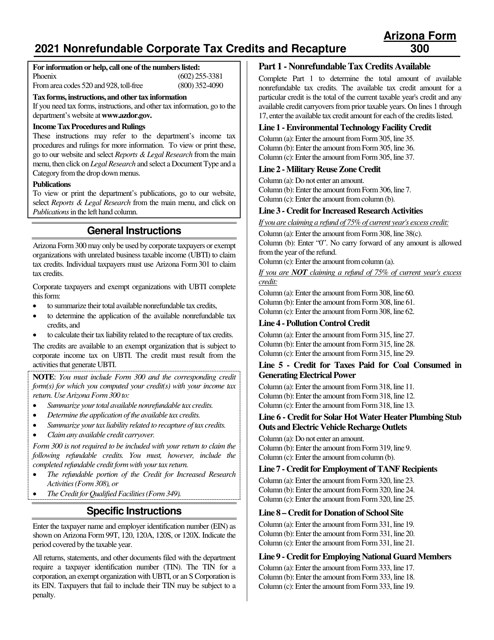

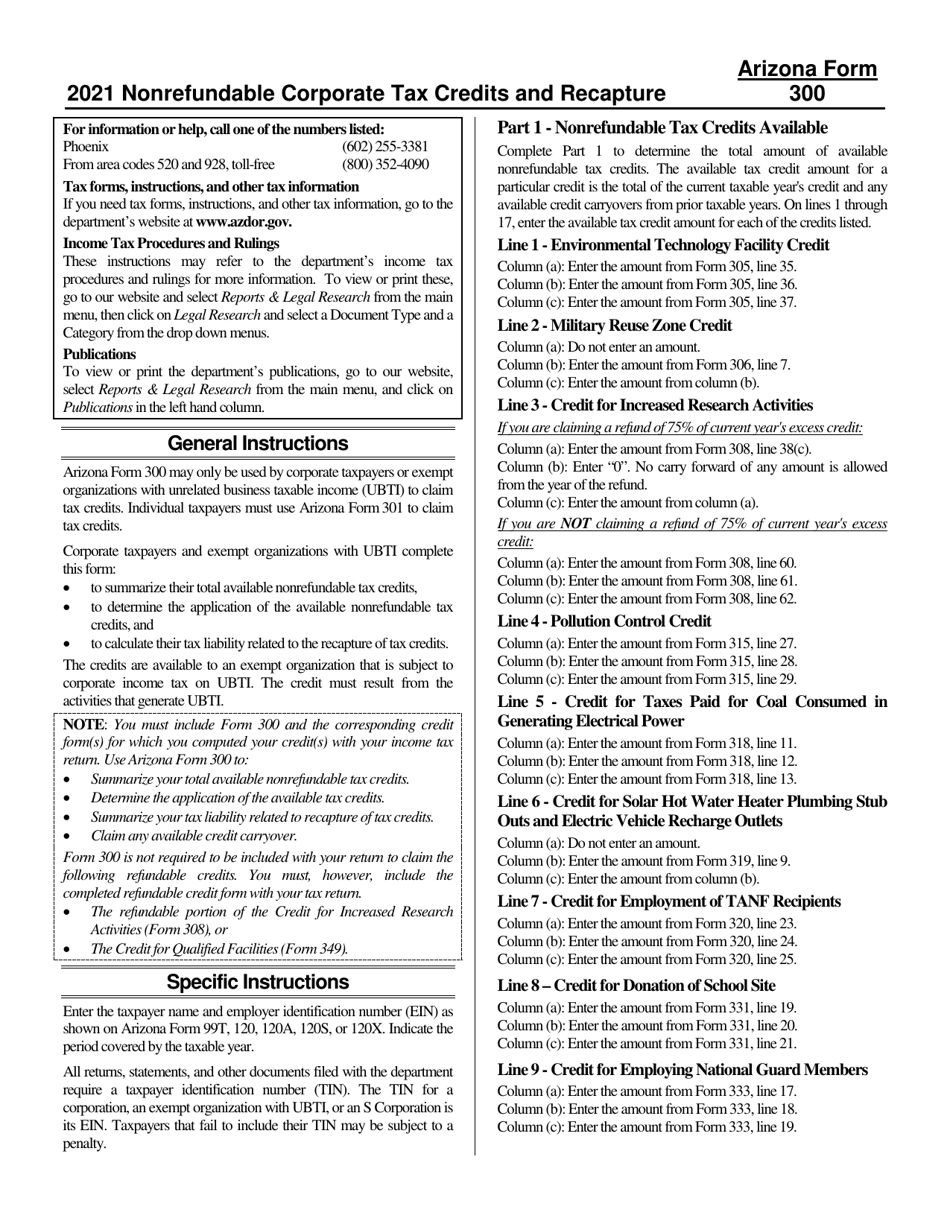

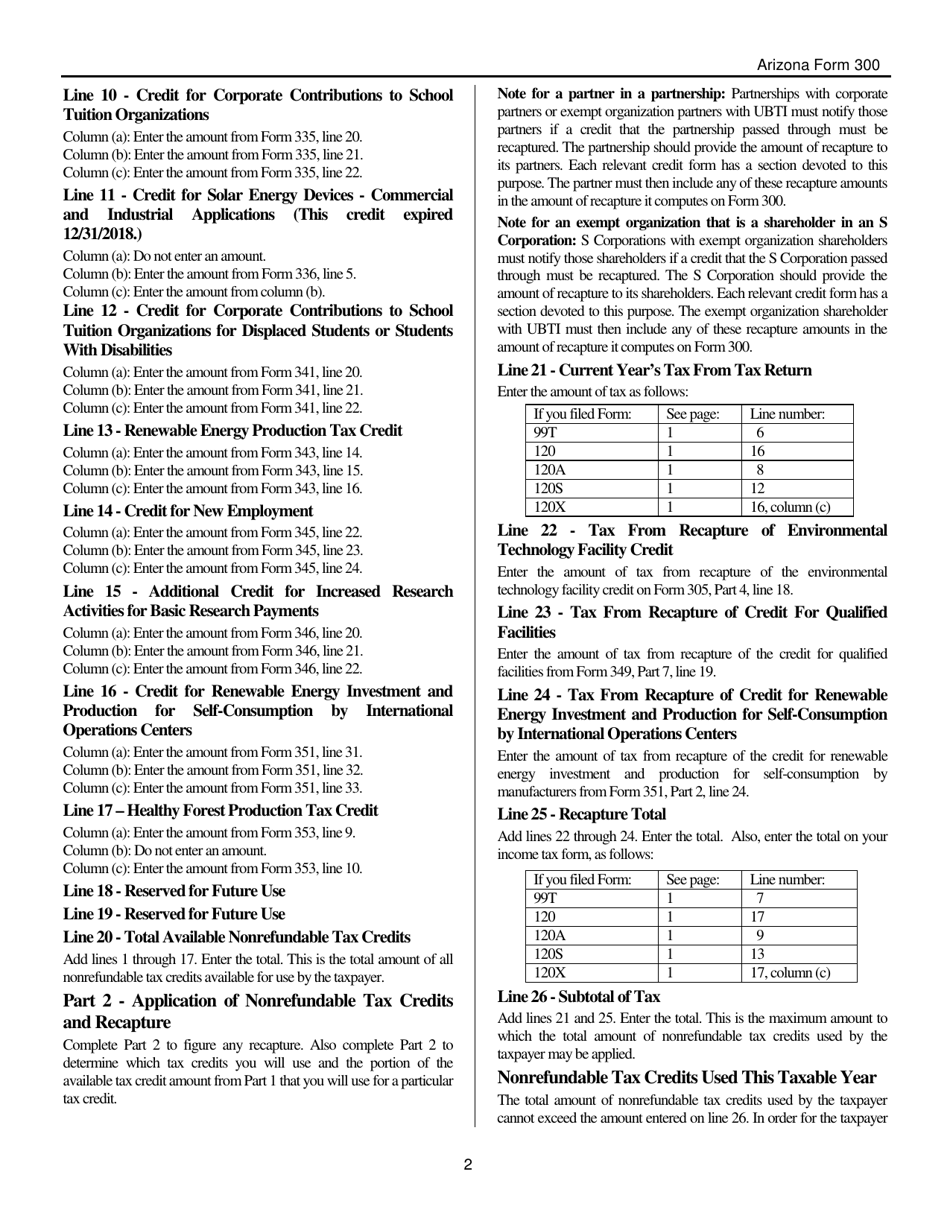

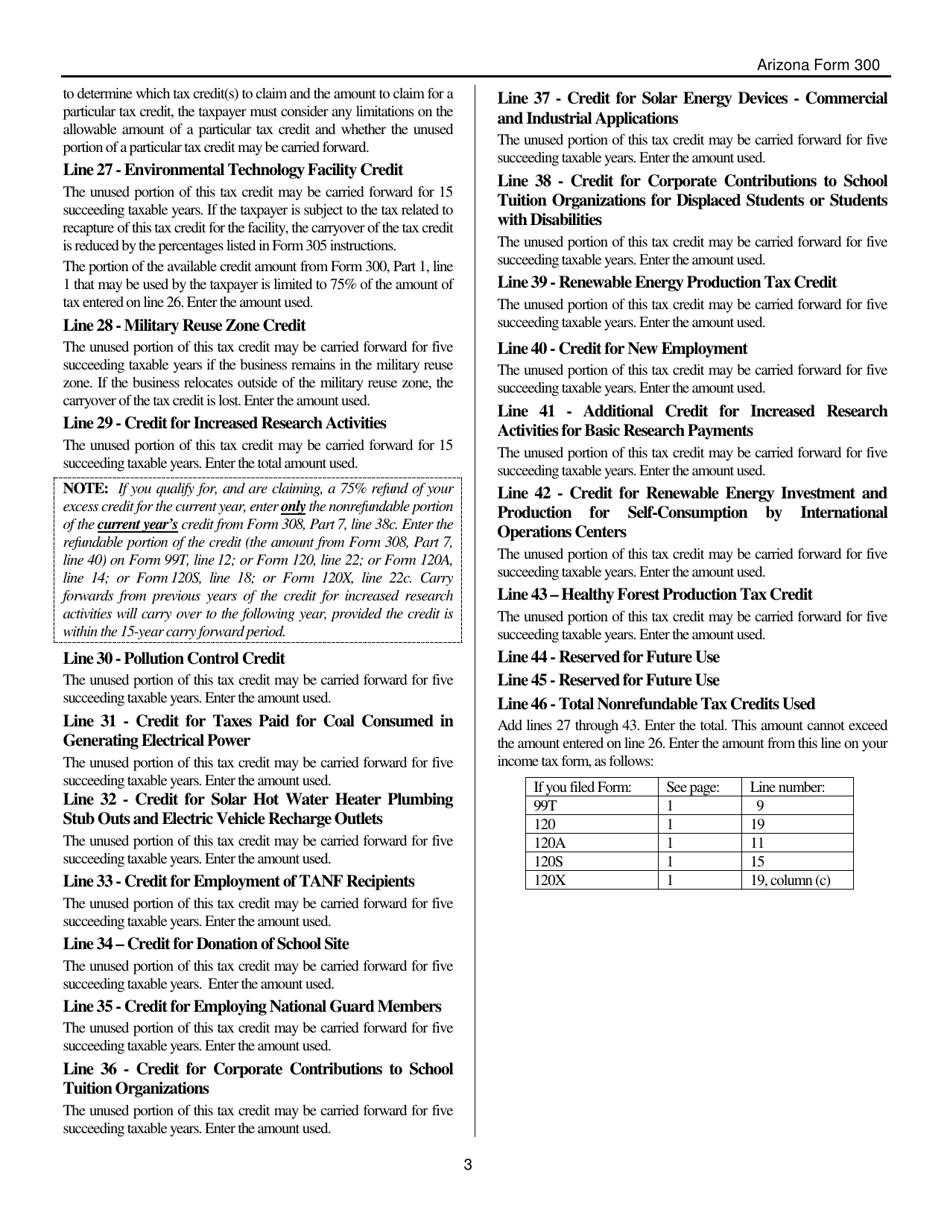

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Arizona Form 300, ADOR10128

for the current year.

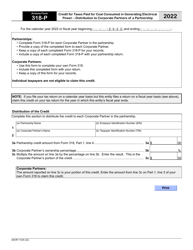

Instructions for Arizona Form 300, ADOR10128 Nonrefundable Corporate Tax Credits and Recapture - Arizona

This document contains official instructions for Arizona Form 300 , and Form ADOR10128 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 300 (ADOR10128) is available for download through this link.

FAQ

Q: What is Arizona Form 300?

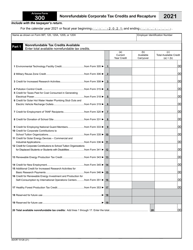

A: Arizona Form 300 is the ADOR10128 Nonrefundable Corporate Tax Credits and Recapture form.

Q: What is the purpose of Arizona Form 300?

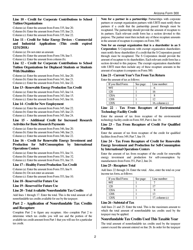

A: The purpose of Arizona Form 300 is to report nonrefundable corporate tax credits and recaptures.

Q: Who needs to file Arizona Form 300?

A: Any corporation or entity that has claimed nonrefundable corporate tax credits in Arizona needs to file Arizona Form 300.

Q: What are nonrefundable corporate tax credits?

A: Nonrefundable corporate tax credits are credits that reduce a corporation's tax liability but cannot be used to generate a tax refund.

Q: What is recapture?

A: Recapture is the process of repaying a previously claimed tax credit if the qualifying conditions are no longer met.

Q: Are there any penalties for not filing Arizona Form 300?

A: Yes, there may be penalties for not filing Arizona Form 300, such as late filing penalties or accuracy-related penalties.

Q: Is Arizona Form 300 the only form required for corporate tax credits?

A: No, there may be additional forms or schedules required depending on the specific tax credits being claimed. It is recommended to consult the instructions provided with Arizona Form 300.

Q: When is the deadline to file Arizona Form 300?

A: The deadline to file Arizona Form 300 is typically the same as the deadline for filing the corporation's Arizona tax return, which is March 15th for calendar year taxpayers.

Q: Can Arizona Form 300 be filed electronically?

A: Yes, Arizona Form 300 can be filed electronically through the Arizona Department of Revenue's e-file system.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.