This version of the form is not currently in use and is provided for reference only. Download this version of

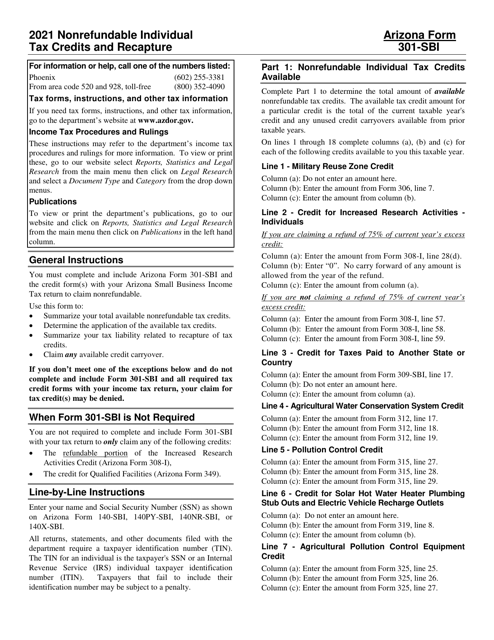

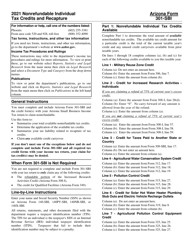

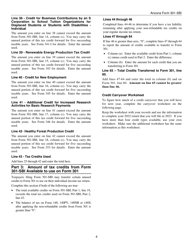

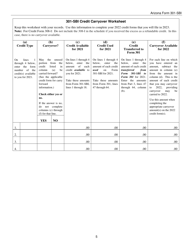

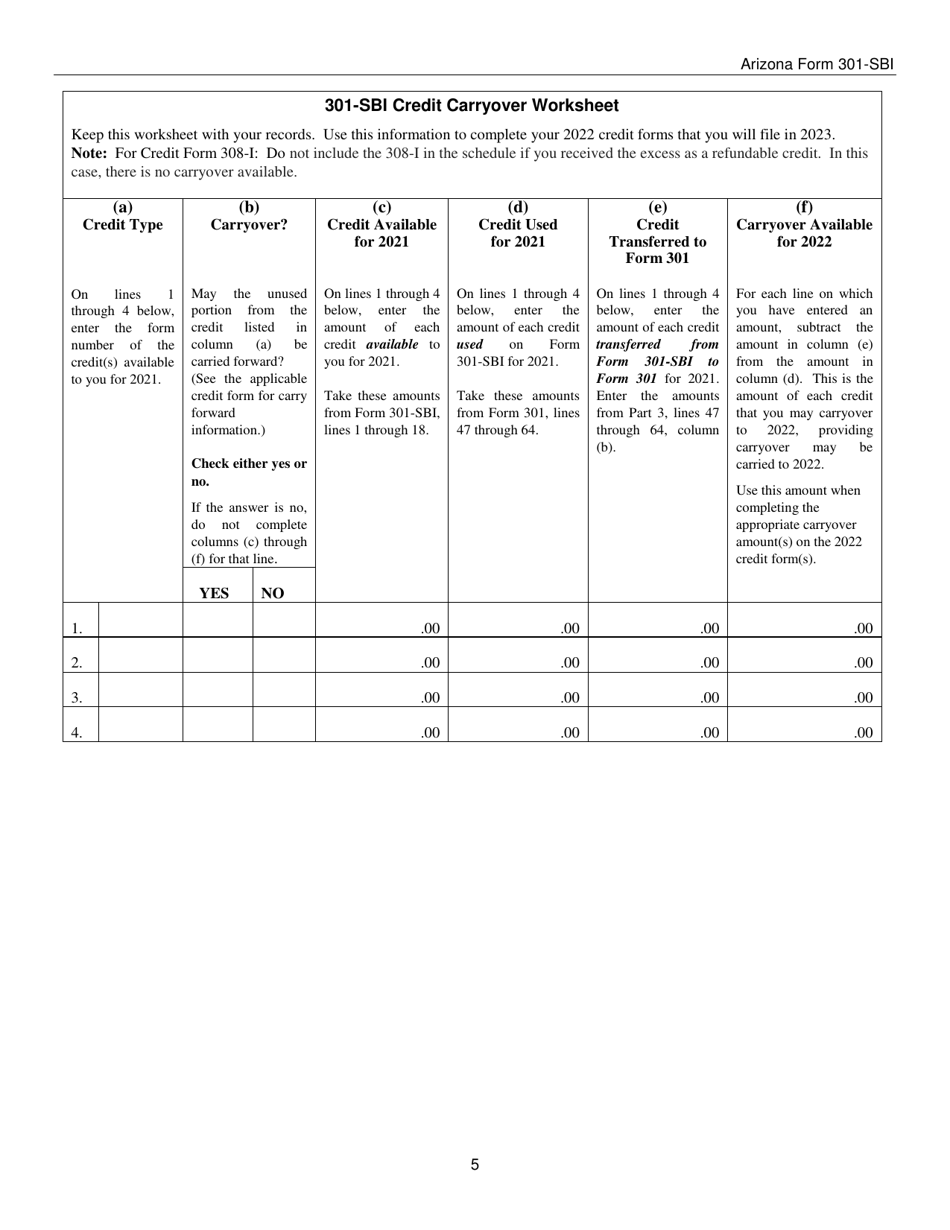

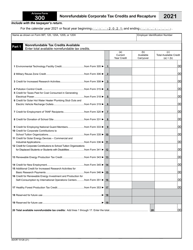

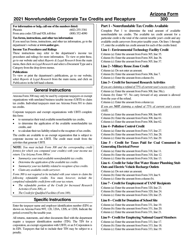

Instructions for Arizona Form 301-SBI, ADOR11405

for the current year.

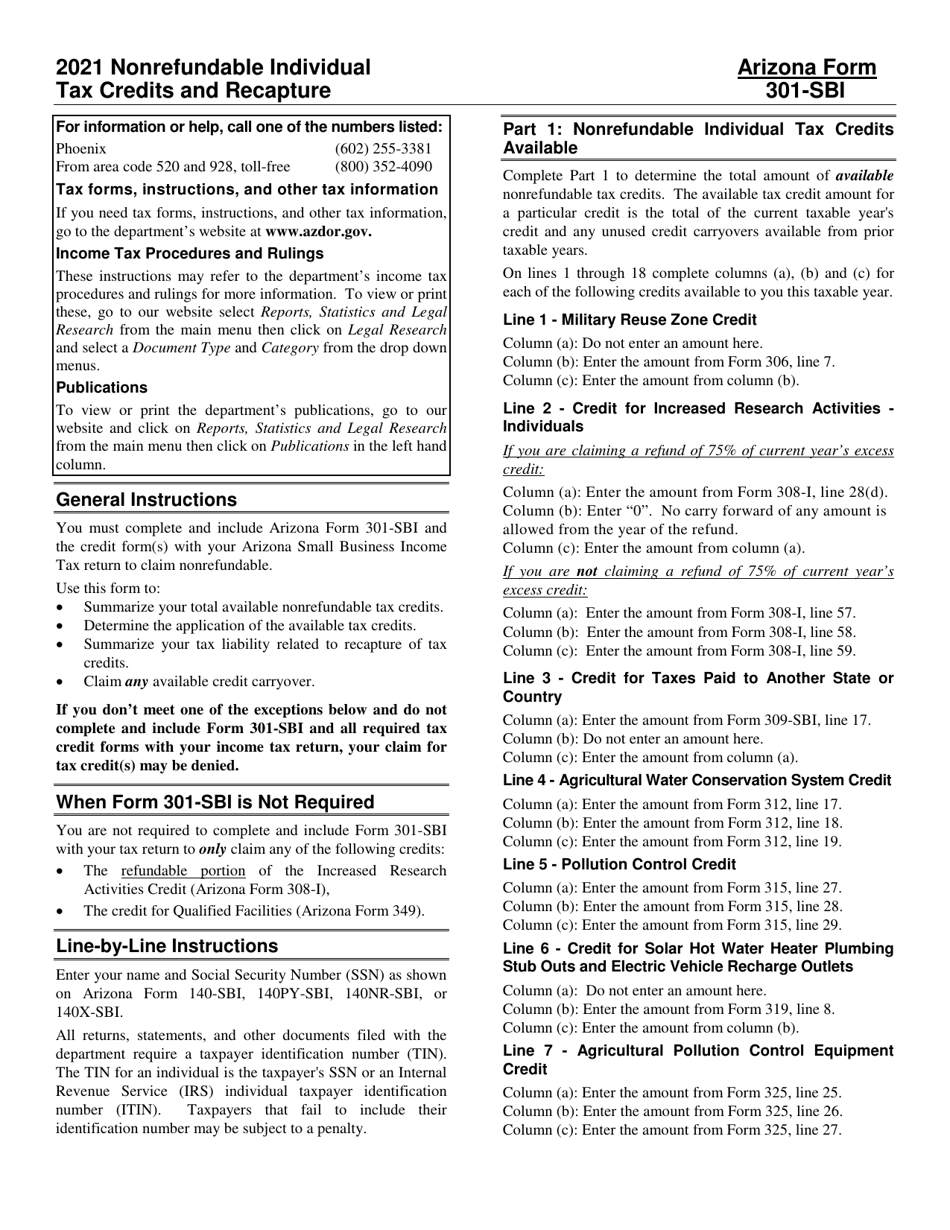

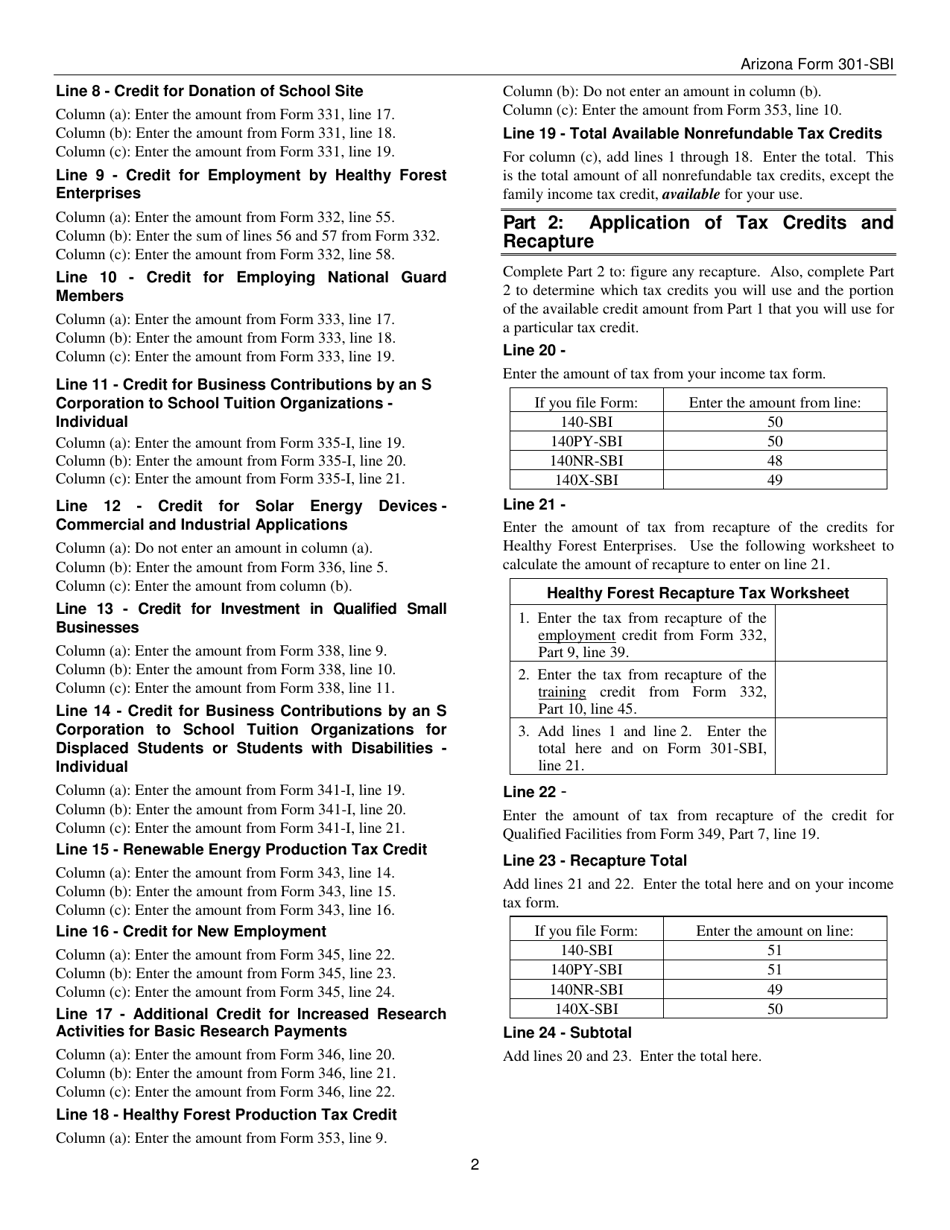

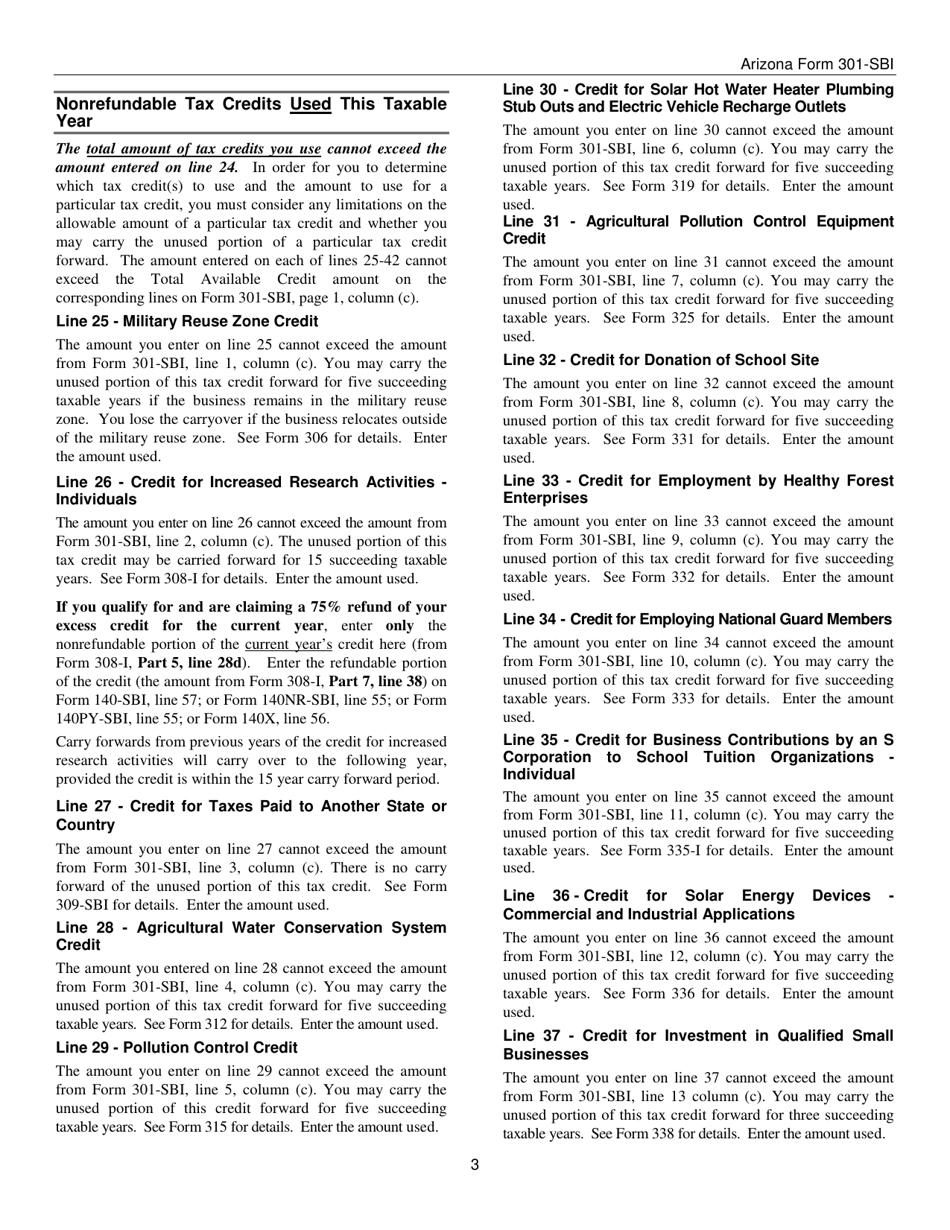

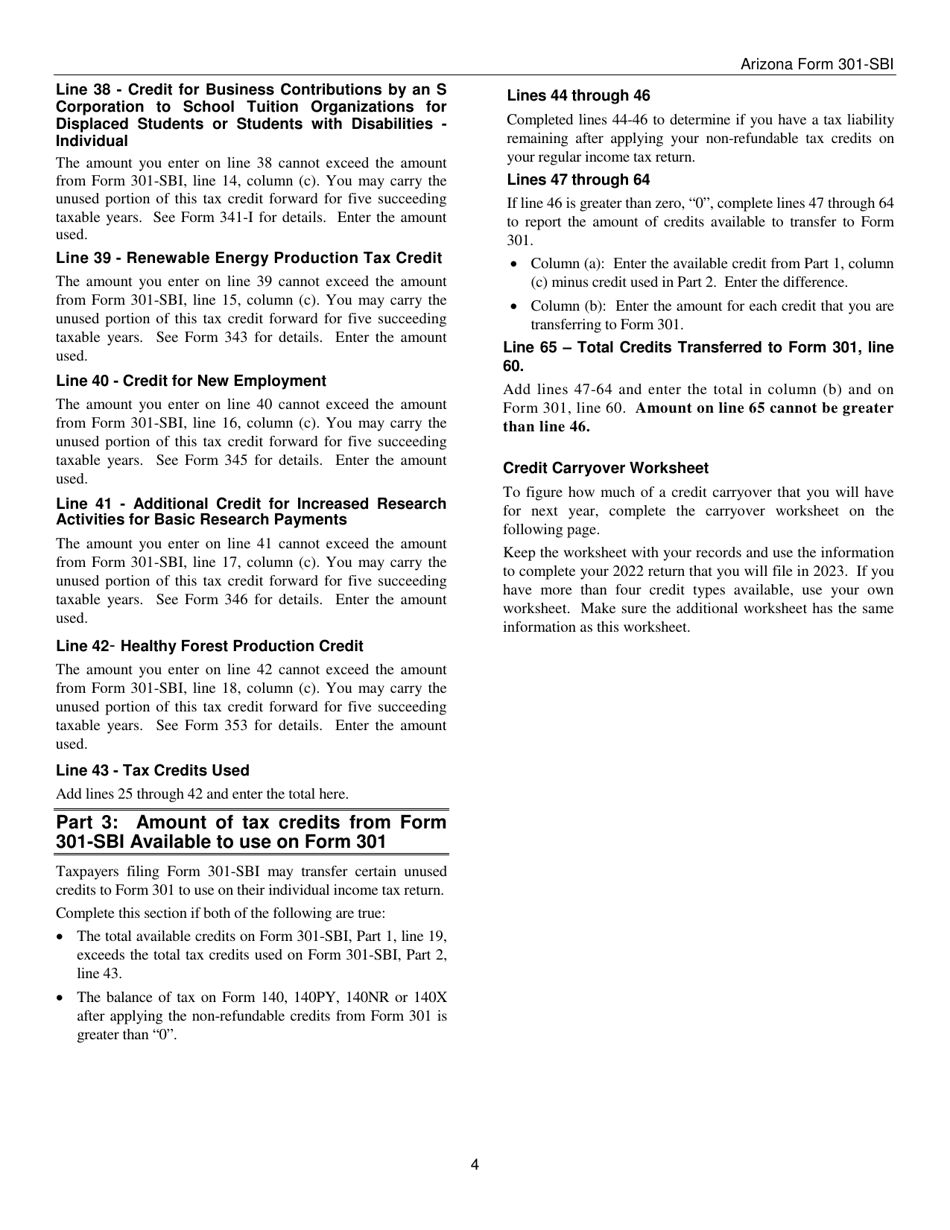

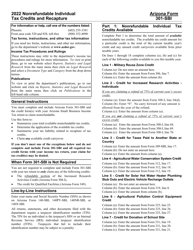

Instructions for Arizona Form 301-SBI, ADOR11405 Nonrefundable Individual Tax Credits and Recapture for Form 140-sbi, 140py-Sbi, 140nr-Sbi or 140x-Sbi - Arizona

This document contains official instructions for Arizona Form 301-SBI , and Form ADOR11405 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Arizona Form 301-SBI?

A: Arizona Form 301-SBI is used for reporting nonrefundable individual tax credits and recapture for Form 140-SBI, 140PY-SBI, 140NR-SBI, or 140X-SBI in Arizona.

Q: Who needs to file Arizona Form 301-SBI?

A: Anyone who is claiming nonrefundable individual tax credits and needs to recapture any of those credits on their Arizona tax return must file Form 301-SBI.

Q: What are nonrefundable individual tax credits?

A: Nonrefundable individual tax credits are credits that can reduce the amount of tax you owe, but they do not result in a refund if they exceed your tax liability.

Q: What is recapture?

A: Recapture is when you have to repay or refund a previously claimed tax credit because you no longer meet the requirements or conditions for that credit.

Q: Which forms are eligible for reporting on Arizona Form 301-SBI?

A: Form 140-SBI, 140PY-SBI, 140NR-SBI, and 140X-SBI are eligible for reporting on Arizona Form 301-SBI.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.