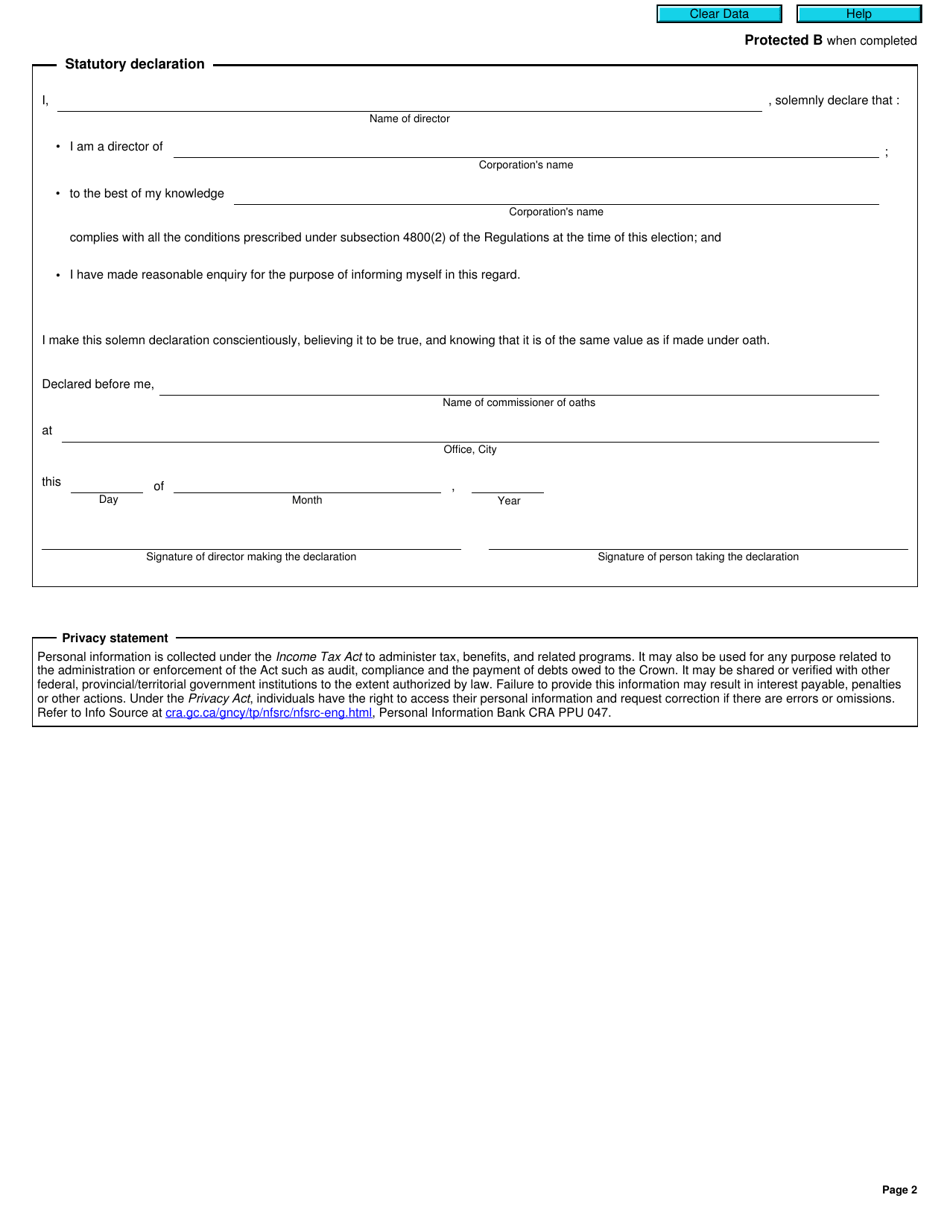

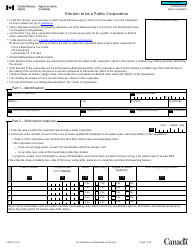

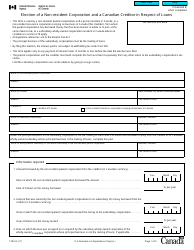

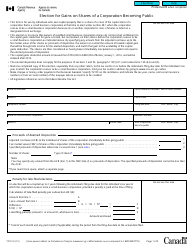

Form T2067 Election Not to Be a Public Corporation - Canada

Form T2067 Election Not to Be a Public Corporation is used in Canada to apply for a non-profit organization to be exempt from being recognized as a public corporation for tax purposes.

The company or corporation that wants to elect not to be treated as a public corporation in Canada would file the Form T2067.

FAQ

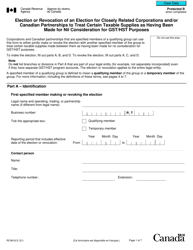

Q: What is Form T2067?

A: Form T2067 is a document in Canada used to elect not to be treated as a public corporation for tax purposes.

Q: Who needs to file Form T2067?

A: Individuals or companies in Canada who want to elect not to be treated as a public corporation for tax purposes need to file Form T2067.

Q: What does it mean to be a public corporation?

A: Being a public corporation means that certain tax provisions apply to the corporation, such as limitations on losses and the ability to claim certain deductions.

Q: What are the benefits of filing Form T2067?

A: Filing Form T2067 allows individuals or companies in Canada to elect not to be treated as a public corporation and avoid certain tax provisions.

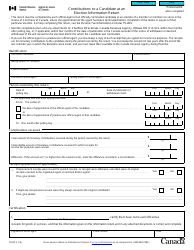

Q: Is there a fee for filing Form T2067?

A: There is currently no fee for filing Form T2067 in Canada.