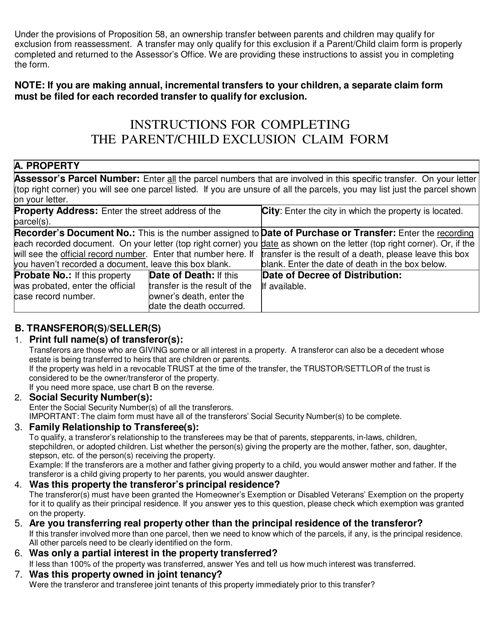

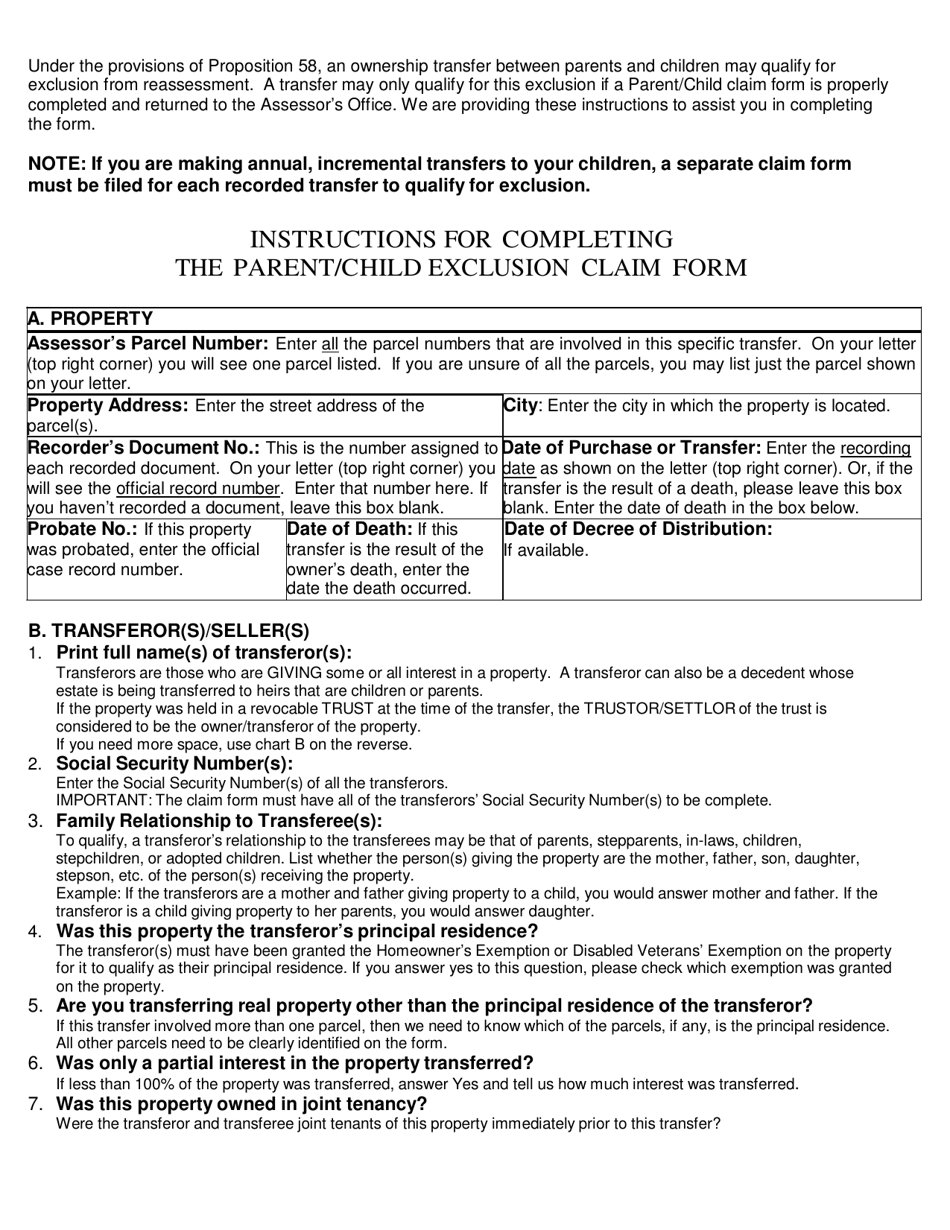

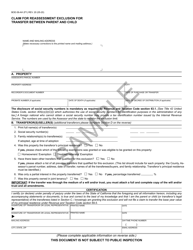

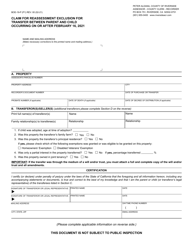

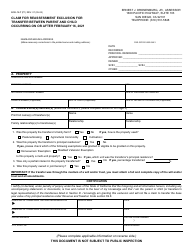

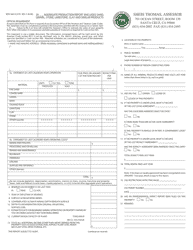

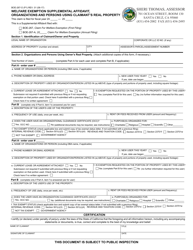

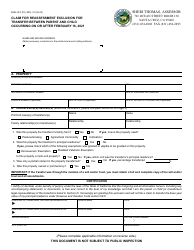

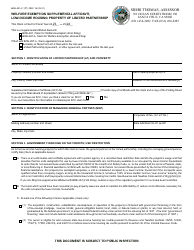

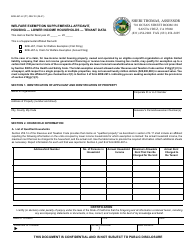

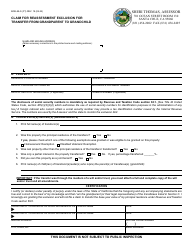

Instructions for Form BOE-58-AH Claim for Reassessment Exclusion for Transfer Between Parent and Child - Santa Cruz County, California

This document contains official instructions for Form BOE-58-AH , Claim for Reassessment Exclusion for Transfer Between Parent and Child - a form released and collected by the Assessor's Office - Santa Cruz County, California.

FAQ

Q: What is Form BOE-58-AH?

A: Form BOE-58-AH is a claim for reassessment exclusion for transfer between parent and child.

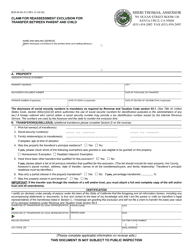

Q: Who can use Form BOE-58-AH?

A: Form BOE-58-AH can be used by parents transferring property to their children.

Q: What does the reassessment exclusion mean?

A: Reassessment exclusion means that the transfer of property between parent and child may not result in a reassessment of the property's value for property tax purposes.

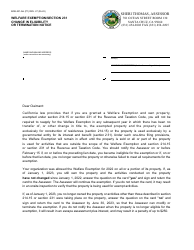

Q: Is there any deadline to file Form BOE-58-AH?

A: Yes, Form BOE-58-AH must be filed within three years of the date of transfer.

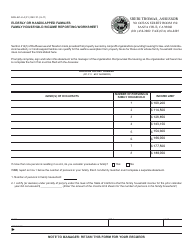

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Assessor's Office - Santa Cruz County, California.