This version of the form is not currently in use and is provided for reference only. Download this version of

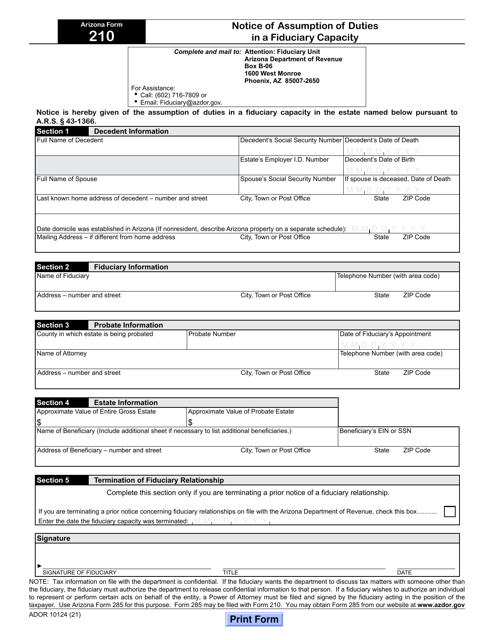

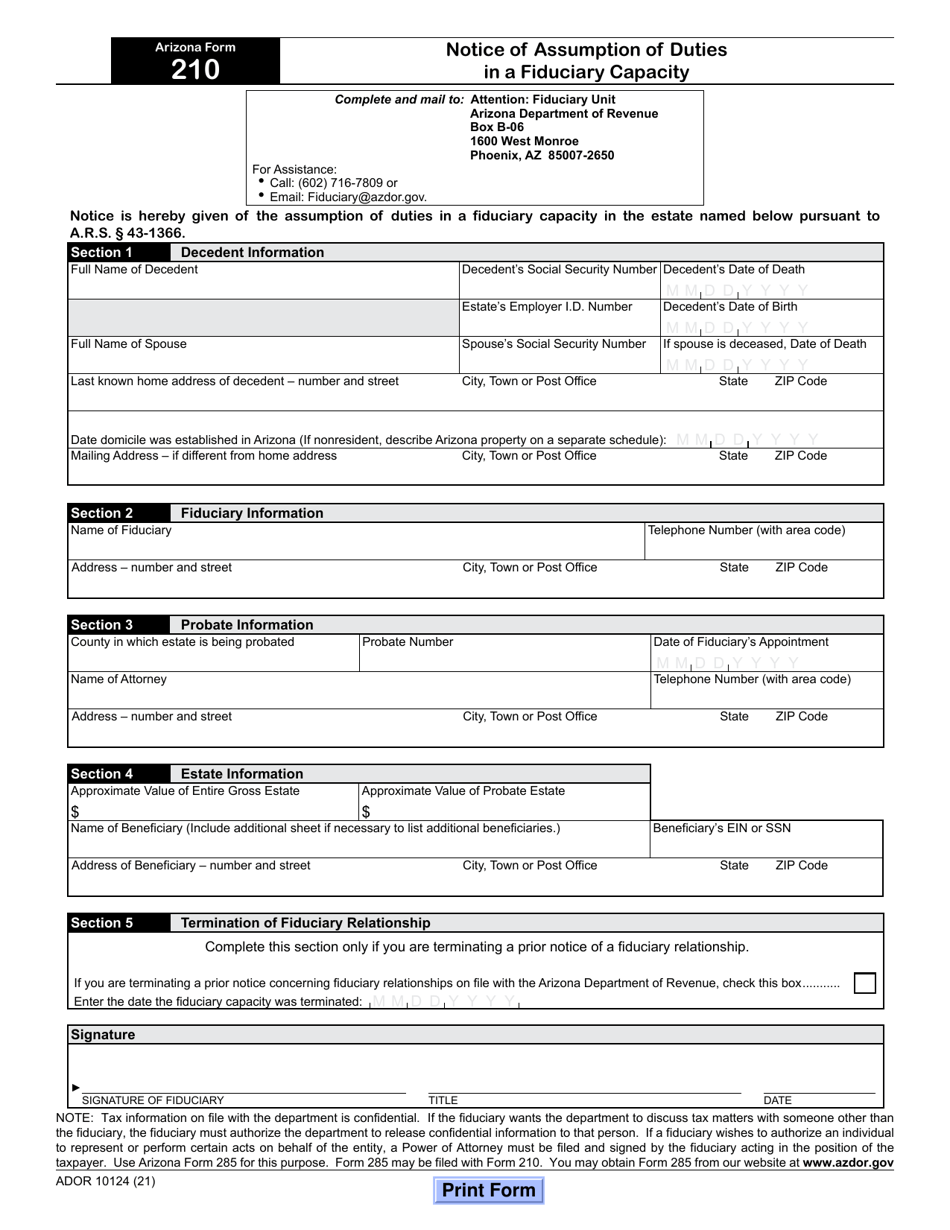

Arizona Form 210 (ADOR10124)

for the current year.

Arizona Form 210 (ADOR10124) Notice of Assumption of Duties in a Fiduciary Capacity - Arizona

What Is Arizona Form 210 (ADOR10124)?

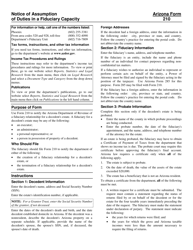

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 210?

A: Arizona Form 210 is the Notice of Assumption of Duties in a Fiduciary Capacity in Arizona.

Q: Who needs to file Arizona Form 210?

A: Individuals who assume duties in a fiduciary capacity in Arizona need to file Arizona Form 210.

Q: What is a fiduciary capacity?

A: A fiduciary capacity refers to a role or position where an individual is entrusted with managing assets or making decisions on behalf of another person or entity.

Q: What information is required on Arizona Form 210?

A: Arizona Form 210 requires information such as the name and address of the fiduciary, the date the duties were assumed, and the name and address of the estate or trust.

Q: Is there a deadline for filing Arizona Form 210?

A: Yes, Arizona Form 210 must be filed within 90 days of assuming the fiduciary duties.

Q: What happens if I fail to file Arizona Form 210?

A: Failure to file Arizona Form 210 may result in penalties or other legal consequences.

Q: Is Arizona Form 210 specific to estates or trusts?

A: Yes, Arizona Form 210 is specifically for individuals assuming duties in a fiduciary capacity for estates or trusts in Arizona.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 210 (ADOR10124) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.