This version of the form is not currently in use and is provided for reference only. Download this version of

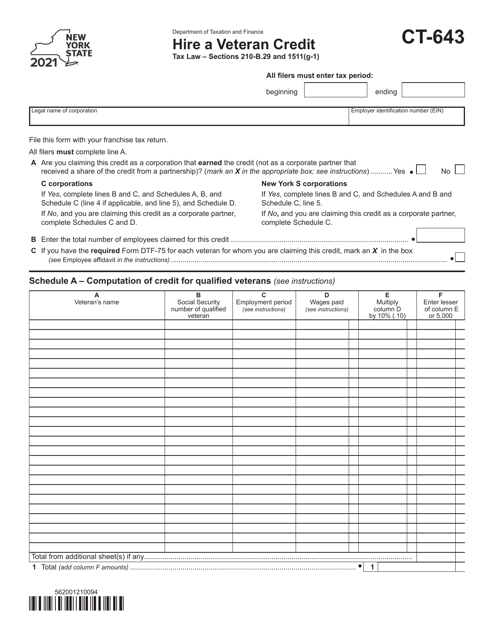

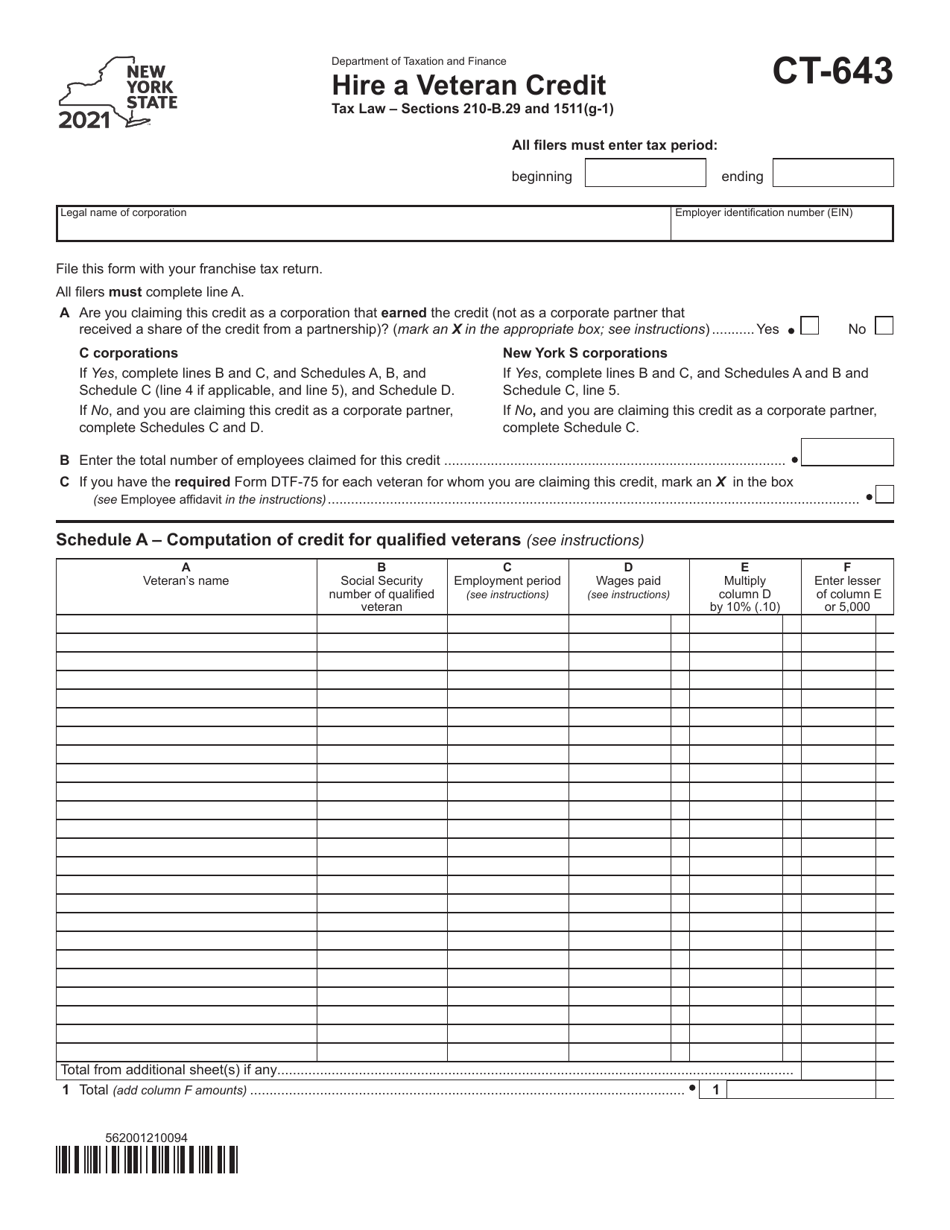

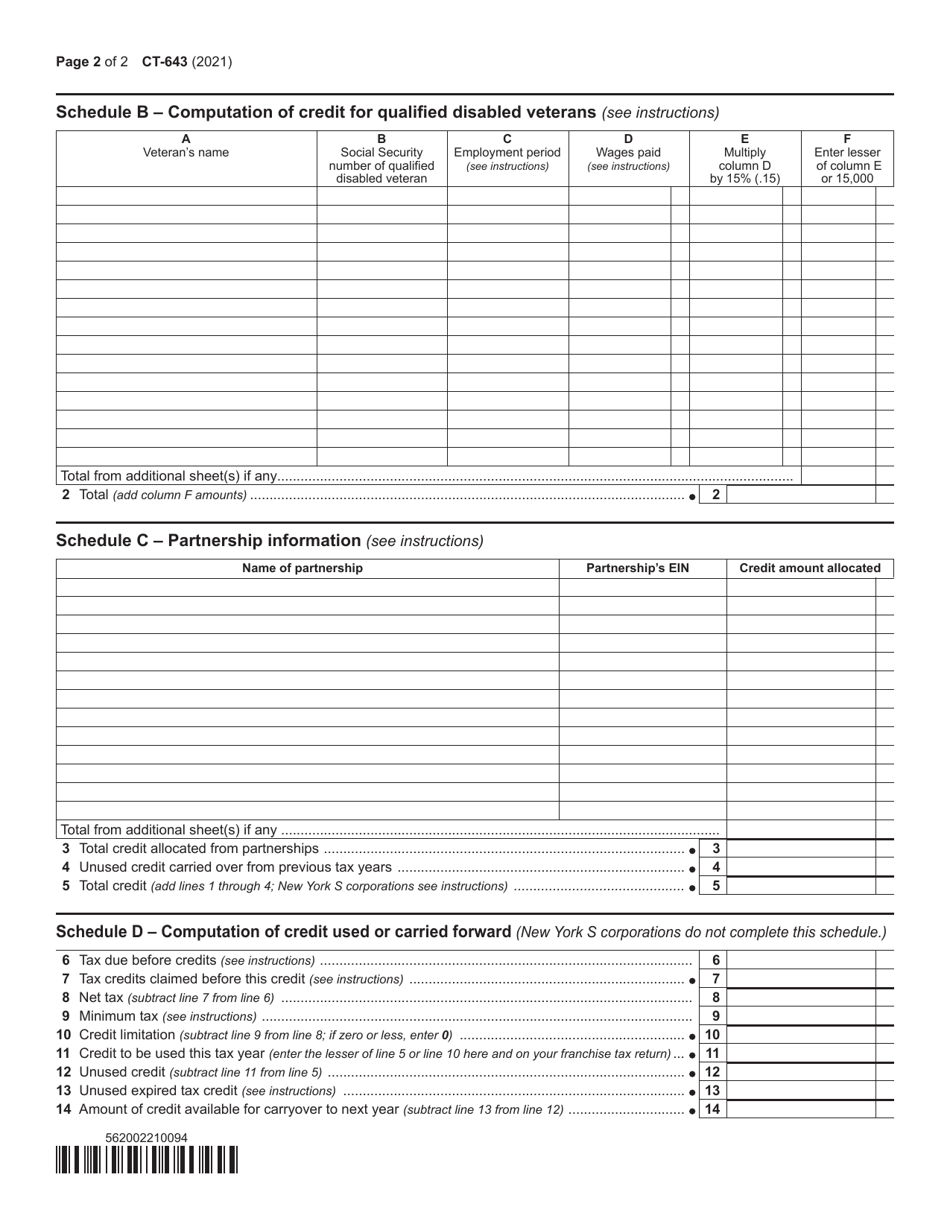

Form CT-643

for the current year.

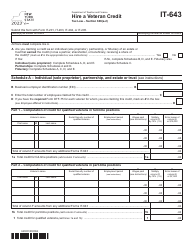

Form CT-643 Hire a Veteran Credit - New York

What Is Form CT-643?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-643?

A: Form CT-643 is a tax form used in the state of New York to claim the Hire a Veteran Credit.

Q: What is the Hire a Veteran Credit?

A: The Hire a Veteran Credit is a tax credit available to businesses in New York that hire qualifying veterans.

Q: Who is eligible for the Hire a Veteran Credit?

A: Businesses in New York that hire qualifying veterans are eligible for the Hire a Veteran Credit.

Q: How much is the Hire a Veteran Credit?

A: The amount of the credit is 10% of wages paid to qualifying veterans, up to a maximum of $5,000 per veteran.

Q: Do I need to file Form CT-643 if I want to claim the Hire a Veteran Credit?

A: Yes, in order to claim the Hire a Veteran Credit, you must file Form CT-643 with the New York State Department of Taxation and Finance.

Q: Is there a deadline for filing Form CT-643?

A: Yes, Form CT-643 must be filed within three years from the due date of the return for the tax year in which the credit is being claimed.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-643 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.