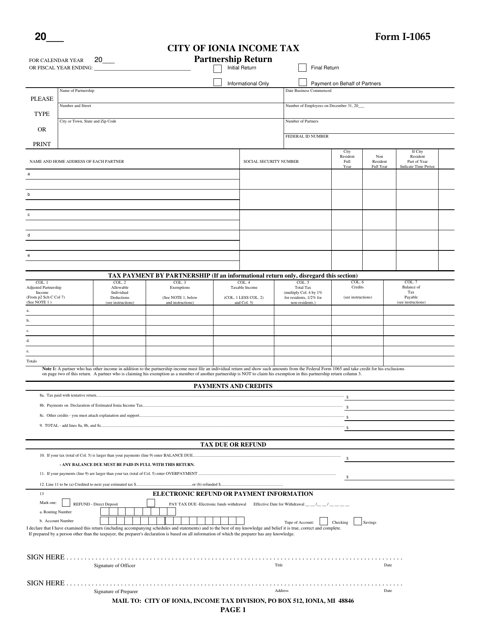

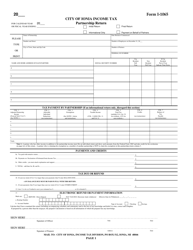

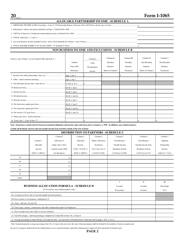

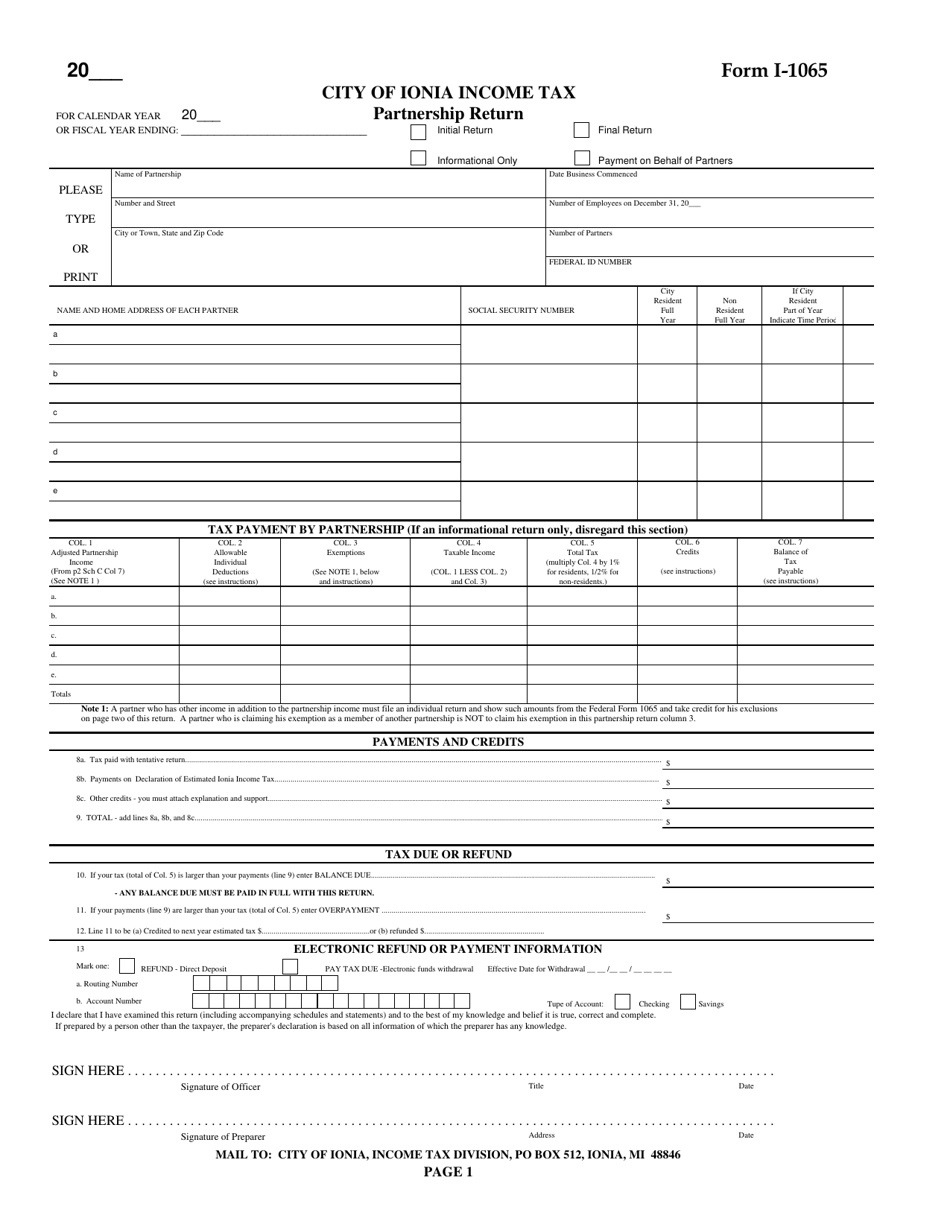

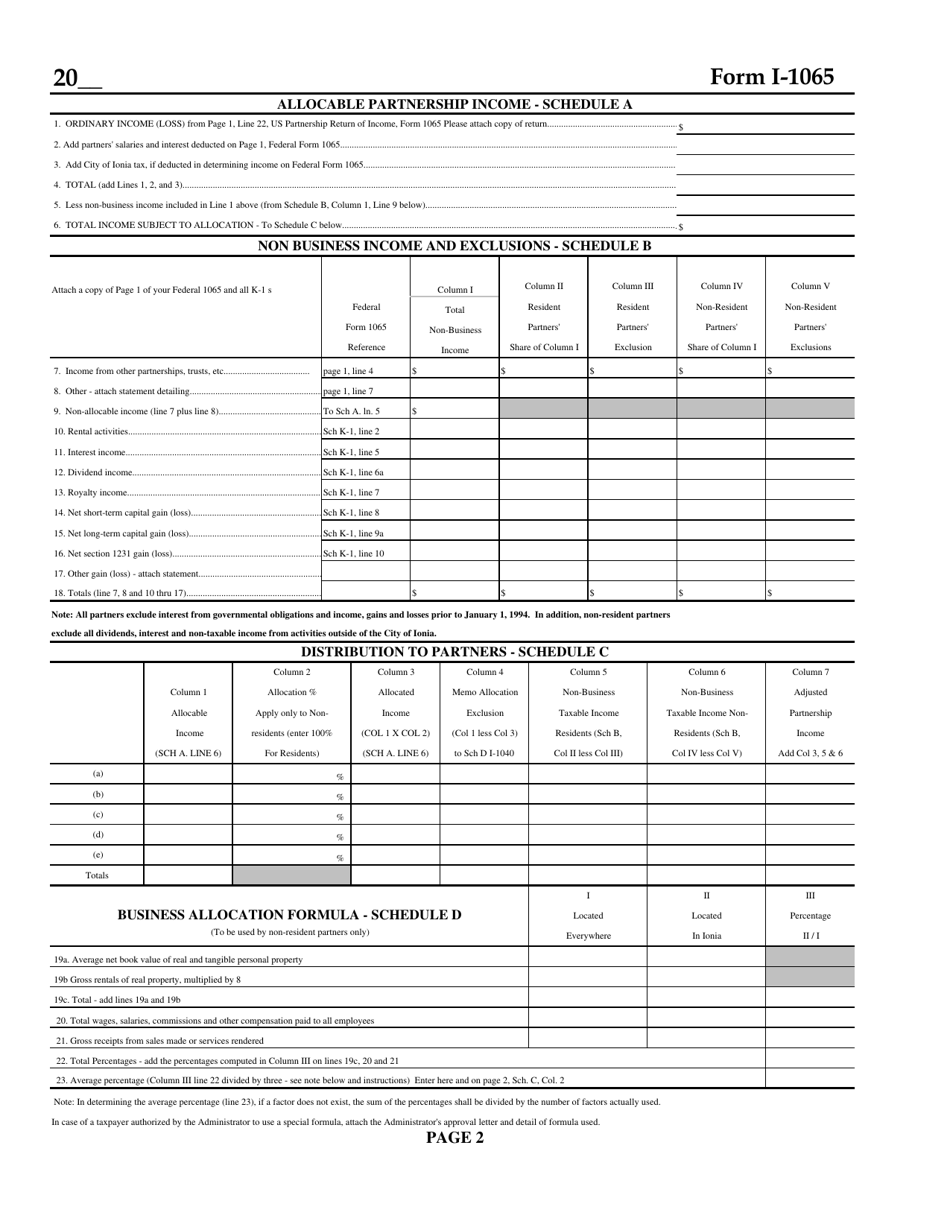

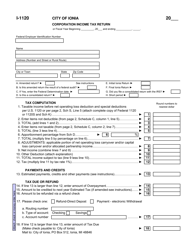

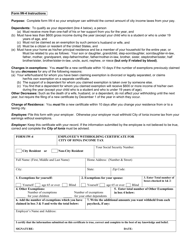

Form I-1065 Income Tax Partnership Return - City of Ionia, Michigan

What Is Form I-1065?

This is a legal form that was released by the Income Tax Department - City of Ionia, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Ionia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-1065?

A: Form I-1065 is the Income Tax Partnership Return form.

Q: Who needs to file Form I-1065?

A: Partnerships must file Form I-1065 to report their income and losses.

Q: What is the purpose of Form I-1065?

A: The purpose of Form I-1065 is to report the partnership's income, deductions, and credits.

Q: What is the City of Ionia, Michigan?

A: The City of Ionia is a city located in the state of Michigan.

Q: Is Form I-1065 specific to the City of Ionia, Michigan?

A: No, Form I-1065 is a federal tax form and is not specific to any particular city or state.

Q: When is the deadline to file Form I-1065?

A: The deadline to file Form I-1065 is generally March 15th of each year.

Q: Are there any penalties for late filing of Form I-1065?

A: Yes, there can be penalties for late filing of Form I-1065. It is important to file the form on time to avoid any penalties.

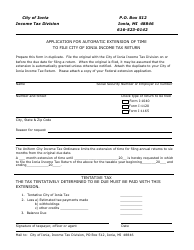

Q: What should I do if I need more time to file Form I-1065?

A: If you need more time to file Form I-1065, you can request an extension by filing Form 7004 with the IRS.

Q: Is it possible to e-file Form I-1065?

A: Yes, it is possible to e-file Form I-1065. The IRS provides options for electronic filing of the form.

Form Details:

- The latest edition provided by the Income Tax Department - City of Ionia, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-1065 by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Ionia, Michigan.