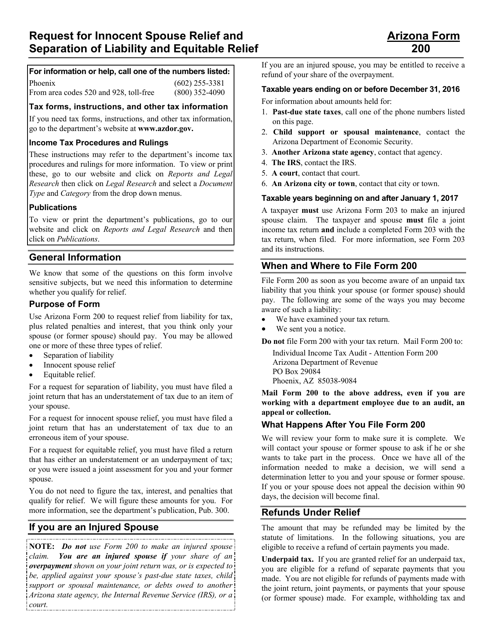

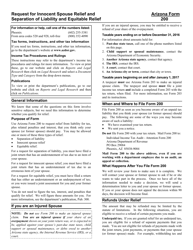

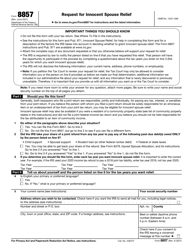

Instructions for Arizona Form 200, ADOR10180 Request for Innocent Spouse Relief and Separation of Liability and Equitable Relief - Arizona

This document contains official instructions for Arizona Form 200 , and Form ADOR10180 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 200 (ADOR10180) is available for download through this link.

FAQ

Q: What is Arizona Form 200?

A: Arizona Form 200 is the ADOR10180 Request forInnocent Spouse Relief and Separation of Liability and Equitable Relief form.

Q: What is the purpose of Arizona Form 200?

A: The purpose of Arizona Form 200 is to request innocent spouse relief and separation of liability and equitable relief.

Q: Who can use Arizona Form 200?

A: Arizona Form 200 can be used by individuals who are requesting innocent spouse relief and separation of liability and equitable relief.

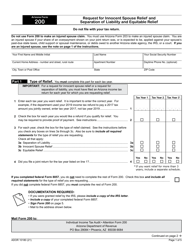

Q: What types of relief can be requested using Arizona Form 200?

A: Using Arizona Form 200, you can request innocent spouse relief, separation of liability relief, or equitable relief.

Q: Are there any eligibility criteria for requesting relief using Arizona Form 200?

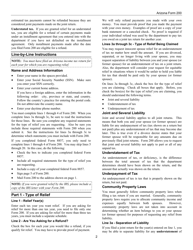

A: Yes, there are specific eligibility criteria that you must meet in order to request relief using Arizona Form 200. These criteria are outlined in the form's instructions.

Q: What supporting documentation is required with Arizona Form 200?

A: You will need to provide supporting documentation, such as tax returns, financial statements, and any other relevant documents, as specified in the form's instructions.

Q: Is there a deadline for submitting Arizona Form 200?

A: Yes, there is a deadline for submitting Arizona Form 200. The specific deadline can be found in the form's instructions.

Q: What happens after I submit Arizona Form 200?

A: After you submit Arizona Form 200, the Arizona Department of Revenue will review your request and supporting documentation. They will then make a determination on whether to grant the requested relief or not.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.