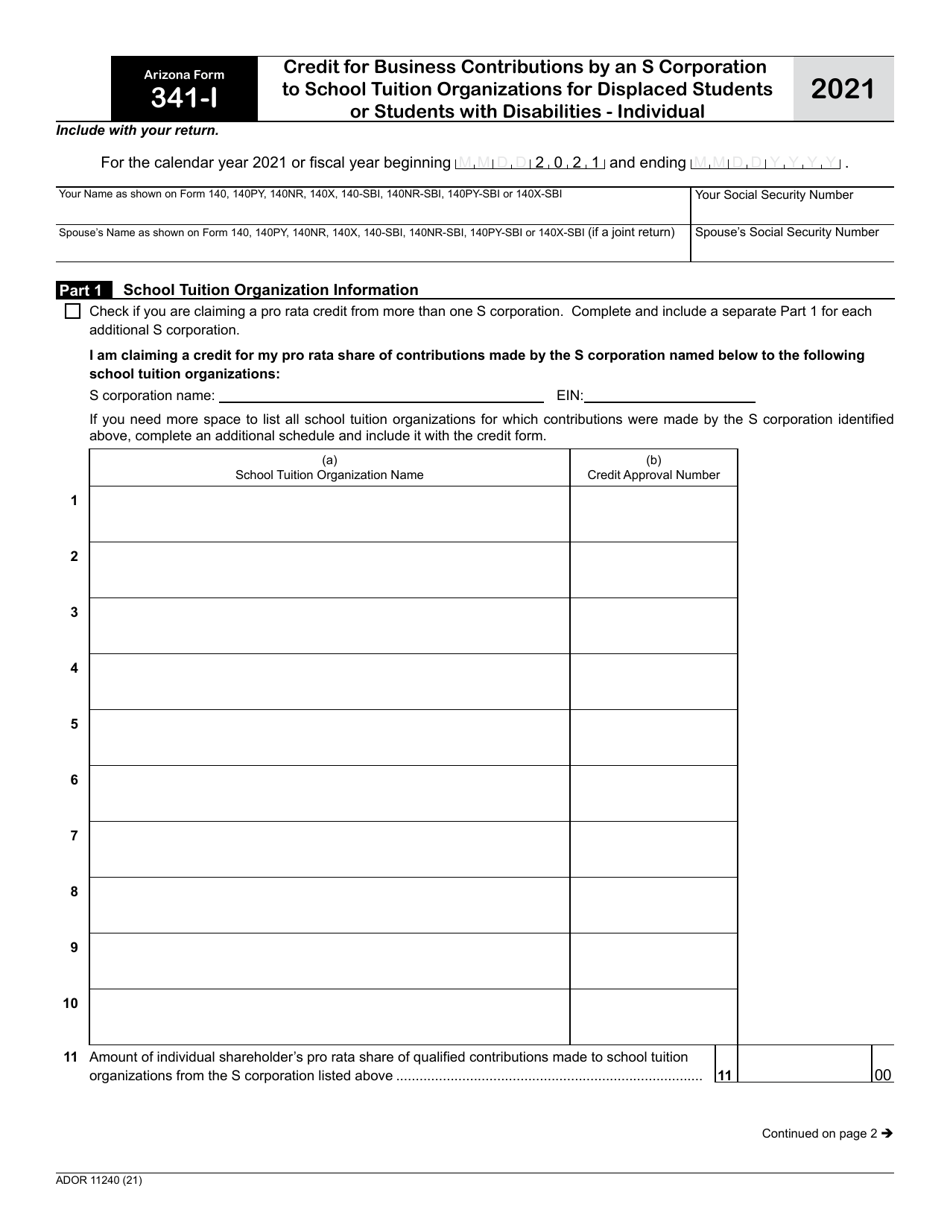

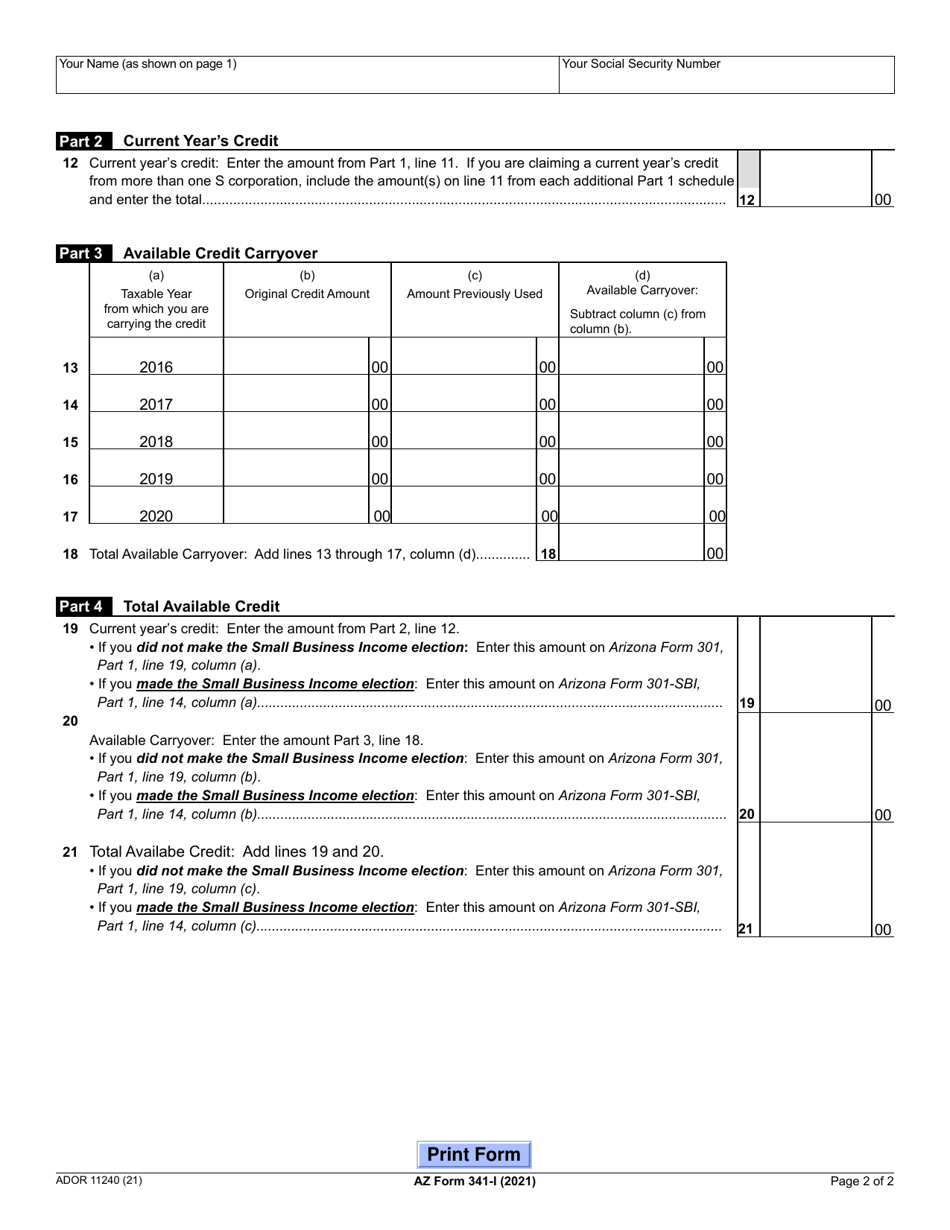

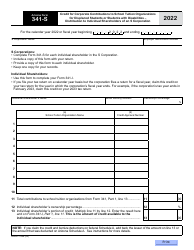

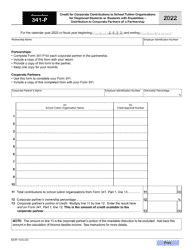

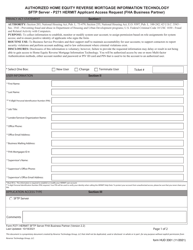

This version of the form is not currently in use and is provided for reference only. Download this version of

Arizona Form 341-I (ADOR11240)

for the current year.

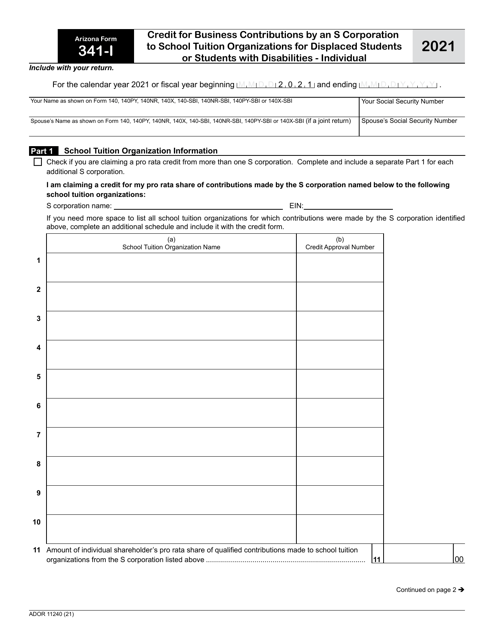

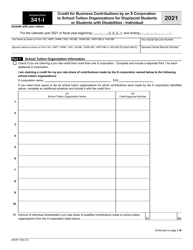

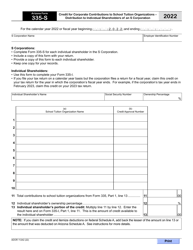

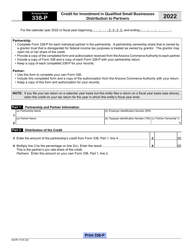

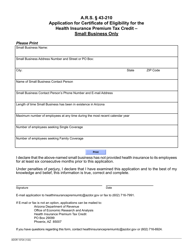

Arizona Form 341-I (ADOR11240) Credit for Business Contributions by an S Corporation to School Tuition Organizations for Displaced Students or Students With Disabilities - Individual - Arizona

What Is Arizona Form 341-I (ADOR11240)?

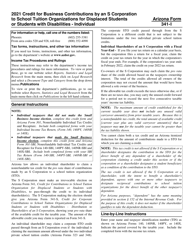

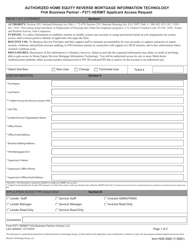

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 341-I?

A: Arizona Form 341-I is a tax form for individual taxpayers in Arizona.

Q: What is ADOR11240?

A: ADOR11240 is the form number assigned to Arizona Form 341-I.

Q: What is the purpose of Arizona Form 341-I?

A: The purpose of Arizona Form 341-I is to claim a credit for business contributions made by an S Corporation to School Tuition Organizations for displaced students or students with disabilities.

Q: Who is eligible to use Arizona Form 341-I?

A: Individual taxpayers in Arizona who want to claim a credit for business contributions by an S Corporation to School Tuition Organizations for displaced students or students with disabilities can use this form.

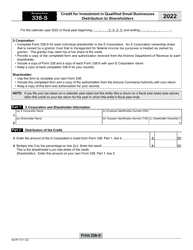

Q: What are School Tuition Organizations?

A: School Tuition Organizations are non-profit organizations that provide scholarships or tuition grants to eligible students attending private schools in Arizona.

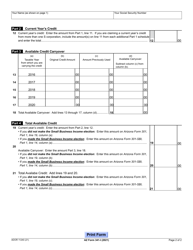

Q: What is the credit for business contributions?

A: The credit for business contributions allows taxpayers to reduce their tax liability by the amount of their eligible business contributions made to School Tuition Organizations.

Q: What are the requirements to claim the credit?

A: To claim the credit, the business contribution must be made during the taxable year to a qualified School Tuition Organization and must be used for scholarships or tuition grants for displaced students or students with disabilities.

Q: Is there a limit to the amount of the credit?

A: Yes, the credit for business contributions is subject to a limit based on the individual's tax liability, with a maximum credit amount specified by the Arizona Department of Revenue.

Q: When is the deadline to file Arizona Form 341-I?

A: The deadline to file Arizona Form 341-I is usually the same as the deadline for filing your Arizona income tax return, which is generally April 15th.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 341-I (ADOR11240) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.