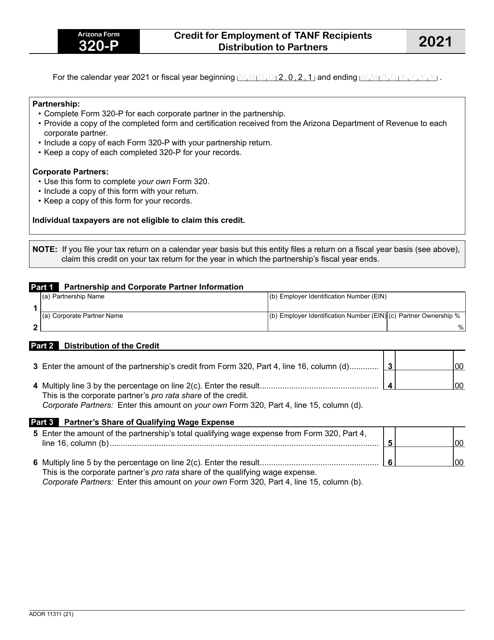

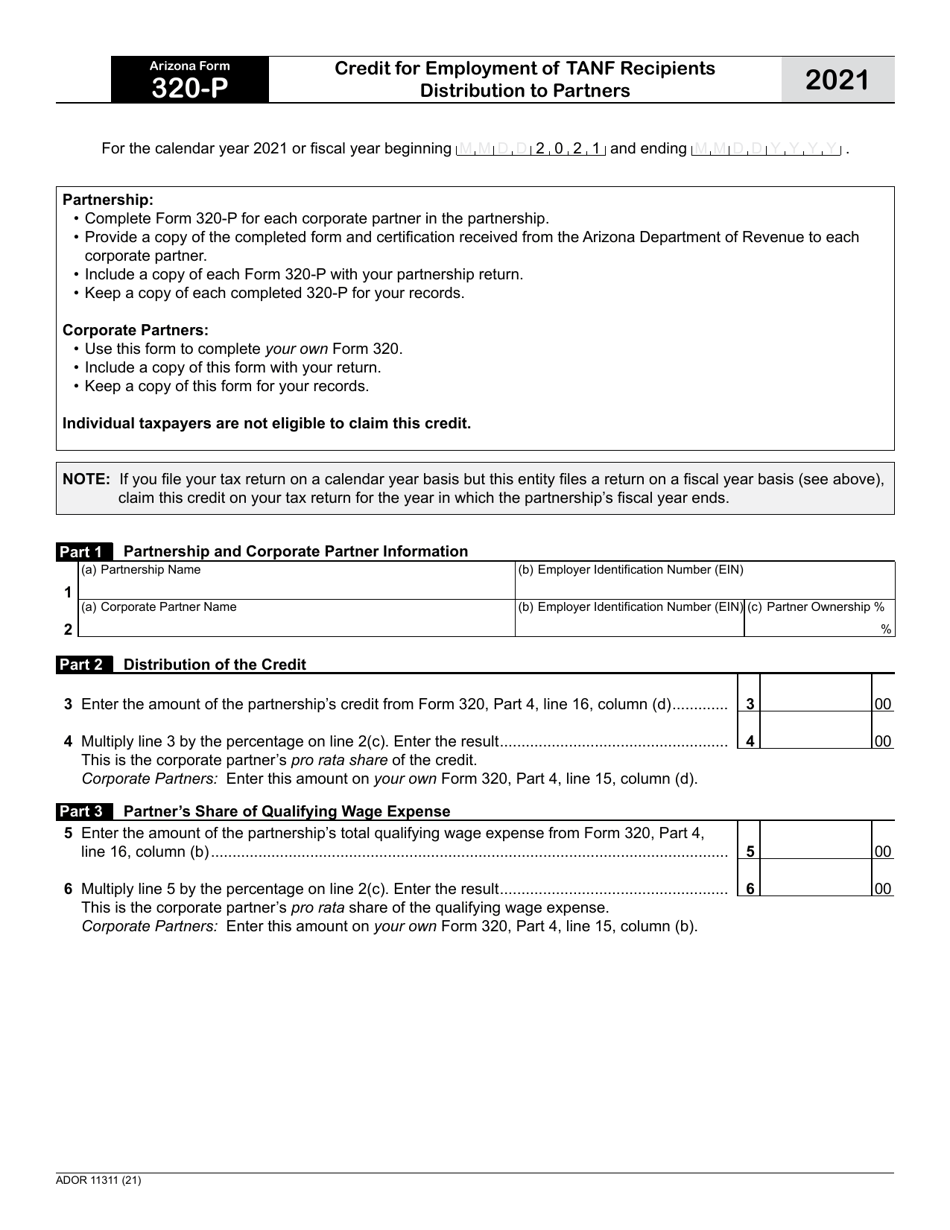

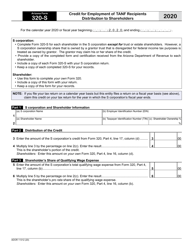

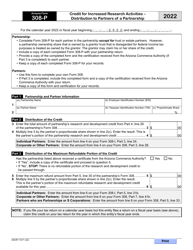

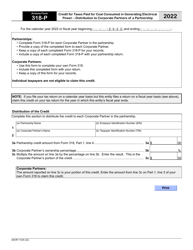

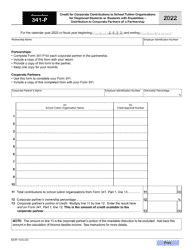

Arizona Form 320-P (ADOR11311) Credit for Employment of TANF Recipients Distribution to Partners - Arizona

What Is Arizona Form 320-P (ADOR11311)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 320-P?

A: Arizona Form 320-P is a form used by employers in Arizona to claim a credit for employing TANF recipients.

Q: What does ADOR11311 stand for?

A: ADOR11311 is the form number assigned by the Arizona Department of Revenue for Arizona Form 320-P.

Q: Who can use Arizona Form 320-P?

A: Employers in Arizona who have hired TANF recipients can use Arizona Form 320-P.

Q: What is TANF?

A: TANF stands for Temporary Assistance for Needy Families, which is a federal assistance program that provides financial support to low-income families.

Q: What is the purpose of Arizona Form 320-P?

A: The purpose of Arizona Form 320-P is for employers to claim a credit for employing TANF recipients.

Q: Are there any specific requirements to claim the credit on Arizona Form 320-P?

A: Yes, there are specific requirements that must be met to claim the credit on Arizona Form 320-P. These requirements are outlined in the instructions for the form.

Q: Is the credit for Employment of TANF Recipients distributed to partners?

A: Yes, the credit for Employment of TANF Recipients claimed on Arizona Form 320-P is distributed to partners according to their partnership agreement.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 320-P (ADOR11311) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.