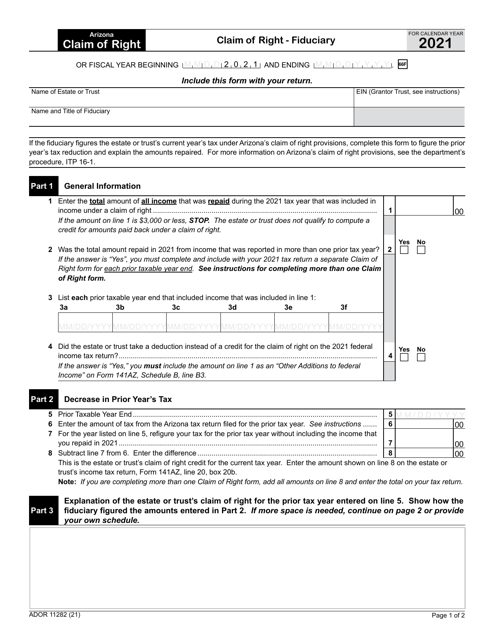

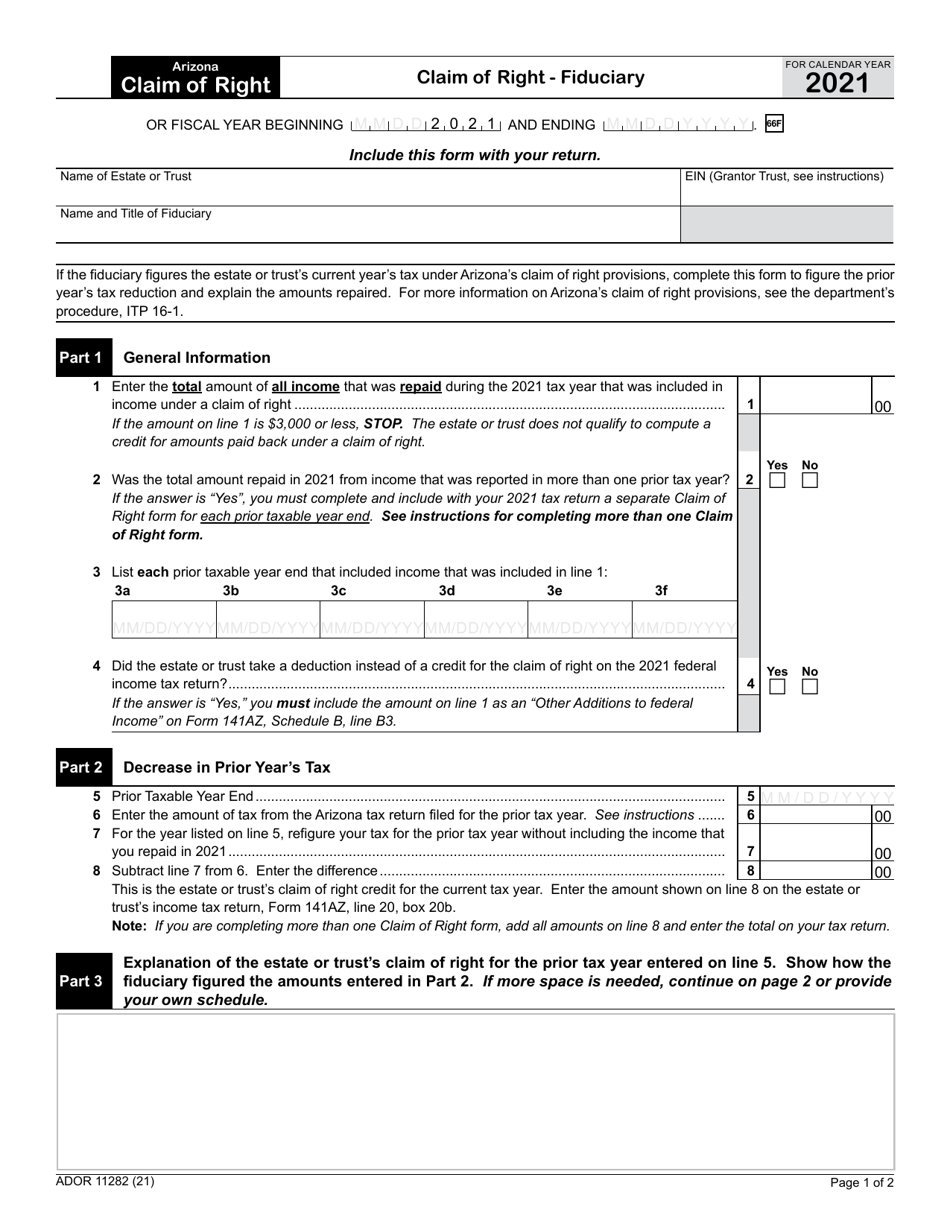

Form ADOR11282 Claim of Right - Fiduciary - Arizona

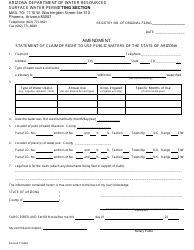

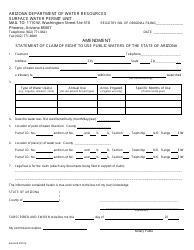

What Is Form ADOR11282?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

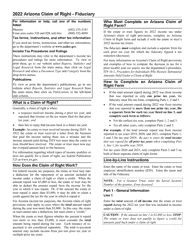

Q: What is Form ADOR11282?

A: Form ADOR11282 is the Claim of Right - Fiduciary form specific to Arizona.

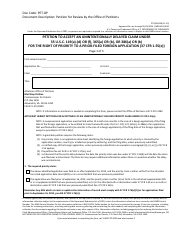

Q: Who should use Form ADOR11282?

A: This form should be used by fiduciaries in Arizona who are making a claim of right.

Q: What is a fiduciary?

A: A fiduciary is a person or entity who is responsible for managing property or assets on behalf of someone else, known as the beneficiary or principal.

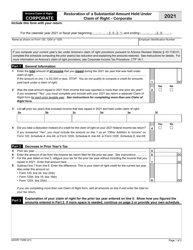

Q: What is a Claim of Right?

A: A Claim of Right is a legal document through which a person or entity asserts their right to the return of property or funds that they believe they are entitled to.

Q: Why would a fiduciary file a Claim of Right?

A: A fiduciary may file a Claim of Right if they believe that certain property or funds belong to the estate or trust they are managing, and are seeking to recover them.

Q: Are there any fees associated with filing Form ADOR11282?

A: There may be fees associated with filing Form ADOR11282, depending on the specific circumstances. It is best to consult the instructions provided with the form or contact the Arizona Department of Revenue for more information.

Q: Are there any deadlines for filing Form ADOR11282?

A: The deadline for filing Form ADOR11282 may vary depending on various factors. It is important to review the instructions provided with the form or consult the Arizona Department of Revenue for specific deadline information.

Q: What should I do if I need help or have questions about Form ADOR11282?

A: If you need assistance or have questions about Form ADOR11282, it is recommended to contact the Arizona Department of Revenue or consult a tax professional for guidance.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11282 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.