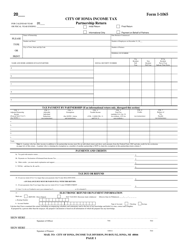

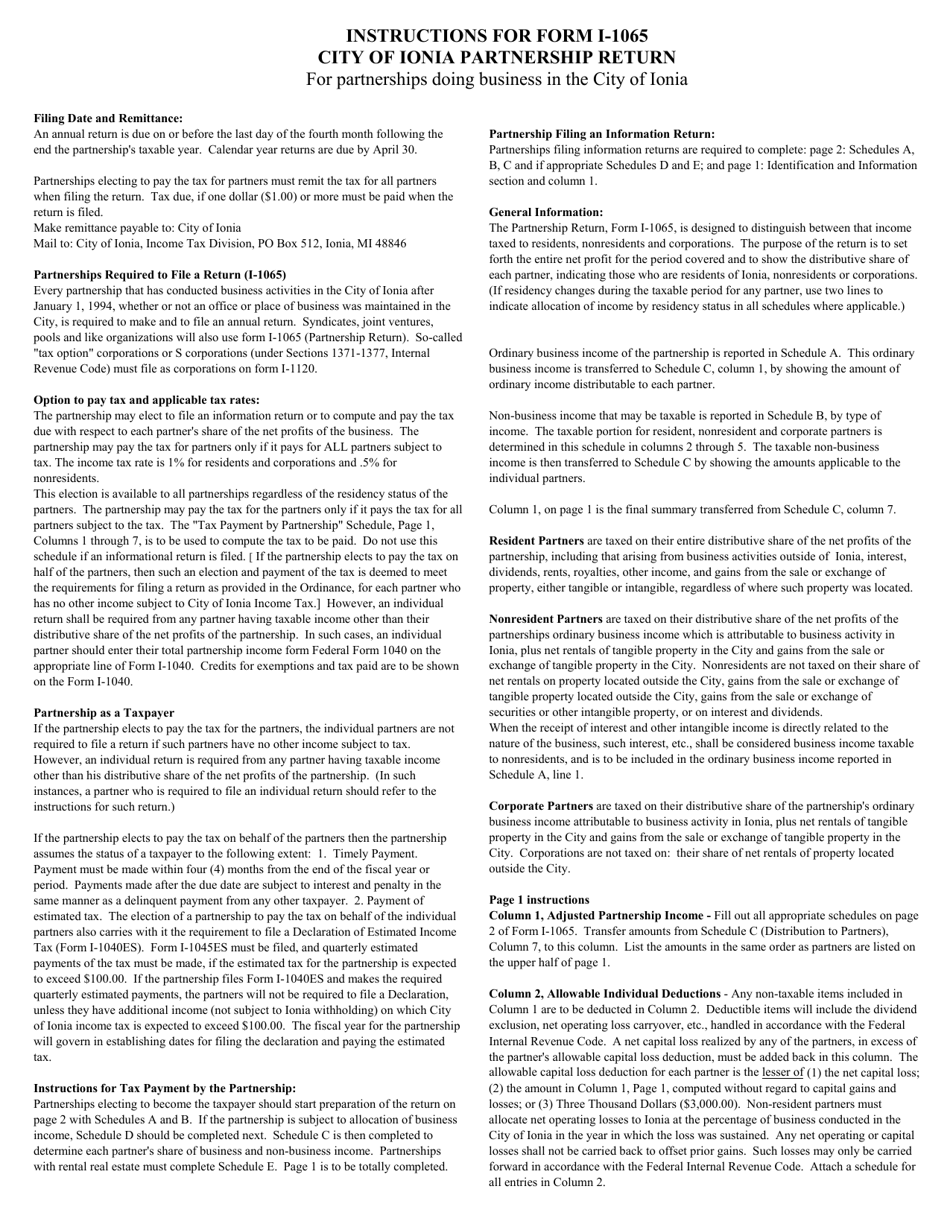

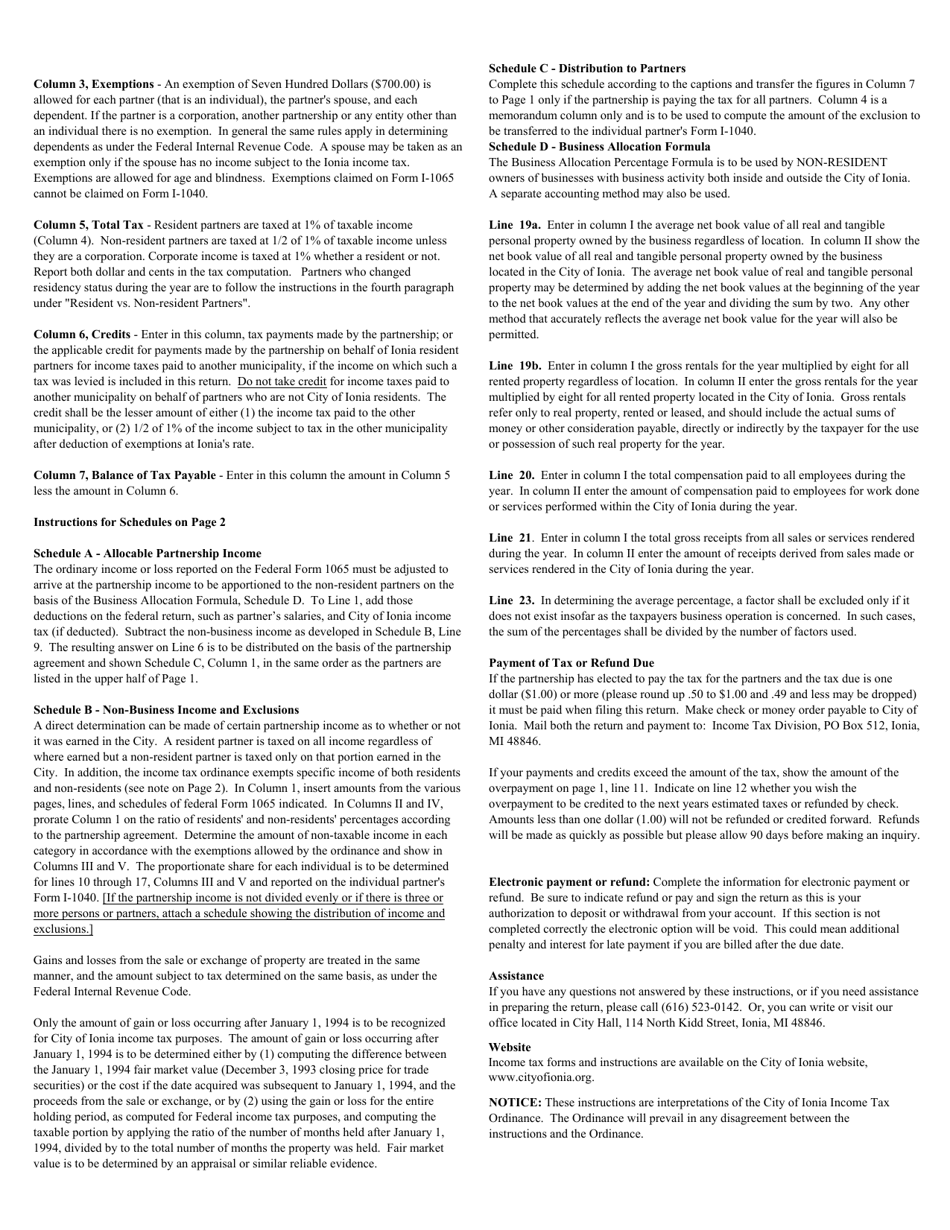

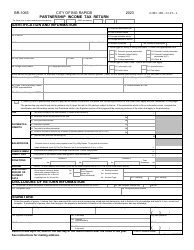

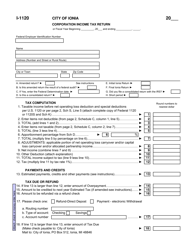

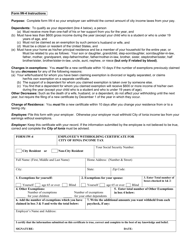

Instructions for Form I-1065 Partnership Return - City of Ionia, Michigan

This document contains official instructions for Form I-1065 , Partnership Return - a form released and collected by the Income Tax Department - City of Ionia, Michigan. An up-to-date fillable Form I-1065 is available for download through this link.

FAQ

Q: What is Form I-1065?

A: Form I-1065 is the Partnership Return form used to report partnership income, deductions, gains, and losses.

Q: Who needs to file Form I-1065?

A: Partnerships, including limited liability partnerships (LLPs), must file Form I-1065.

Q: What information do I need to complete Form I-1065?

A: You will need to provide information about the partnership, partners, income, deductions, and credits.

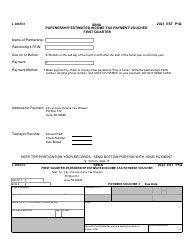

Q: When is the deadline for filing Form I-1065?

A: Form I-1065 must be filed by the 15th day of the 4th month following the end of the partnership's tax year.

Q: Are there any penalties for late filing of Form I-1065?

A: Yes, there are penalties for late filing or failure to file Form I-1065. It is important to file the form on time to avoid penalties.

Q: Can Form I-1065 be filed electronically?

A: Yes, you can file Form I-1065 electronically using the e-file system.

Q: Are there any special requirements for Form I-1065 for partnerships with foreign partners?

A: Yes, partnerships with foreign partners may have additional reporting requirements. It is recommended to consult with a tax professional or refer to the instructions for Form I-1065 for more information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Department - City of Ionia, Michigan.