This version of the form is not currently in use and is provided for reference only. Download this version of

Form HR-T (IC-134)

for the current year.

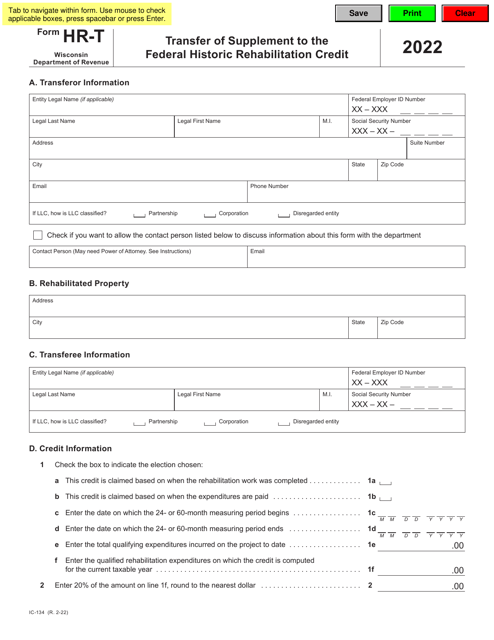

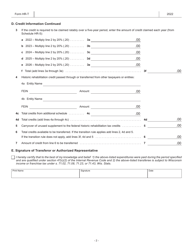

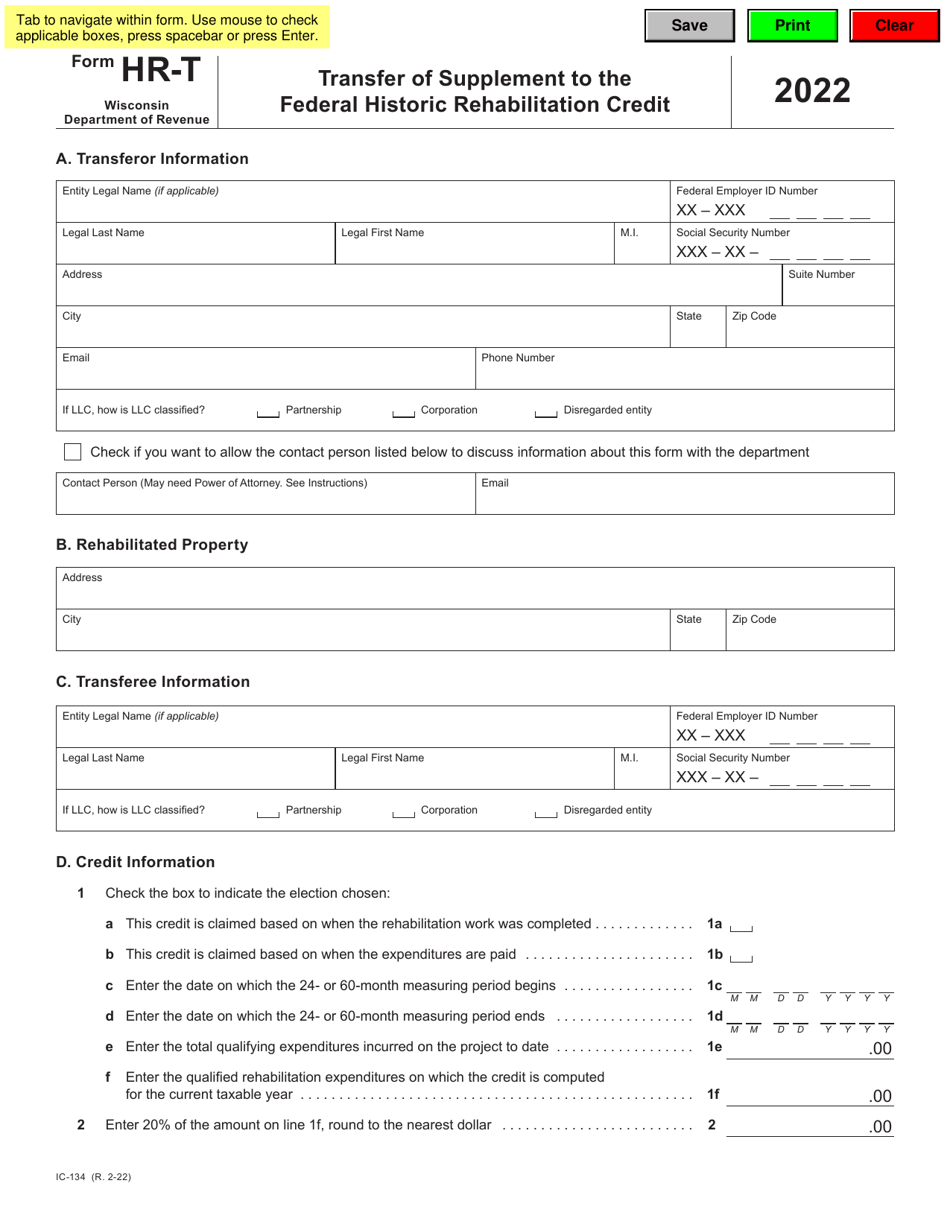

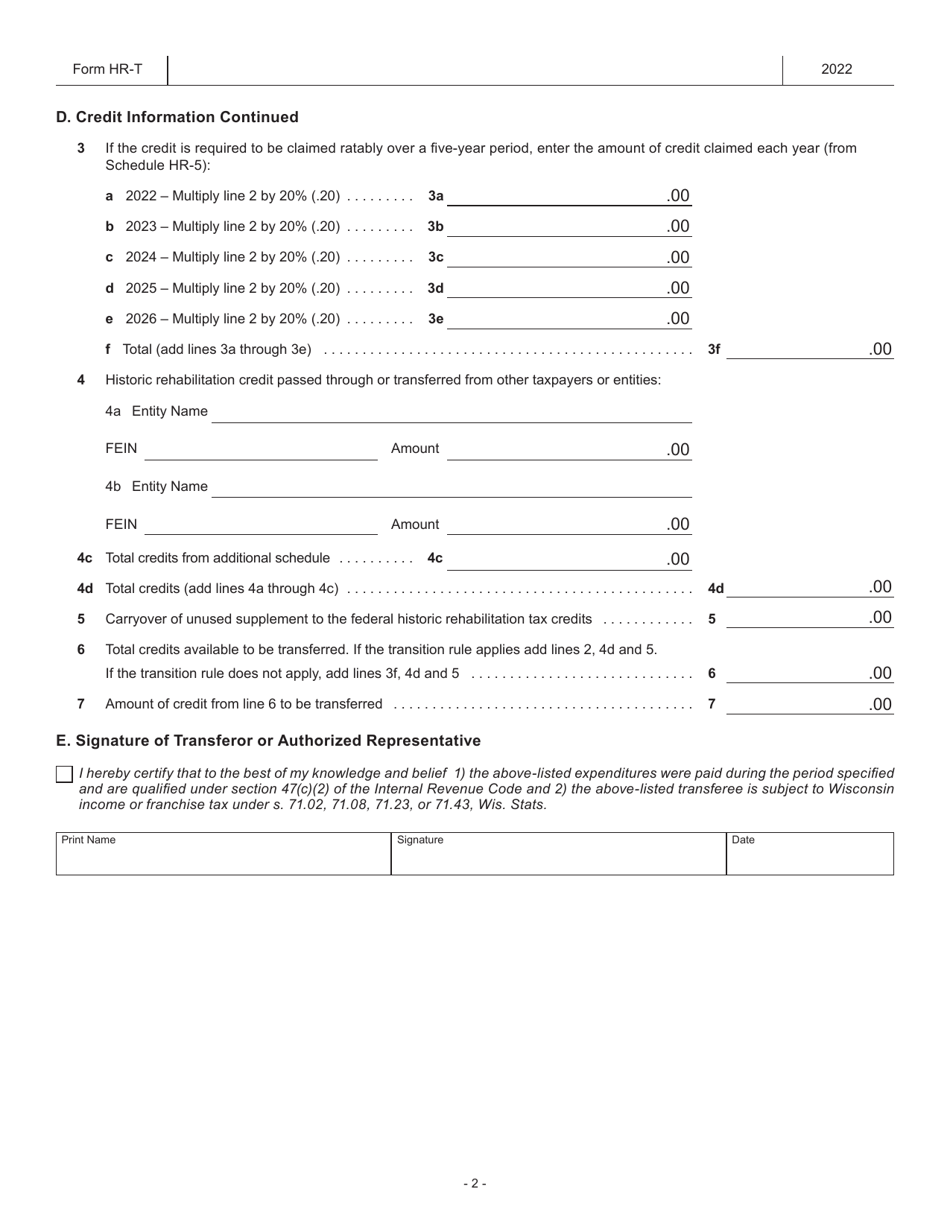

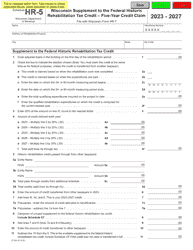

Form HR-T (IC-134) Transfer of Supplement to the Federal Historic Rehabilitation Credit - Wisconsin

What Is Form HR-T (IC-134)?

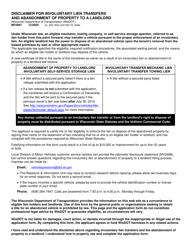

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form HR-T (IC-134)?

A: Form HR-T (IC-134) is a Transfer of Supplement to the Federal Historic Rehabilitation Credit form specific to Wisconsin.

Q: What is the purpose of form HR-T (IC-134)?

A: The purpose of form HR-T (IC-134) is to transfer the Supplement to the Federal Historic Rehabilitation Credit.

Q: Who needs to use form HR-T (IC-134)?

A: People or entities in Wisconsin who are transferring the Supplement to the Federal Historic Rehabilitation Credit need to use form HR-T (IC-134).

Q: How do I fill out form HR-T (IC-134)?

A: The instructions forfilling out form HR-T (IC-134) are provided with the form itself. Make sure to read and follow the instructions carefully.

Q: Are there any filing fees associated with form HR-T (IC-134)?

A: There may be filing fees associated with form HR-T (IC-134). Please check with the Wisconsin Department of Revenue for the current fee schedule.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HR-T (IC-134) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.