This version of the form is not currently in use and is provided for reference only. Download this version of

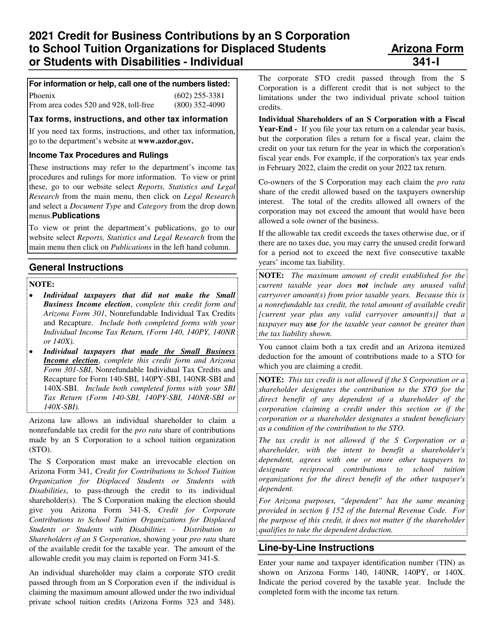

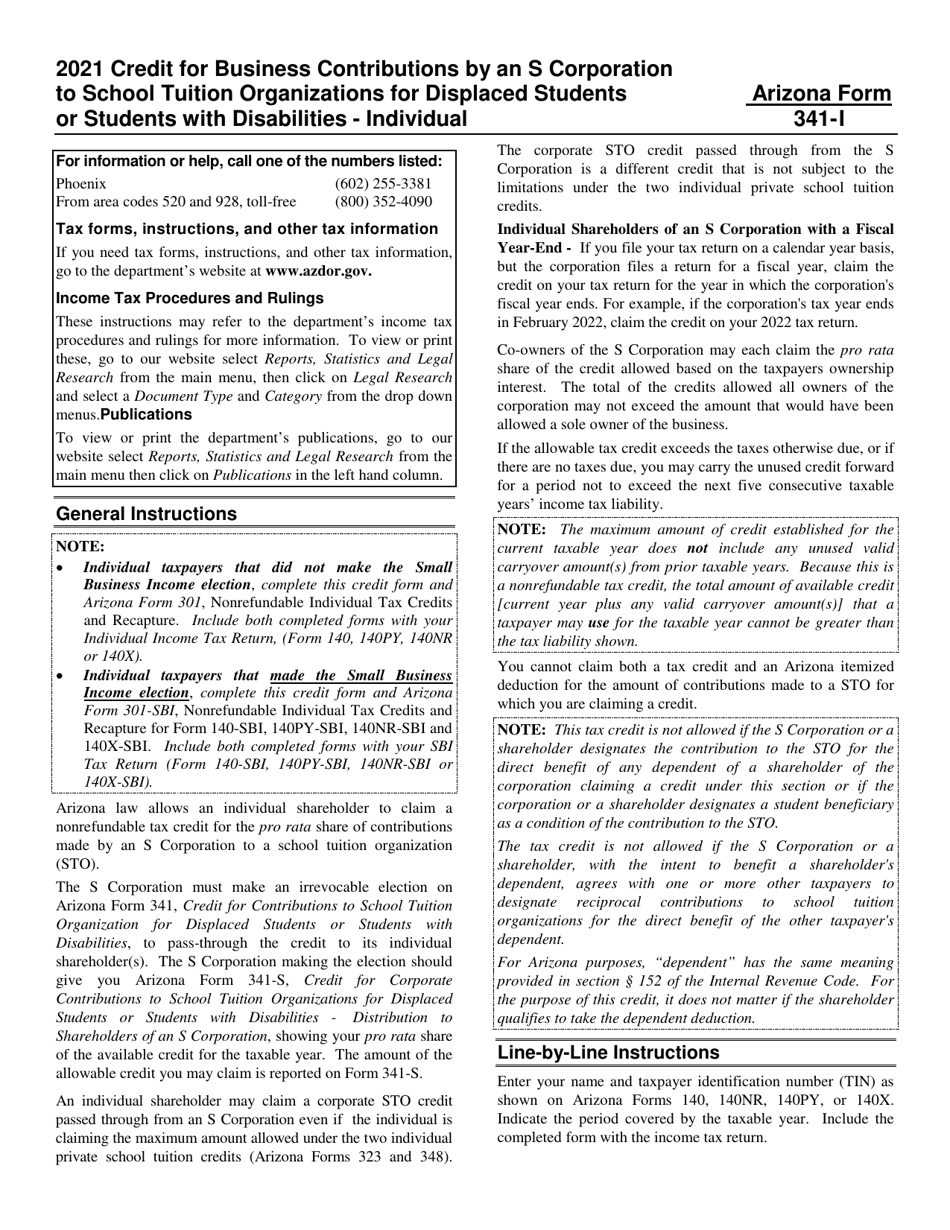

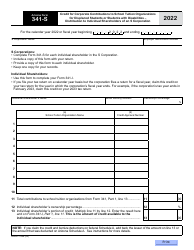

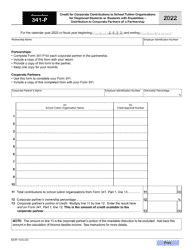

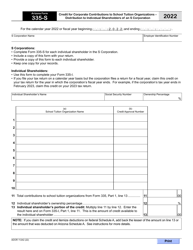

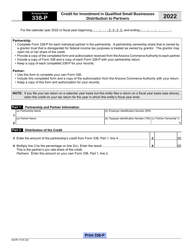

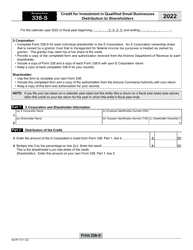

Instructions for Arizona Form 341-I, ADOR11240

for the current year.

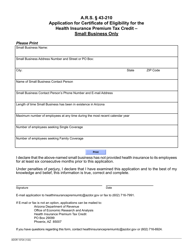

Instructions for Arizona Form 341-I, ADOR11240 Credit for Business Contributions by an S Corporation to School Tuition Organizations for Displaced Students or Students With Disabilities - Individual - Arizona

This document contains official instructions for Arizona Form 341-I , and Form ADOR11240 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 341-I (ADOR11240) is available for download through this link.

FAQ

Q: What is Arizona Form 341-I?

A: Arizona Form 341-I is a tax form for individuals in Arizona.

Q: What does the form ADOR11240 refer to?

A: The form ADOR11240 is specifically related to the Credit for Business Contributions by an S Corporation to School Tuition Organizations for Displaced Students or Students With Disabilities.

Q: What is the purpose of this form?

A: The purpose of this form is to claim a tax credit for contributions made by an S corporation to school tuition organizations in support of displaced students or students with disabilities.

Q: Who can use this form?

A: Individuals in Arizona who are claiming a tax credit for contributions made by an S corporation to school tuition organizations for displaced students or students with disabilities can use this form.

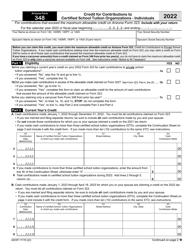

Q: What information is required on this form?

A: The form requires information such as the taxpayer's name, SSN, and address, as well as details about the S corporation's contributions.

Q: Is there a deadline for filing this form?

A: Yes, the form must be filed by the due date for filing the taxpayer's individual income tax return, usually April 15th.

Q: Can I claim this tax credit if I am not an S corporation?

A: No, this tax credit is specifically for contributions made by an S corporation, so individuals who are not part of an S corporation are not eligible to claim it.

Q: What is a school tuition organization?

A: A school tuition organization is a nonprofit organization that provides scholarships or tuition assistance to students, particularly those who are displaced or have disabilities.

Q: How much is the tax credit for contributions by an S corporation to school tuition organizations?

A: The tax credit is generally 100% of the contributions made by the S corporation, up to certain limits set by the Arizona Department of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.