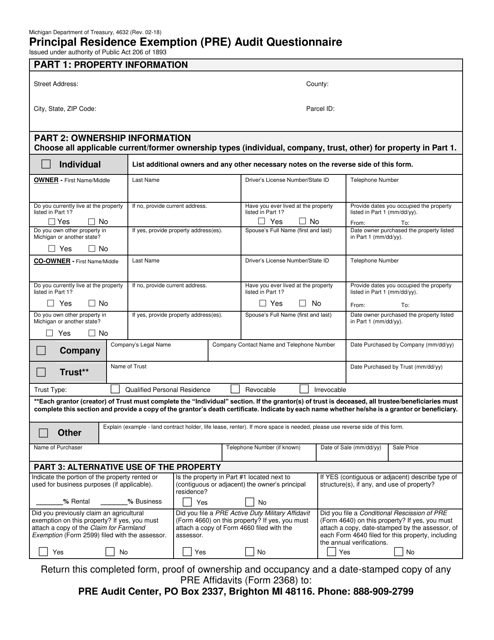

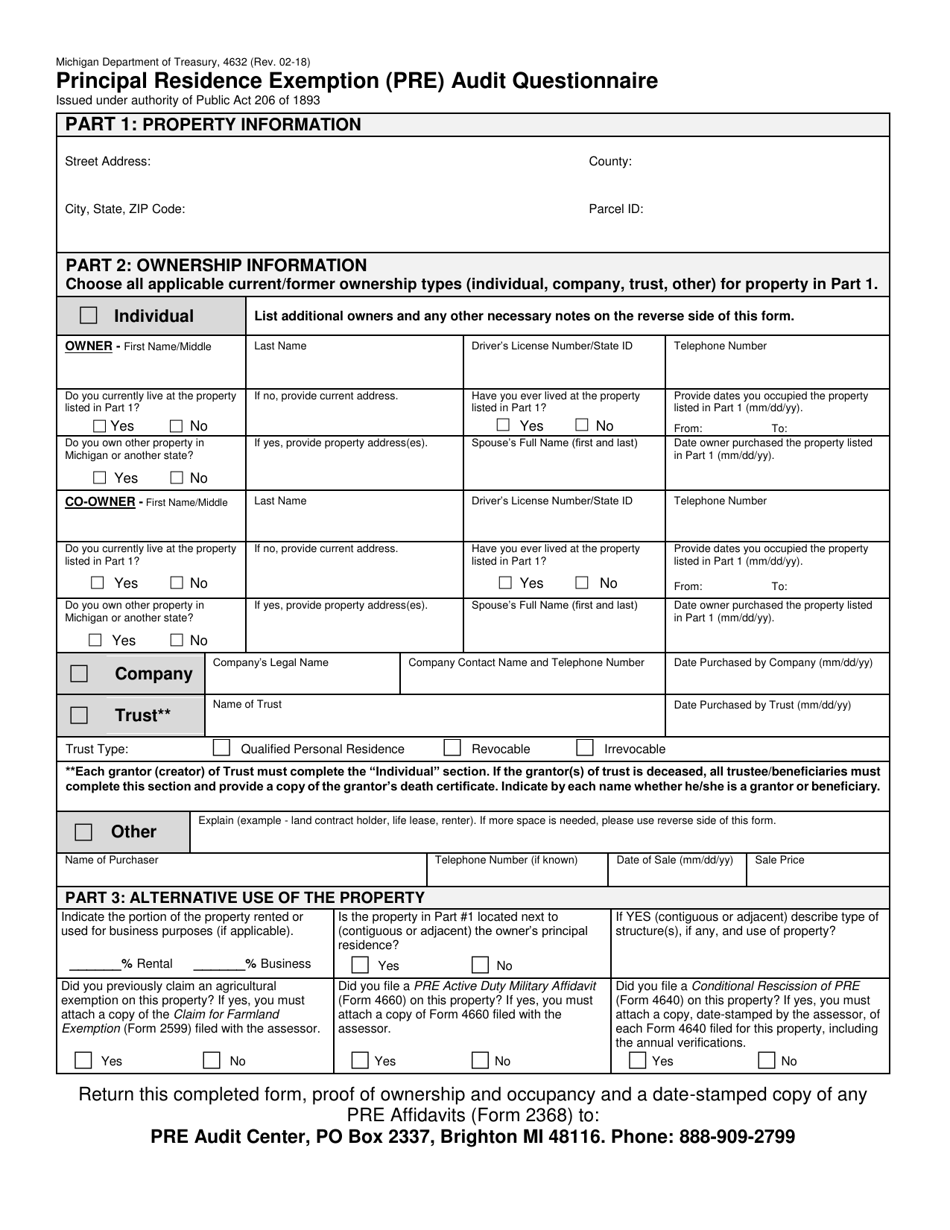

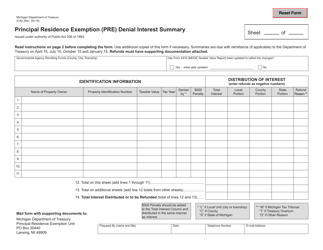

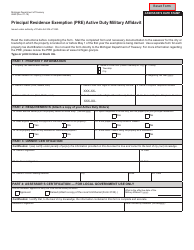

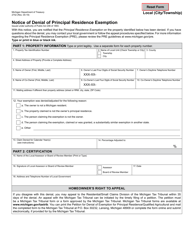

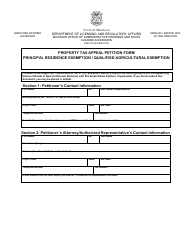

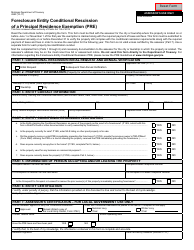

Form 4632 Principal Residence Exemption (Pre) Audit Questionnaire - Michigan

What Is Form 4632?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 4632 Principal Residence Exemption (PRE) Audit Questionnaire?

A: Form 4632 Principal Residence Exemption (PRE) Audit Questionnaire is a document used in Michigan to audit the principal residence exemption on property taxes.

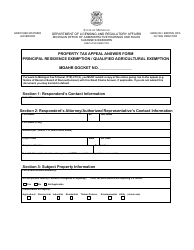

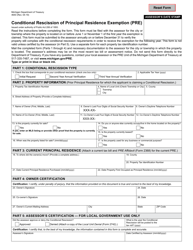

Q: Who needs to fill out Form 4632?

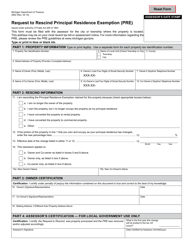

A: Property owners in Michigan who claim the principal residence exemption on their property taxes may be required to fill out Form 4632.

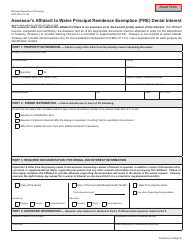

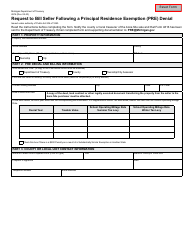

Q: What is the purpose of the Principal Residence Exemption (PRE) Audit Questionnaire?

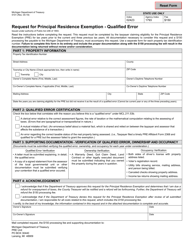

A: The purpose of the Principal Residence Exemption (PRE) Audit Questionnaire is to verify that the property owner meets the eligibility requirements for the principal residence exemption.

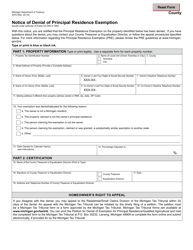

Q: What information is required on Form 4632?

A: Form 4632 requires information about the property owner's residency, ownership, and use of the property as their principal residence.

Q: What happens if a property owner does not fill out Form 4632?

A: Failure to provide the requested information on Form 4632 may result in the denial or revocation of the principal residence exemption.

Q: When should Form 4632 be submitted?

A: Form 4632 should be submitted within 45 days of the request from the assessing officer.

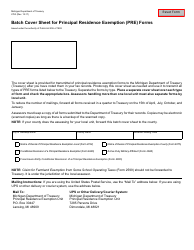

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4632 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.