This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IC-300 Schedule A-02

for the current year.

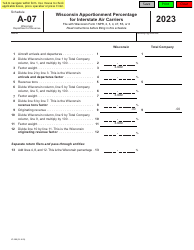

Instructions for Form IC-300 Schedule A-02 Wisconsin Apportionment Percentage for Interstate Financial Institutions - Wisconsin

This document contains official instructions for Form IC-300 Schedule A-02, Wisconsin Apportionment Percentage for Interstate Financial Institutions - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form IC-300 Schedule A-02 is available for download through this link.

FAQ

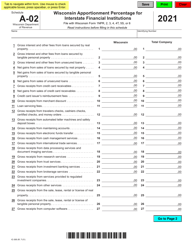

Q: What is Form IC-300 Schedule A-02?

A: Form IC-300 Schedule A-02 is a form used to determine the Wisconsin apportionment percentage for interstate financial institutions.

Q: Who needs to file Form IC-300 Schedule A-02?

A: Interstate financial institutions doing business in Wisconsin need to file Form IC-300 Schedule A-02.

Q: What is the purpose of Form IC-300 Schedule A-02?

A: The purpose of Form IC-300 Schedule A-02 is to calculate the apportionment percentage for interstate financial institutions in Wisconsin.

Q: What does the Wisconsin apportionment percentage mean?

A: The Wisconsin apportionment percentage is the percentage of a financial institution's income that is subject to Wisconsin income tax.

Q: How is the Wisconsin apportionment percentage calculated?

A: The Wisconsin apportionment percentage is calculated using a formula that takes into account various factors such as the institution's property, payroll, and sales in Wisconsin compared to its total property, payroll, and sales.

Q: Is Form IC-300 Schedule A-02 specific to Wisconsin?

A: Yes, Form IC-300 Schedule A-02 is specific to Wisconsin and is used specifically for calculating the apportionment percentage for interstate financial institutions in the state.

Q: When is Form IC-300 Schedule A-02 due?

A: Form IC-300 Schedule A-02 is typically due on the same date as the financial institution's Wisconsin income tax return. Check with the Wisconsin Department of Revenue for specific due dates.

Q: Are there any penalties for not filing Form IC-300 Schedule A-02?

A: Yes, there may be penalties for not filing Form IC-300 Schedule A-02 or for filing it late. It is important to comply with all applicable tax filing requirements.

Q: What should I do if I have questions or need assistance with Form IC-300 Schedule A-02?

A: If you have questions or need assistance with Form IC-300 Schedule A-02, you should contact the Wisconsin Department of Revenue. They will be able to provide guidance and support.

Instruction Details:

- This 12-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.