This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Arizona Form 320, ADOR10579, Arizona Form 320-P, ADOR11311

for the current year.

Instructions for Arizona Form 320, ADOR10579, Arizona Form 320-P, ADOR11311 - Arizona

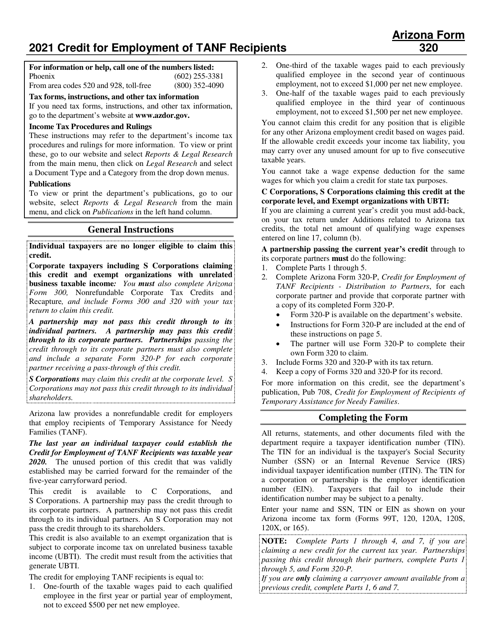

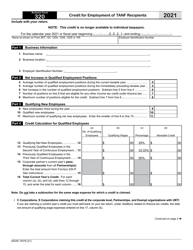

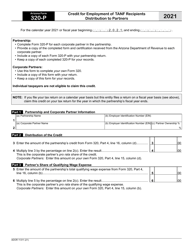

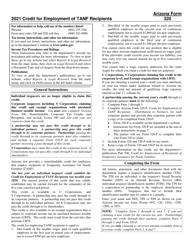

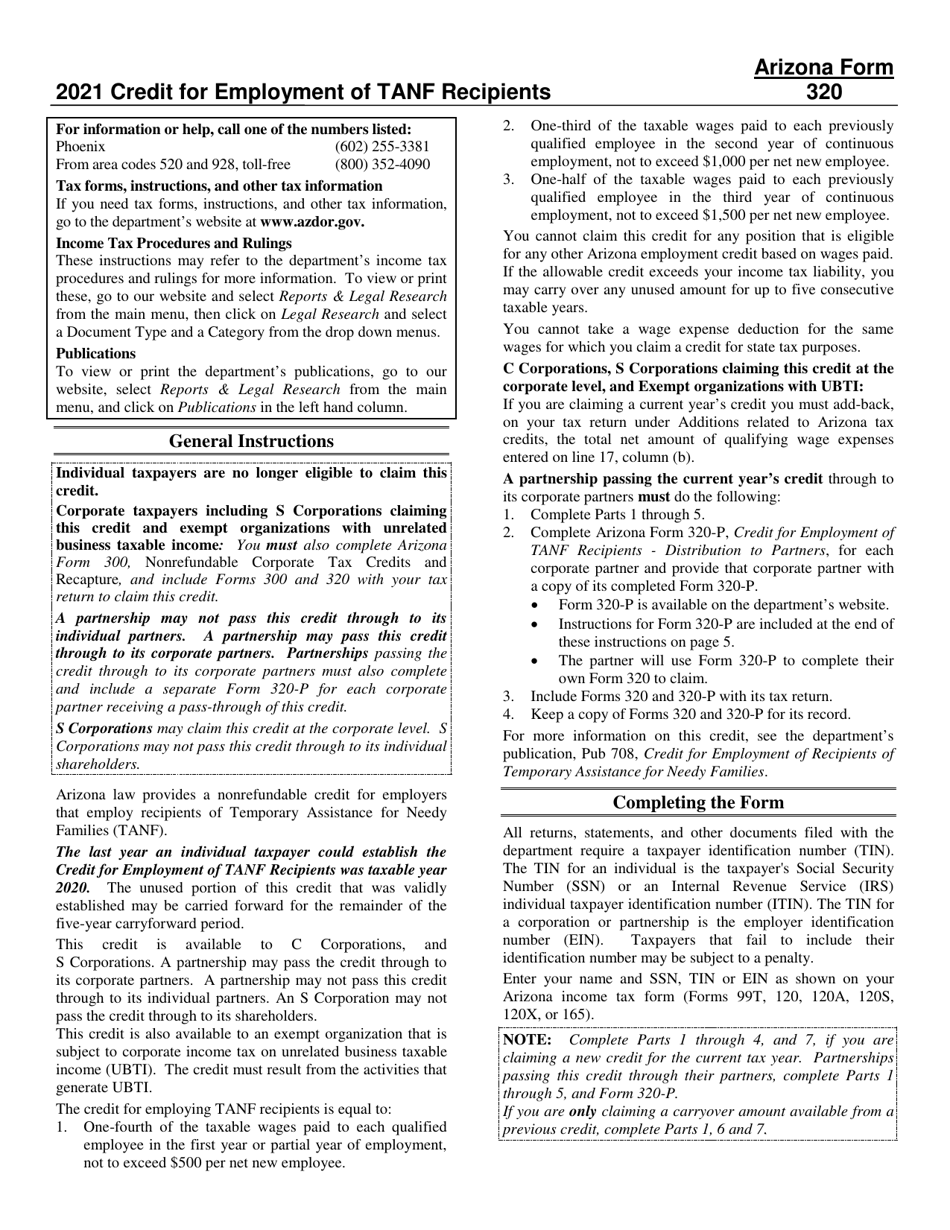

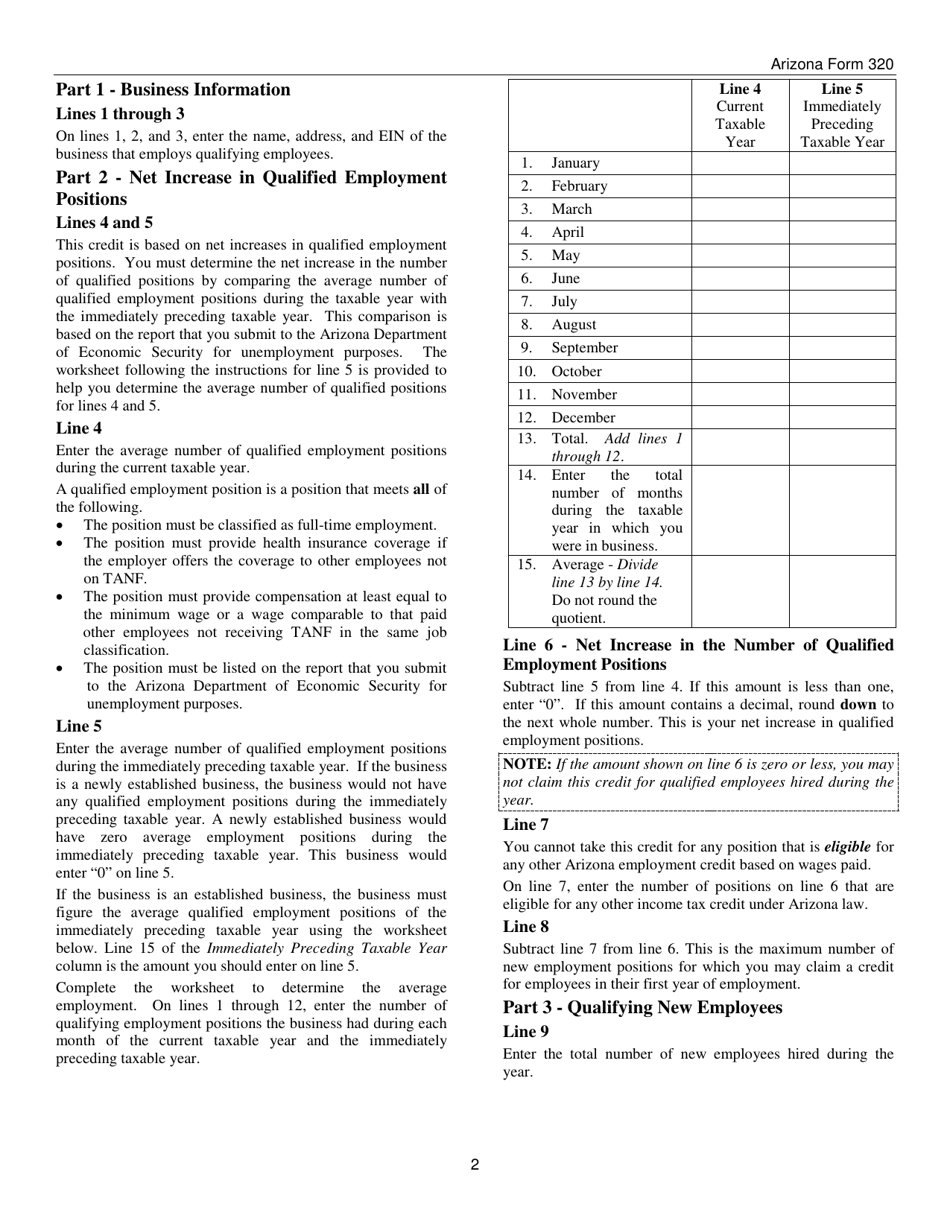

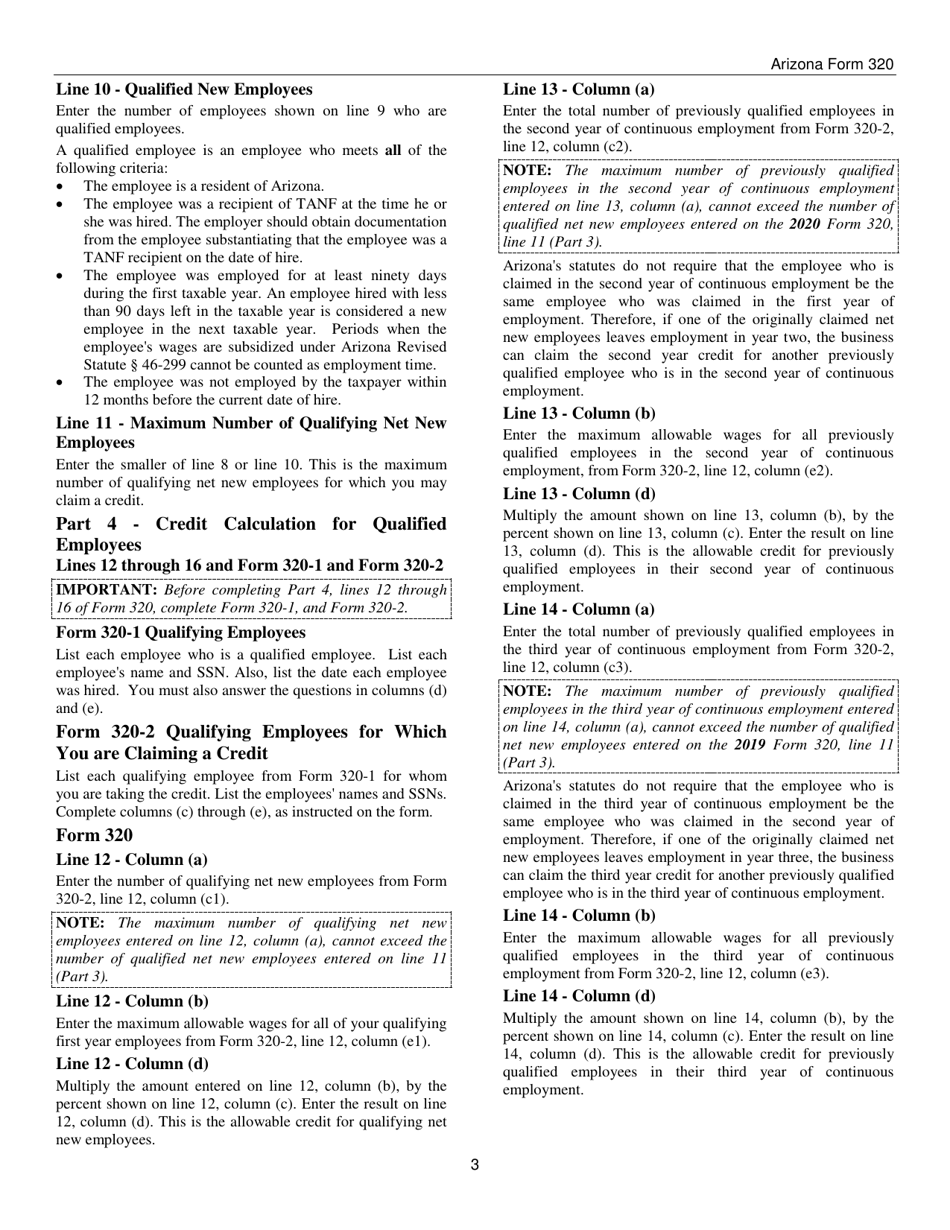

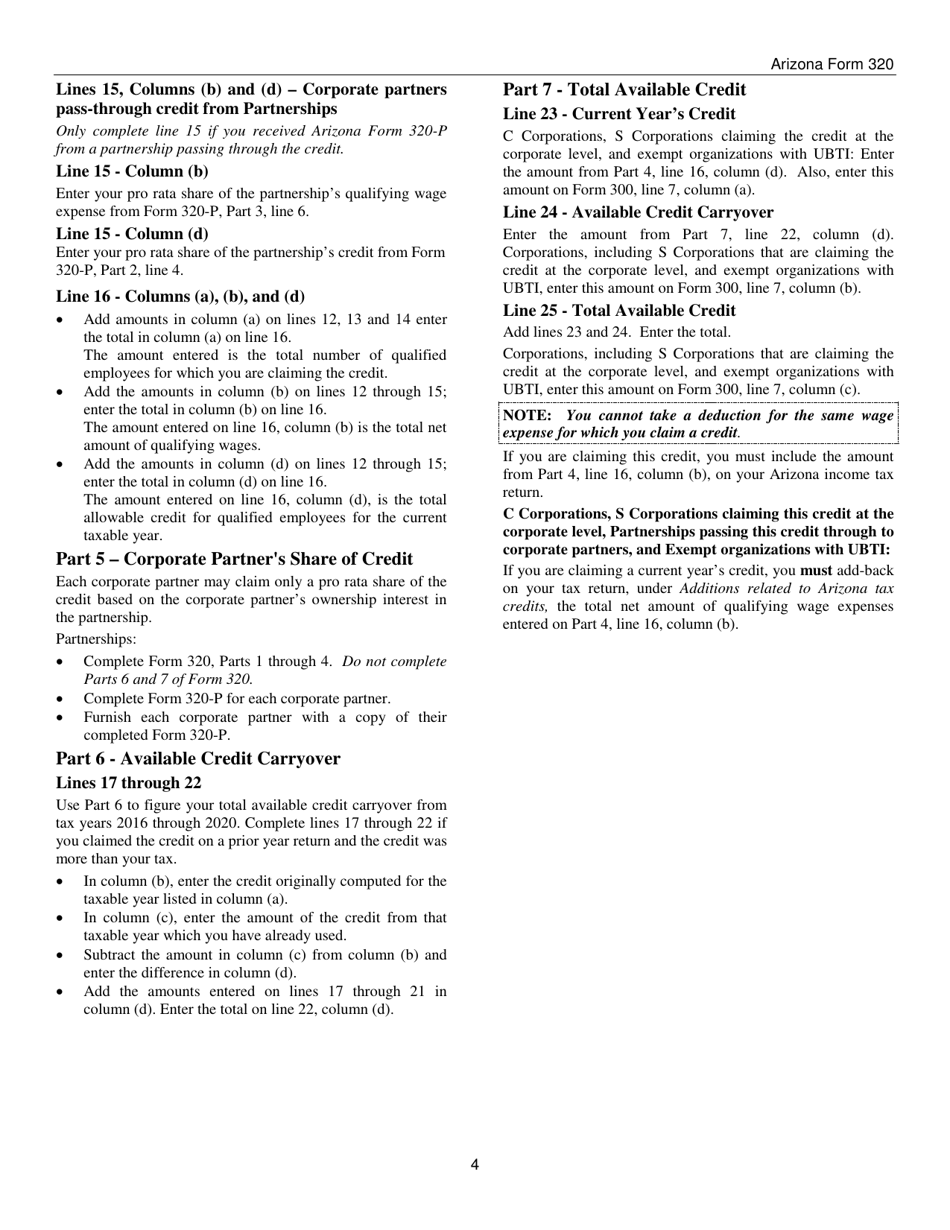

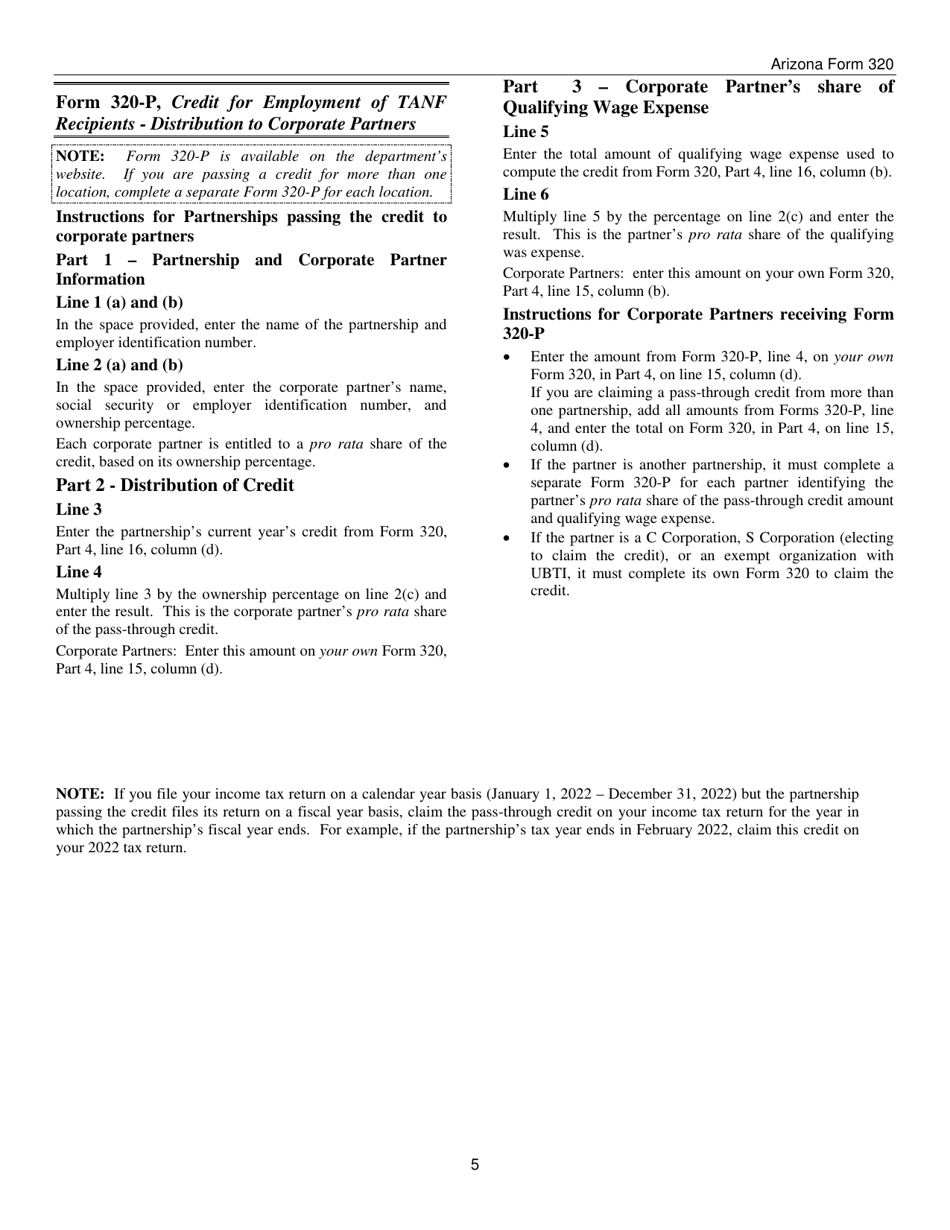

This document contains official instructions for Arizona Form 320 , Form ADOR10579 , Arizona Form 320-P , and Form ADOR11311 . All forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 320 (ADOR10579) is available for download through this link. The latest available Arizona Form 320-P (ADOR11311) can be downloaded through this link.

FAQ

Q: What is Arizona Form 320?

A: Arizona Form 320 is a tax form used in Arizona for reporting and paying transaction privilege tax.

Q: What is ADOR10579?

A: ADOR10579 is the form number for the instructions specific to Arizona Form 320.

Q: What is Arizona Form 320-P?

A: Arizona Form 320-P is a payment voucher used to submit payment for the transaction privilege tax.

Q: What is ADOR11311?

A: ADOR11311 is the form number for the instructions specific to Arizona Form 320-P.

Q: What is transaction privilege tax?

A: Transaction privilege tax is a tax imposed on business activities in Arizona, including sales of goods or services.

Q: How do I file Arizona Form 320?

A: Arizona Form 320 can be filed electronically or by mail, following the instructions provided.

Q: What is the deadline for filing Arizona Form 320?

A: The deadline for filing Arizona Form 320 depends on the reporting period, typically the 20th day of the month following the end of the period.

Q: What is the penalty for late filing of Arizona Form 320?

A: The penalty for late filing of Arizona Form 320 is 4.5% of the tax due per month, up to a maximum of 25%.

Q: What is the penalty for late payment of transaction privilege tax?

A: The penalty for late payment of transaction privilege tax is 1% of the tax due per month, up to a maximum of 25%.

Q: Who is required to file Arizona Form 320?

A: Businesses engaged in activities subject to transaction privilege tax in Arizona are required to file Arizona Form 320.

Q: Do I need to file Arizona Form 320 if I don't have any sales or business activity?

A: If you have no sales or business activity subject to transaction privilege tax, you may be eligible for a zero filing.

Q: Can I get an extension to file Arizona Form 320?

A: Extensions may be granted for filing Arizona Form 320, but you must request the extension before the original due date.

Q: Can I pay transaction privilege tax in person?

A: Yes, you can pay transaction privilege tax in person at the Arizona Department of Revenue's offices.

Q: What is the contact number for the Arizona Department of Revenue?

A: The contact number for the Arizona Department of Revenue is (602) 255-3381.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.