This version of the form is not currently in use and is provided for reference only. Download this version of

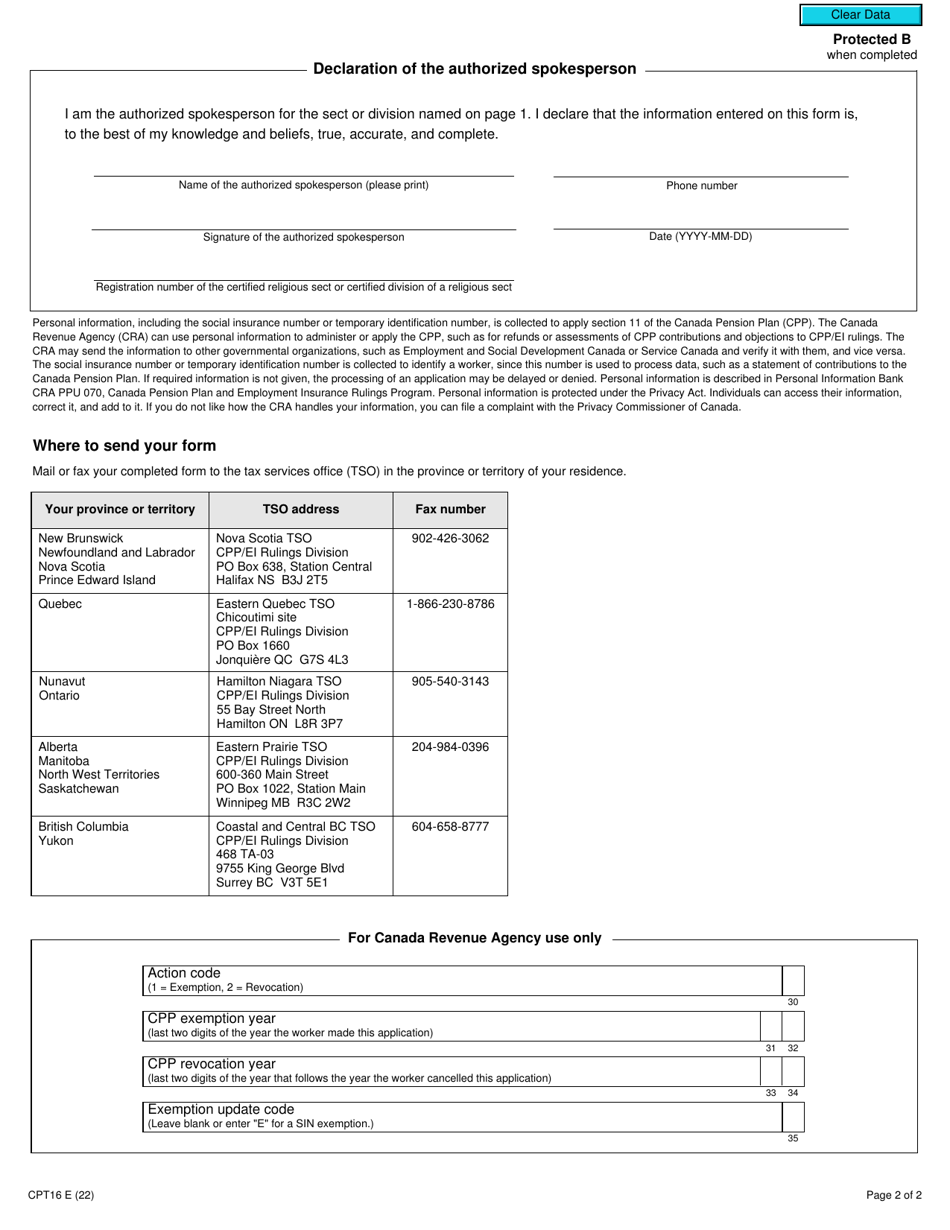

Form CPT16

for the current year.

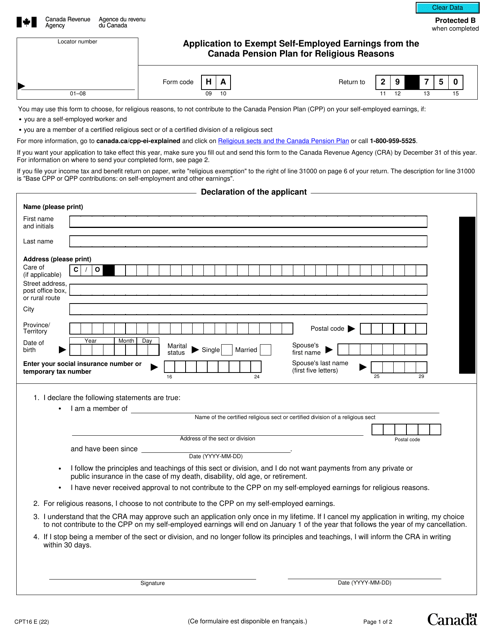

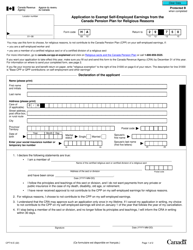

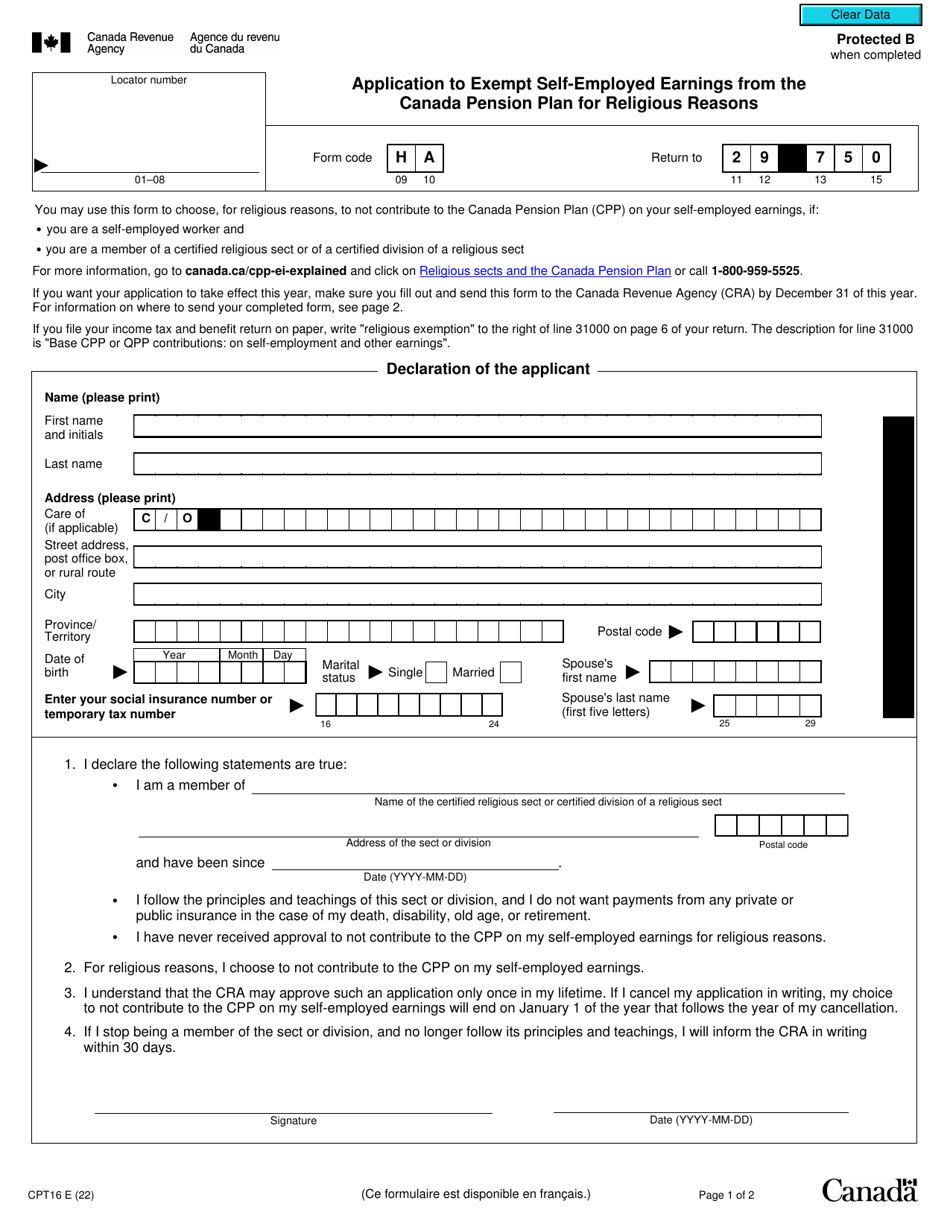

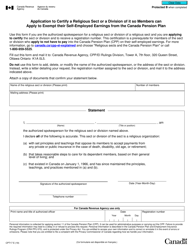

Form CPT16 Application to Exempt Self-employed Earnings From the Canada Pension Plan for Religious Reasons - Canada

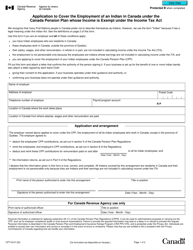

Form CPT16 Application to Exempt Self-employed Earnings From the Canada Pension Plan for Religious Reasons is used in Canada for individuals who wish to apply for an exemption from contributing to the Canada Pension Plan due to religious reasons.

The Form CPT16 application to exempt self-employed earnings from the Canada Pension Plan for religious reasons in Canada is filed by individuals who have religious objections to the Canada Pension Plan.

FAQ

Q: What is Form CPT16?

A: Form CPT16 is an application to exempt self-employed earnings from the Canada Pension Plan for religious reasons.

Q: Who can use Form CPT16?

A: Form CPT16 is for self-employed individuals in Canada who have religious reasons for seeking exemption from the Canada Pension Plan.

Q: What does the form CPT16 allow?

A: Form CPT16 allows self-employed individuals to request exemption from the Canada Pension Plan contributions based on religious grounds.

Q: What information is required on Form CPT16?

A: Form CPT16 asks for personal information, details about your religious beliefs or practices, and a declaration of your religious objections to the Canada Pension Plan.

Q: Can anyone claim exemption based on religious grounds?

A: No, you must have sincere religious beliefs or practices that are against the Canada Pension Plan to qualify for exemption.

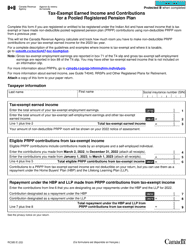

Q: What are the implications of exempting self-employed earnings from the Canada Pension Plan?

A: Exempting self-employed earnings from the Canada Pension Plan means that you will not make contributions, but it may have an impact on your eligibility for certain benefits and retirement income in the future.

Q: Is there a deadline for submitting Form CPT16?

A: There is no specific deadline for submitting Form CPT16, but it is recommended to submit it as soon as possible to avoid any late filing penalties or delays.