This version of the form is not currently in use and is provided for reference only. Download this version of

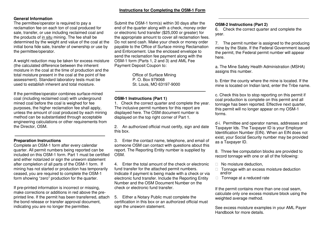

Instructions for Form ACFR-1

for the current year.

Instructions for Form ACFR-1 Accounts Receivable - Vermont

This document contains official instructions for Form ACFR-1 , Accounts Receivable - a form released and collected by the Vermont Department of Finance & Management.

FAQ

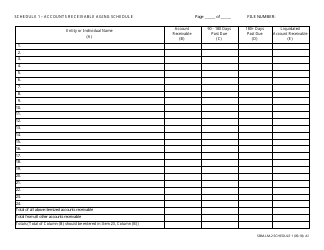

Q: What is Form ACFR-1?

A: Form ACFR-1 is a document used for managing accounts receivable in Vermont.

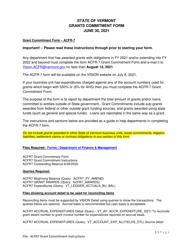

Q: Who needs to fill out Form ACFR-1?

A: Any entity or individual that has accounts receivable in Vermont needs to fill out this form.

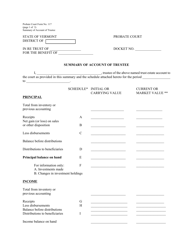

Q: What information is required on Form ACFR-1?

A: The form requires information such as the name and contact information of the accounts receivable manager, details of the outstanding receivables, and any payments received.

Q: Is there a deadline for submitting Form ACFR-1?

A: Yes, the form must be filed annually by March 15th.

Q: Are there any penalties for not filing Form ACFR-1?

A: Yes, failure to file the form may result in penalties, such as fines or interest charges.

Q: Who should I contact if I have questions about Form ACFR-1?

A: For any questions or assistance regarding Form ACFR-1, you can contact the Vermont Department of Taxes directly.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Finance & Management.