This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-643

for the current year.

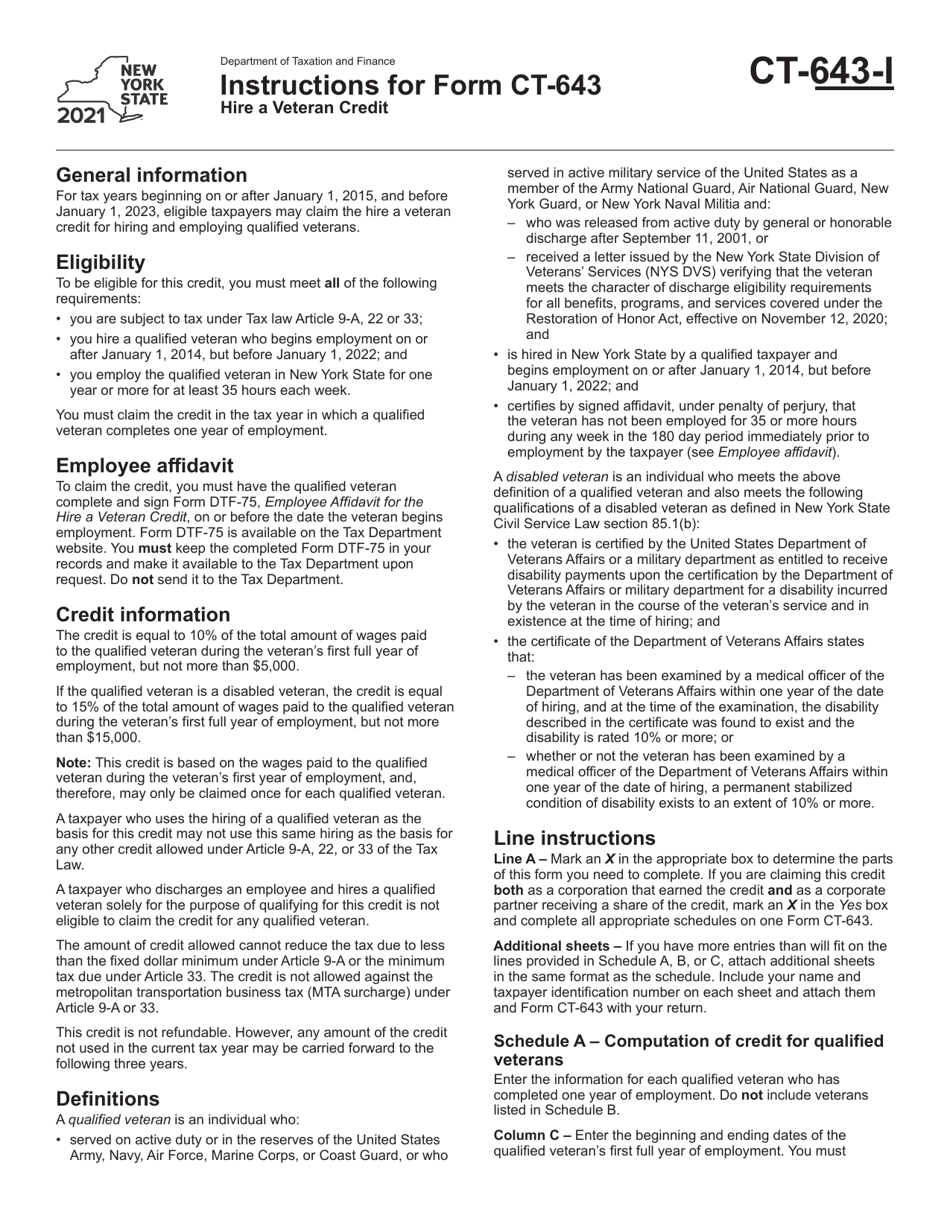

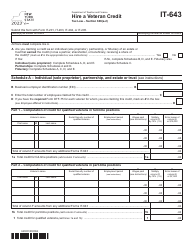

Instructions for Form CT-643 Hire a Veteran Credit - New York

This document contains official instructions for Form CT-643 , Hire a Veteran Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-643 is available for download through this link.

FAQ

Q: What is Form CT-643?

A: Form CT-643 is a form used in New York to claim the Hire a Veteran Credit.

Q: What is the Hire a Veteran Credit?

A: The Hire a Veteran Credit is a tax credit available to businesses in New York that hire qualified veterans.

Q: Who can claim the Hire a Veteran Credit?

A: Businesses in New York that hire qualified veterans can claim the Hire a Veteran Credit.

Q: What are the qualifications for the Hire a Veteran Credit?

A: To qualify for the Hire a Veteran Credit, the veteran must have been honorably discharged from active military duty in the U.S. Armed Forces or the reserves.

Q: How much is the Hire a Veteran Credit?

A: The credit amount is $5,000 per qualified veteran hired.

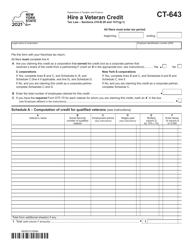

Q: How do I complete Form CT-643?

A: You must fill out the form with your business information, the veteran's information, and the details of the employment.

Q: Are there any deadlines to submit Form CT-643?

A: Yes, Form CT-643 must be filed within three years from the last day of the tax year in which the qualified veteran was first employed.

Q: Are there any additional requirements for claiming the credit?

A: Yes, you must also submit a Certificate of Eligibility for the credit, which can be obtained from the New York State Division of Veterans' Affairs.

Instruction Details:

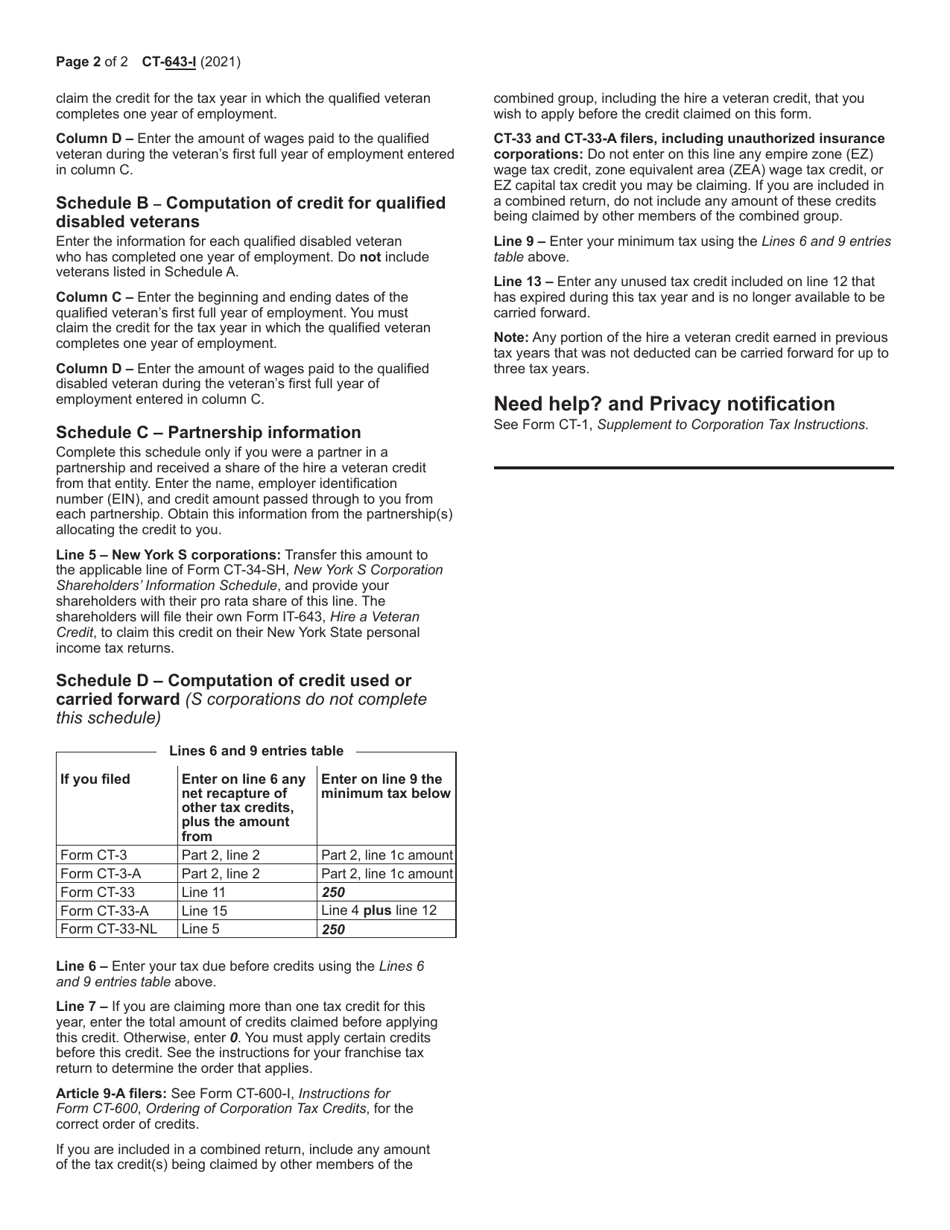

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.