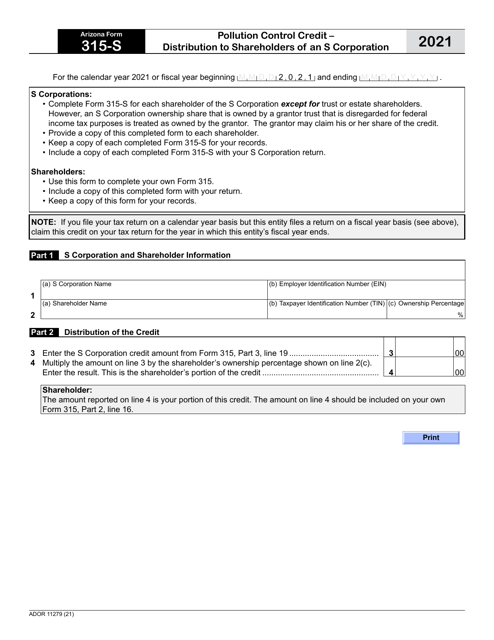

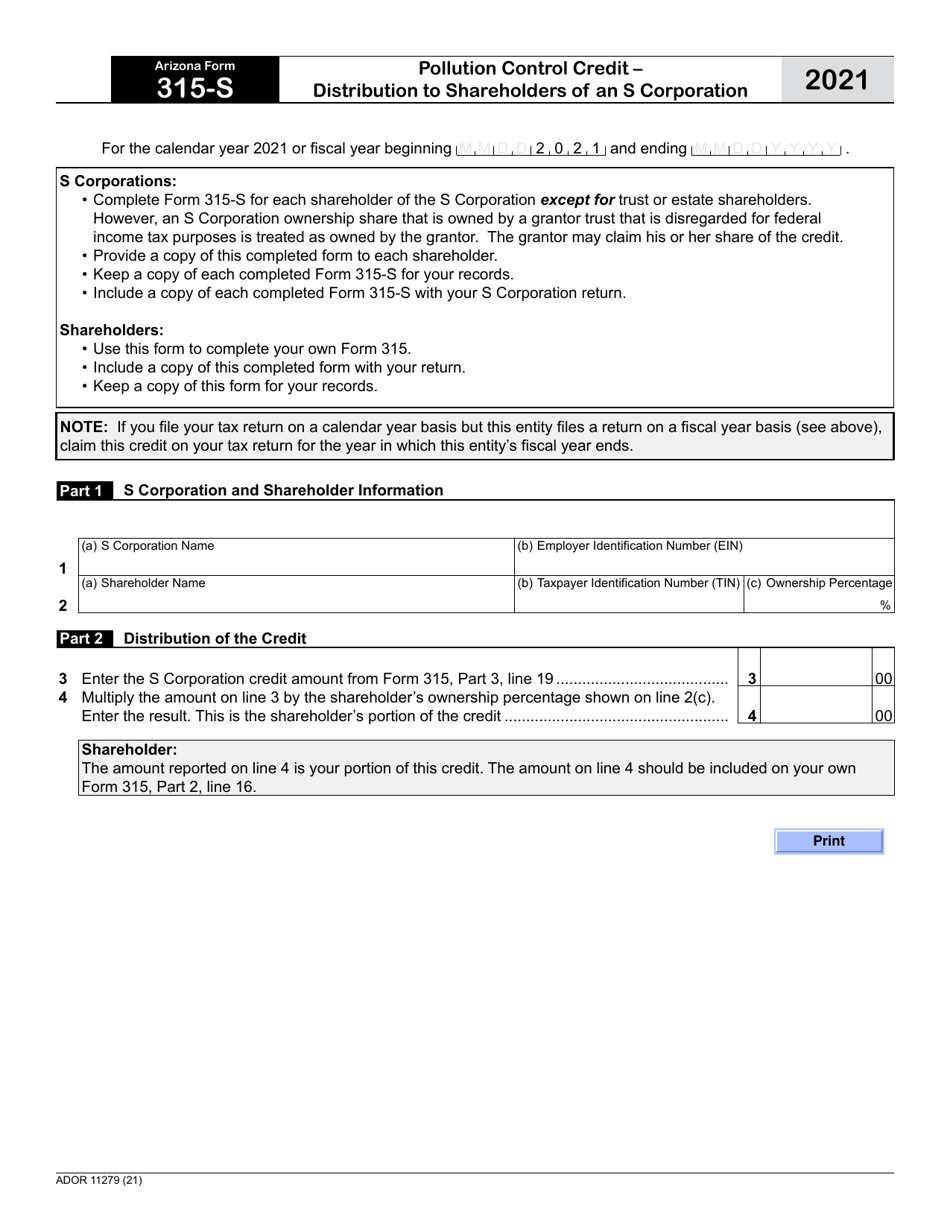

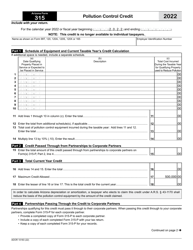

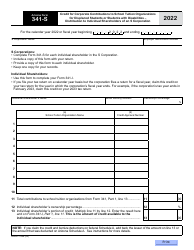

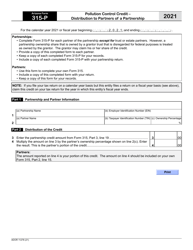

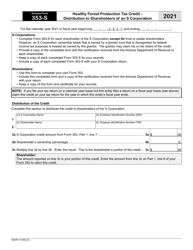

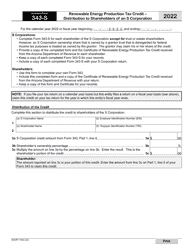

Arizona Form 315-S (ADOR11279) Pollution Control Credit - Distribution to Shareholders of an S Corporation - Arizona

What Is Arizona Form 315-S (ADOR11279)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 315-S?

A: Arizona Form 315-S is a tax form used for claiming pollution control credits when distributing them to shareholders of an S Corporation in Arizona.

Q: What is the purpose of Arizona Form 315-S?

A: The purpose of Arizona Form 315-S is to report the distribution of pollution control credits to shareholders of an S Corporation in Arizona.

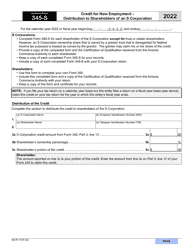

Q: Who needs to file Arizona Form 315-S?

A: S Corporations in Arizona that have distributed pollution control credits to their shareholders need to file Arizona Form 315-S.

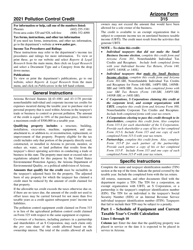

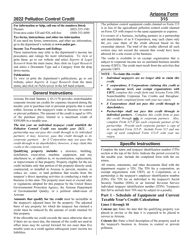

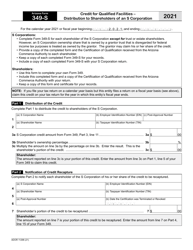

Q: What is a pollution control credit?

A: A pollution control credit is a credit that can be claimed for costs incurred in implementing pollution control equipment or activities.

Q: How do S Corporations distribute pollution control credits to shareholders?

A: S Corporations can distribute pollution control credits to shareholders based on their respective ownership percentages.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 315-S (ADOR11279) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.