This version of the form is not currently in use and is provided for reference only. Download this version of

Arizona Form 200 (ADOR10180)

for the current year.

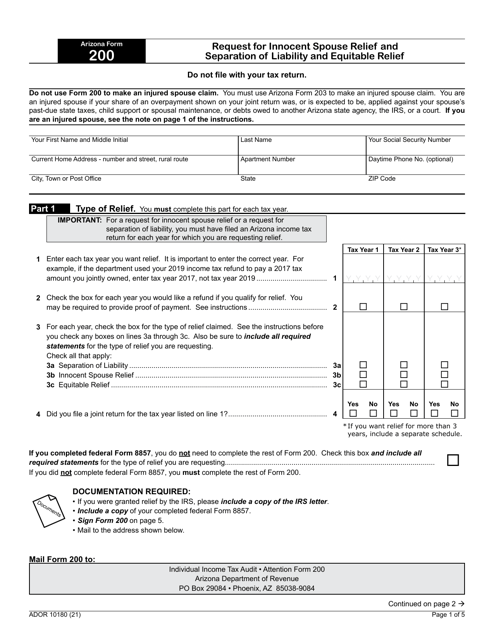

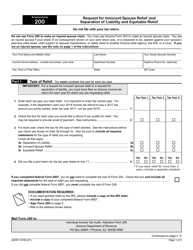

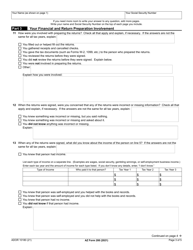

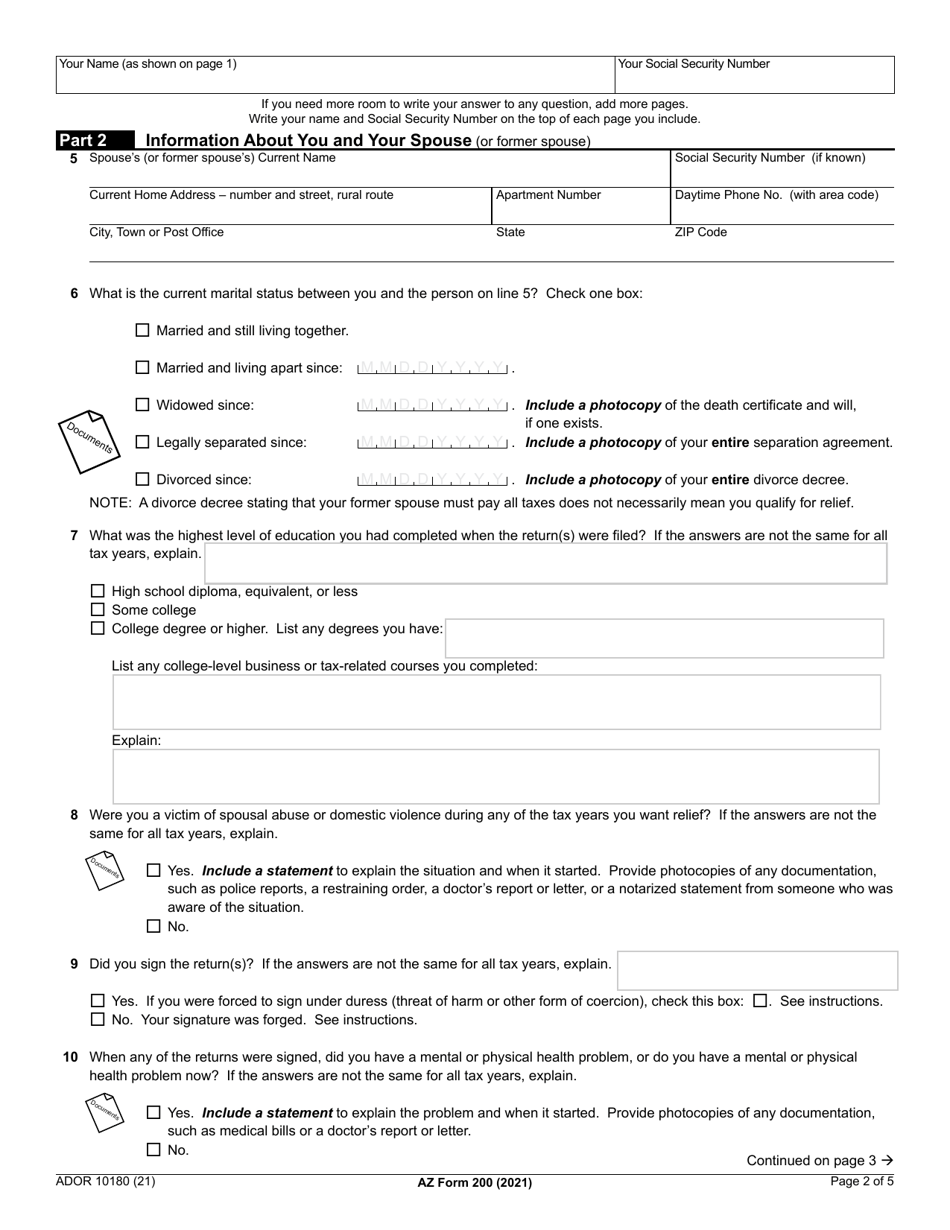

Arizona Form 200 (ADOR10180) Request for Innocent Spouse Relief and Separation of Liability and Equitable Relief - Arizona

What Is Arizona Form 200 (ADOR10180)?

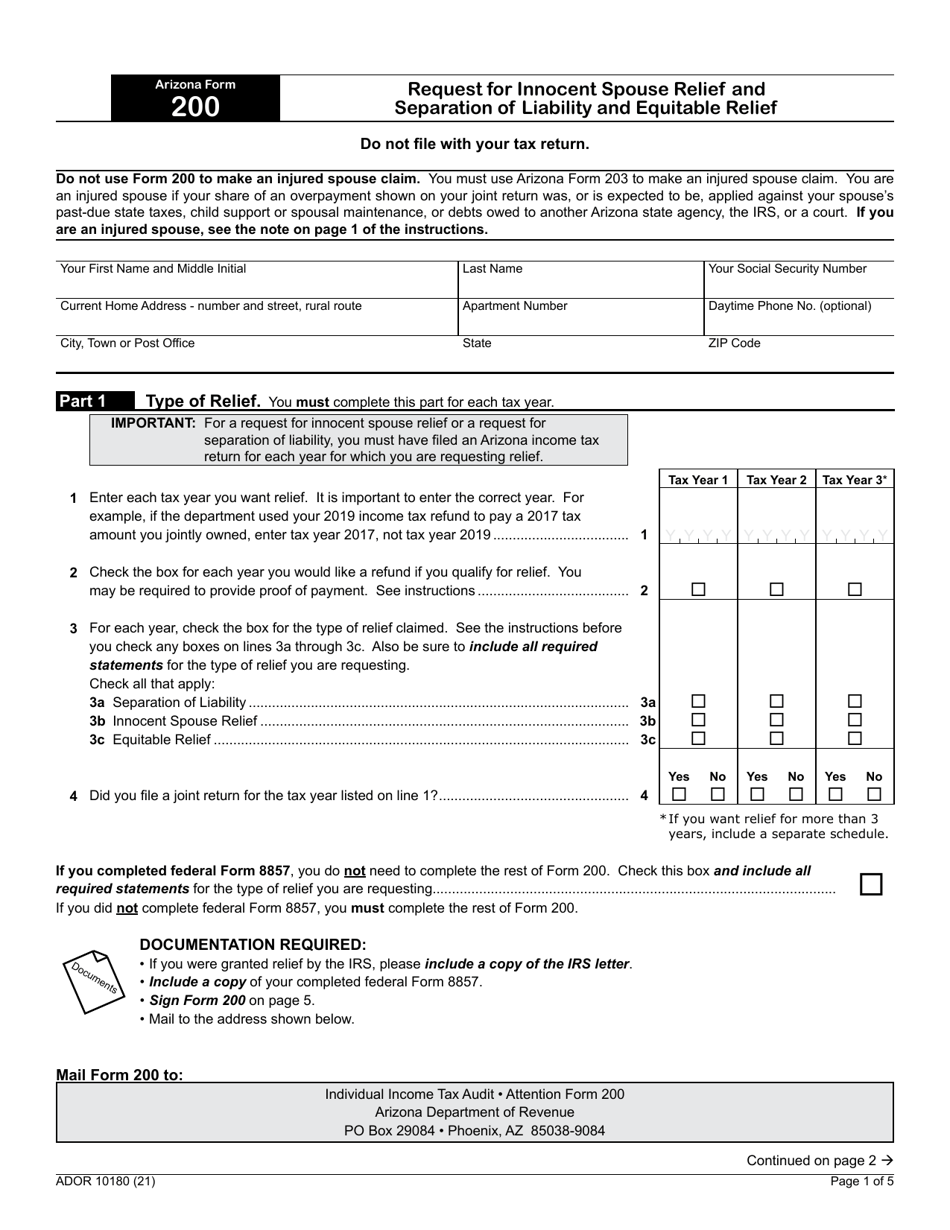

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 200?

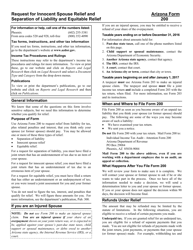

A: Arizona Form 200 is a form used to request Innocent Spouse Relief and Separation of Liability and Equitable Relief in Arizona.

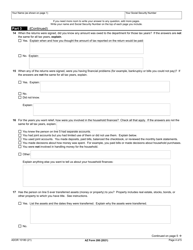

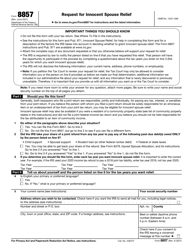

Q: What is Innocent Spouse Relief?

A: Innocent Spouse Relief is a provision that allows a taxpayer to be relieved of responsibility for paying tax, interest, and penalties on a joint tax return.

Q: What is Separation of Liability?

A: Separation of Liability is a provision that allows for the allocation of tax understatement between spouses who are no longer married or separated.

Q: What is Equitable Relief?

A: Equitable Relief is a provision that provides relief from tax liability when neither Innocent Spouse Relief nor Separation of Liability applies.

Q: Who can request Innocent Spouse Relief?

A: An individual who filed a joint tax return and believes they should not be held responsible for the tax liability due to their spouse's actions can request Innocent Spouse Relief.

Q: Who can request Separation of Liability?

A: An individual who is no longer married or legally separated and wants to allocate tax understatement between themselves and their former spouse can request Separation of Liability.

Q: Who can request Equitable Relief?

A: An individual who does not qualify for Innocent Spouse Relief or Separation of Liability, but believes it would be unfair to hold them responsible for the tax liability, can request Equitable Relief.

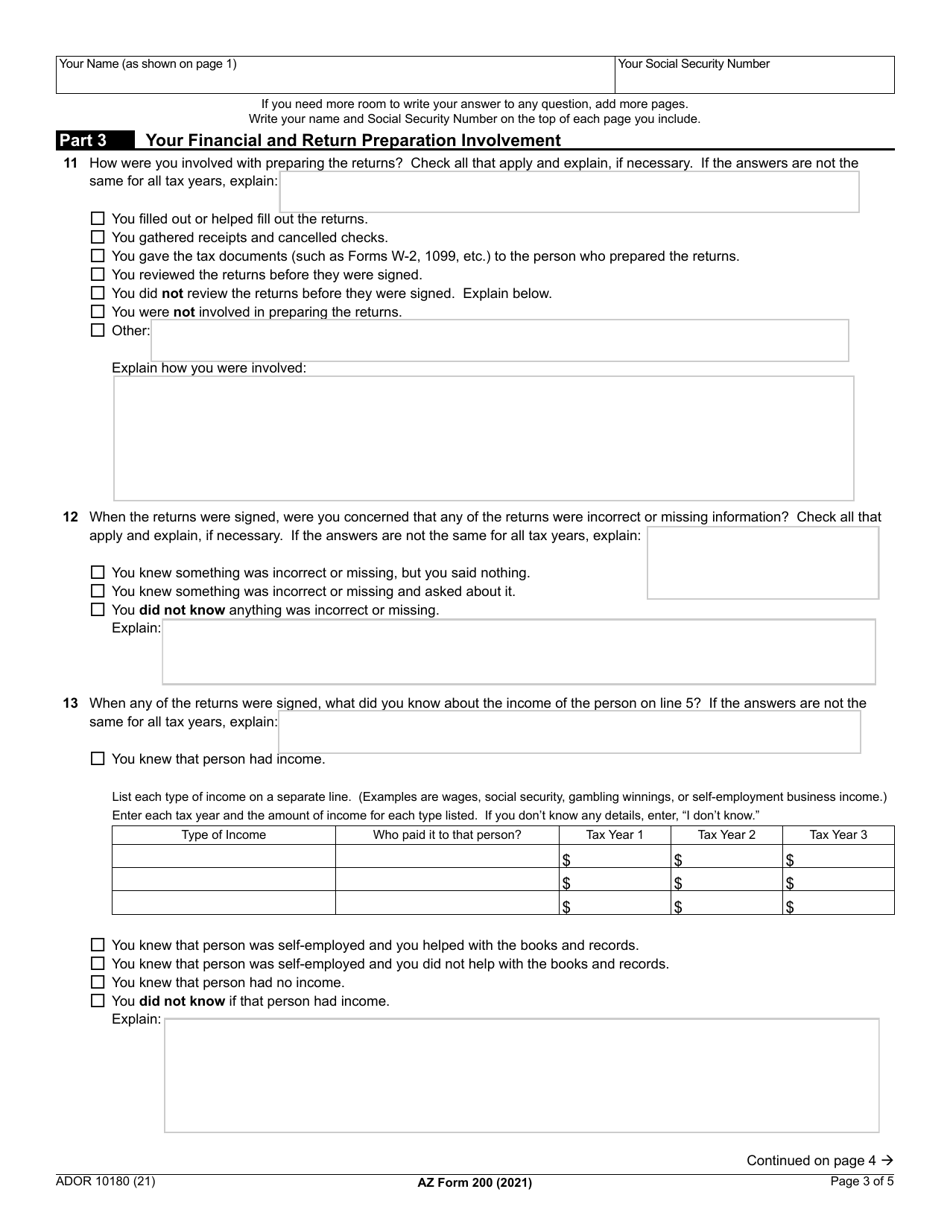

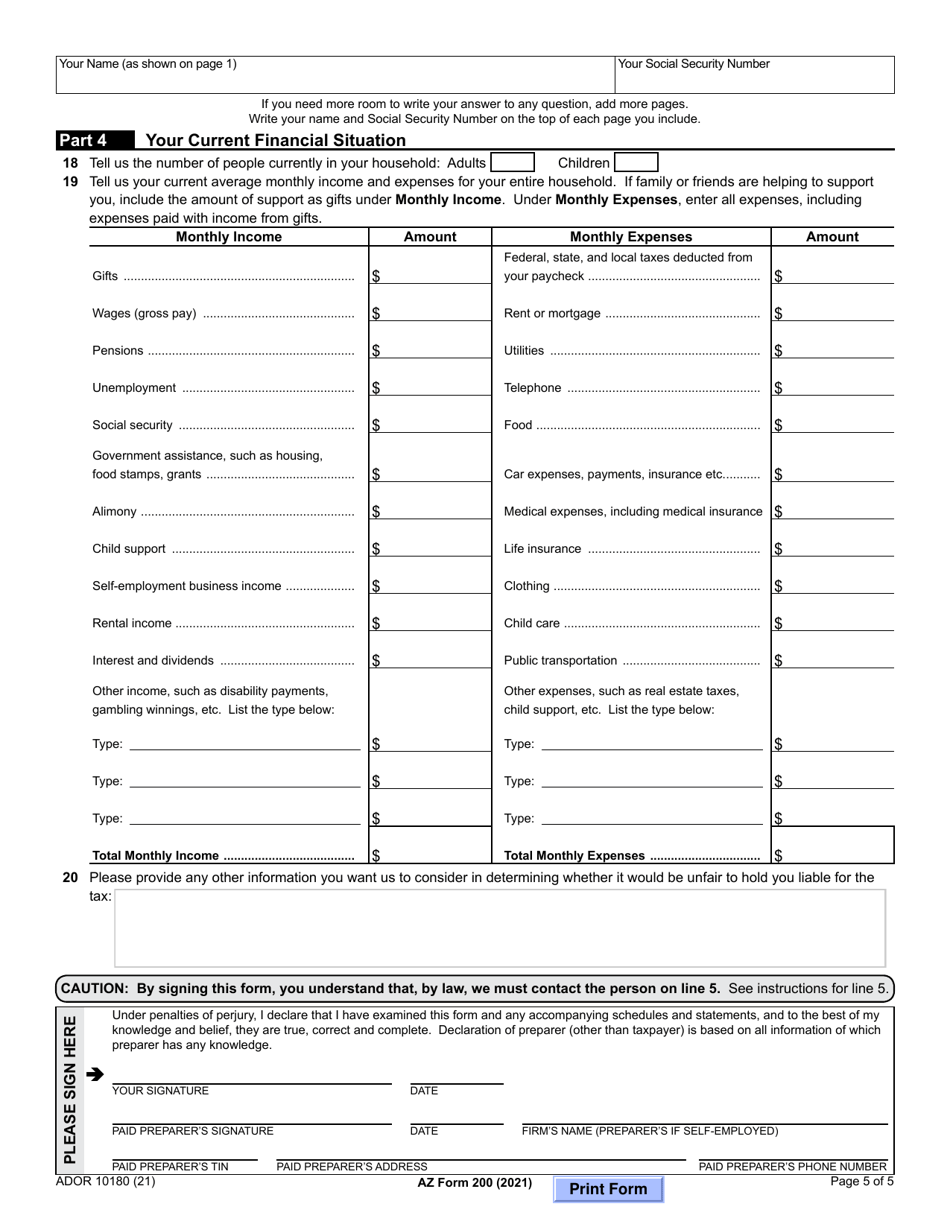

Q: How do I fill out Arizona Form 200?

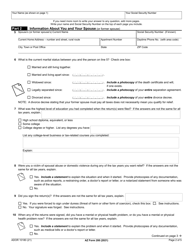

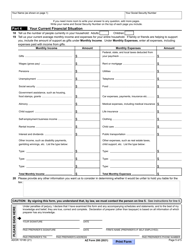

A: To fill out Arizona Form 200, provide your personal information, details about the joint tax return, and explain why you are seeking relief. Follow the instructions on the form for additional requirements and documentation.

Q: Is there a deadline to submit Arizona Form 200?

A: Yes, there is a deadline to submit Arizona Form 200. Consult the instructions on the form or contact the Arizona Department of Revenue for the specific deadline.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 200 (ADOR10180) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.