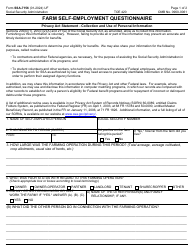

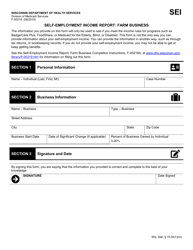

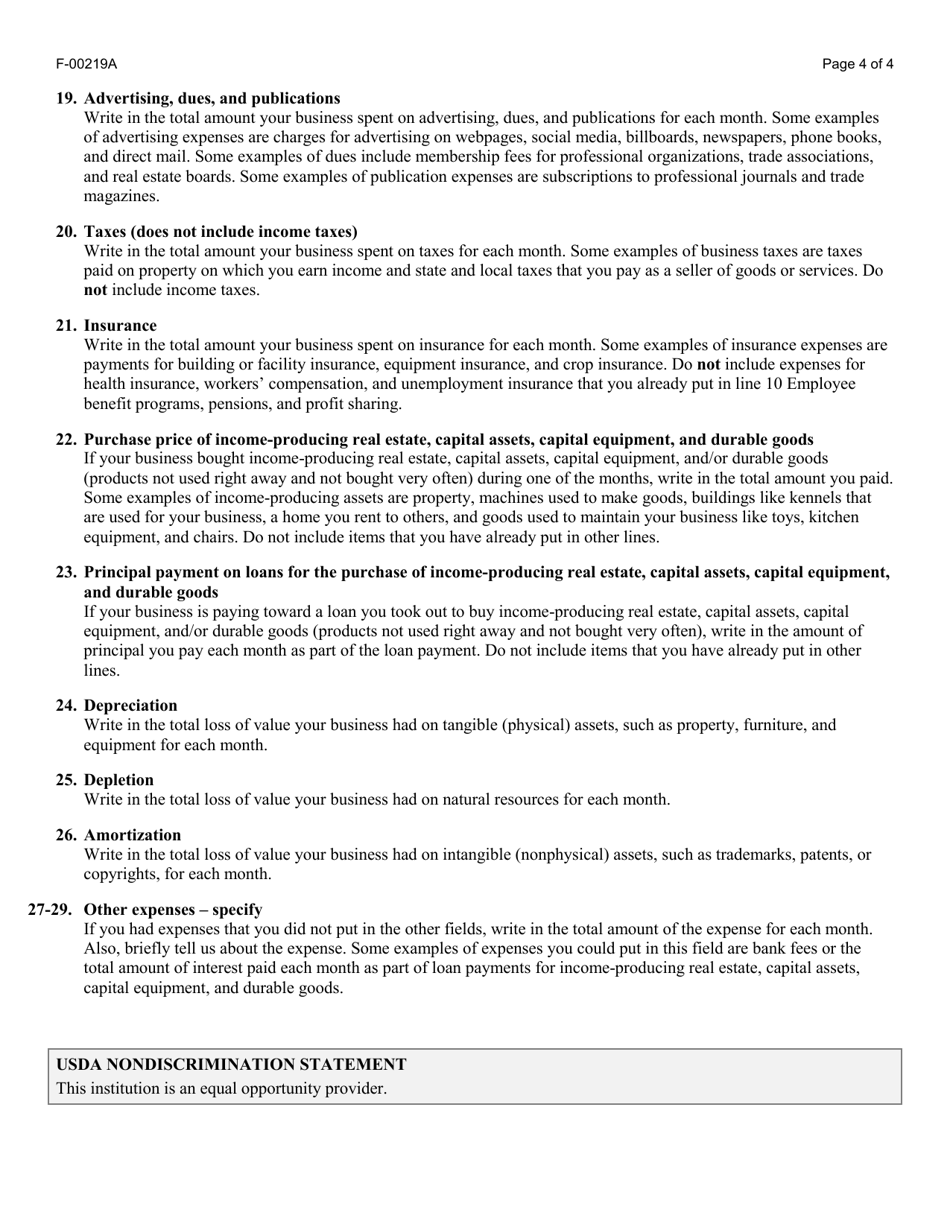

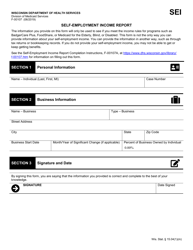

Instructions for Form F-00219 Self-employment Income Report: Farm Business - Wisconsin

This document contains official instructions for Form F-00219 , Self-employment Income Report: Farm Business - a form released and collected by the Wisconsin Department of Health Services. An up-to-date fillable Form F-00219 is available for download through this link.

FAQ

Q: What is Form F-00219?

A: Form F-00219 is a self-employment income report for farm businesses in Wisconsin.

Q: Who needs to file Form F-00219?

A: Farm business owners in Wisconsin who have self-employment income need to file Form F-00219.

Q: What is the purpose of Form F-00219?

A: The purpose of Form F-00219 is to report self-employment income from farm businesses in Wisconsin.

Q: When is Form F-00219 due?

A: Form F-00219 is due by the due date of your Wisconsin income tax return, which is typically April 15th.

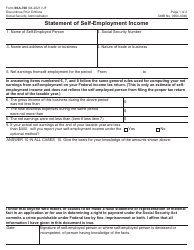

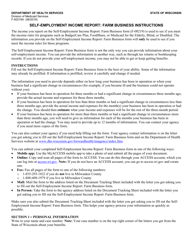

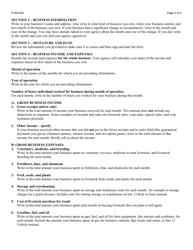

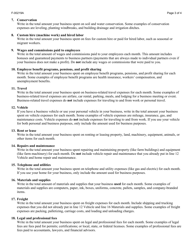

Q: What information do I need to complete Form F-00219?

A: You will need information about your farm business income, expenses, and any deductions or credits applicable to your situation.

Q: Do I need to attach any documents with Form F-00219?

A: You may need to attach supporting documents such as receipts or financial statements, depending on your circumstances.

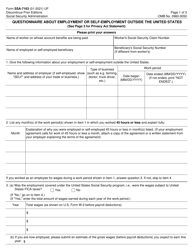

Q: Can I file Form F-00219 electronically?

A: As of now, Wisconsin does not offer electronic filing for Form F-00219. It must be filed by mail.

Q: What if I need help filling out Form F-00219?

A: You can consult the instructions provided with the form or reach out to the Wisconsin Department of Revenue for assistance.

Q: Is there a penalty for not filing Form F-00219?

A: Yes, there may be penalties for failing to file Form F-00219 or for providing incorrect or incomplete information.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

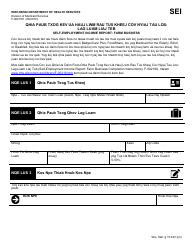

- Also available in Hmong;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Health Services.

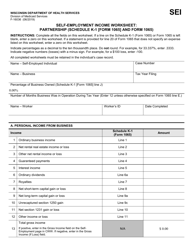

![Document preview: Form F-16035 Self-employment Income Worksheet: S Corporation (Schedule K-1 [form 1120s] and Form 1120s) - Wisconsin](https://data.templateroller.com/pdf_docs_html/2834/28349/2834988/form-f-16035-self-employment-income-worksheet-s-corporation-schedule-k-1-form-1120s-and-form-1120s-wisconsin.png)