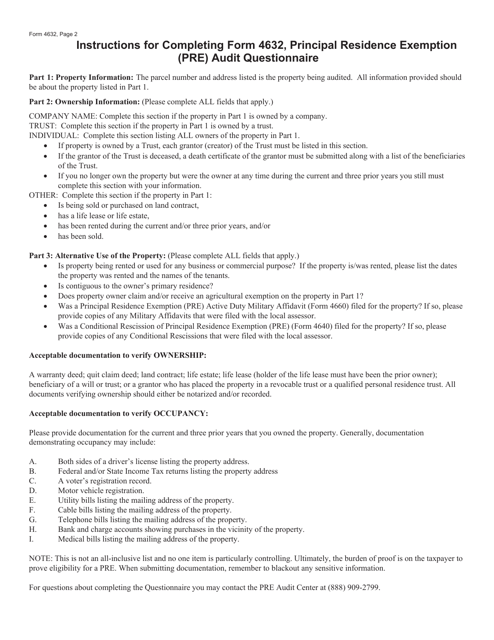

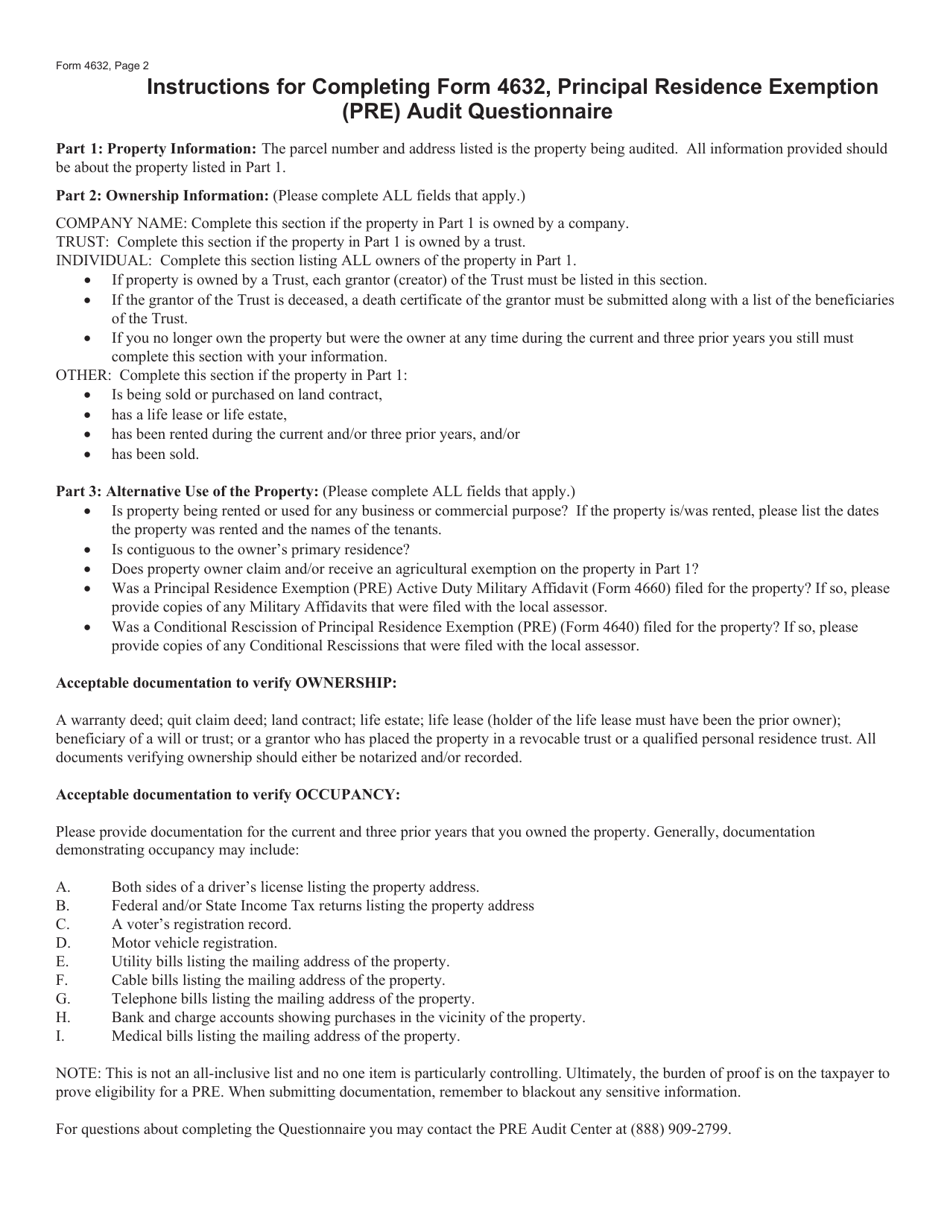

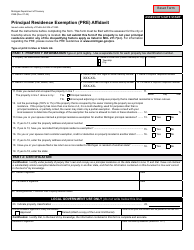

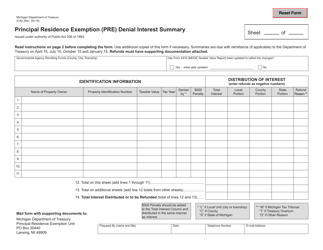

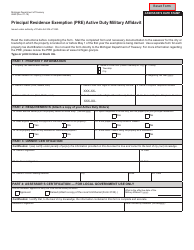

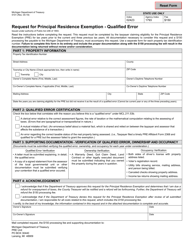

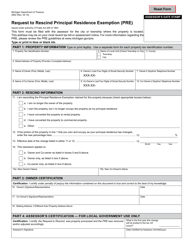

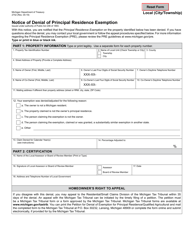

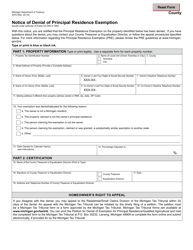

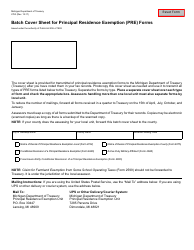

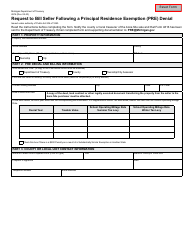

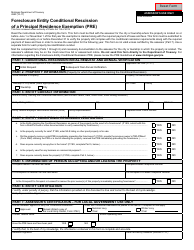

Instructions for Form 4632 Principal Residence Exemption (Pre) Audit Questionnaire - Michigan

This document contains official instructions for Form 4632 , Principal Residence Exemption (Pre) Audit Questionnaire - a form released and collected by the Michigan Department of Treasury. An up-to-date fillable Form 4632 is available for download through this link.

FAQ

Q: What is Form 4632 Principal Residence Exemption (PRE) Audit Questionnaire?

A: Form 4632 is a questionnaire used for conducting a Principal Residence Exemption (PRE) audit in Michigan.

Q: Who needs to complete Form 4632?

A: This form needs to be completed by individuals who claim the Principal Residence Exemption (PRE) in Michigan.

Q: What is the Principal Residence Exemption (PRE)?

A: The Principal Residence Exemption (PRE) is a tax exemption provided to qualified homeowners in Michigan on their primary residence.

Q: Why do I need to complete the PRE Audit Questionnaire?

A: The PRE Audit Questionnaire helps the Michigan government ensure that individuals claiming the Principal Residence Exemption (PRE) are eligible for the tax exemption.

Q: Are all homeowners required to complete the PRE Audit Questionnaire?

A: No, only homeowners who claim the Principal Residence Exemption (PRE) in Michigan are required to complete the questionnaire.

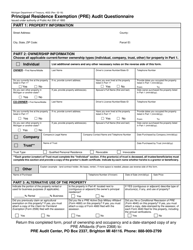

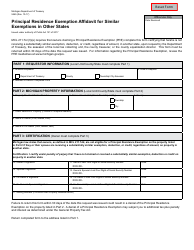

Q: What information is requested in Form 4632?

A: Form 4632 requests information about the homeowner's residency status, property ownership, and other relevant details to verify eligibility for the Principal Residence Exemption (PRE).

Q: Are there any penalties for not completing the PRE Audit Questionnaire?

A: Failure to complete the PRE Audit Questionnaire can result in revocation of the Principal Residence Exemption (PRE) and potential penalties for falsely claiming the tax exemption.

Q: When should I submit Form 4632?

A: Form 4632 should be submitted as soon as possible after receiving it from the assessor's office to ensure compliance with the PRE audit process.

Q: Can I appeal the revocation of the Principal Residence Exemption (PRE)?

A: Yes, homeowners have the right to appeal the revocation of the Principal Residence Exemption (PRE) if they believe it was done in error.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Michigan Department of Treasury.