This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form HR-T, IC-134

for the current year.

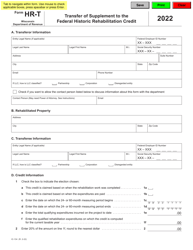

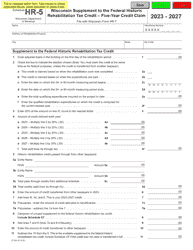

Instructions for Form HR-T, IC-134 Transfer of Supplement to the Federal Historic Rehabilitation Credit - Wisconsin

This document contains official instructions for Form HR-T , and Form IC-134 . Both forms are released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form HR-T (IC-134) is available for download through this link.

FAQ

Q: What is Form HR-T?

A: Form HR-T is the form used for transferring the Supplement to the Federal Historic Rehabilitation Credit in Wisconsin.

Q: What is the purpose of Form HR-T?

A: The purpose of Form HR-T is to transfer the Supplement to the Federal Historic Rehabilitation Credit from one party to another in Wisconsin.

Q: Who needs to fill out and submit Form HR-T?

A: Both the transferor and the transferee need to fill out and submit Form HR-T.

Q: What information is required on Form HR-T?

A: Form HR-T requires information about the transferor, transferee, and the details of the credit being transferred.

Q: Are there any fees associated with submitting Form HR-T?

A: No, there are no fees associated with submitting Form HR-T.

Q: Can I e-file Form HR-T?

A: No, you cannot e-file Form HR-T. It must be submitted by mail to the Wisconsin Department of Revenue.

Q: What is the deadline for submitting Form HR-T?

A: Form HR-T should be submitted within two years of the final taxable year in which the Supplement to the Federal Historic Rehabilitation Credit was claimed.

Q: Are there any additional forms or documents that need to be submitted with Form HR-T?

A: Yes, you need to include a copy of the final federal certification letter and any other relevant documentation.

Q: Who can I contact for more information about Form HR-T?

A: For more information about Form HR-T, you can contact the Wisconsin Department of Revenue.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.