This version of the form is not currently in use and is provided for reference only. Download this version of

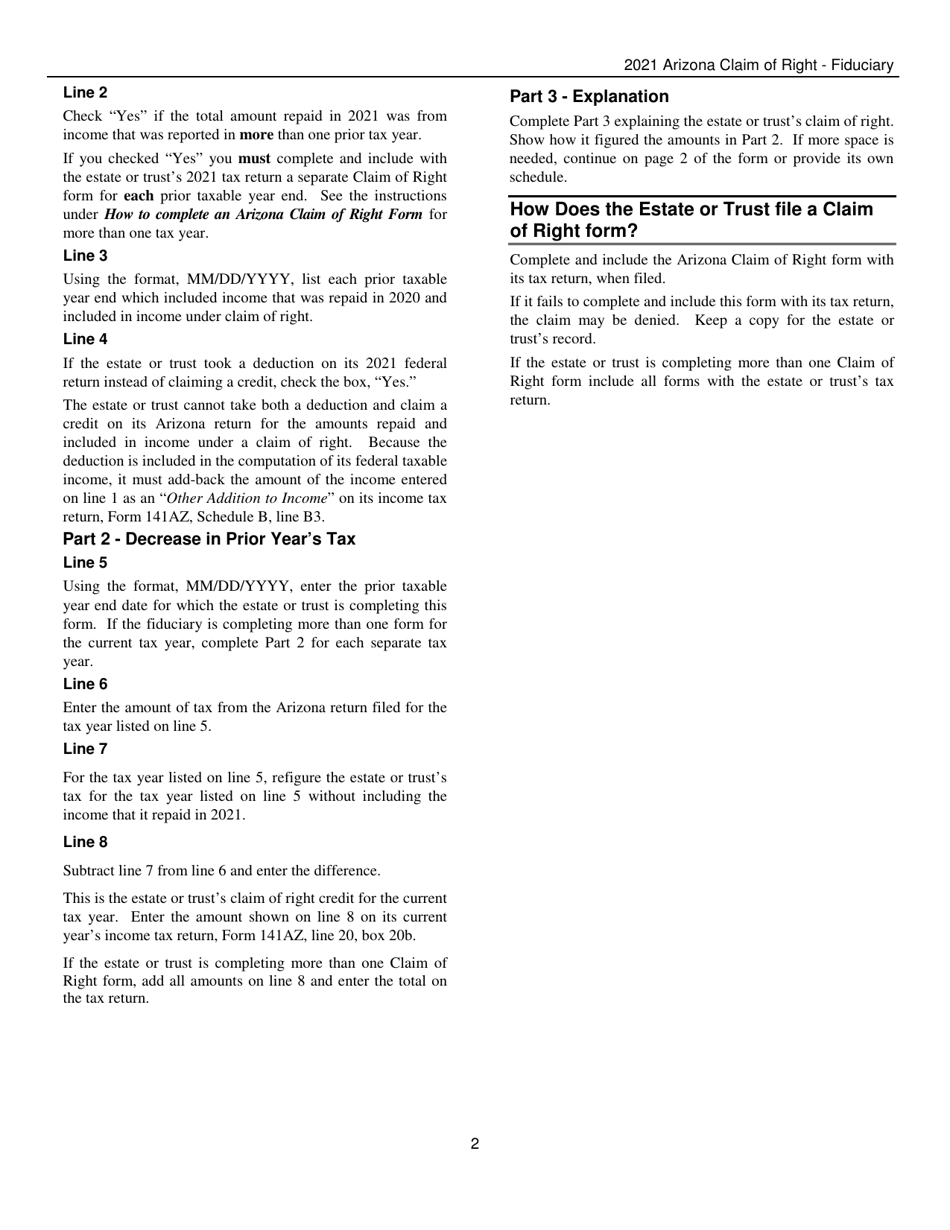

Instructions for Form ADOR11282

for the current year.

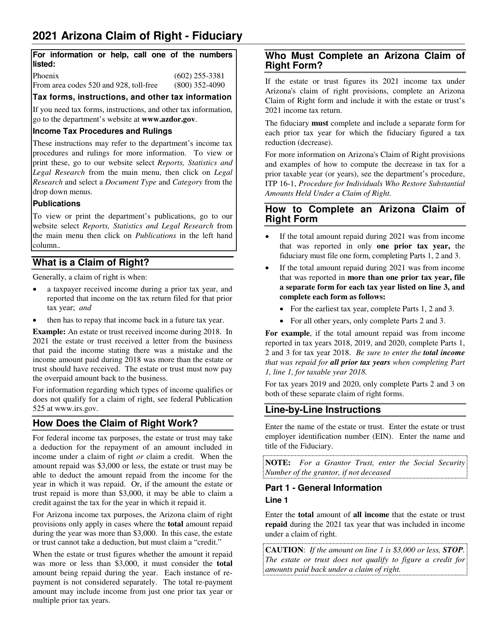

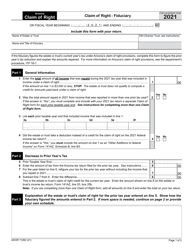

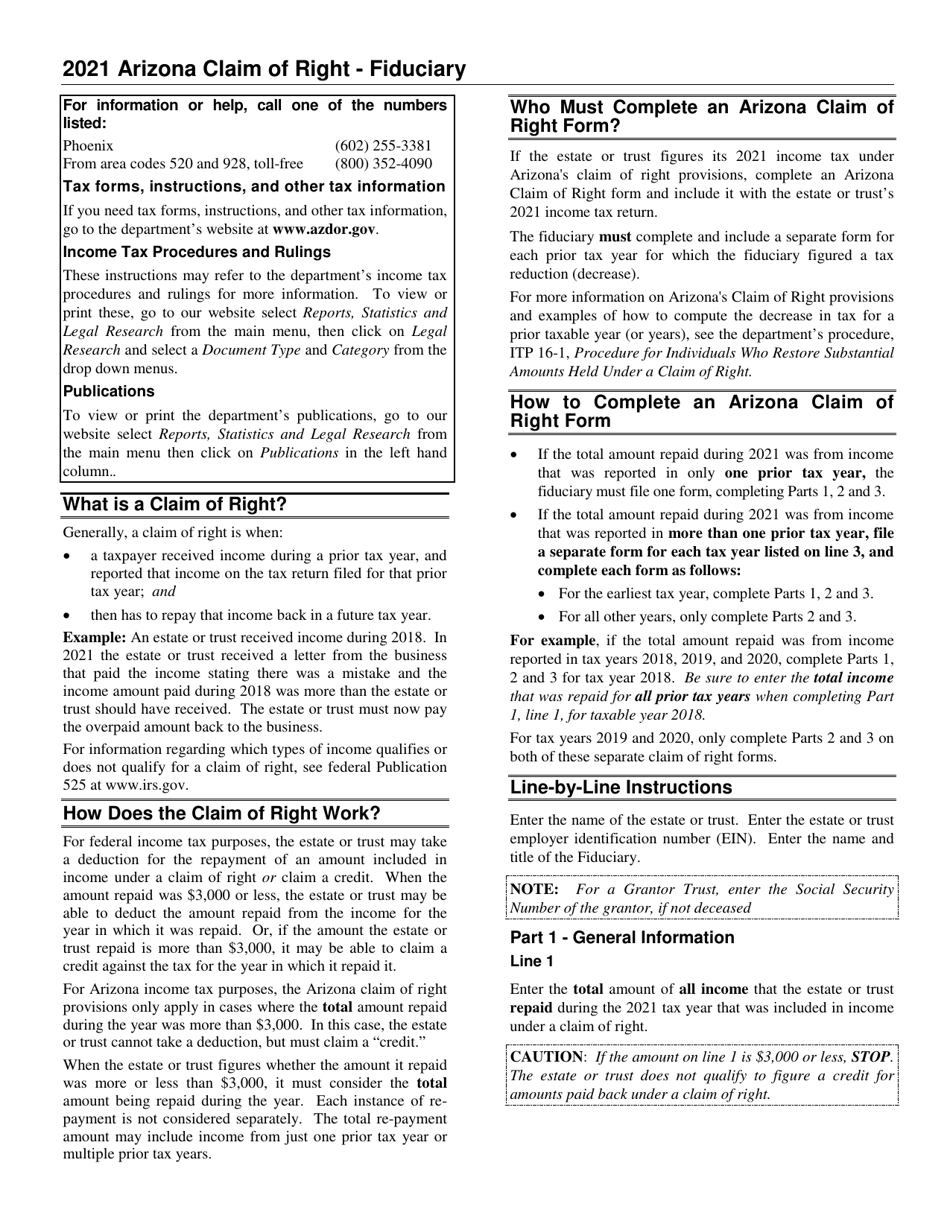

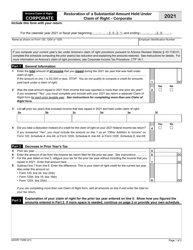

Instructions for Form ADOR11282 Claim of Right - Fiduciary - Arizona

This document contains official instructions for Form ADOR11282 , Claim of Right - Fiduciary - a form released and collected by the Arizona Department of Revenue. An up-to-date fillable Form ADOR11282 is available for download through this link.

FAQ

Q: What is Form ADOR11282?

A: Form ADOR11282 is a document used for filing a Claim of Right - Fiduciary in Arizona.

Q: What is a Claim of Right - Fiduciary?

A: A Claim of Right - Fiduciary is a legal claim made by a fiduciary to recover funds held on behalf of someone else.

Q: Who can file Form ADOR11282?

A: Form ADOR11282 can be filed by fiduciaries in Arizona.

Q: What is the purpose of filing Form ADOR11282?

A: The purpose of filing Form ADOR11282 is to make a claim for the recovery of funds held on behalf of someone else.

Q: Are there any fees to file Form ADOR11282?

A: There are no fees to file Form ADOR11282.

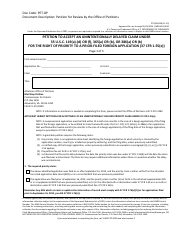

Q: What supporting documents do I need to submit with Form ADOR11282?

A: You may need to submit documentation that shows the fiduciary relationship, the amount of funds held, and any relevant court orders or agreements.

Q: What is the deadline for filing Form ADOR11282?

A: The deadline for filing Form ADOR11282 may vary depending on the specific circumstances. It is recommended to contact the Arizona Department of Revenue for more information.

Q: What should I do if I have a question about Form ADOR11282?

A: If you have a question about Form ADOR11282, you can contact the Arizona Department of Revenue for assistance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.