This version of the form is not currently in use and is provided for reference only. Download this version of

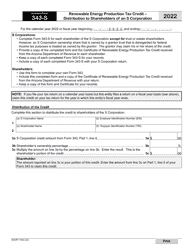

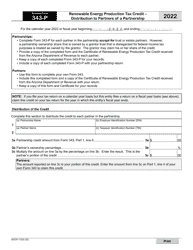

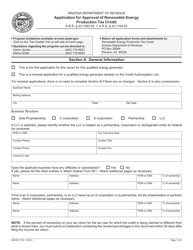

Instructions for Arizona Form 351, ADOR11222, Arizona Form 351-P, ADOR11248

for the current year.

Instructions for Arizona Form 351, ADOR11222, Arizona Form 351-P, ADOR11248 - Arizona

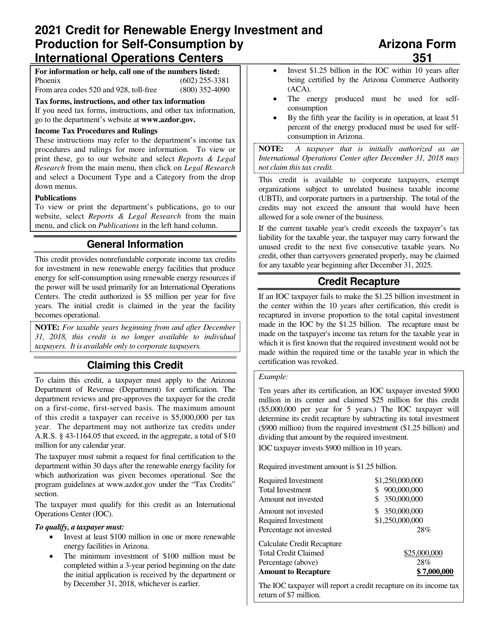

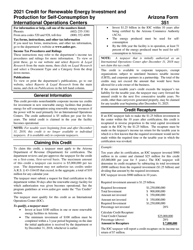

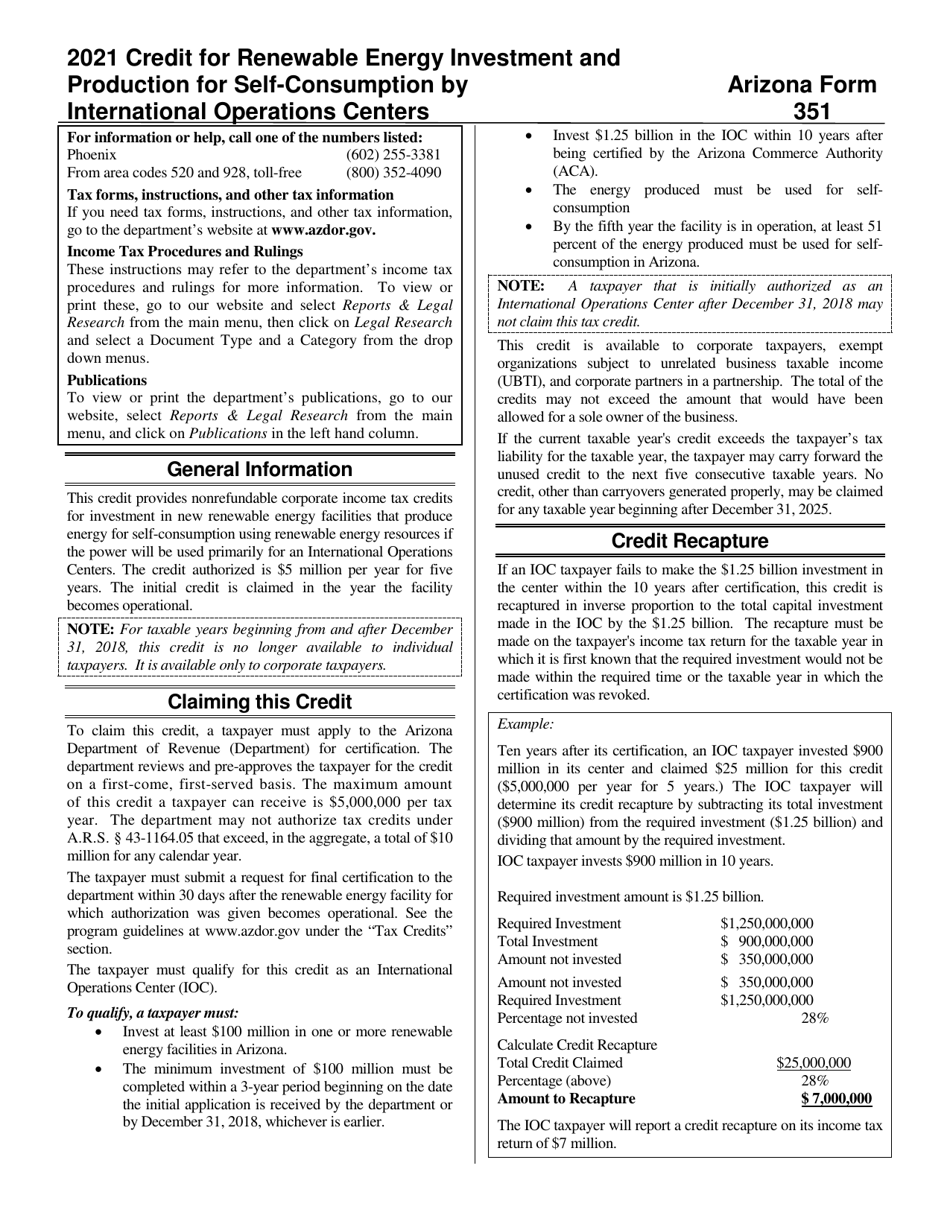

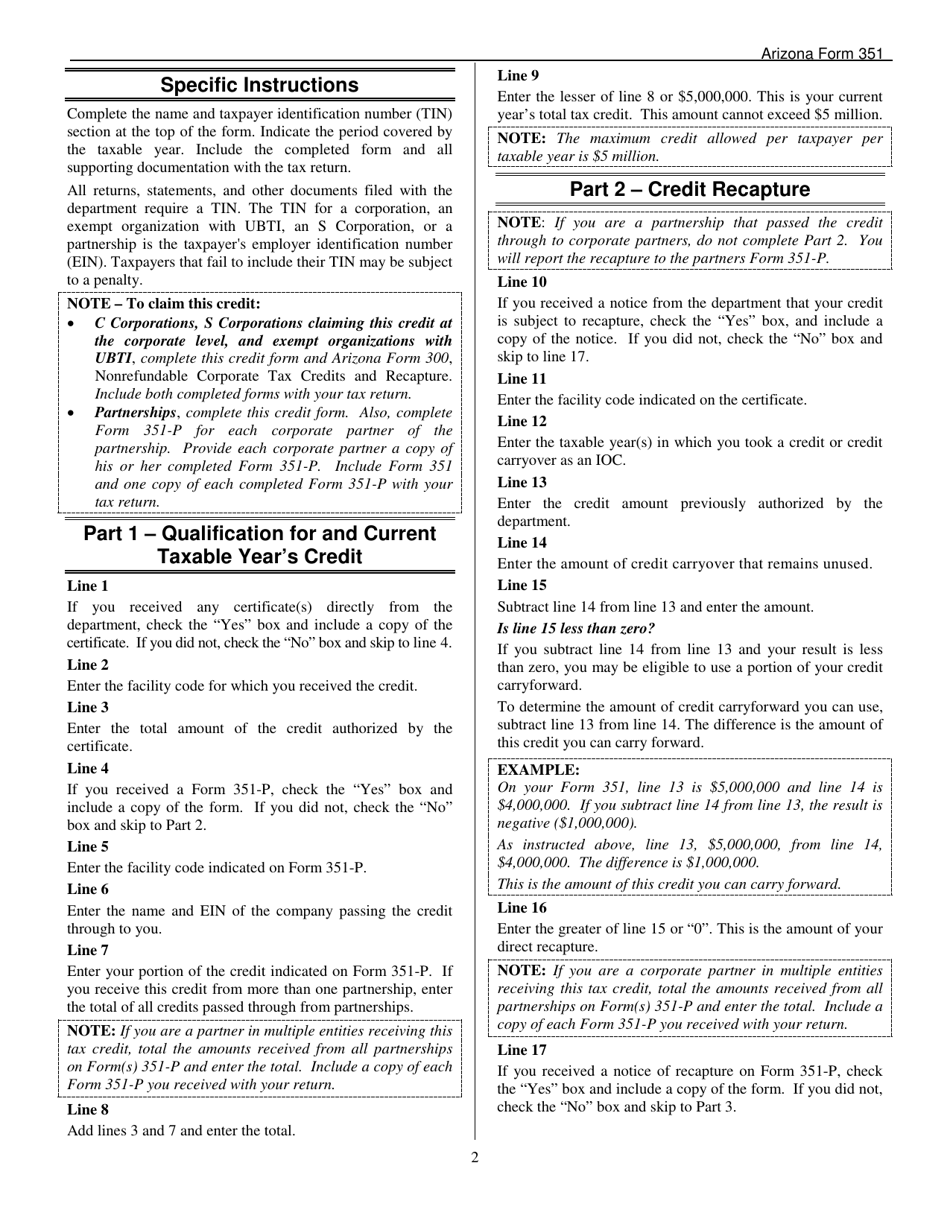

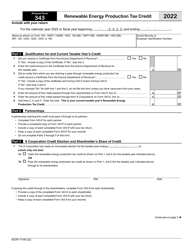

Arizona Form 351 (ADOR11222) Credit for Renewable Energy Investment and Production for Self-consumption by International Operations Centers - Arizona

Arizona Form 351 (ADOR11222) Credit for Renewable Energy Investment and Production for Self-consumption by International Operations Centers - Arizona

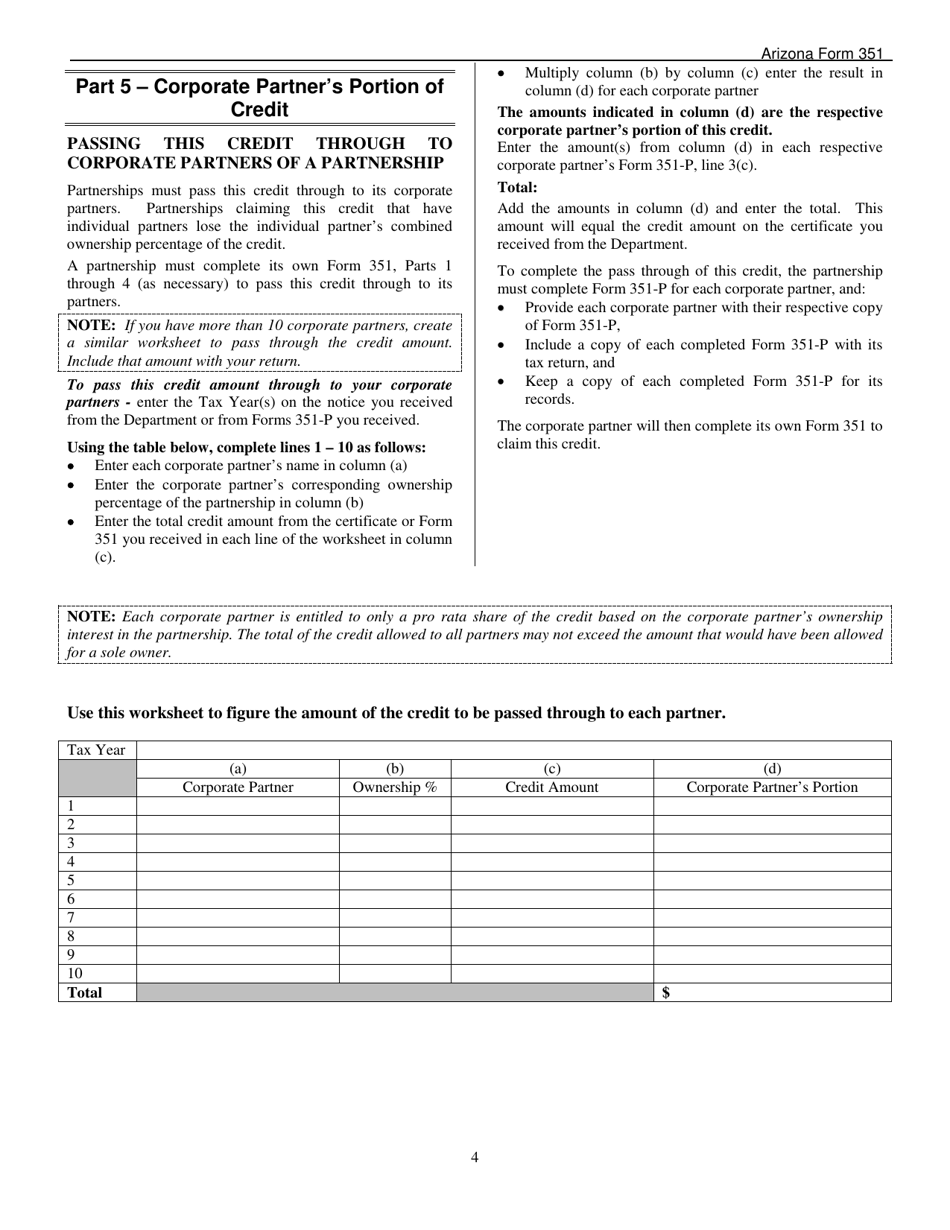

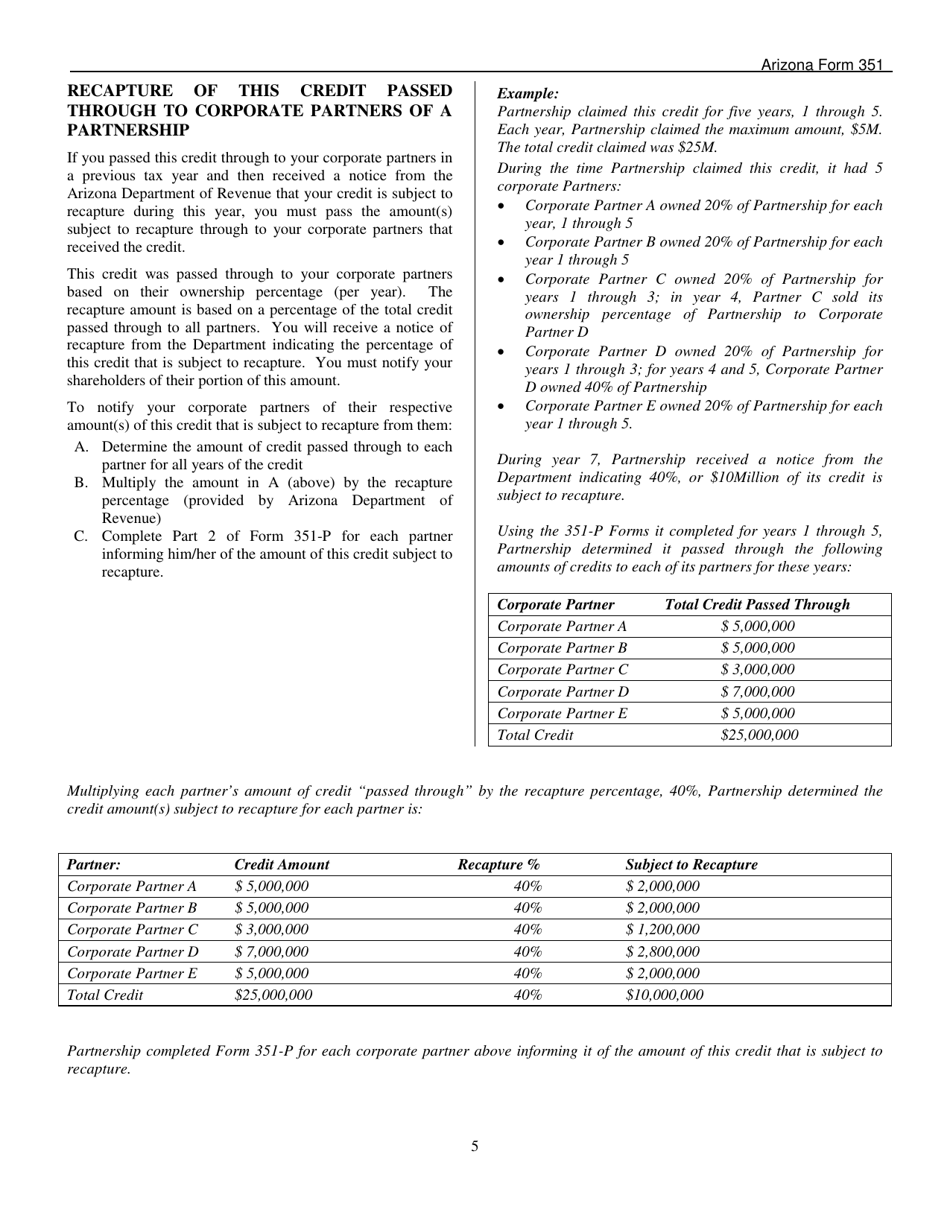

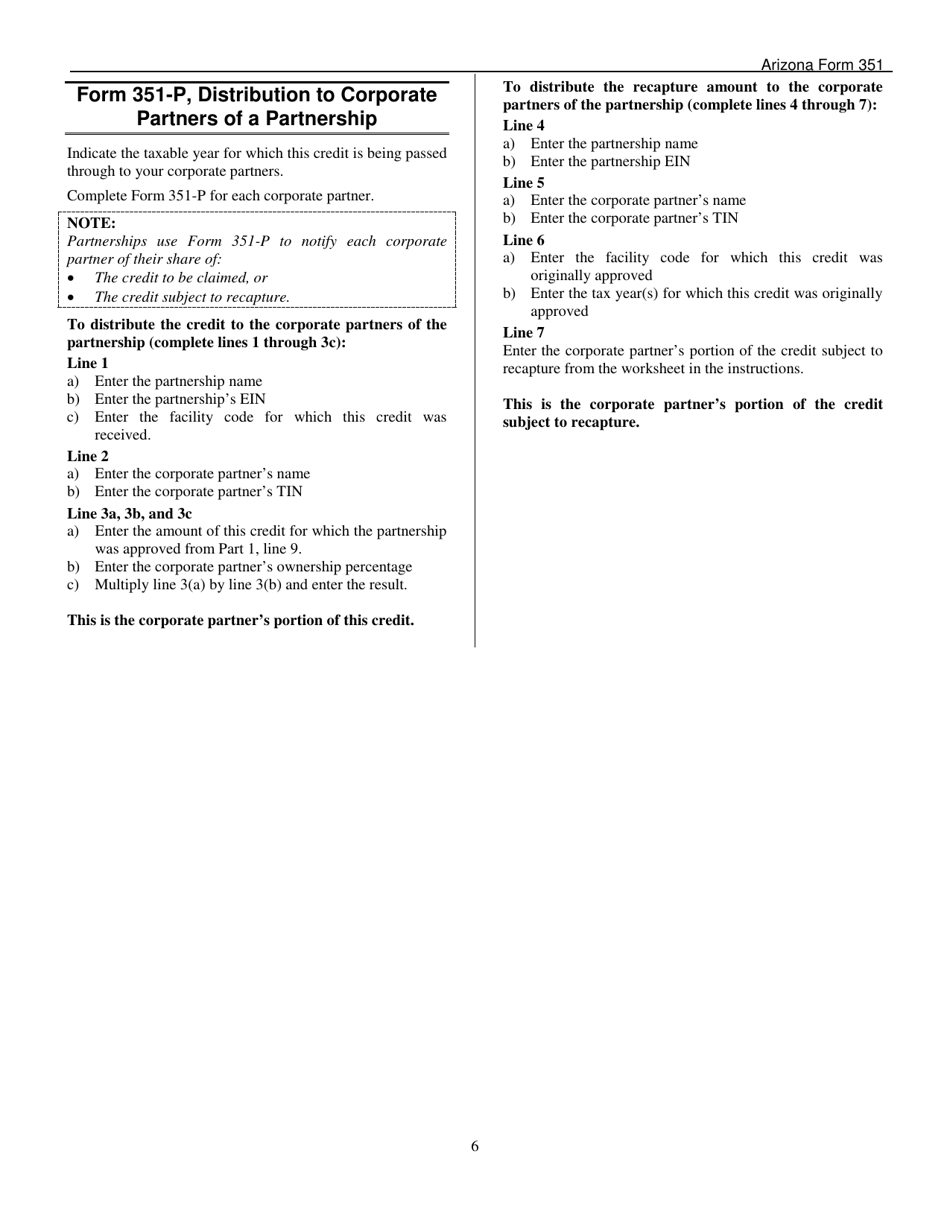

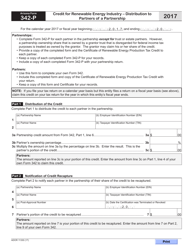

Arizona Form 351-P (ADOR11248) Credit for Renewable Energy Investment and Production for Self-consumption by International Operations Centers - Distribution to Corporate Partners of a Partnership - Arizona

Arizona Form 351-P (ADOR11248) Credit for Renewable Energy Investment and Production for Self-consumption by International Operations Centers - Distribution to Corporate Partners of a Partnership - Arizona

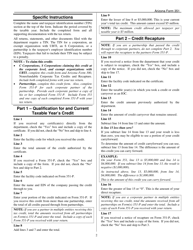

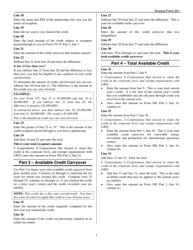

This document contains official instructions for Arizona Form 351 , Form ADOR11222 , Arizona Form 351-P , and Form ADOR11248 . All forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 351 (ADOR11222) is available for download through this link. The latest available Arizona Form 351-P (ADOR11248) can be downloaded through this link.

FAQ

Q: What is Arizona Form 351?

A: Arizona Form 351 is a tax form used by individuals and businesses in Arizona to report their annual income.

Q: What is ADOR11222?

A: ADOR11222 is the corresponding instruction document for Arizona Form 351, providing guidance on how tofill out the form correctly.

Q: What is Arizona Form 351-P?

A: Arizona Form 351-P is a payment voucher used in conjunction with Arizona Form 351 to submit tax payments.

Q: What is ADOR11248?

A: ADOR11248 is the instruction document for Arizona Form 351-P, providing instructions on how to complete the payment voucher.

Q: Who needs to file Arizona Form 351?

A: Individuals and businesses in Arizona who have income to report are required to file Arizona Form 351.

Q: What is the deadline for filing Arizona Form 351?

A: The deadline for filing Arizona Form 351 is typically April 15th, unless it falls on a weekend or holiday.

Q: Is there a penalty for filing Arizona Form 351 late?

A: Yes, there may be penalties for filing Arizona Form 351 late. It is best to file on time to avoid any potential penalties.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.