Instructions for Quitclaim Deed - County of San Diego, California

This document was released by Assessor-County Clerk-Recorder's-Elections office - County of San Mateo, California and contains the most recent official instructions for Quitclaim Deed .

FAQ

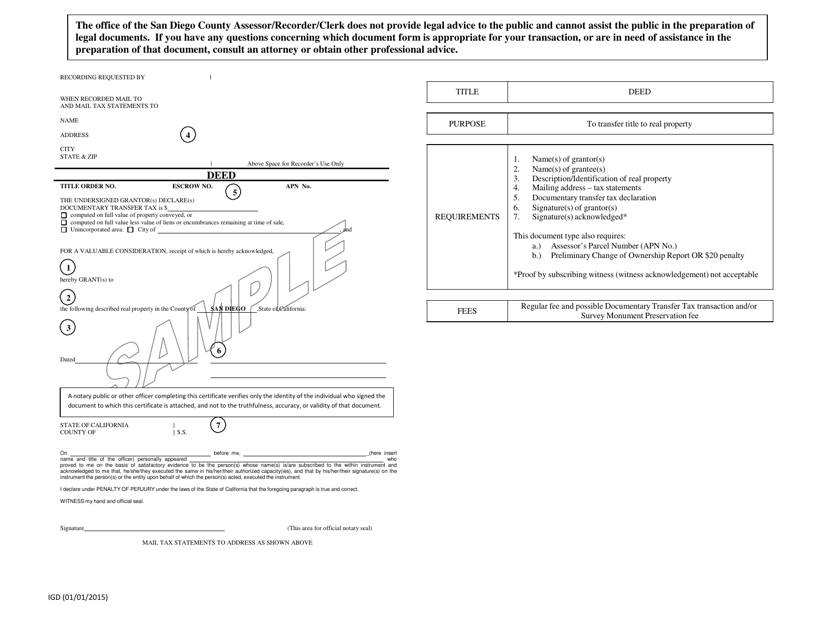

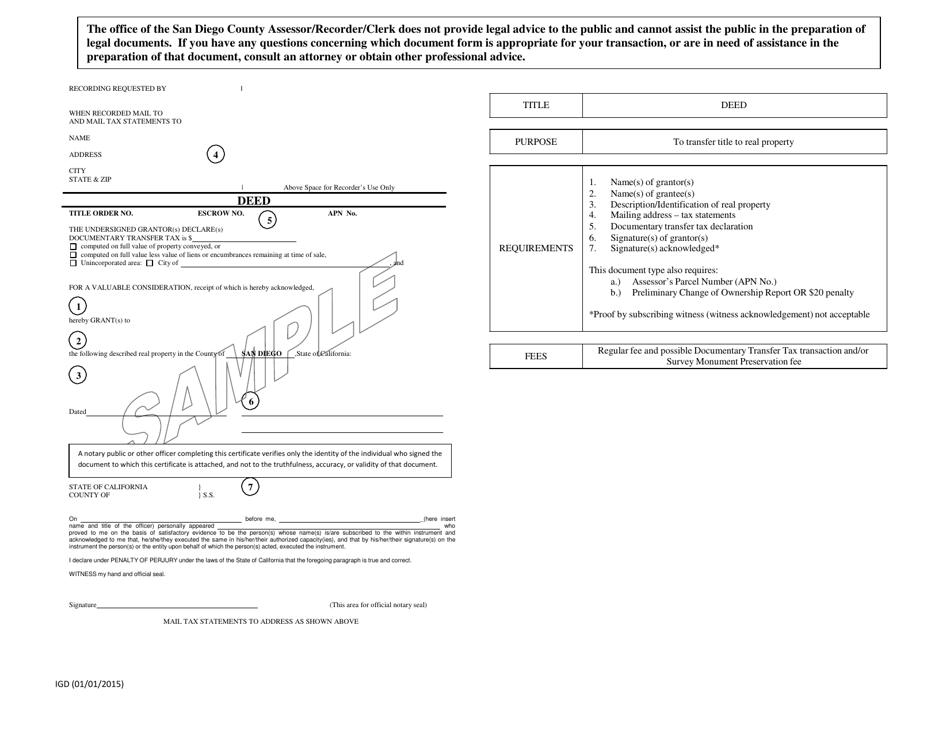

Q: What is a Quitclaim Deed?

A: A Quitclaim Deed is a legal document used to transfer ownership of real property.

Q: Why would I use a Quitclaim Deed?

A: You might use a Quitclaim Deed to transfer property between family members, in divorce or marriage dissolution, or to clear up title issues.

Q: What information is needed for a Quitclaim Deed in San Diego County, California?

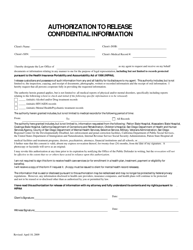

A: You will need the names and addresses of the grantor (current owner) and the grantee (new owner), a legal property description, and the notarized signatures of the grantor and two witnesses.

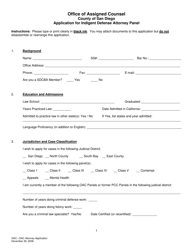

Q: Do I need to hire a lawyer to prepare a Quitclaim Deed?

A: While it is possible to prepare a Quitclaim Deed without a lawyer, it is recommended to seek legal advice to ensure all necessary steps are followed correctly.

Q: How do I record a Quitclaim Deed in San Diego County?

A: To record a Quitclaim Deed, you must submit the original document, along with any required fees, to the Clerk of the County Recorder's Office.

Q: What fees are associated with recording a Quitclaim Deed in San Diego County?

A: The fees for recording a Quitclaim Deed vary depending on factors such as the number of pages and additional services requested. Contact the County Recorder's Office for specific fee information.

Q: Can I use a Quitclaim Deed to transfer property outside of San Diego County?

A: Yes, a Quitclaim Deed can be used to transfer property anywhere in the state of California, not just in San Diego County.

Q: Are there any tax implications with using a Quitclaim Deed?

A: Transferring property with a Quitclaim Deed may have tax implications. It is recommended to consult with a tax professional or attorney for advice specific to your situation.

Q: Can a Quitclaim Deed be used to transfer property to a trust?

A: Yes, a Quitclaim Deed can be used to transfer property to a trust. However, it is advisable to consult with an attorney experienced in trust law to ensure the transfer is done correctly.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Assessor-County Clerk-Recorder's-Elections office - County of San Mateo, California.