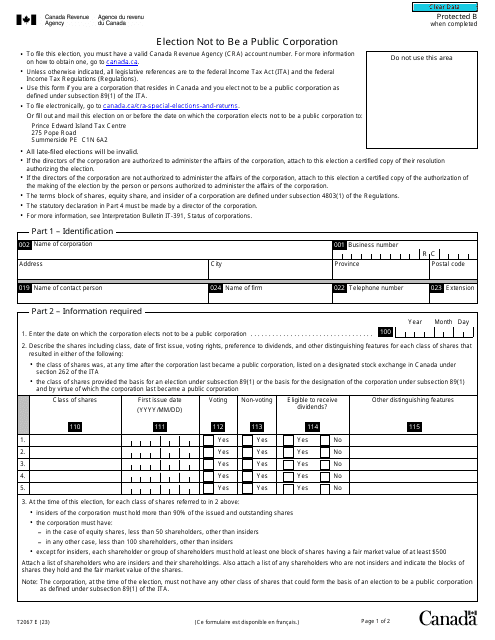

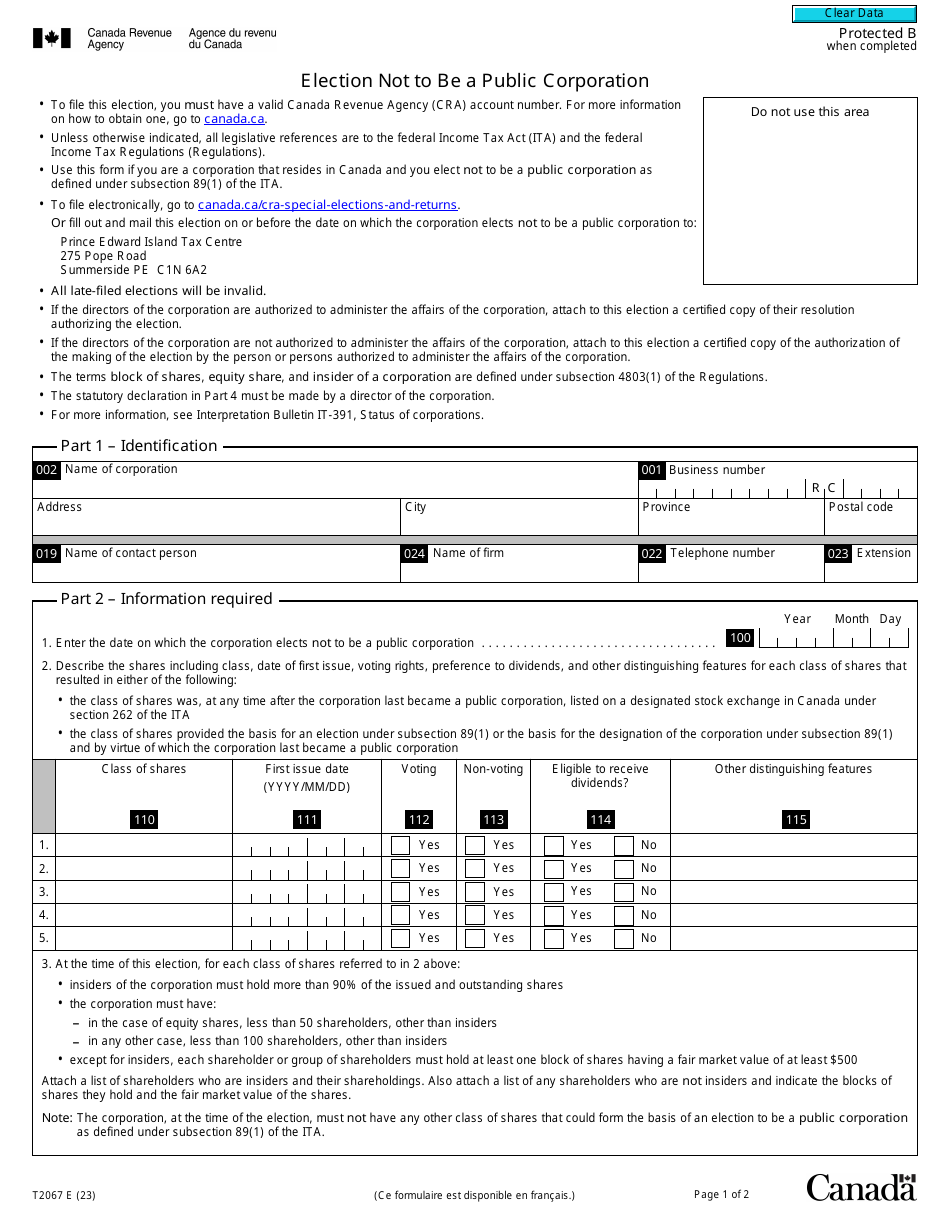

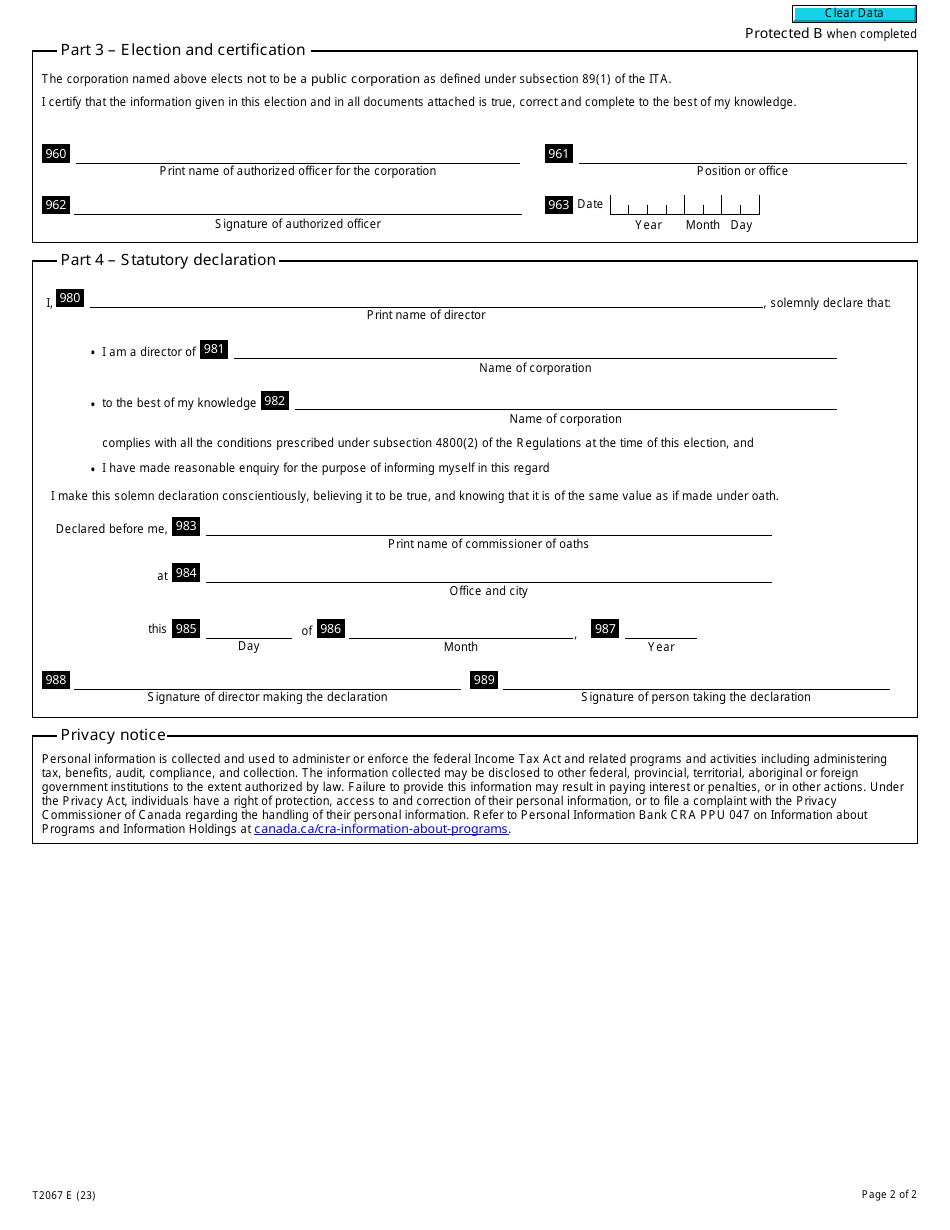

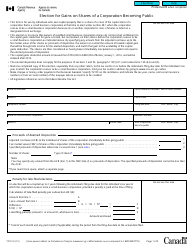

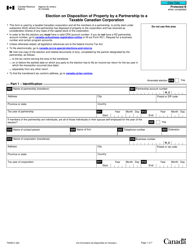

Form T2067 Election Not to Be a Public Corporation - Canada

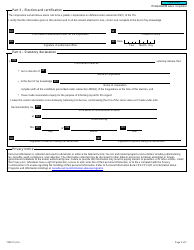

Form T2067 Election Not to Be a Public Corporation in Canada is used by certain organizations to elect not to be considered a public corporation for tax purposes. By filing this form, these organizations may be eligible for certain tax benefits and exemptions.

The form T2067 Election Not to Be a Public Corporation in Canada is typically filed by corporations that want to elect not to be treated as public corporations for Canadian income tax purposes.

Form T2067 Election Not to Be a Public Corporation - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2067?

A: Form T2067 is a tax form used in Canada.

Q: What does Form T2067 allow?

A: Form T2067 allows a corporation to declare that it does not want to be considered a public corporation.

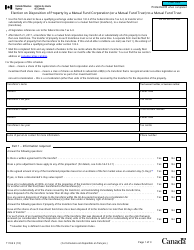

Q: What is a public corporation?

A: A public corporation is a corporation that has shares traded on a stock exchange.

Q: Why would a corporation choose not to be a public corporation?

A: Corporations may choose not to be a public corporation to avoid certain reporting and compliance requirements.

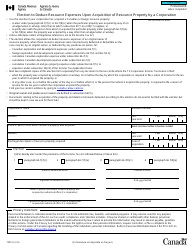

Q: How does a corporation file Form T2067?

A: Corporations can file Form T2067 with the Canada Revenue Agency.

Q: Are there any eligibility requirements to file Form T2067?

A: Yes, there are certain eligibility requirements that must be met to file Form T2067.

Q: Is there a deadline to file Form T2067?

A: Yes, the deadline to file Form T2067 is typically within six months after the end of the corporation's fiscal year.

Q: What happens if a corporation fails to file Form T2067?

A: If a corporation fails to file Form T2067, it may be deemed a public corporation by default.

Q: Can a corporation change its status from a public corporation to not being a public corporation?

A: Yes, a corporation can file Form T2067 to make this change if it meets the eligibility requirements.