This version of the form is not currently in use and is provided for reference only. Download this version of

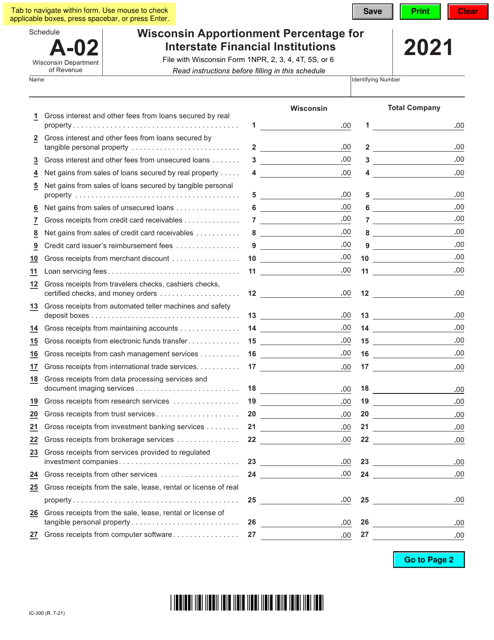

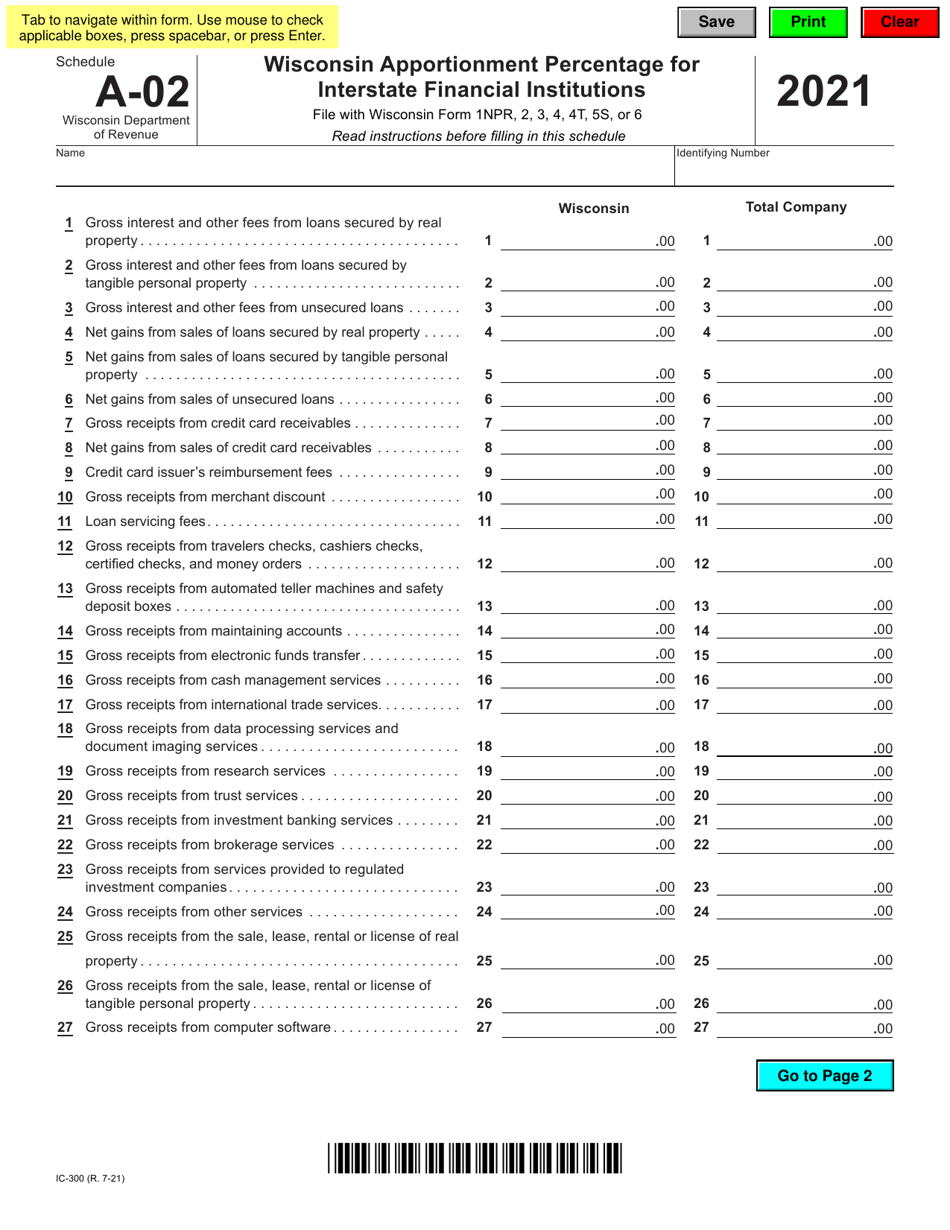

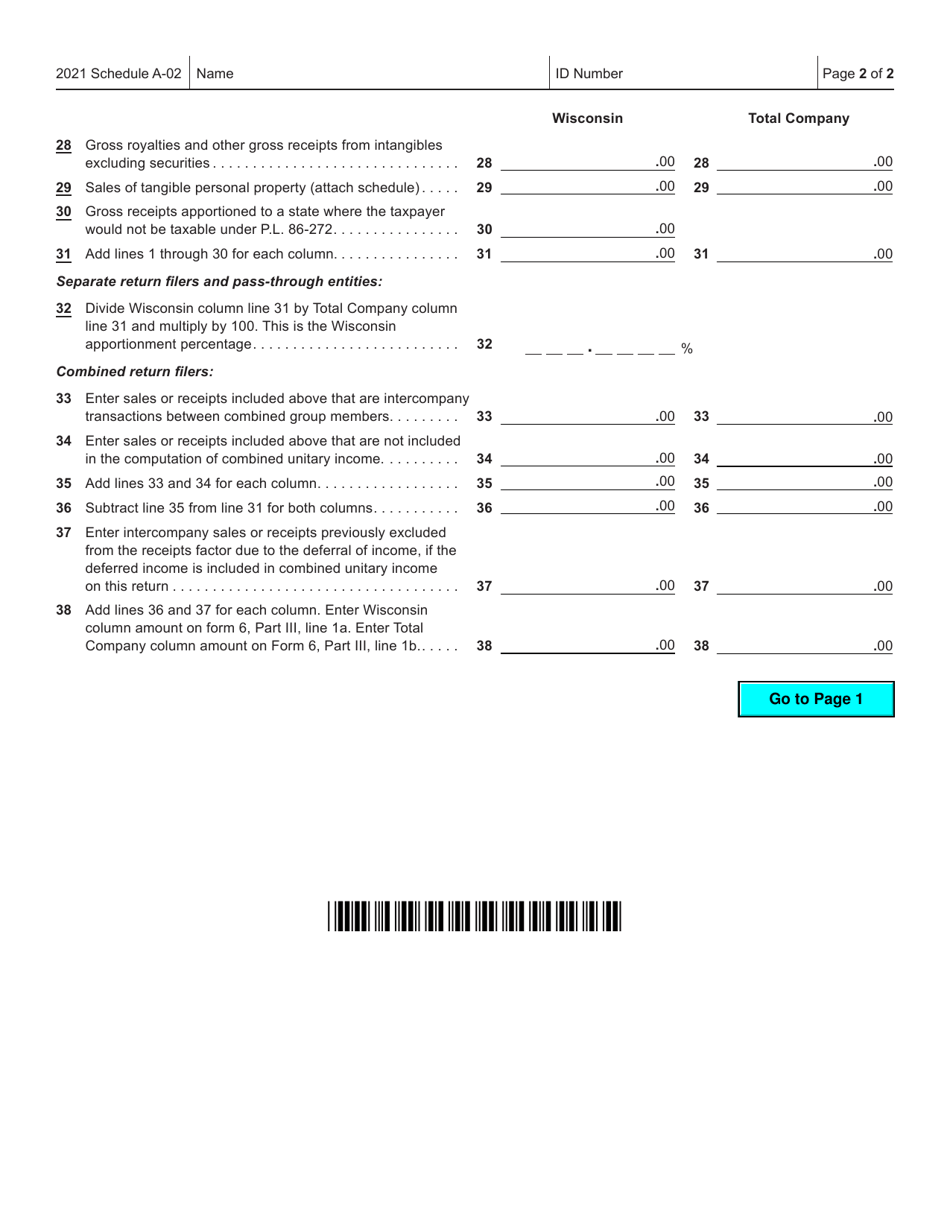

Form IC-300 Schedule A-02

for the current year.

Form IC-300 Schedule A-02 Wisconsin Apportionment Percentage for Interstate Financial Institutions - Wisconsin

What Is Form IC-300 Schedule A-02?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is IC-300 Schedule A-02?

A: IC-300 Schedule A-02 is a form used in Wisconsin to determine the apportionment percentage for interstate financial institutions.

Q: What is the purpose of IC-300 Schedule A-02?

A: The purpose of IC-300 Schedule A-02 is to calculate the apportionment percentage for interstate financial institutions in Wisconsin.

Q: Who uses IC-300 Schedule A-02?

A: IC-300 Schedule A-02 is used by interstate financial institutions in Wisconsin.

Q: What is the apportionment percentage?

A: The apportionment percentage is the portion of a financial institution's income that is subject to Wisconsin income tax.

Q: What is an interstate financial institution?

A: An interstate financial institution is a financial institution that operates in multiple states, including Wisconsin.

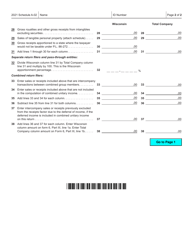

Q: How is the apportionment percentage calculated?

A: The apportionment percentage is calculated using a formula that takes into account the financial institution's property, payroll, and sales in Wisconsin compared to its total property, payroll, and sales.

Q: Why is the apportionment percentage important for interstate financial institutions?

A: The apportionment percentage is important because it determines the amount of income that is subject to Wisconsin income tax for interstate financial institutions.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-300 Schedule A-02 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.