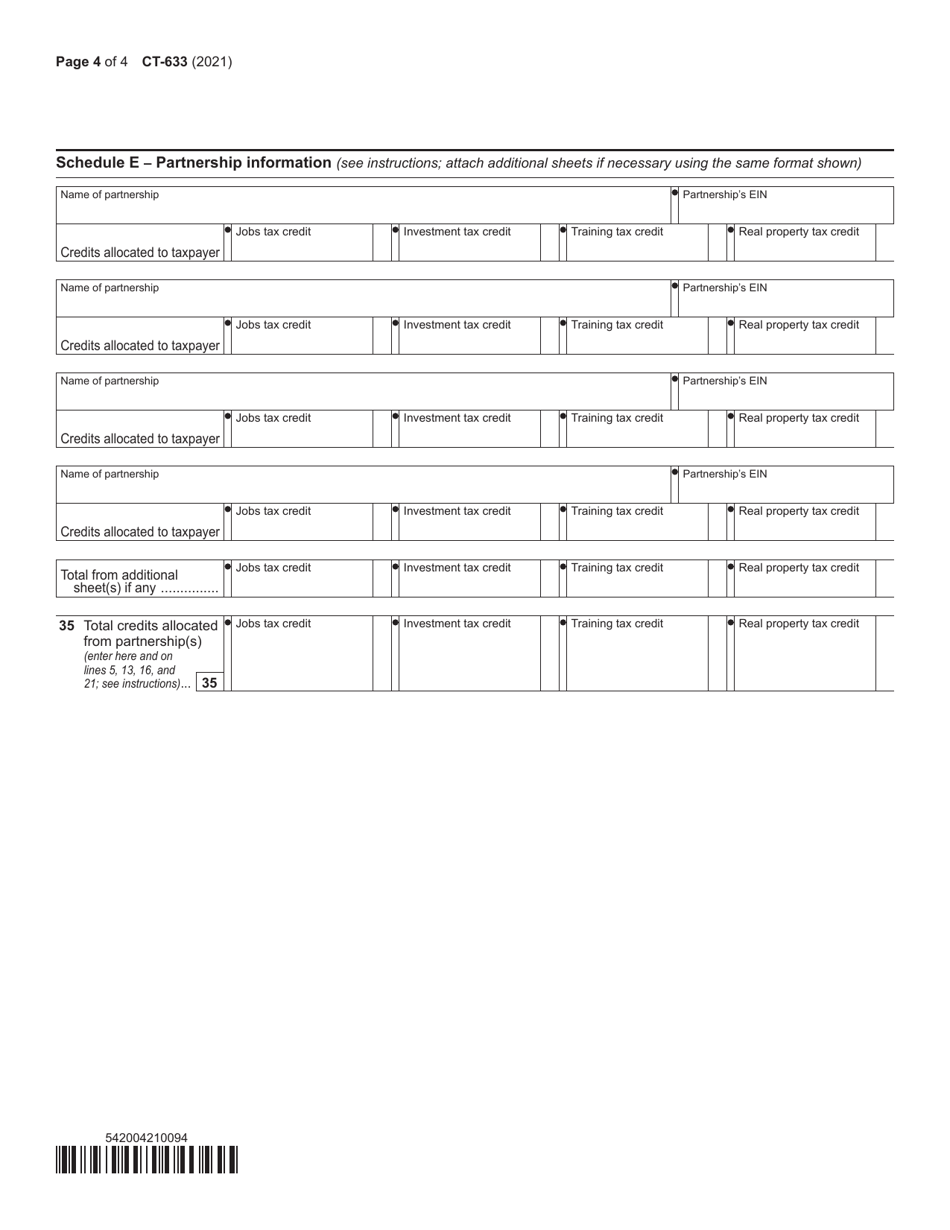

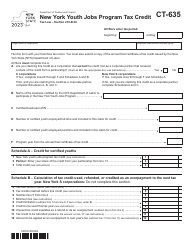

This version of the form is not currently in use and is provided for reference only. Download this version of

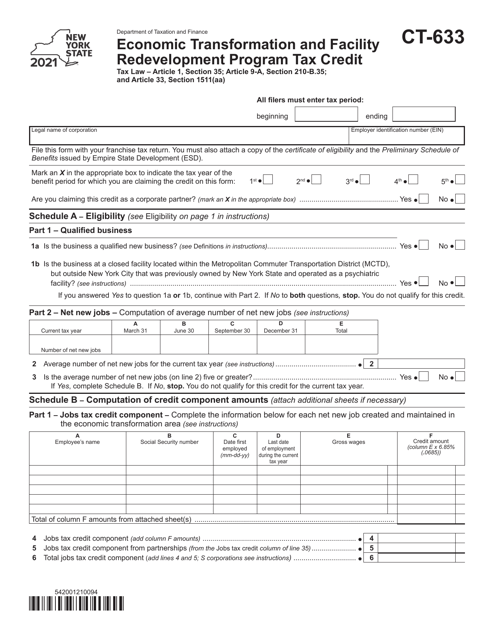

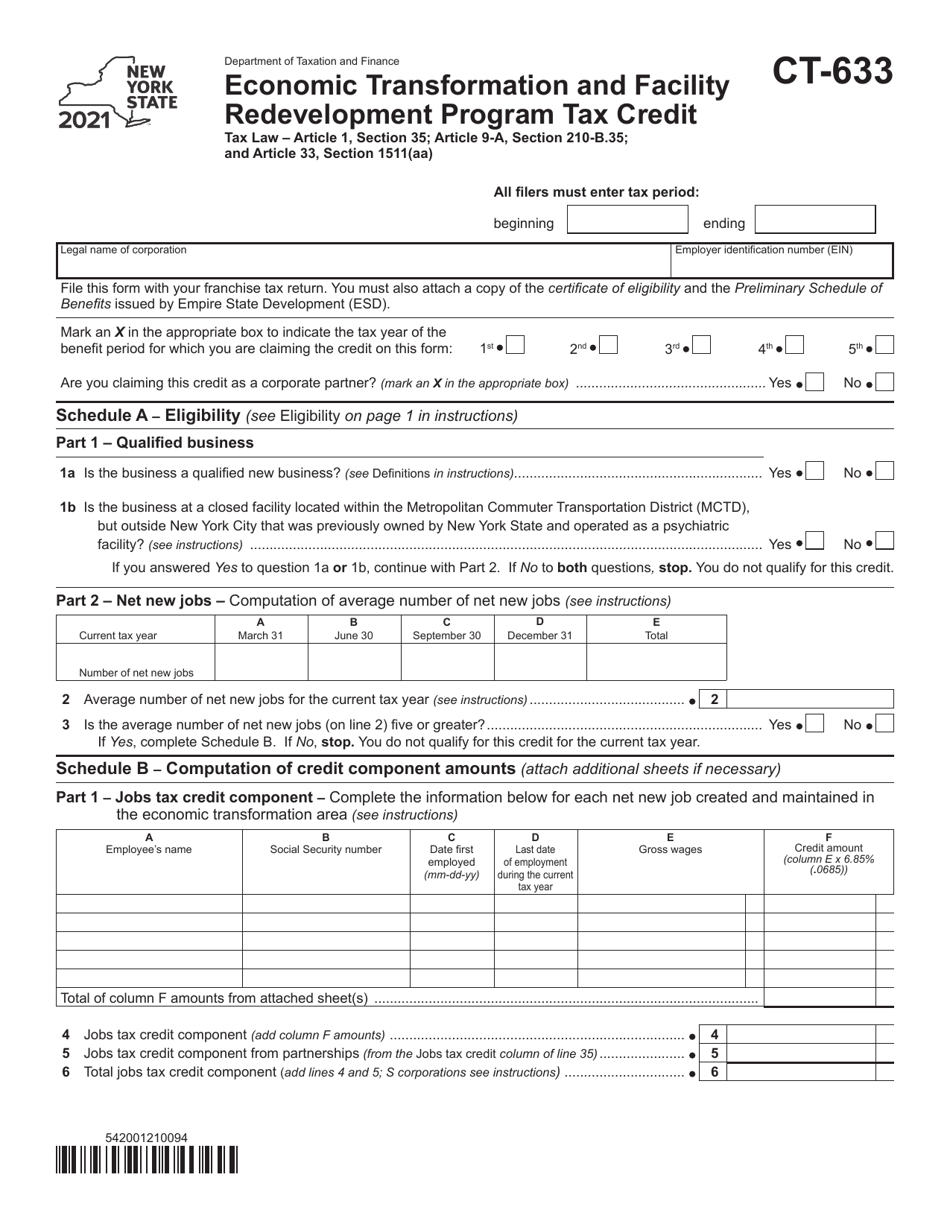

Form CT-633

for the current year.

Form CT-633 Economic Transformation and Facility Redevelopment Program Tax Credit - New York

What Is Form CT-633?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-633?

A: Form CT-633 is the application for the Economic Transformation and Facility Redevelopment Program Tax Credit in New York.

Q: What is the Economic Transformation and Facility Redevelopment Program Tax Credit?

A: The Economic Transformation and Facility Redevelopment Program Tax Credit is a tax credit available in New York to businesses that undertake qualifying projects for the redevelopment of eligible facilities.

Q: Who is eligible to claim the tax credit?

A: Businesses that undertake qualifying projects for the redevelopment of eligible facilities in New York are eligible to claim the tax credit.

Q: What type of projects qualify for the tax credit?

A: Projects that involve the substantial rehabilitation or redevelopment of eligible facilities in New York and that meet certain criteria set by the program qualify for the tax credit.

Q: What is the benefit of claiming the tax credit?

A: By claiming the tax credit, businesses can receive a credit against their New York state tax liability, which can help offset the costs of eligible projects.

Q: How can businesses apply for the tax credit?

A: Businesses can apply for the tax credit by completing and submitting Form CT-633 to the New York State Department of Taxation and Finance.

Q: Is there a deadline for submitting the application?

A: Yes, there is a deadline for submitting the application. The specific deadline can vary, so businesses should check the latest guidelines to ensure they meet the deadline.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-633 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.