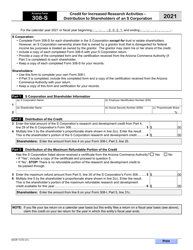

This version of the form is not currently in use and is provided for reference only. Download this version of

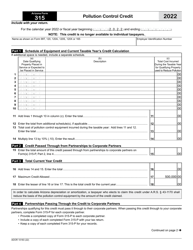

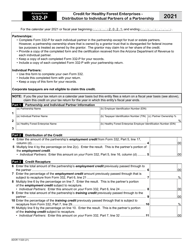

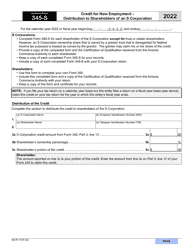

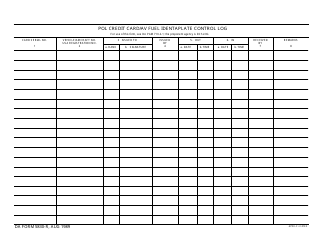

Instructions for Arizona Form 315, ADOR10183, Arizona Form 315-P, ADOR11278, Arizona Form 315-S, ADOR11279

for the current year.

Instructions for Arizona Form 315, ADOR10183, Arizona Form 315-P, ADOR11278, Arizona Form 315-S, ADOR11279 - Arizona

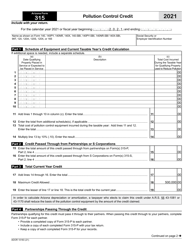

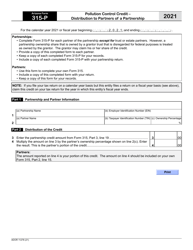

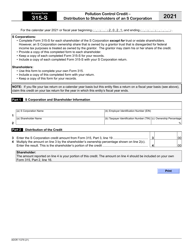

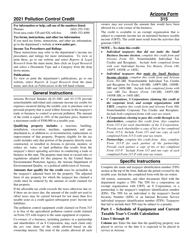

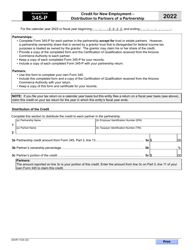

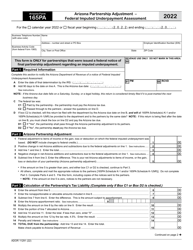

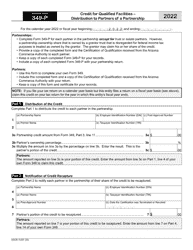

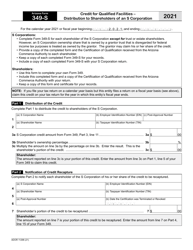

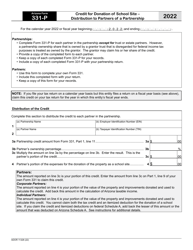

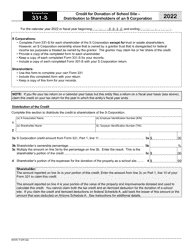

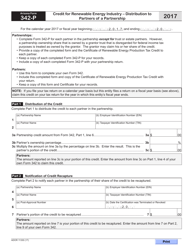

This document contains official instructions for Arizona Form 315 , Form ADOR10183 , Arizona Form 315-P , Form ADOR11278 , Arizona Form 315-S , and Form ADOR11279 . All forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 315 (ADOR10183) is available for download through this link. The latest available Arizona Form 315-P (ADOR11278) can be downloaded through this link. Arizona Form 315-S (ADOR11279) can be found here.

FAQ

Q: What are the Arizona Form 315, ADOR10183, Arizona Form 315-P, ADOR11278, Arizona Form 315-S, ADOR11279 used for?

A: These forms are used for filing Arizona state income tax returns for various types of businesses.

Q: Do I need to file all of these forms?

A: No, you need to file the specific form that corresponds to your type of business or tax situation.

Q: Can I file these forms electronically?

A: Yes, the Arizona Department of Revenue allows electronic filing for these forms. You can do so through their e-file system or by using approved third-party software.

Q: What is the deadline for filing these forms?

A: The deadline for filing these forms is generally the same as the federal income tax deadline, which is April 15th of each year. However, it may vary in certain circumstances, so it's important to check with ADOR for any specific due date changes.

Q: Are there any penalties for late filing?

A: Yes, if you fail to file these forms by the deadline or file them incorrectly, you may be subject to penalties and interest charges. It's important to comply with the filing requirements to avoid any potential penalties.

Q: Can I claim a refund on these forms?

A: Yes, if you overpaid your Arizona state income tax, you can claim a refund on these forms. Make sure to follow the instructions provided on the forms for claiming a refund.

Q: Is there any assistance available for filling out these forms?

A: Yes, if you need assistance in filling out these forms, you can contact the Arizona Department of Revenue directly. They can provide guidance and answer any questions you may have.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.