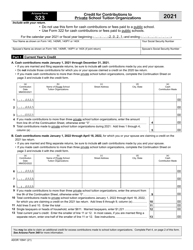

This version of the form is not currently in use and is provided for reference only. Download this version of

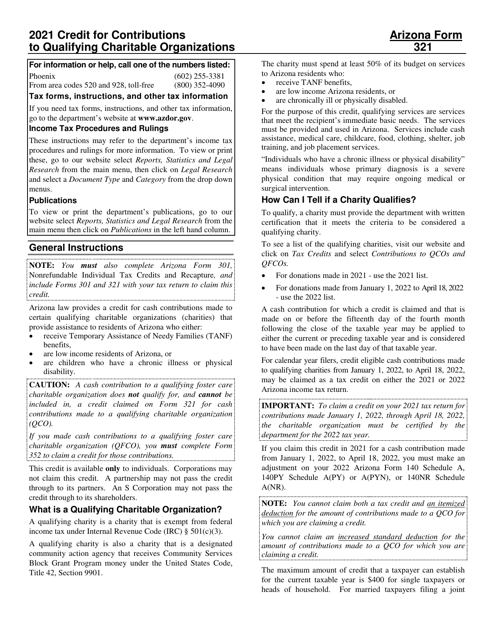

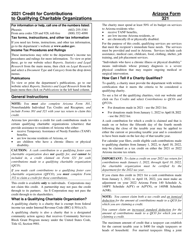

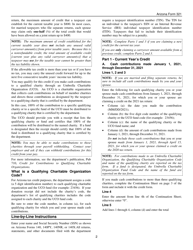

Instructions for Arizona Form 321, ADOR10643

for the current year.

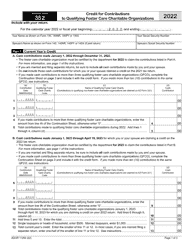

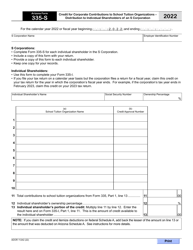

Instructions for Arizona Form 321, ADOR10643 Credit for Contributions to Qualifying Charitable Organizations - Arizona

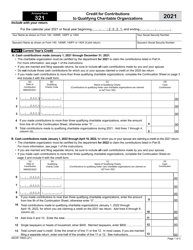

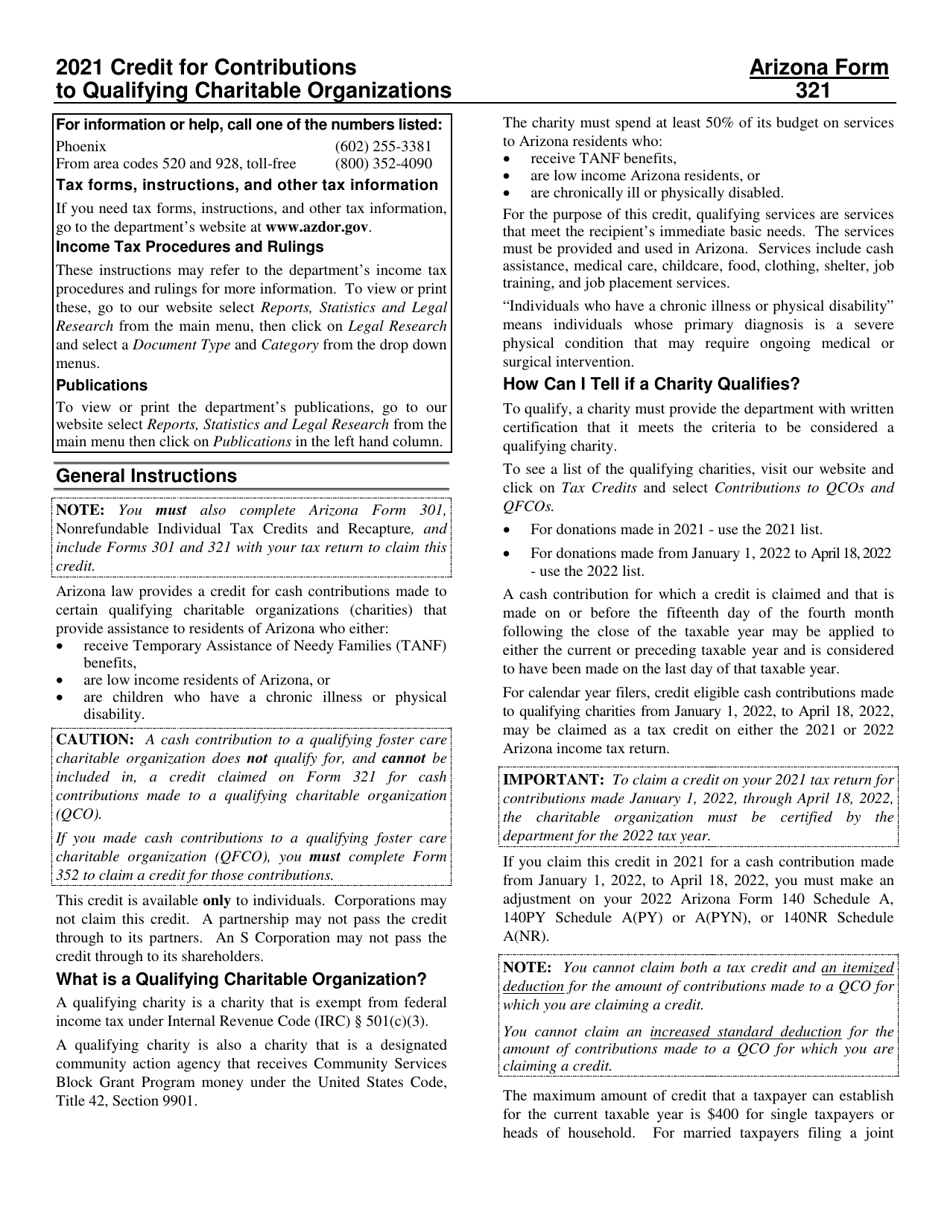

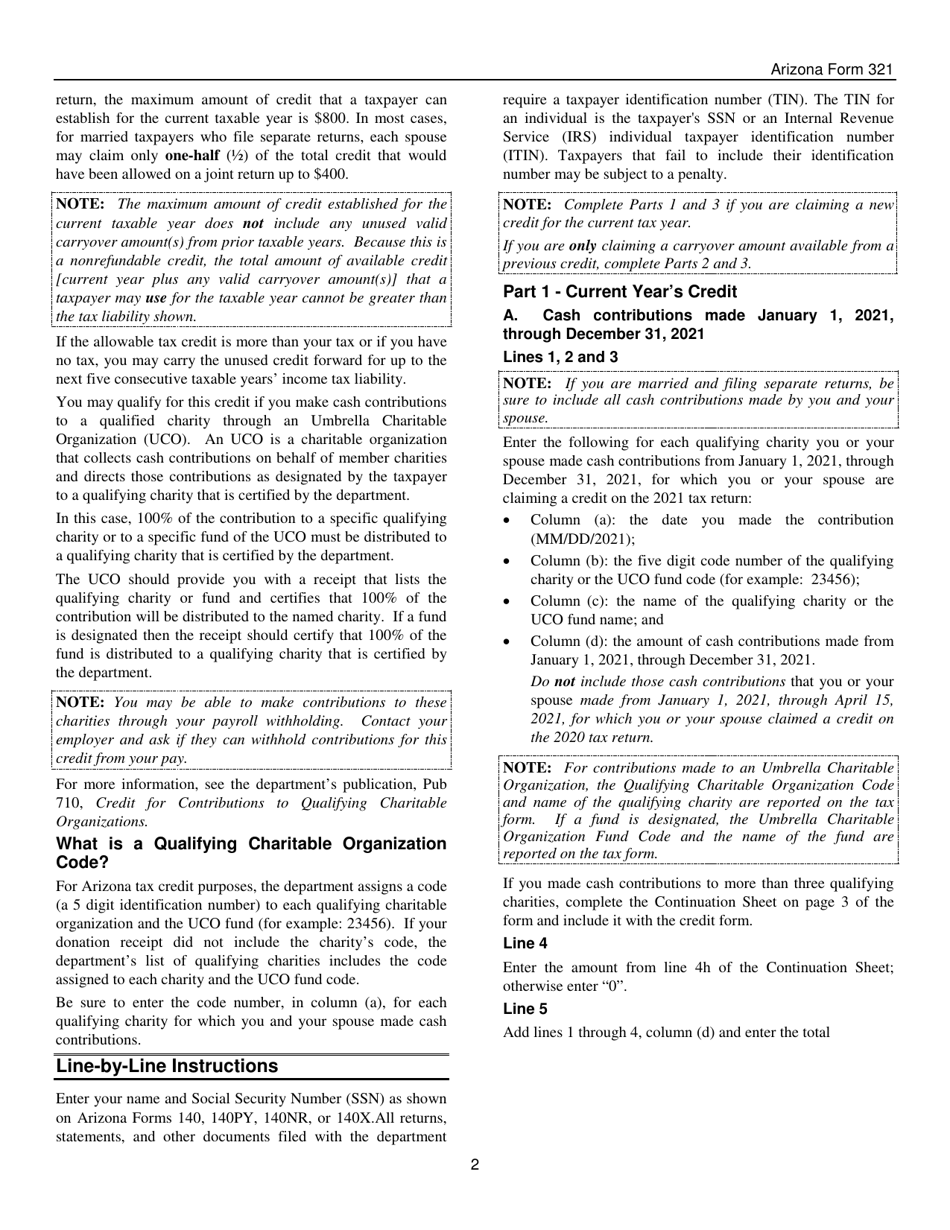

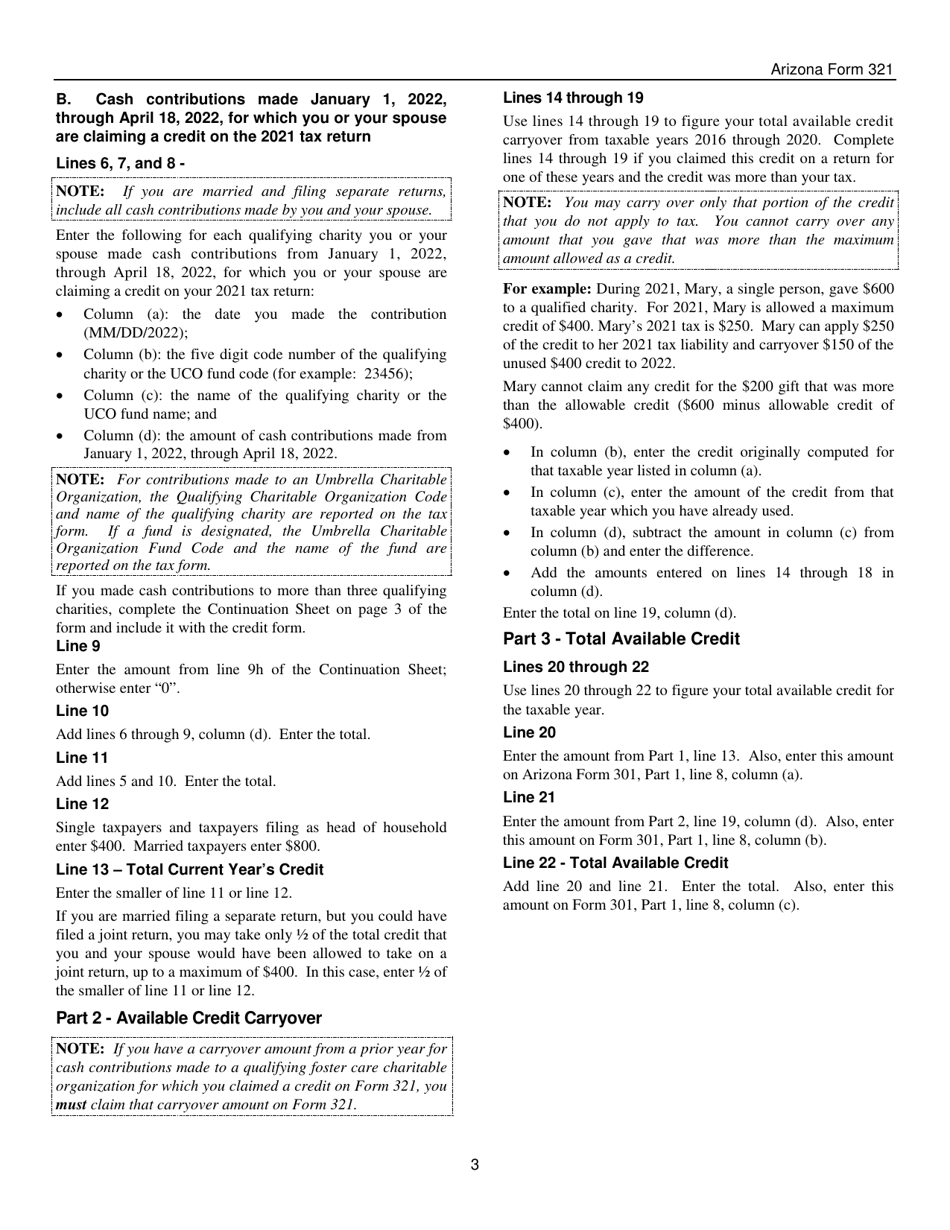

This document contains official instructions for Arizona Form 321 , and Form ADOR10643 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 321 (ADOR10643) is available for download through this link.

FAQ

Q: What is Arizona Form 321?

A: Arizona Form 321 is a tax form used to claim the Credit for Contributions to Qualifying Charitable Organizations in Arizona.

Q: Who can use Arizona Form 321?

A: Arizona taxpayers who have made contributions to qualifying charitable organizations can use Form 321.

Q: What is the purpose of Arizona Form 321?

A: The purpose of Form 321 is to allow taxpayers to claim a credit for their contributions to qualifying charitable organizations.

Q: What is the deadline for filing Arizona Form 321?

A: Arizona Form 321 must be filed by the same deadline as the taxpayer's individual income tax return, usually April 15th.

Q: How much credit can I claim with Arizona Form 321?

A: The maximum credit that can be claimed on Form 321 is $400 for single filers and $800 for married couples filing jointly.

Q: What documentation do I need to include with Arizona Form 321?

A: Taxpayers must attach copies of their receipts or other documentation provided by the qualifying charitable organizations to support their claimed contributions.

Q: Can I claim the credit for contributions made to any charitable organization?

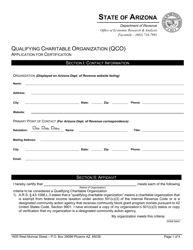

A: No, only contributions made to qualifying charitable organizations in Arizona are eligible to be claimed on Form 321.

Q: Can I e-file Arizona Form 321?

A: Yes, Arizona Form 321 can be e-filed along with the taxpayer's individual income tax return.

Q: What is the benefit of claiming the Credit for Contributions to Qualifying Charitable Organizations?

A: Claiming this credit can reduce the taxpayer's Arizona income tax liability dollar-for-dollar, potentially resulting in a lower tax bill.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.