This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N, IC-045

for the current year.

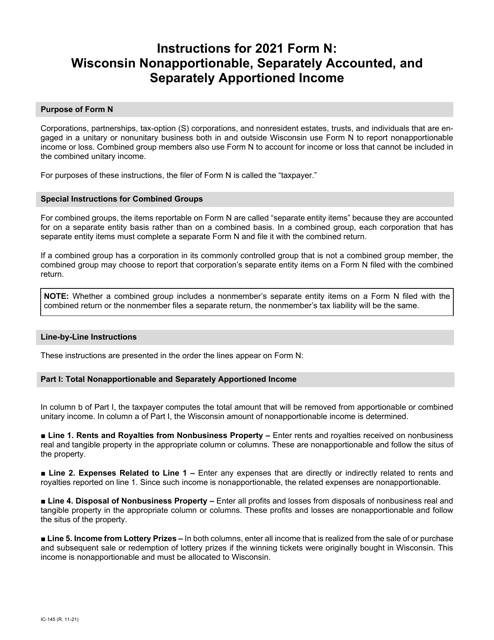

Instructions for Form N, IC-045 Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income - Wisconsin

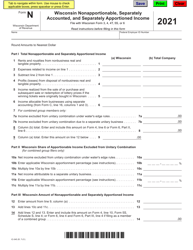

This document contains official instructions for Form N , and Form IC-045 . Both forms are released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form N (IC-045) is available for download through this link.

FAQ

Q: What is Form N, IC-045?

A: Form N, IC-045 is a tax form that is used in Wisconsin to report nonapportionable, separately accounted, and separately apportioned income.

Q: Who needs to file Form N, IC-045?

A: Taxpayers in Wisconsin who have nonapportionable, separately accounted, or separately apportioned income need to file Form N, IC-045.

Q: What is nonapportionable income?

A: Nonapportionable income is income that is not subject to apportionment among the states.

Q: What is separately accounted income?

A: Separately accounted income is income that is tracked separately for tax purposes.

Q: What is separately apportioned income?

A: Separately apportioned income is income that is apportioned separately from other income.

Q: Is Form N, IC-045 for individuals or businesses?

A: Form N, IC-045 can be used by both individuals and businesses.

Q: When is Form N, IC-045 due?

A: Form N, IC-045 is due on the same date as your Wisconsin income tax return.

Q: Are there any penalties for not filing Form N, IC-045?

A: Yes, there may be penalties for not filing Form N, IC-045 or for filing it late. It's important to file the form on time to avoid any penalties.

Q: Can I e-file Form N, IC-045?

A: Yes, you can e-file Form N, IC-045 if you are required to file a Wisconsin income tax return electronically.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.