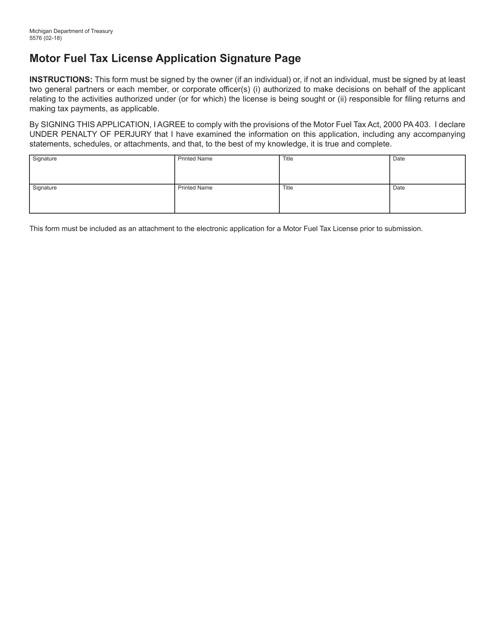

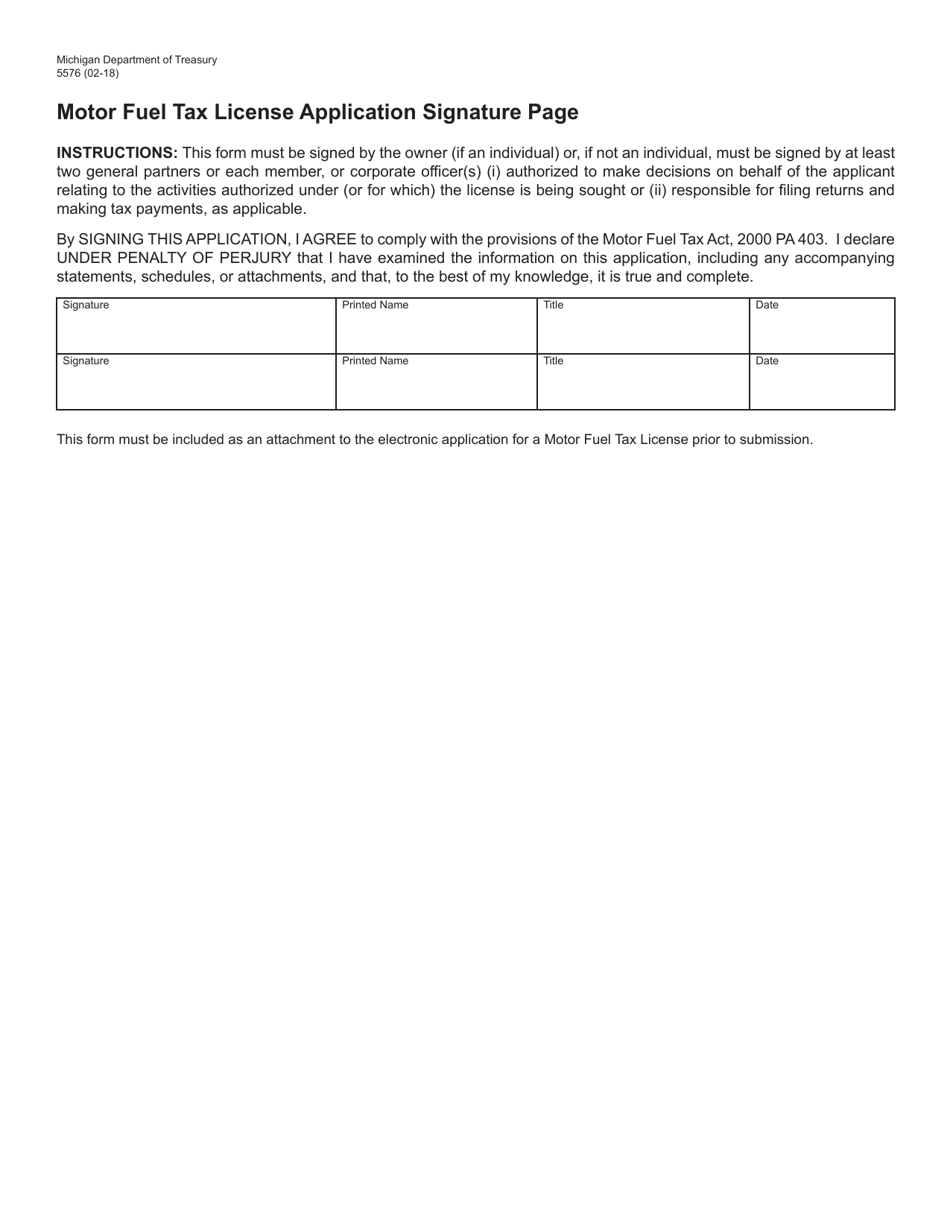

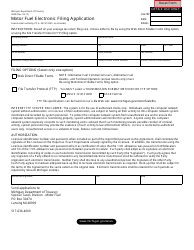

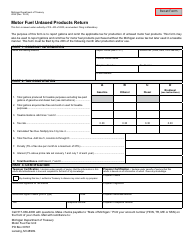

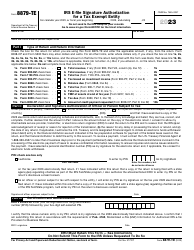

Form 5576 Motor Fuel Tax License Application Signature Page - Michigan

What Is Form 5576?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5576?

A: Form 5576 is the Motor FuelTax License Application Signature Page specifically for Michigan.

Q: What is the purpose of Form 5576?

A: The purpose of Form 5576 is to apply for a Motor Fuel Tax License in Michigan.

Q: Do I need to submit Form 5576 to obtain a Motor Fuel Tax License?

A: Yes, you must submit Form 5576 to obtain a Motor Fuel Tax License in Michigan.

Q: Is there a fee for applying for a Motor Fuel Tax License?

A: Yes, there is a fee associated with the Motor Fuel Tax License application in Michigan. The specific fee amount can be found on the Form 5576.

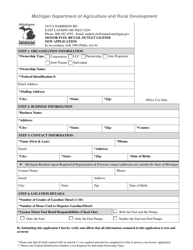

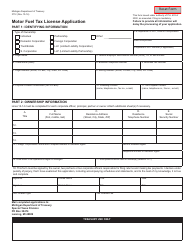

Q: What information should I include in Form 5576?

A: You should provide accurate and complete information about your business, including name, address, contact information, and other details required on the form.

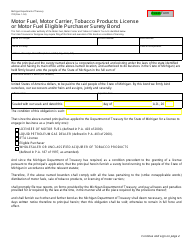

Q: Are there any additional documents required along with Form 5576?

A: Yes, there may be additional documents required to support your Motor Fuel Tax License application in Michigan. These documents can vary based on the specific situation, so it is important to carefully review the instructions and requirements provided with the form.

Q: Who should I contact for assistance with Form 5576?

A: If you need assistance with Form 5576 or have any questions regarding the Motor Fuel Tax License application process in Michigan, you can contact the Michigan Department of Treasury for guidance.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5576 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.