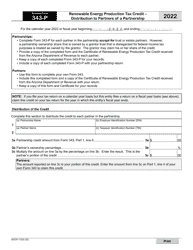

This version of the form is not currently in use and is provided for reference only. Download this version of

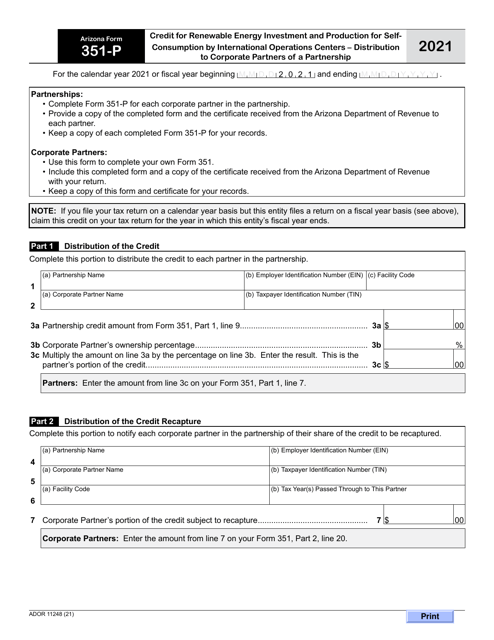

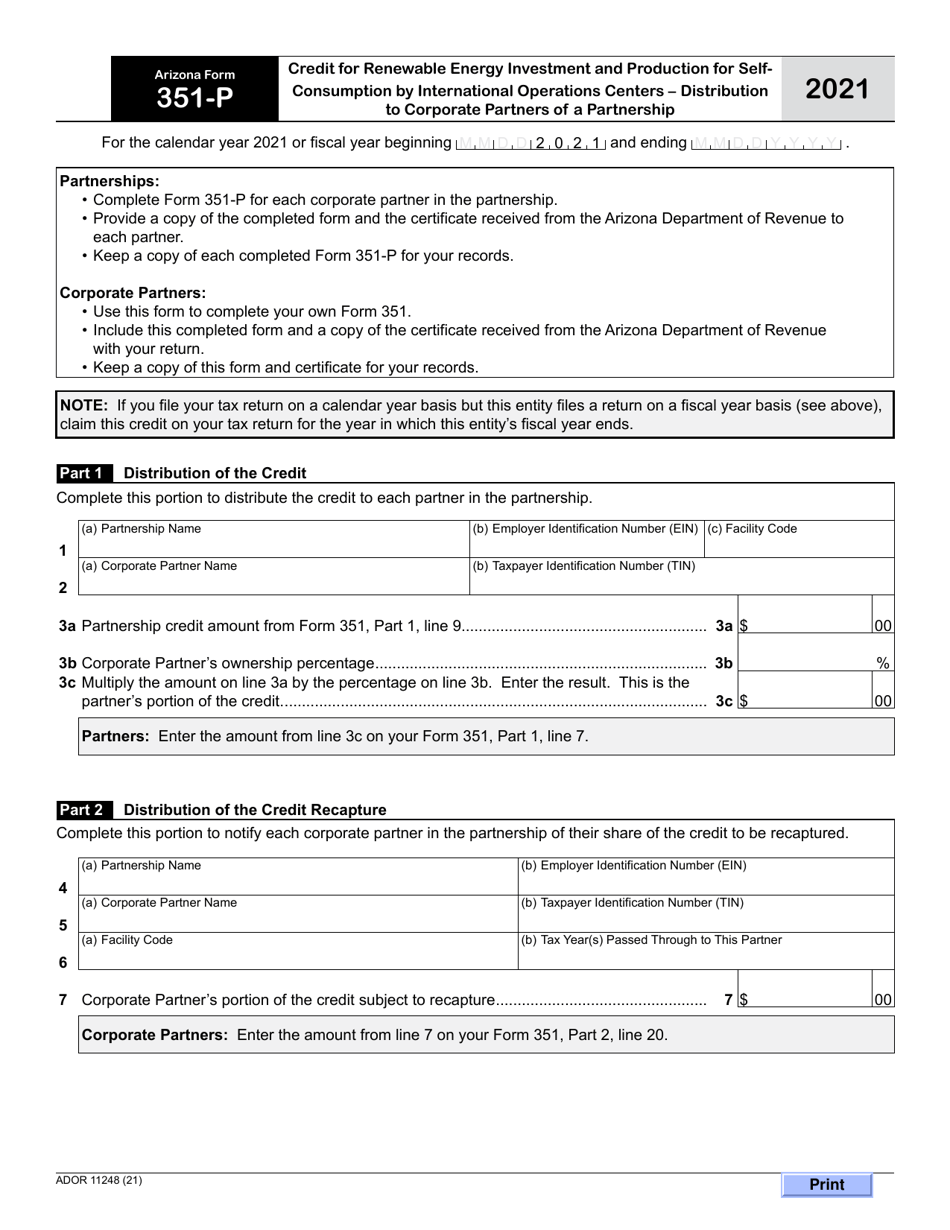

Arizona Form 351-P (ADOR11248)

for the current year.

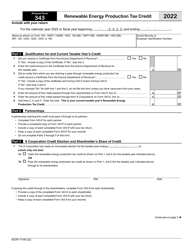

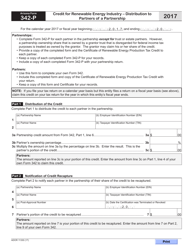

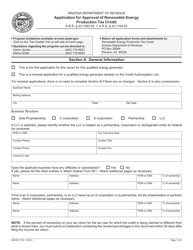

Arizona Form 351-P (ADOR11248) Credit for Renewable Energy Investment and Production for Self-consumption by International Operations Centers - Distribution to Corporate Partners of a Partnership - Arizona

What Is Arizona Form 351-P (ADOR11248)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 351-P?

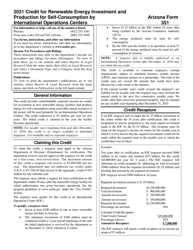

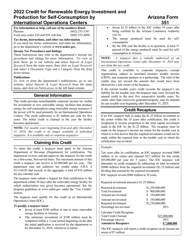

A: Arizona Form 351-P is a form used to claim the Credit for Renewable Energy Investment and Production for Self-consumption by International Operations Centers.

Q: Who can use Arizona Form 351-P?

A: This form can be used by international operations centers in Arizona that want to claim the credit for renewable energy investment and production for self-consumption.

Q: What is the credit for renewable energy investment and production for self-consumption?

A: It is a credit that can be claimed by international operations centers in Arizona for investing in and producing renewable energy for their own use.

Q: Can corporate partners of a partnership claim this credit?

A: Yes, corporate partners of a partnership can claim the credit for renewable energy investment and production for self-consumption.

Q: What is the purpose of Arizona Form 351-P?

A: The purpose of this form is to calculate and document the credit for renewable energy investment and production for self-consumption by international operations centers.

Q: Is Arizona Form 351-P specific to international operations centers?

A: Yes, Arizona Form 351-P is specifically designed for international operations centers in Arizona.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 351-P (ADOR11248) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.