This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-633

for the current year.

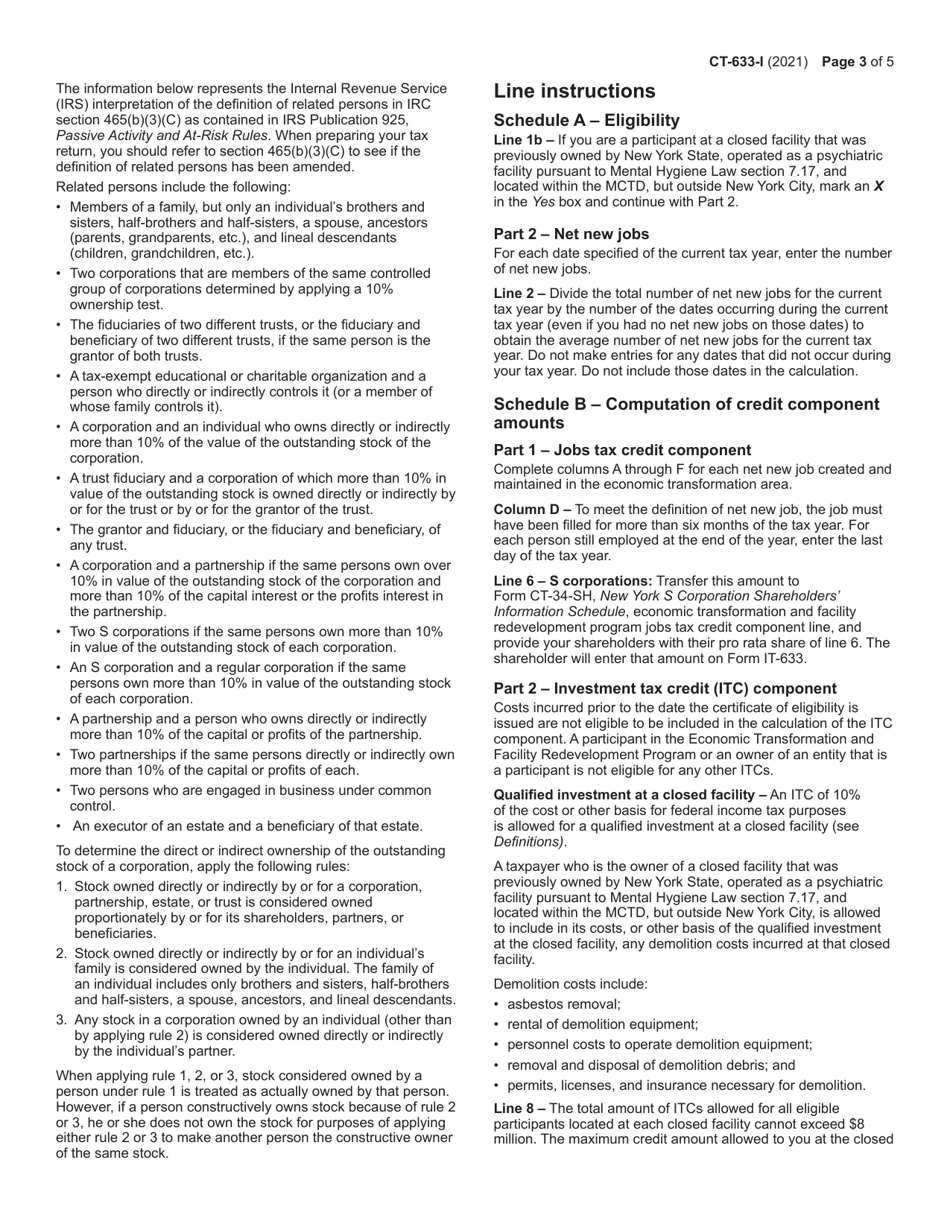

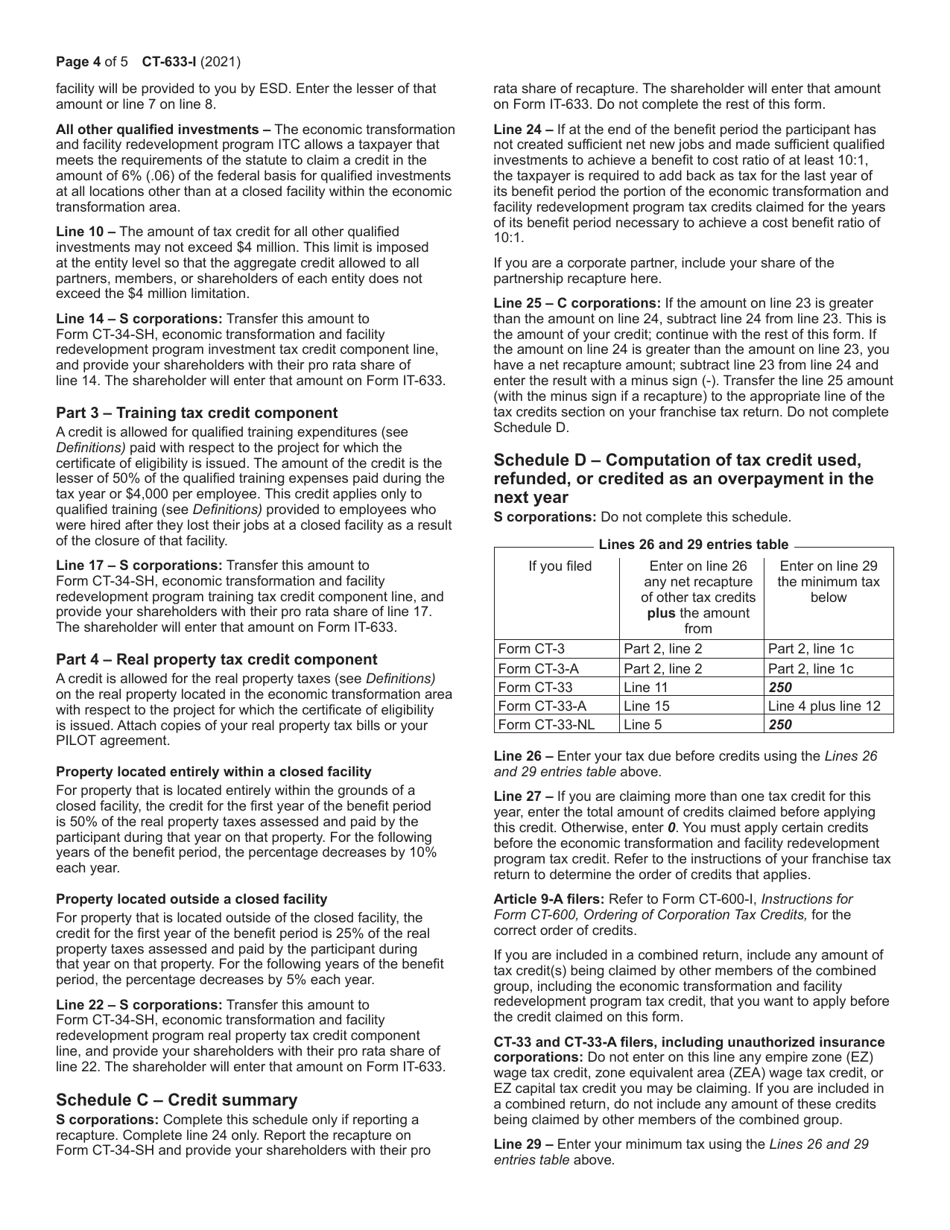

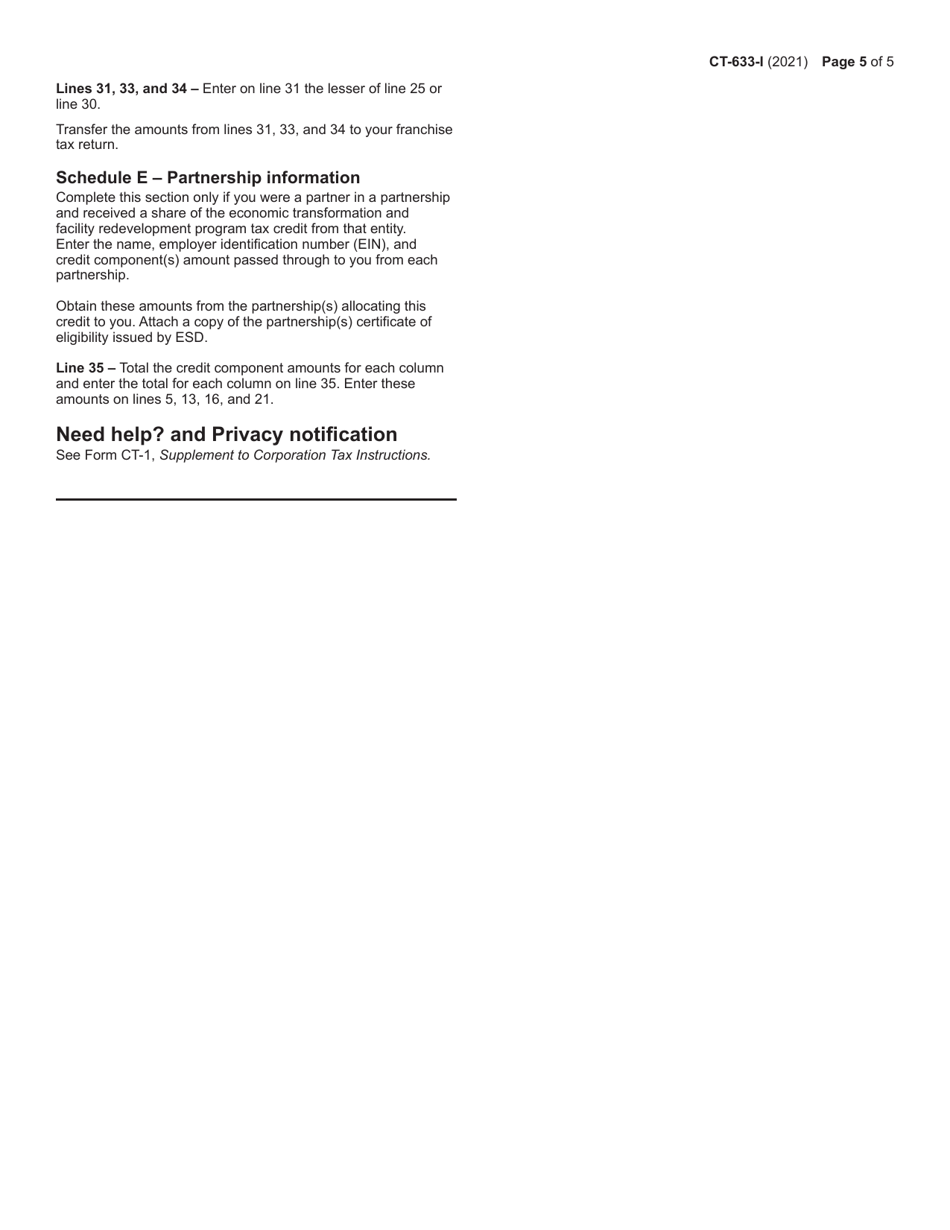

Instructions for Form CT-633 Economic Transformation and Facility Redevelopment Program Tax Credit - New York

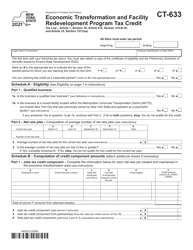

This document contains official instructions for Form CT-633 , Economic Transformation and Facility Redevelopment Program Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-633 is available for download through this link.

FAQ

Q: What is Form CT-633?

A: Form CT-633 is a tax form used specifically for the Economic Transformation and Facility Redevelopment Program Tax Credit in New York.

Q: What is the Economic Transformation and Facility Redevelopment Program Tax Credit?

A: The Economic Transformation and Facility Redevelopment Program Tax Credit is a tax incentive program in New York designed to encourage economic development and the revitalization of underutilized or abandoned properties.

Q: Who is eligible for the tax credit?

A: Eligibility for the tax credit is determined by the New York State Department of Economic Development. It is generally available to businesses that are planning to expand or redevelop their facilities in specific areas designated by the program.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to provide a financial incentive for businesses to invest in the redevelopment of economically distressed areas, creating jobs and stimulating economic growth.

Q: How do I claim the tax credit?

A: To claim the tax credit, you must complete and submit Form CT-633 to the New York State Department of Taxation and Finance along with any required documentation.

Q: Is there a deadline for filing Form CT-633?

A: Yes, there is a deadline for filing Form CT-633. You should consult the instructions for the form or contact the New York State Department of Taxation and Finance for specific deadline information.

Q: What documentation do I need to include with Form CT-633?

A: The specific documentation required to be included with Form CT-633 may vary depending on the circumstances. Consult the instructions for the form or contact the New York State Department of Taxation and Finance for more information.

Q: Are there any limitations or restrictions for the tax credit?

A: Yes, there may be limitations or restrictions on the tax credit. It is important to review the instructions for Form CT-633 or consult with the New York State Department of Taxation and Finance for details.

Q: Can individuals claim the tax credit?

A: The tax credit is generally available to businesses, not individuals. However, individual business owners may be eligible to claim the tax credit on their personal income tax returns if they meet certain criteria.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.