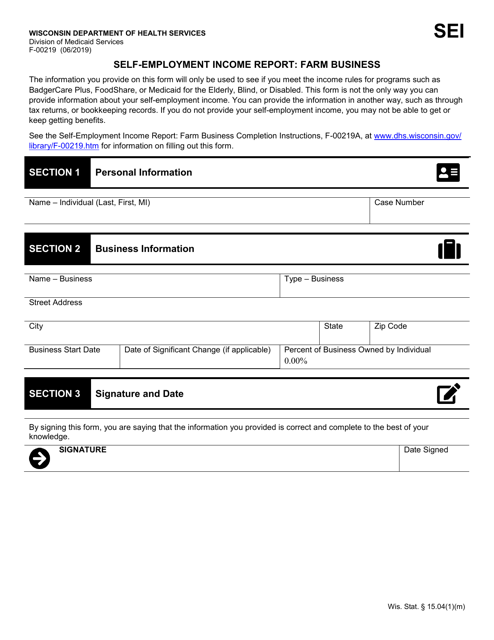

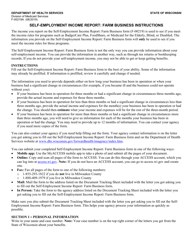

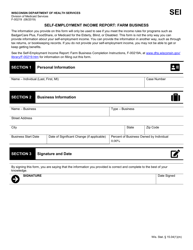

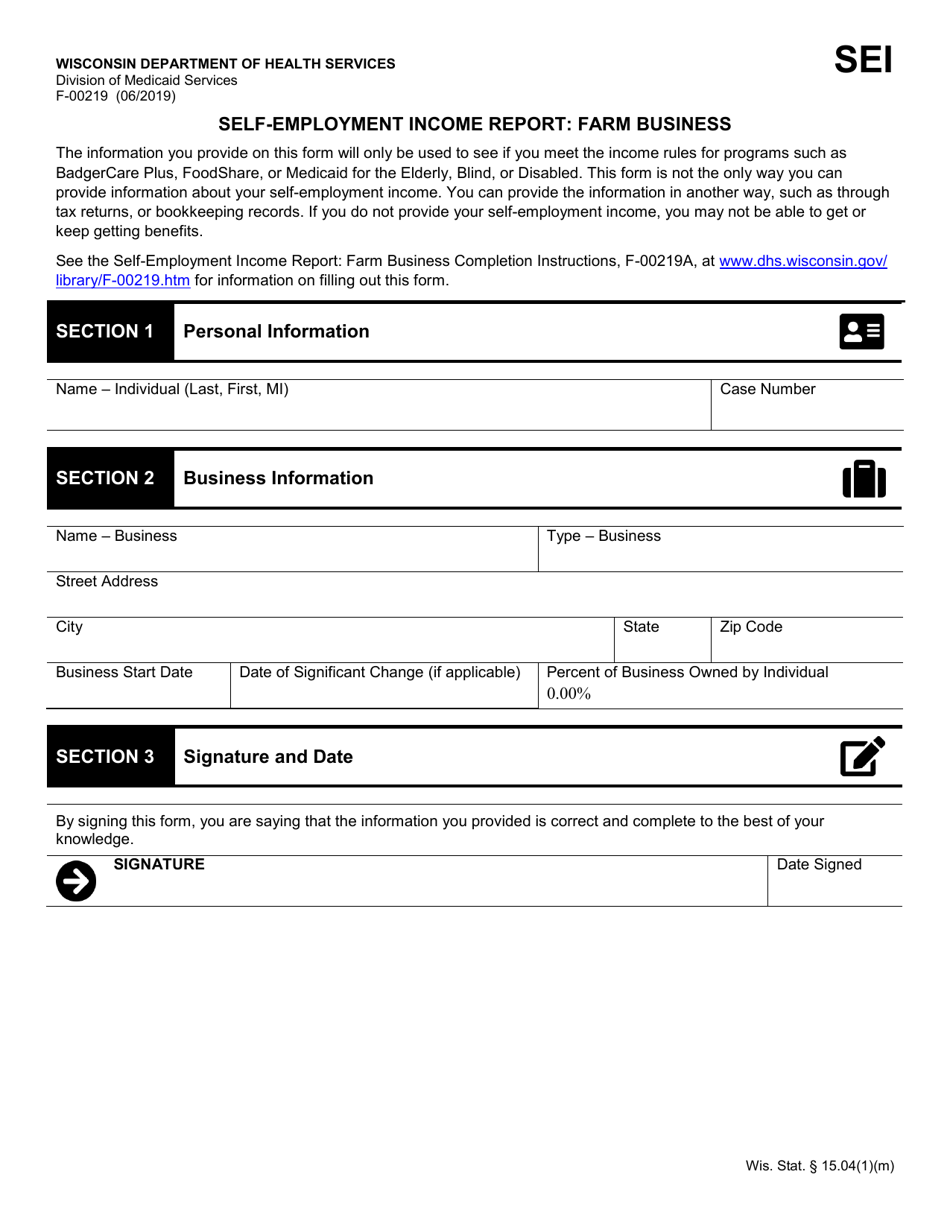

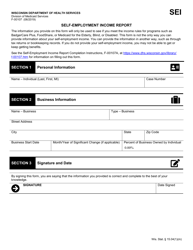

Form F-00219 Self-employment Income Report: Farm Business - Wisconsin

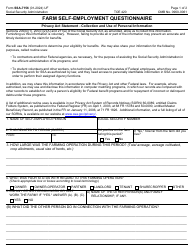

What Is Form F-00219?

This is a legal form that was released by the Wisconsin Department of Health Services - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form F-00219?

A: Form F-00219 is a Self-employment Income Report specifically for Farm Businesses in Wisconsin.

Q: Who needs to file Form F-00219?

A: Farmers in Wisconsin who are self-employed and have farm business income need to file Form F-00219.

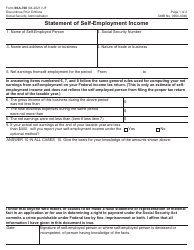

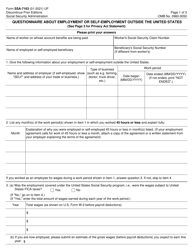

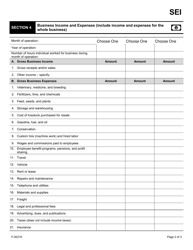

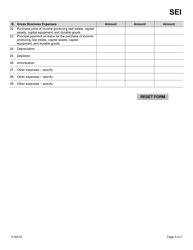

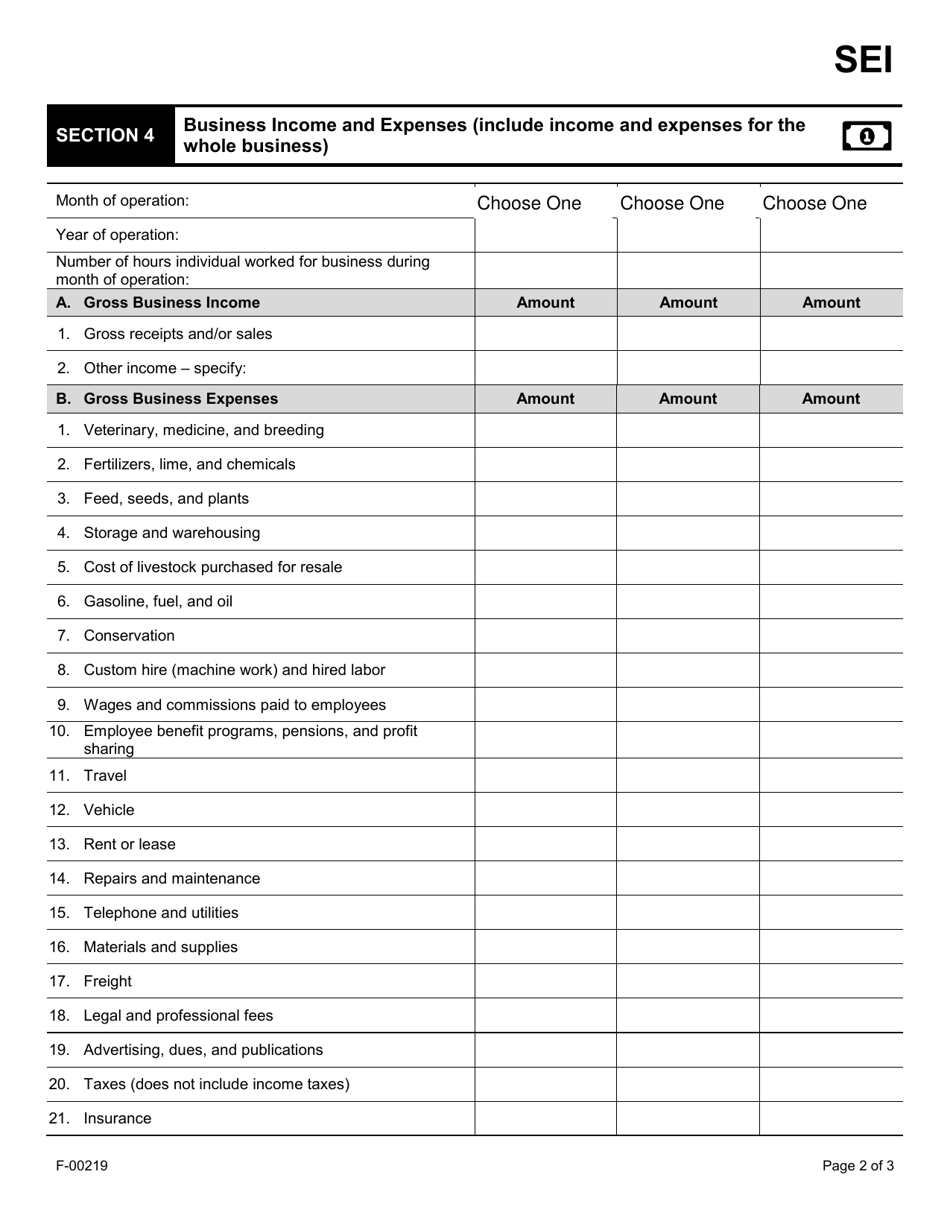

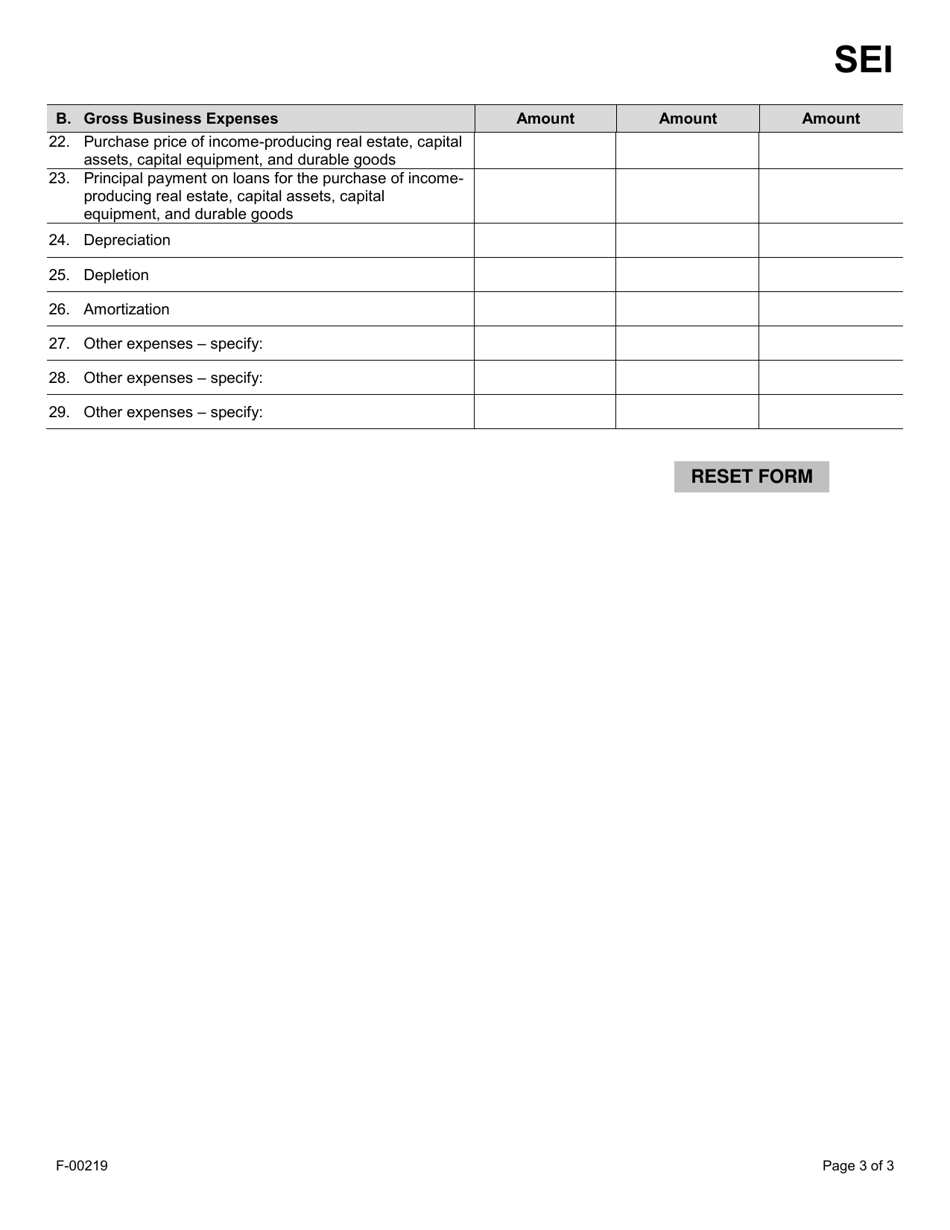

Q: What information is required on Form F-00219?

A: Form F-00219 requires information about the farmer's self-employment income and farm business details.

Q: When is Form F-00219 due?

A: Form F-00219 is due by April 15th of each year for the previous tax year.

Q: Are there any penalties for not filing Form F-00219?

A: Yes, there may be penalties for not filing Form F-00219 or for filing it late. It is important to submit the form on time to avoid any penalties.

Q: Can I e-file Form F-00219?

A: No, Form F-00219 cannot be e-filed. It must be printed and mailed to the Wisconsin Department of Revenue.

Q: Can I make changes to Form F-00219 after submitting it?

A: Yes, if you need to make changes to Form F-00219 after submitting it, you can file an amended form with the Wisconsin Department of Revenue.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Wisconsin Department of Health Services;

- Easy to use and ready to print;

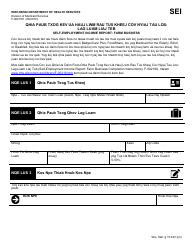

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-00219 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Health Services.

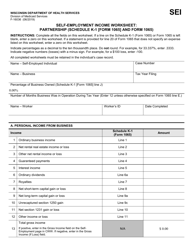

![Document preview: Form F-16035 Self-employment Income Worksheet: S Corporation (Schedule K-1 [form 1120s] and Form 1120s) - Wisconsin](https://data.templateroller.com/pdf_docs_html/2834/28349/2834988/form-f-16035-self-employment-income-worksheet-s-corporation-schedule-k-1-form-1120s-and-form-1120s-wisconsin.png)