This version of the form is not currently in use and is provided for reference only. Download this version of

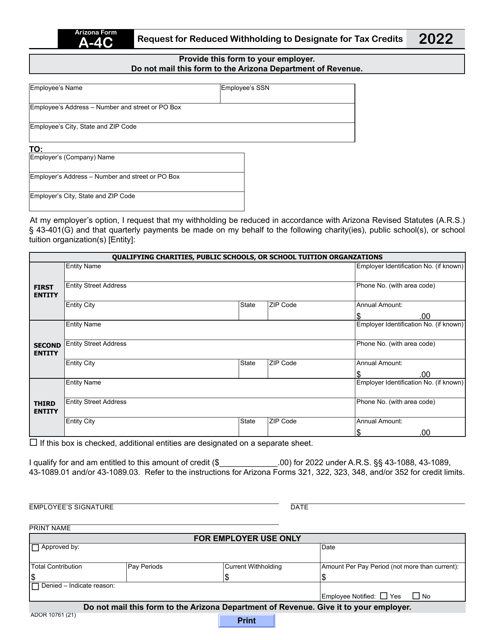

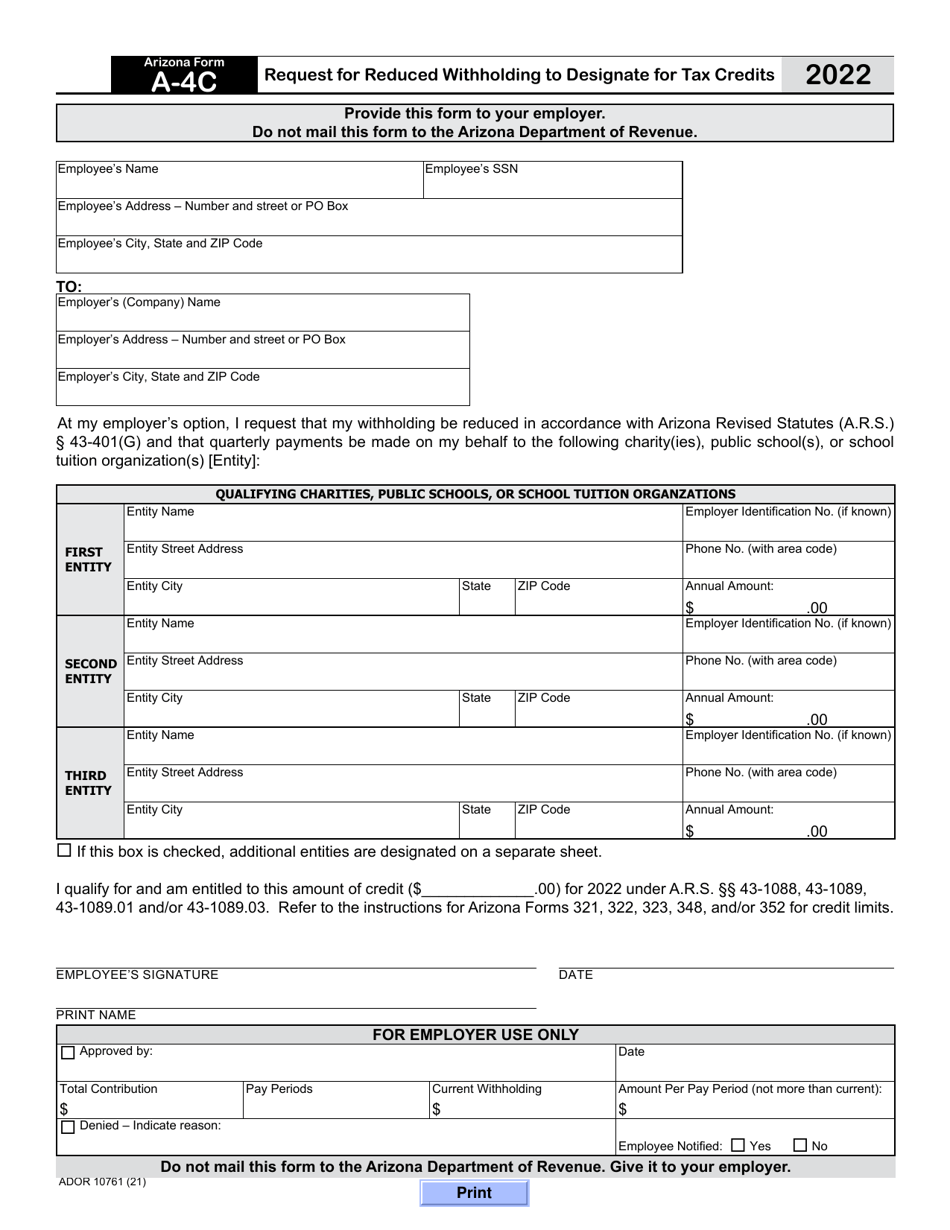

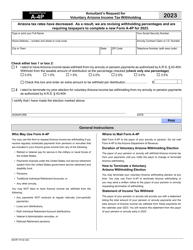

Arizona Form A-4C (ADOR10761)

for the current year.

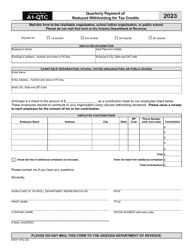

Arizona Form A-4C (ADOR10761) Request for Reduced Withholding to Designate for Tax Credits - Arizona

What Is Arizona Form A-4C (ADOR10761)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form A-4C?

A: Arizona Form A-4C is a tax form used to request reduced withholding to designate for tax credits in Arizona.

Q: Who should use Arizona Form A-4C?

A: Employees who want to reduce their withholding for the purpose of designating a portion of it for tax credits in Arizona should use this form.

Q: What is the purpose of Arizona Form A-4C?

A: The purpose of this form is to allow employees to designate a portion of their withholding to go towards tax credits in Arizona.

Q: Are there any requirements to qualify for reduced withholding?

A: Yes, there are certain requirements that need to be met in order to qualify for reduced withholding. It is recommended to refer to the instructions on the form for more information.

Q: Is Arizona Form A-4C only for Arizona residents?

A: No, Arizona Form A-4C can be used by both Arizona residents and non-residents who have Arizona withholding.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form A-4C (ADOR10761) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.