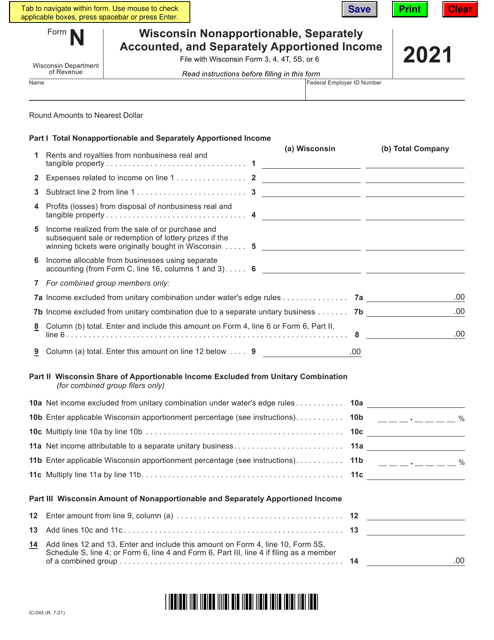

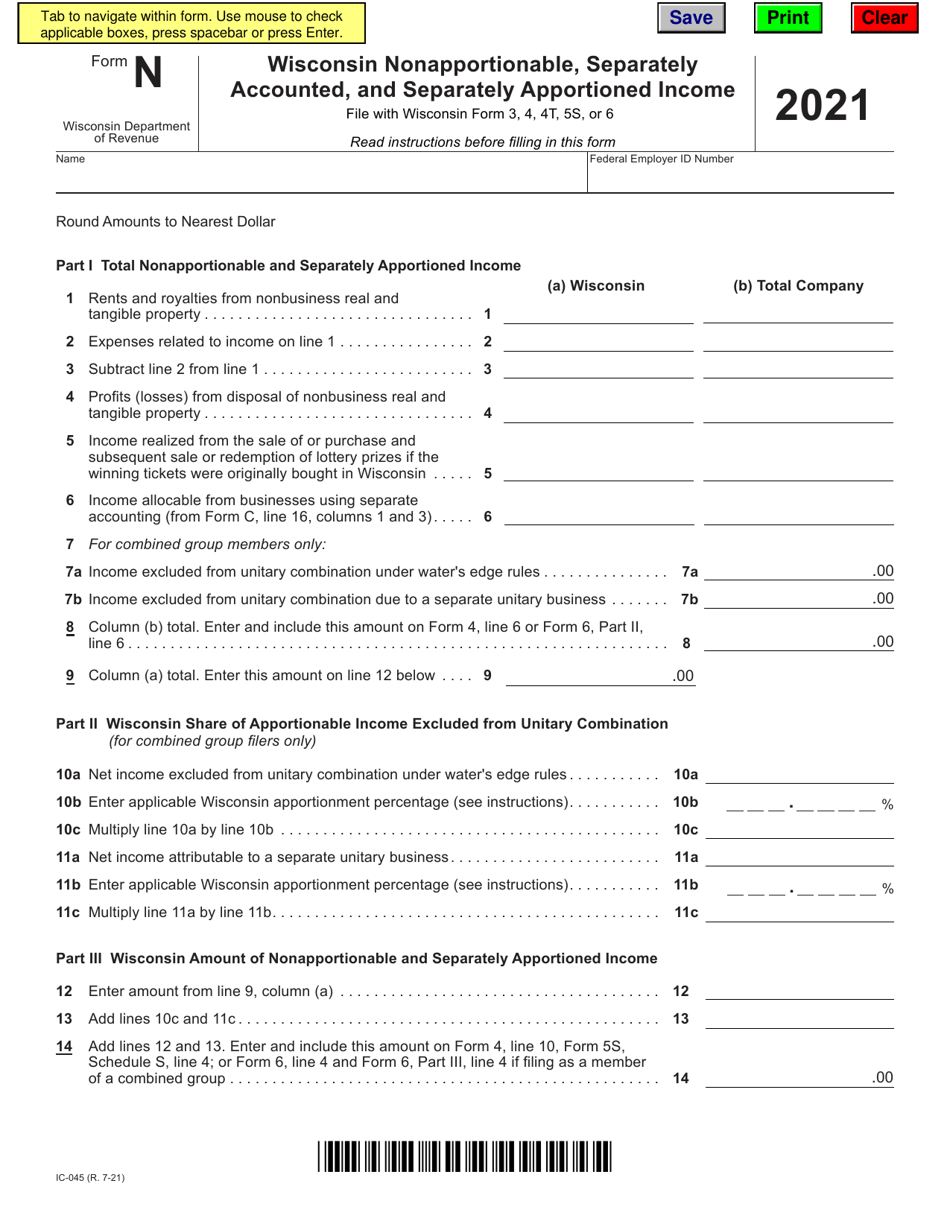

This version of the form is not currently in use and is provided for reference only. Download this version of

Form N (IC-045)

for the current year.

Form N (IC-045) Wisconsin Nonapportionable, Separately Accounted, and Separately Apportioned Income - Wisconsin

What Is Form N (IC-045)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

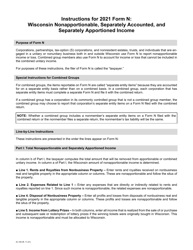

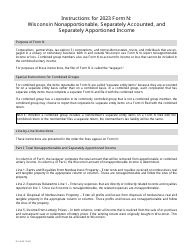

Q: What is Form N (IC-045)?

A: Form N (IC-045) is a Wisconsin tax form that is used to report nonapportionable, separately accounted, and separately apportioned income.

Q: Who needs to file Form N (IC-045)?

A: Taxpayers who have nonapportionable, separately accounted, and separately apportioned income in Wisconsin are required to file Form N (IC-045).

Q: What is nonapportionable income?

A: Nonapportionable income refers to income that is not subject to apportionment, meaning it is only taxable in Wisconsin.

Q: What is separately accounted income?

A: Separately accounted income is income that is tracked separately from other income and requires its own specific reporting.

Q: What is separately apportioned income?

A: Separately apportioned income refers to income that is allocated or attributed to a specific state using a separate apportionment formula.

Q: How do I file Form N (IC-045)?

A: Form N (IC-045) can be filed electronically or by mail. The instructions on the form provide details on how to complete and submit it.

Q: When is the deadline to file Form N (IC-045)?

A: The deadline to file Form N (IC-045) is the same as the deadline for filing the Wisconsin income tax return, which is usually April 15th of each year.

Q: Are there any penalties for not filing Form N (IC-045)?

A: Yes, if you have nonapportionable, separately accounted, and separately apportioned income in Wisconsin and fail to file Form N (IC-045), you may be subject to penalties and interest.

Q: Can I amend Form N (IC-045) if I made a mistake?

A: Yes, if you made a mistake on Form N (IC-045), you can file an amended form, which is Form N (IC-045X), to correct the error.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N (IC-045) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.