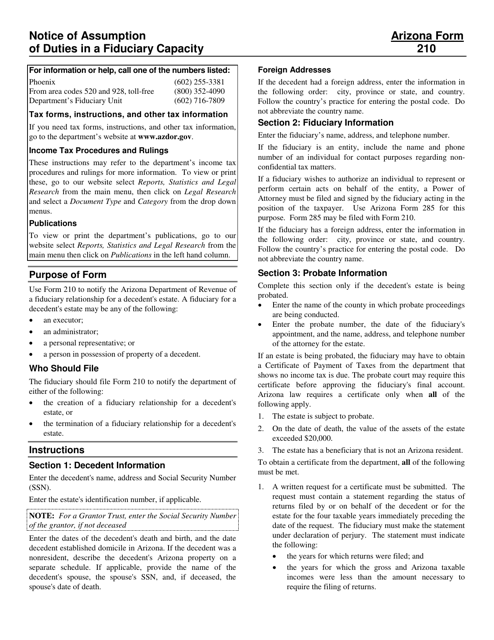

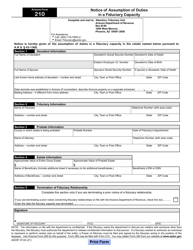

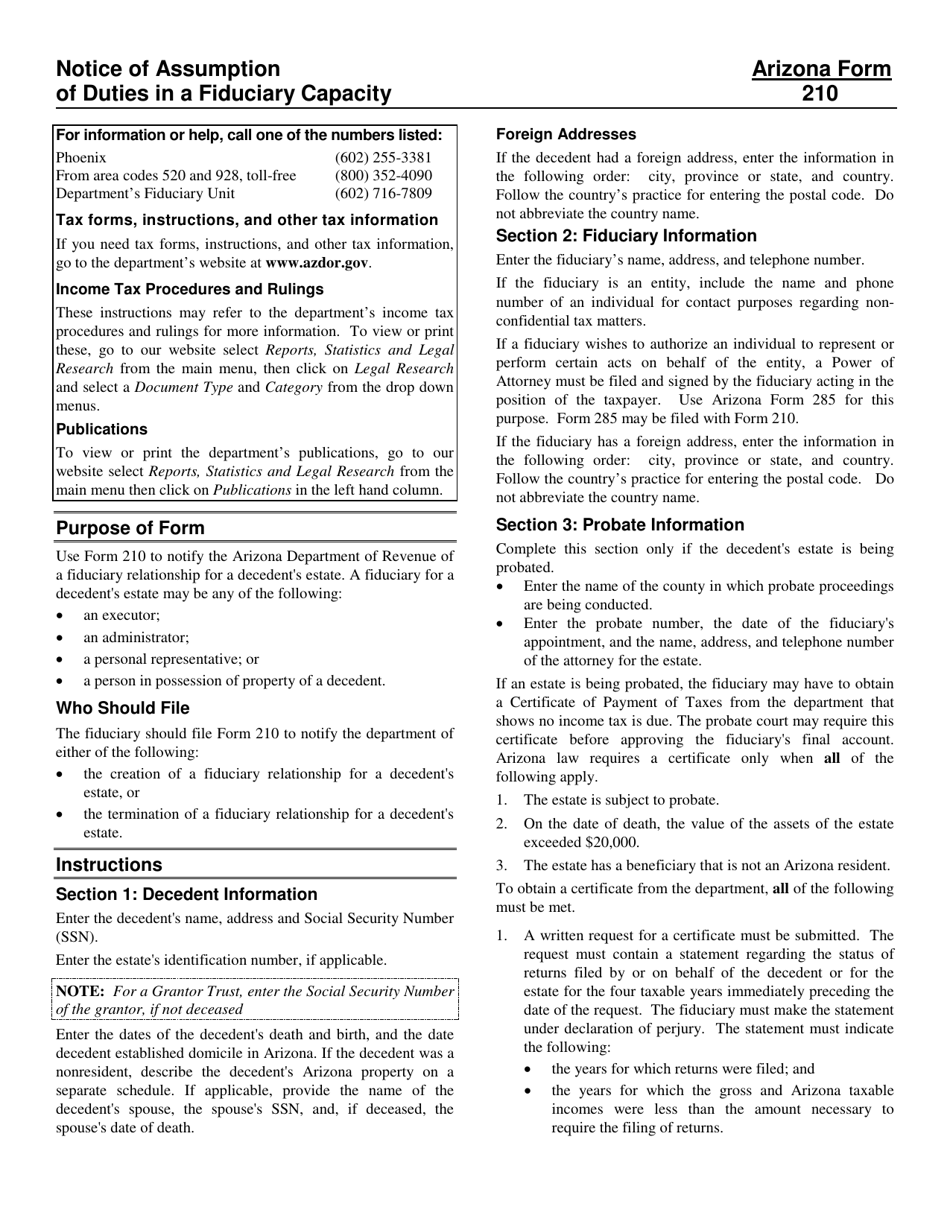

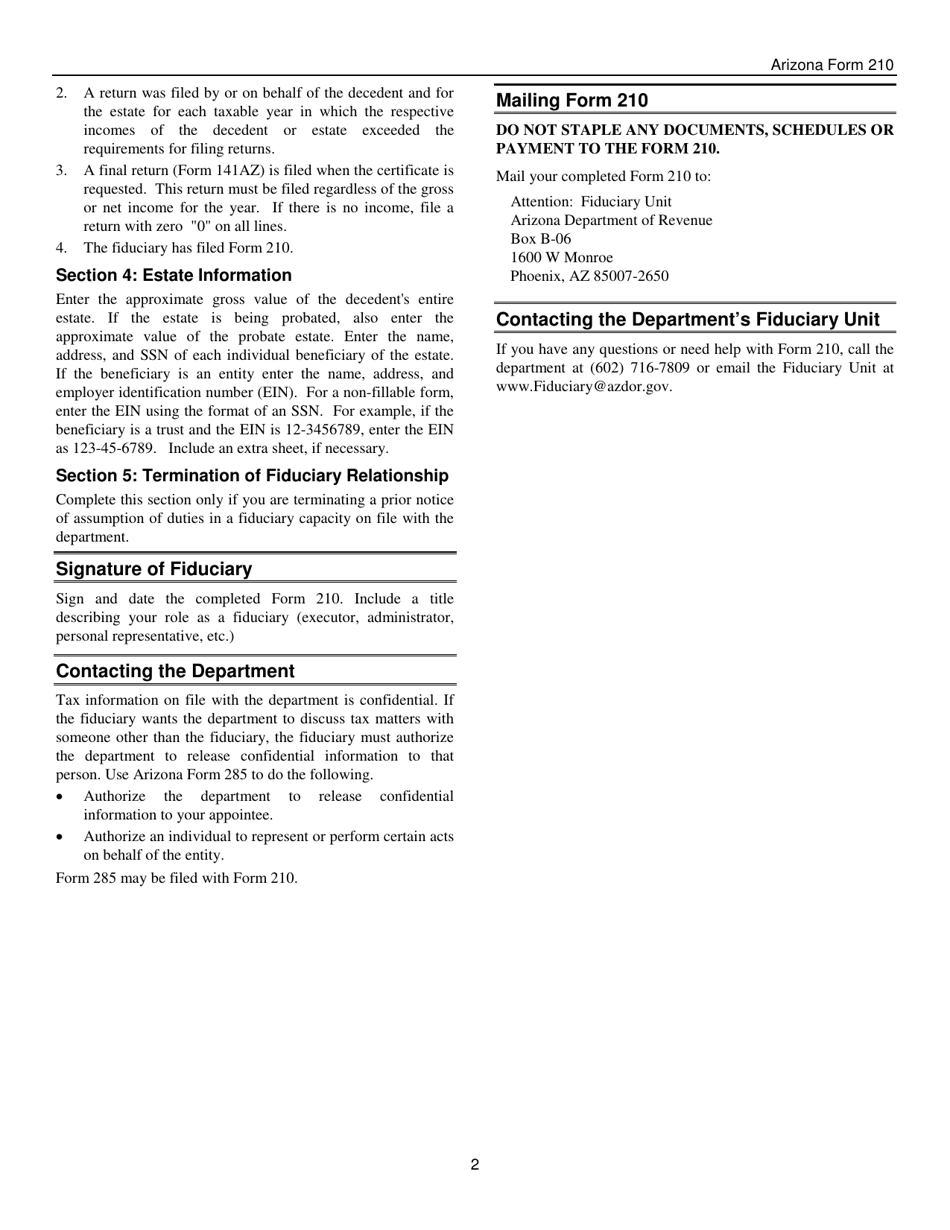

Instructions for Arizona Form 210, ADOR10124 Notice of Assumption of Duties in a Fiduciary Capacity - Arizona

This document contains official instructions for Arizona Form 210 , and Form ADOR10124 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 210 (ADOR10124) is available for download through this link.

FAQ

Q: What is Arizona Form 210?

A: Arizona Form 210 is the ADOR10124 Notice of Assumption of Duties in a Fiduciary Capacity that needs to be filled out for certain fiduciary duties in Arizona.

Q: Who needs to fill out Arizona Form 210?

A: Individuals and entities assuming fiduciary duties in Arizona need to fill out Arizona Form 210.

Q: What are fiduciary duties?

A: Fiduciary duties are legal responsibilities that one party (the fiduciary) has to act in the best interest of another party (the beneficiary). Examples of fiduciaries include executors of estates, trustees, or guardians.

Q: Do I need to include any supporting documents with Arizona Form 210?

A: Yes, you may need to include supporting documents such as letters of testamentary, letters of guardianship, or other relevant legal documents.

Q: Is there a deadline for filing Arizona Form 210?

A: Yes, Arizona Form 210 should be filed within 90 days of assuming fiduciary duties.

Q: What happens if I don't file Arizona Form 210?

A: Failure to file Arizona Form 210 may result in penalties and fines imposed by the Arizona Department of Revenue.

Q: Are there any fees associated with filing Arizona Form 210?

A: No, there are no fees associated with filing Arizona Form 210.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.