This version of the form is not currently in use and is provided for reference only. Download this version of

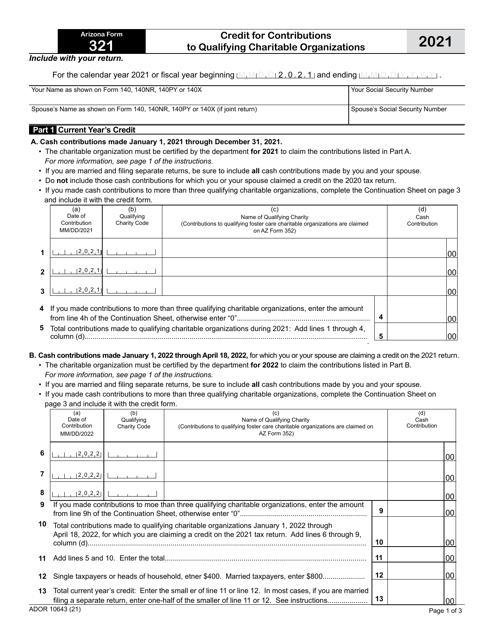

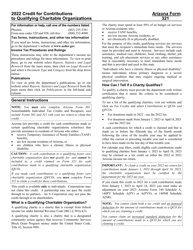

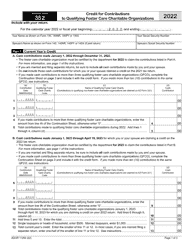

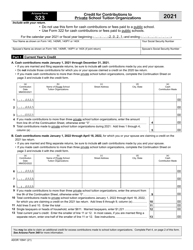

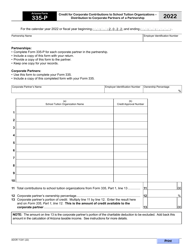

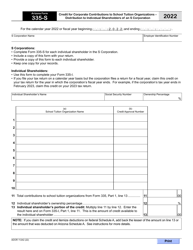

Arizona Form 321 (ADOR10643)

for the current year.

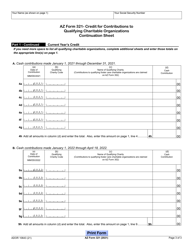

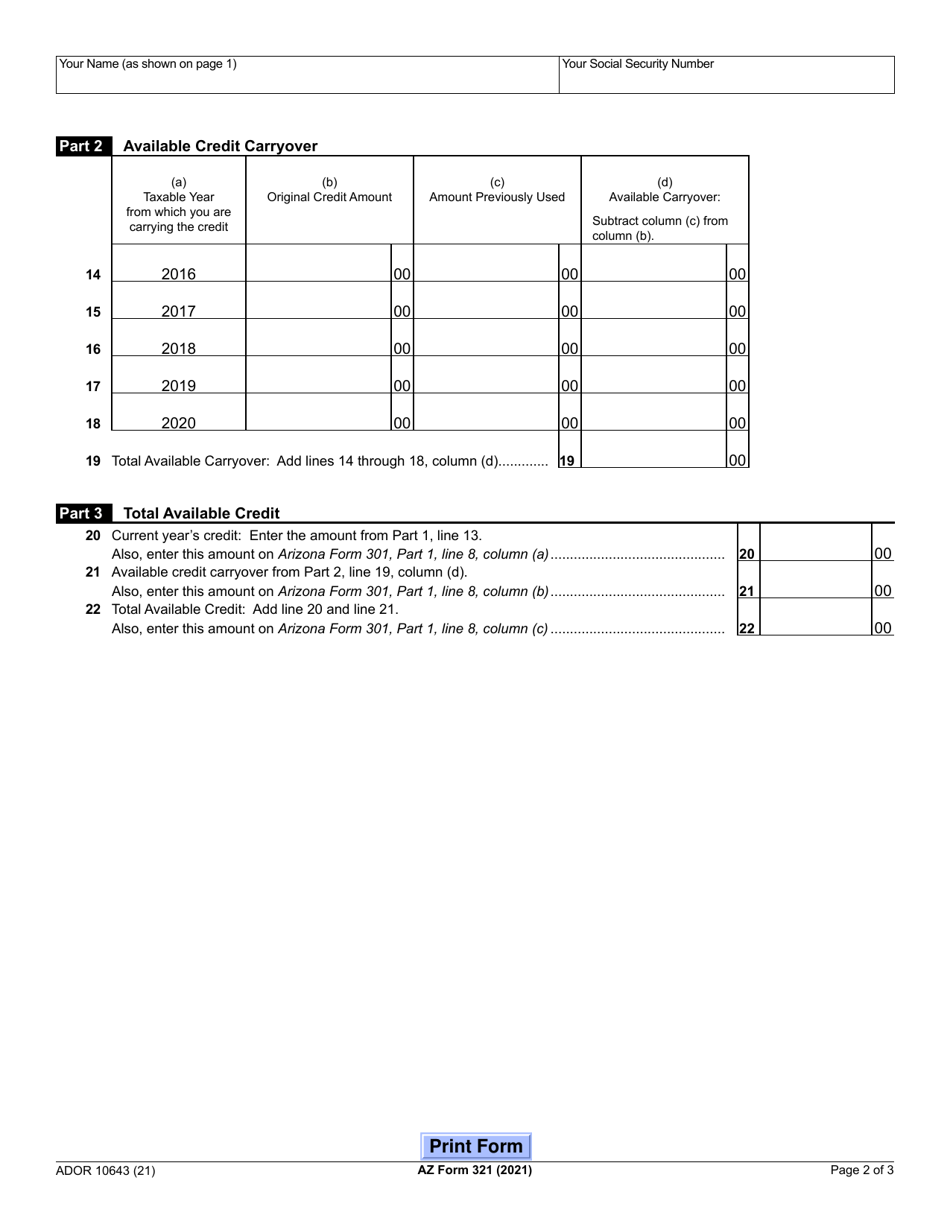

Arizona Form 321 (ADOR10643) Credit for Contributions to Qualifying Charitable Organizations - Arizona

What Is Arizona Form 321 (ADOR10643)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

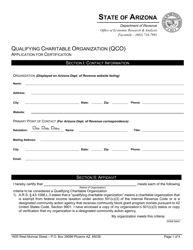

Q: What is Arizona Form 321?

A: Arizona Form 321 is a form used to claim a tax credit for contributions to qualifying charitable organizations in Arizona.

Q: Who is eligible to use Arizona Form 321?

A: Any taxpayer who made qualifying contributions to eligible charitable organizations in Arizona is eligible to use Arizona Form 321.

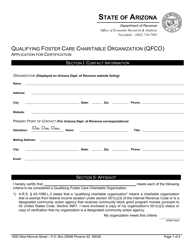

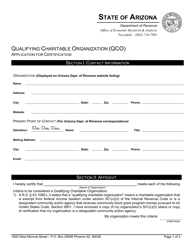

Q: What is a qualifying charitable organization?

A: A qualifying charitable organization is an organization that meets the criteria set by the Arizona Department of Revenue.

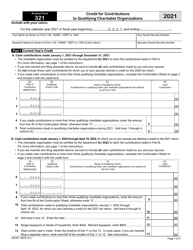

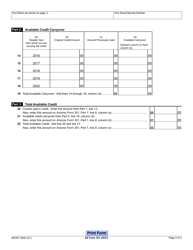

Q: How much of a tax credit can I claim with Arizona Form 321?

A: The maximum amount of tax credit you can claim with Arizona Form 321 is $400 for single individuals or heads of household, and $800 for married couples filing jointly.

Q: Are there any income limits to claim the tax credit with Arizona Form 321?

A: No, there are no income limits to claim the tax credit with Arizona Form 321.

Q: What documentation do I need to include with Arizona Form 321?

A: You will need to attach a receipt or proof of your contributions to the qualifying charitable organizations with Arizona Form 321.

Q: When is the deadline to file Arizona Form 321?

A: The deadline to file Arizona Form 321 is the same as the deadline to file your Arizona income tax return, usually April 15th.

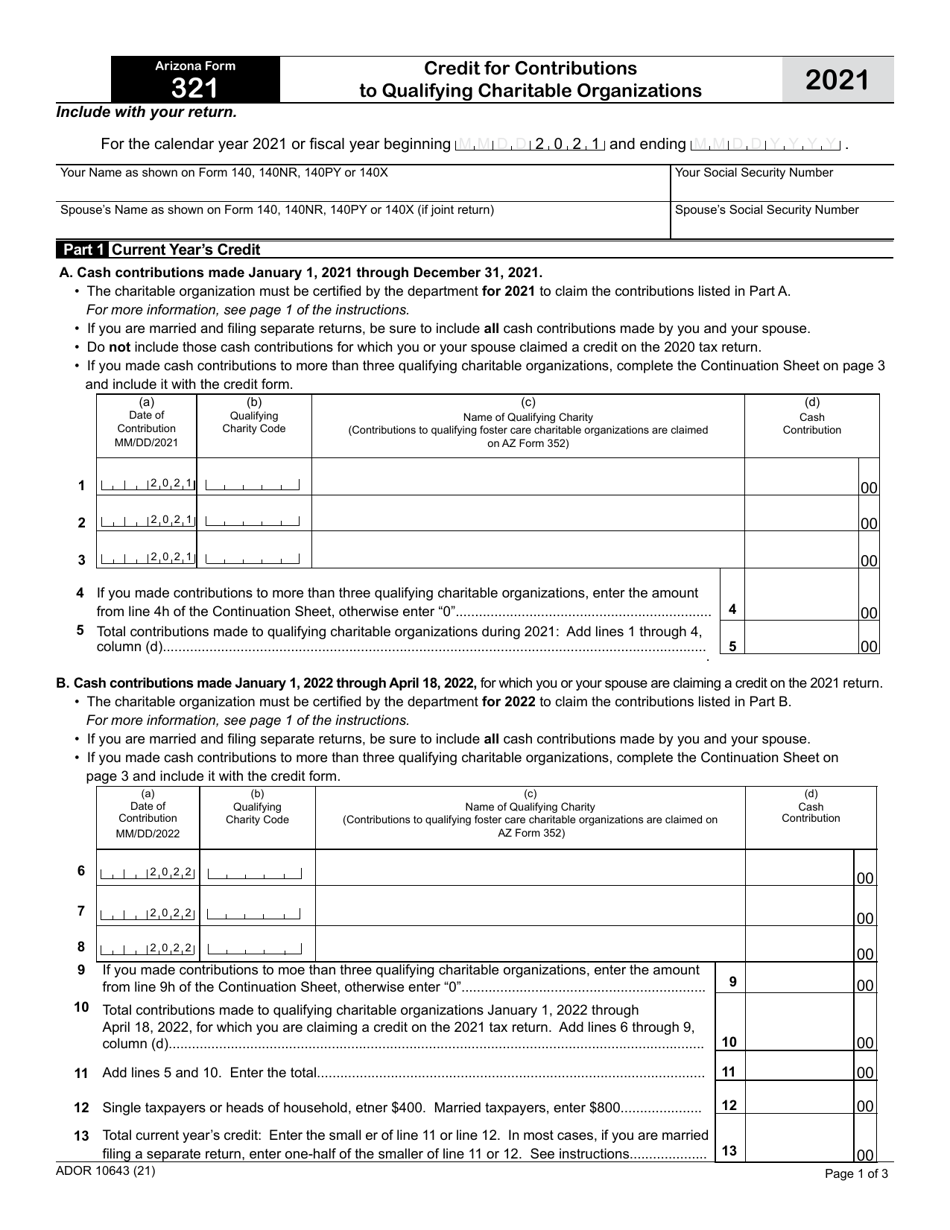

Q: Can I carry forward any unused tax credit from Arizona Form 321?

A: No, any unused tax credit from Arizona Form 321 cannot be carried forward to future years.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 321 (ADOR10643) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.