This version of the form is not currently in use and is provided for reference only. Download this version of

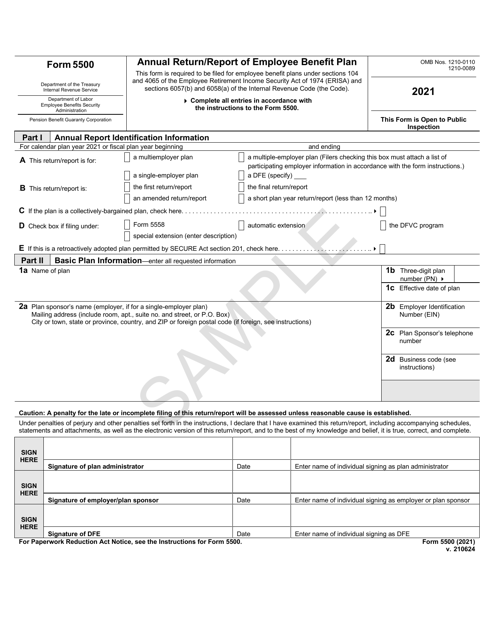

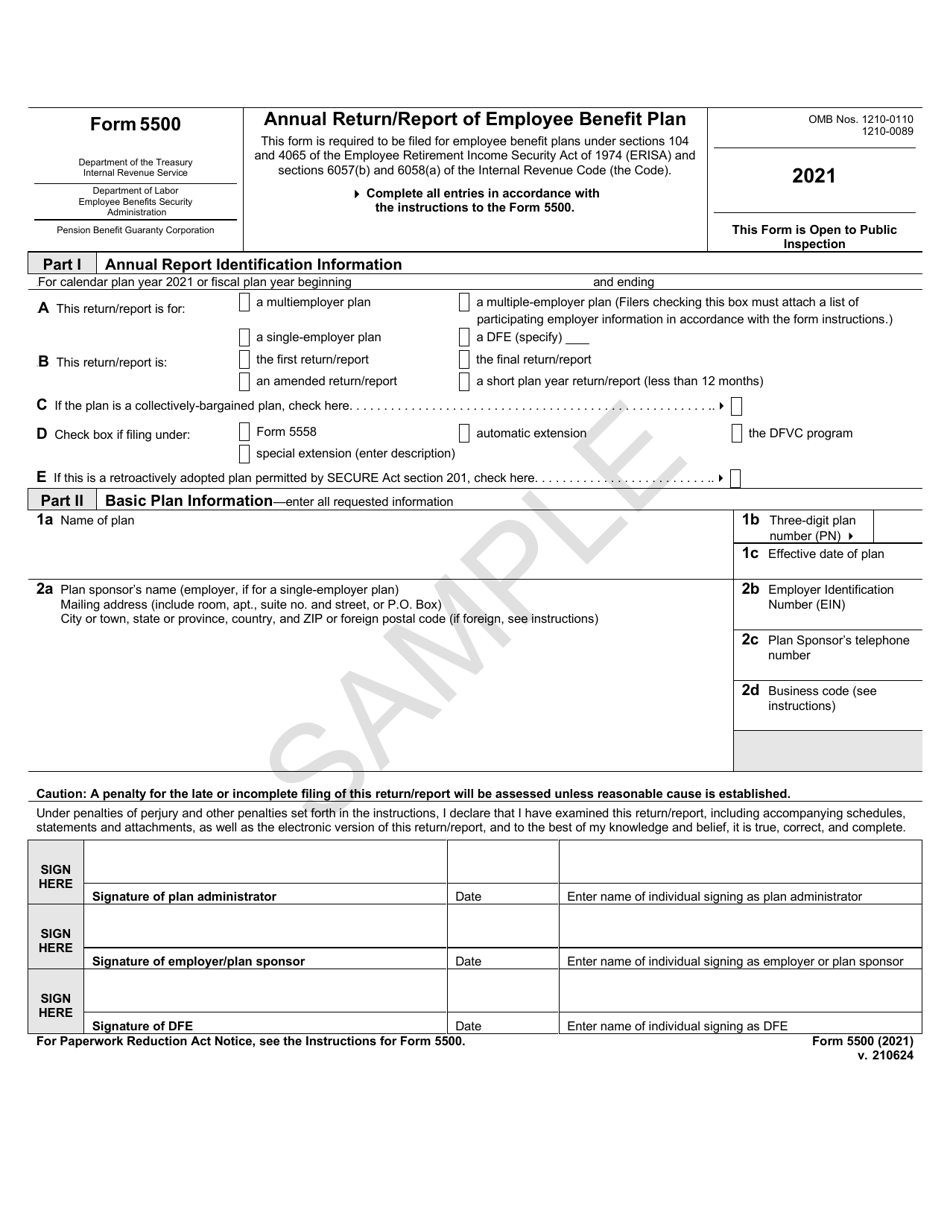

Form 5500

for the current year.

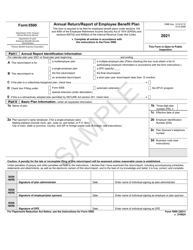

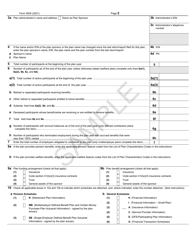

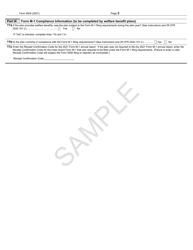

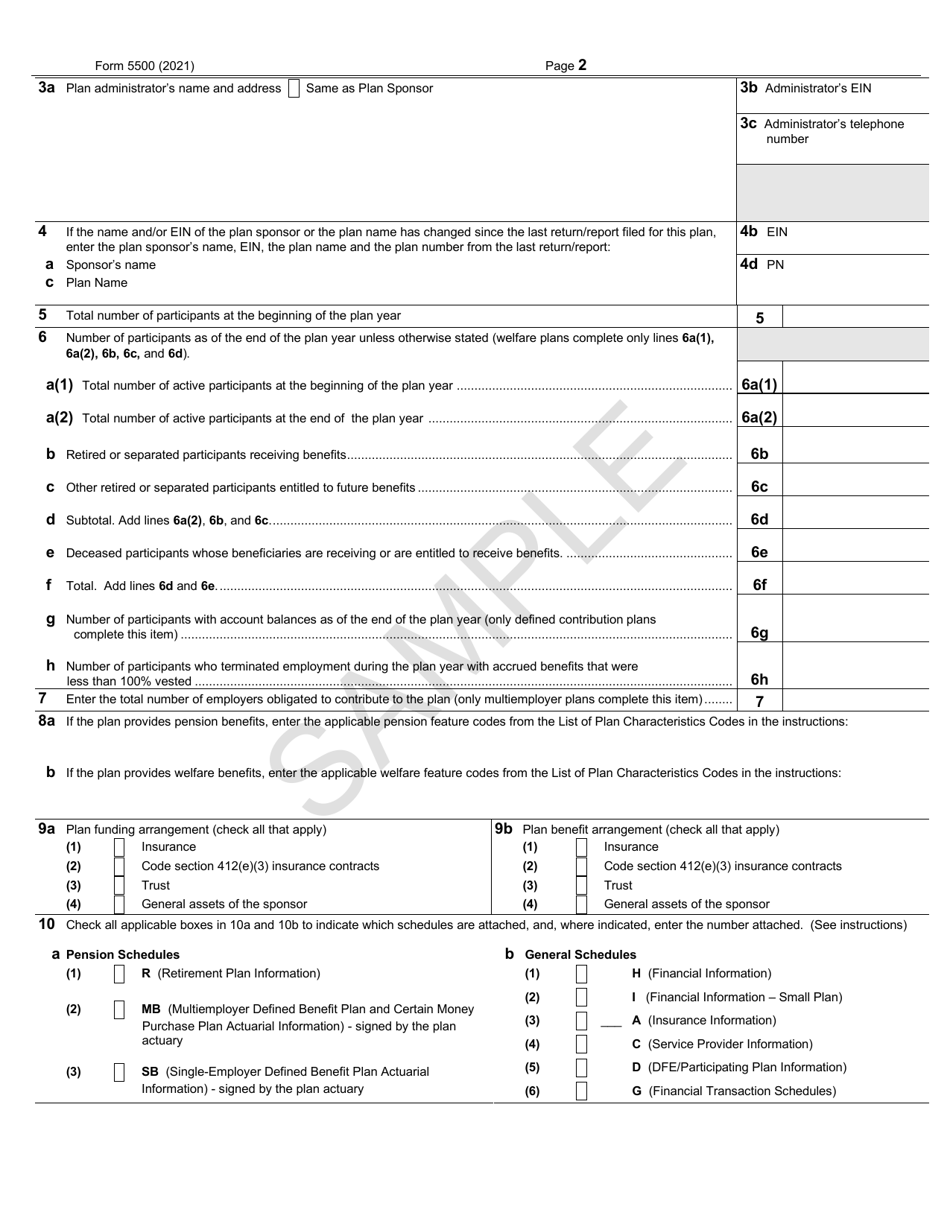

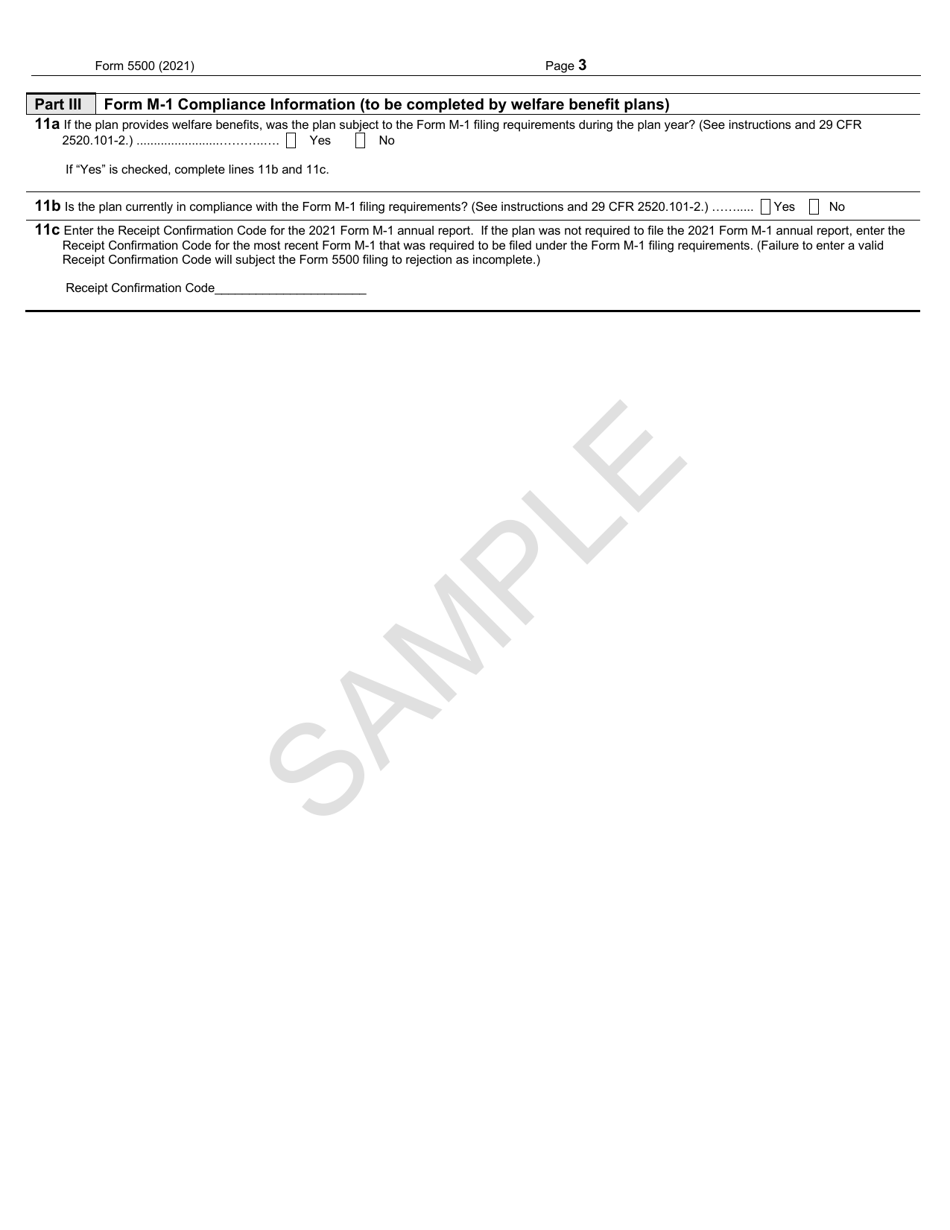

Form 5500 Annual Return / Report of Employee Benefit Plan - Sample

What Is Form 5500?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on June 24, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500?

A: Form 5500 is an annual return/report that must be filed by employee benefit plans.

Q: Who is required to file Form 5500?

A: Employee benefit plans, including pension, welfare, and certain other plans, are required to file Form 5500.

Q: What information is reported on Form 5500?

A: Form 5500 reports information about the plan's operations, funding, investments, and other relevant details.

Q: When is Form 5500 due?

A: Form 5500 generally must be filed by the last day of the seventh month after the plan year ends.

Q: Are there any penalties for late or non-filing of Form 5500?

A: Yes, there are penalties for late or non-filing of Form 5500, which can vary depending on the circumstances.

Form Details:

- Released on June 24, 2021;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.