This version of the form is not currently in use and is provided for reference only. Download this version of

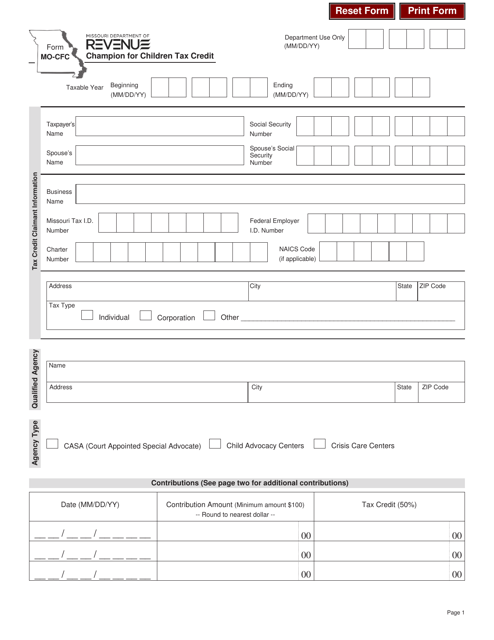

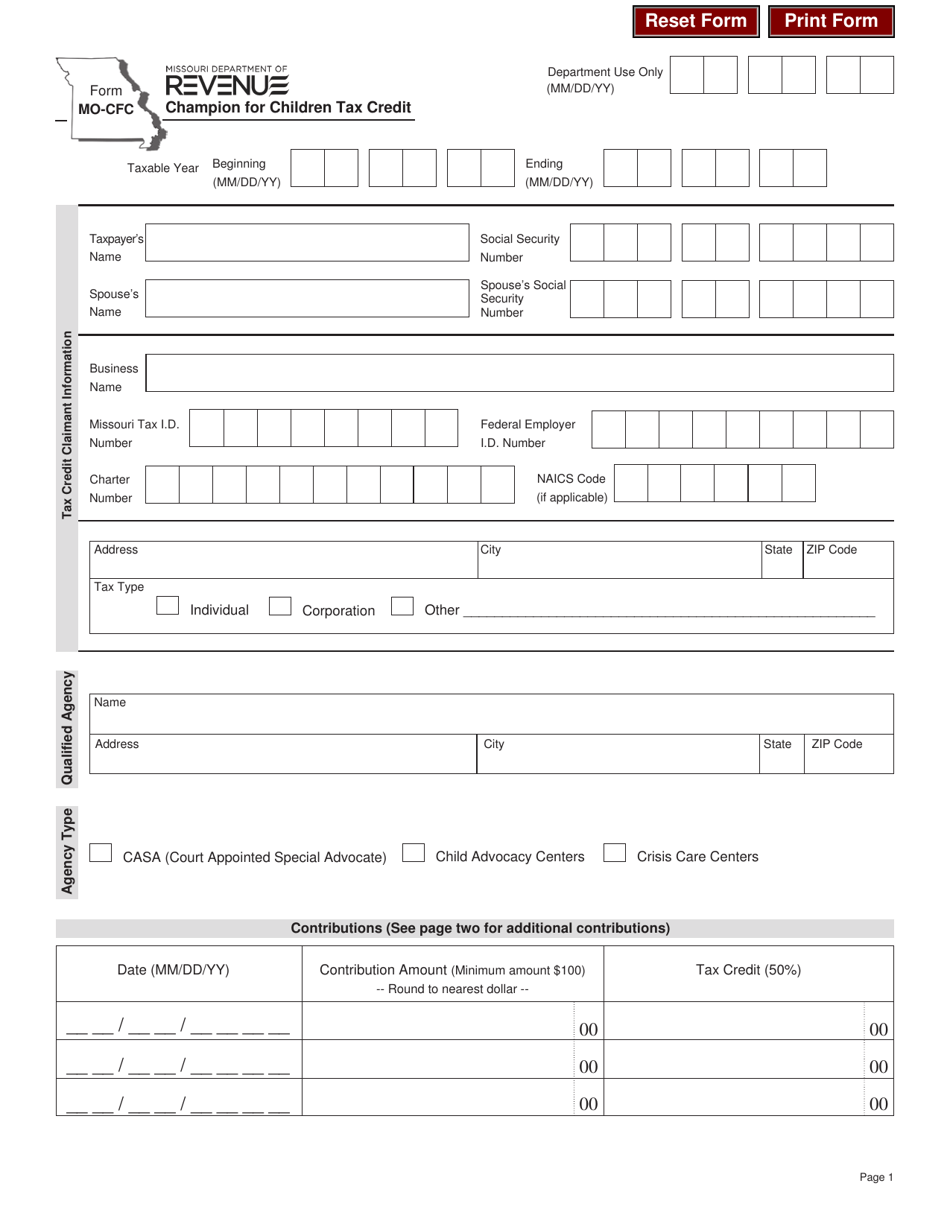

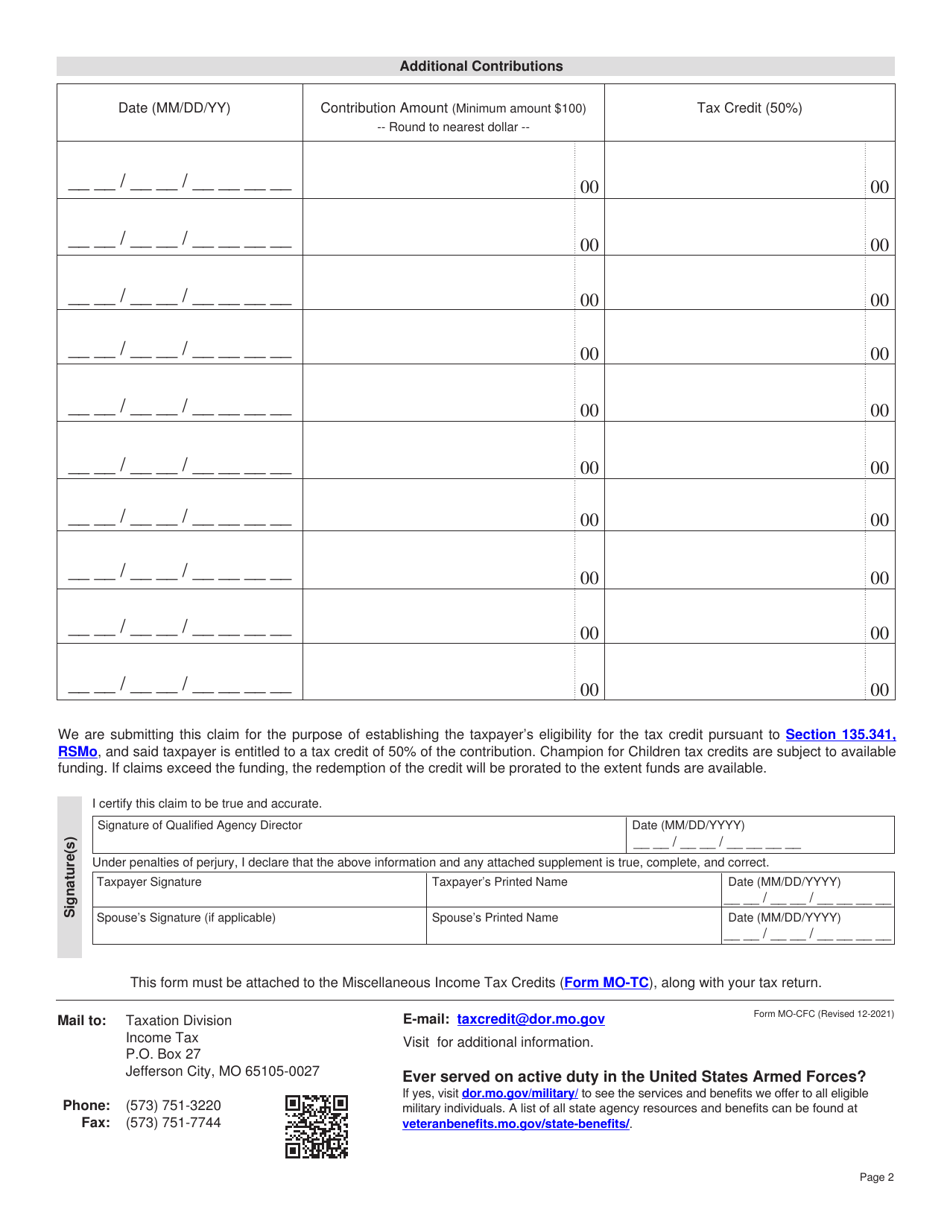

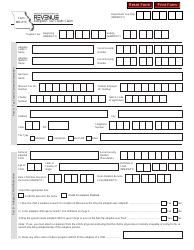

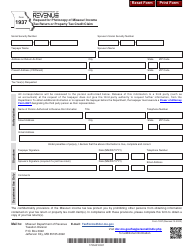

Form MO-CFC

for the current year.

Form MO-CFC Champion for Children Tax Credit Claim - Missouri

What Is Form MO-CFC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-CFC?

A: Form MO-CFC is a tax form used to claim the Champion for Children Tax Credit in Missouri.

Q: What is the Champion for Children Tax Credit?

A: The Champion for Children Tax Credit is a credit available to Missouri taxpayers who make contributions to certain organizations that provide services to children.

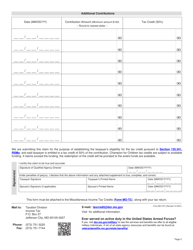

Q: How do I claim the Champion for Children Tax Credit?

A: To claim the credit, you need to fill out Form MO-CFC and attach it to your Missouri state income tax return.

Q: What organizations qualify for the Champion for Children Tax Credit?

A: The tax credit is available for contributions made to organizations that are certified by the Missouri Department of Social Services.

Q: How much is the Champion for Children Tax Credit worth?

A: The credit is equal to 50% of your contribution, up to a maximum credit of $100 for individuals or $200 for married couples filing jointly.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-CFC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.