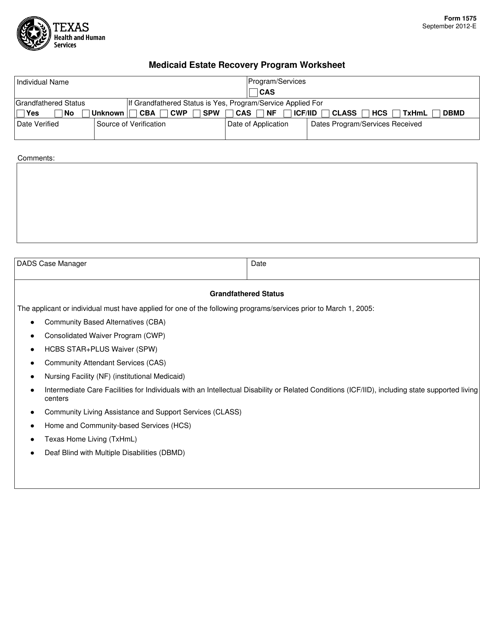

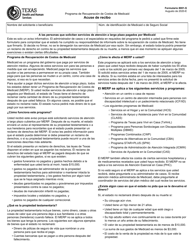

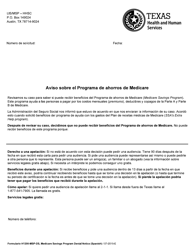

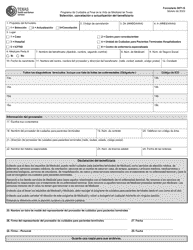

Form 1575 Medicaid Estate Recovery Program Worksheet - Texas

What Is Form 1575?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1575?

A: Form 1575 is the Medicaid Estate Recovery Program Worksheet in Texas.

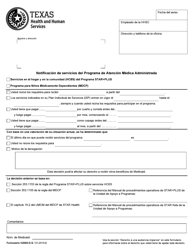

Q: What is the Medicaid Estate Recovery Program?

A: The Medicaid Estate Recovery Program is a program in Texas that allows the state to recover funds from an individual's estate after they have received Medicaid benefits.

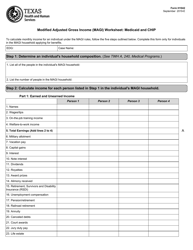

Q: What is the purpose of Form 1575?

A: The purpose of Form 1575 is to calculate the amount of Medicaid benefits that may need to be recovered from an individual's estate.

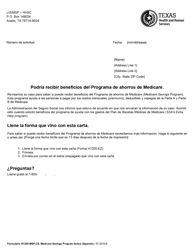

Q: Who needs to fill out Form 1575?

A: Form 1575 needs to be filled out by the executor or administrator of an individual's estate.

Q: What information is needed to complete Form 1575?

A: To complete Form 1575, you will need information about the individual's estate, their Medicaid eligibility, and any assets that may be subject to recovery.

Q: Is filling out Form 1575 mandatory?

A: Yes, if you are the executor or administrator of an individual's estate and they received Medicaid benefits, you are required to fill out Form 1575.

Q: When should Form 1575 be filled out?

A: Form 1575 should be filled out after the individual's death, but before the estate is distributed to beneficiaries.

Q: What happens after Form 1575 is submitted?

A: After Form 1575 is submitted, the HHSC will review the information provided and determine if any Medicaid benefits need to be recovered from the individual's estate.

Q: What should I do if I have questions about Form 1575?

A: If you have questions about Form 1575 or the Medicaid Estate Recovery Program, you can contact the Texas HHSC for assistance.

Form Details:

- Released on September 1, 2012;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1575 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.